- Investors and long-term holders expected better returns from Bitcoin, based on historical trends

- Large wave of selling earlier this month showed disbelief in the bullish scenario

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of ups and downs, bull runs, and bear markets. The recent performance of Bitcoin has been quite intriguing, to say the least. After the strong rally at the end of September, I was expecting a continuation of the bullish trend based on historical data and the general optimism surrounding the market.

As an analyst, I’ve noticed that Bitcoin (BTC) encountered resistance at approximately $66.5k following a robust surge toward the end of September. Traditionally, October has been a favorable period for the coin, but this year, it seems to be different, at least in the initial stages. In fact, at this moment, BTC is experiencing a 4% decrease from the month’s opening price.

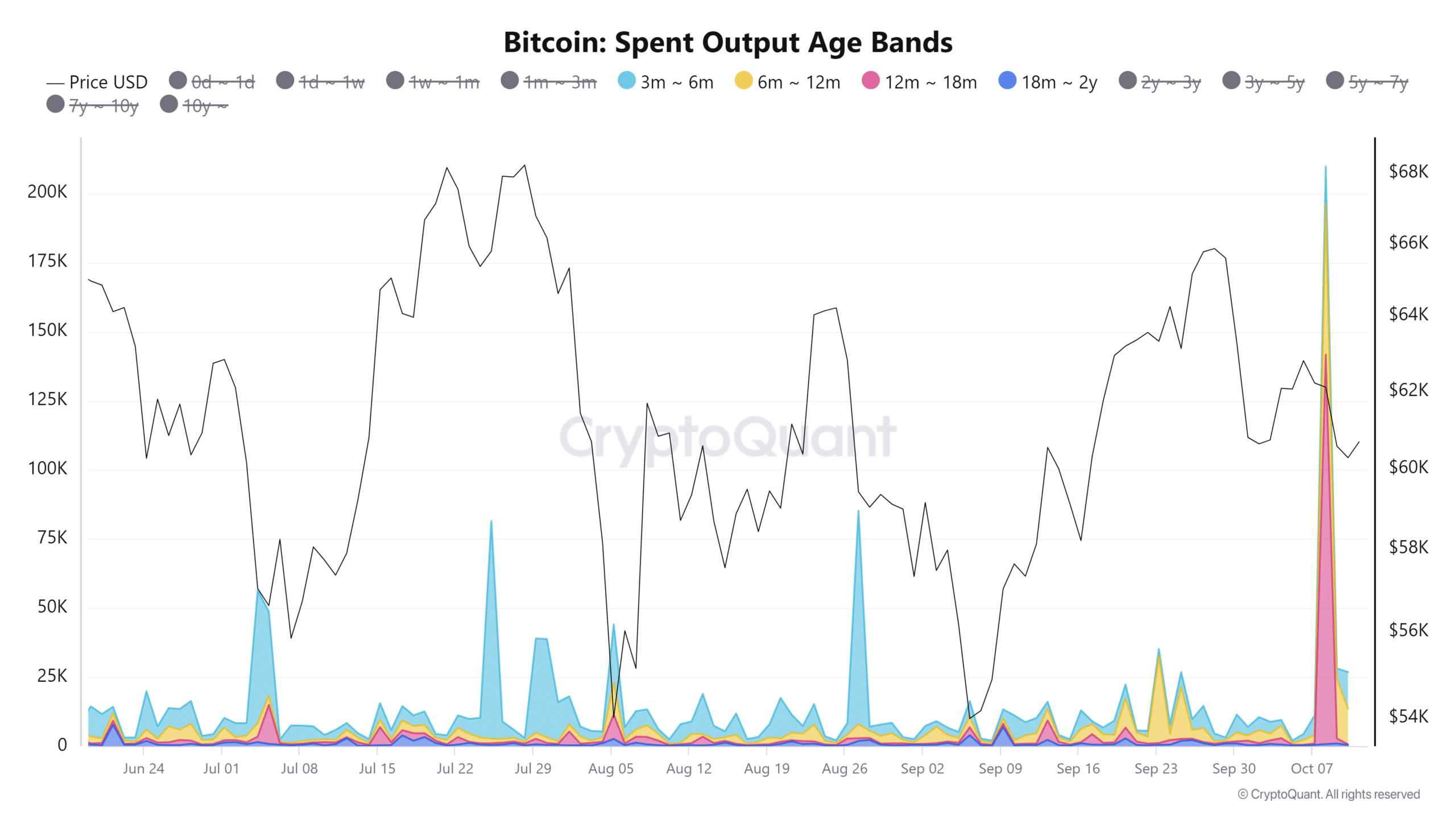

On October 8th, it was observed that a significant number of long-term Bitcoin holders, particularly those who had held for 12 months to 18 months, decided to offload their Bitcoin based on the spent output age bands data.

The short-term holders also participated, leading to a wave of selling not seen since January 2021.

Bitcoin halving returns do not match expectations

As a researcher, I’ve recently taken note of a post by Ki Young Ju, Founder and CEO of CryptoQuant, who pointed out that this year we might be experiencing the longest period of sideways price action in a halving cycle. In contrast to the 2020 cycle where Bitcoin started its rally halfway through October.

In Q1 of this year, Bitcoin’s performance significantly outdid its performance in 2020. However, those two years had starkly contrasting beginnings. In 2024, there was a surge in demand for Bitcoin due to the approval of spot exchange-traded funds (ETFs) in the U.S.

2020 saw the impending arrival of the Coronavirus pandemic causing a wave of concern among financial analysts and investors, as they braced themselves for potential economic harm.

A counterargument is that the longer the consolidation phase, the stronger the breakout. Could this happen to Bitcoin, or is the king coin more mature and less amenable to the crazy gains it saw in previous cycles? Only time will tell.

Buy the dip scenario

According to crypto expert nestay, it’s worth noting that the initial fortnight of October often exhibits market volatility and a temporary drop, which is usually followed by a recovery.

2021, 2023, and 2024 market trends were examined. In all these instances, the market exhibited a bearish pattern prior to a bullish phase that started in the latter part of each month.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This could inspire thoughts of purchasing at a dip. It’s uncertain if Bitcoin will perform as powerfully as it did during its previous cycle, but long-term investors are likely to hang on rather than selling when Bitcoin’s performance falls short of expectations.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-12 03:05