Right, so, according to some new research from River, which, let’s face it, sounds like a perfectly cromulent name for a research firm, the United States of America, that land of the free and home of the brave (and also, occasionally, questionable reality TV), has apparently become the undisputed global Bitcoin superpower. Yes, you heard that right. Superpower. As in, capes and tights, but with more cryptography and less actual flying. Probably.

A Nation at the Helm of… What Exactly?

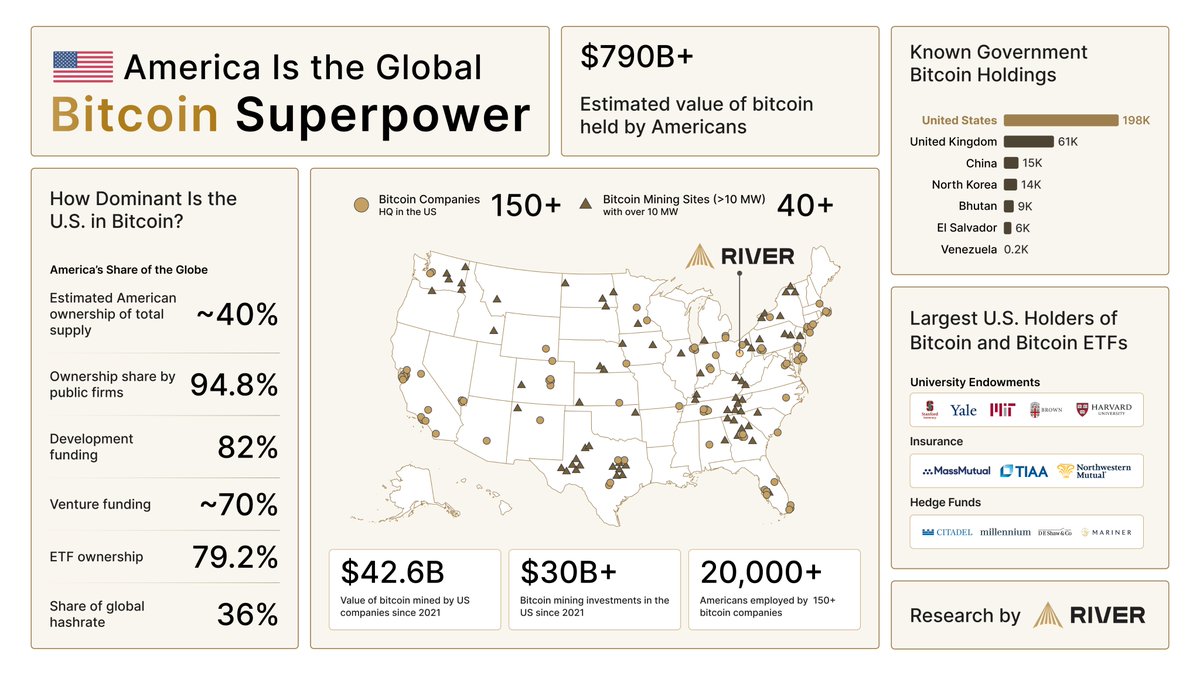

The report, which I’m sure is absolutely riveting reading for insomniacs everywhere, reveals that Americans are hoarding, I mean, holding, an estimated $790 billion+ worth of Bitcoin. That’s roughly 40% of the total global supply. Which, if you think about it, means that the other 60% is probably scattered across various forgotten hard drives and buried in landfills. This staggering concentration of ownership is, apparently, complemented by overwhelming leadership in several key metrics. Metrics! The very word makes my fillings ache.

- 94.8% of Bitcoin held by public firms is controlled by U.S.-based entities. Which begs the question: what are the other 5.2% doing? Lost in the Bermuda Triangle of blockchain?

- 82% of Bitcoin software development contributions come from American developers. So, if your Bitcoin wallet crashes, you know who to blame. Just kidding! (Mostly.)

- The U.S. attracts approximately 70% of all venture capital funding in the Bitcoin space. Which is probably why there are so many startups promising to revolutionize the world with blockchain-powered cat food delivery.

- U.S.-based ETFs account for 79.2% of global ETF ownership of Bitcoin. ETFs. The financial equivalent of alphabet soup.

- American companies hold a 36% share of global hashrate, reinforcing the country’s strength in mining operations. Mining! As in, digging for digital gold. Except instead of pickaxes, you have massive server farms that consume enough electricity to power a small country. Progress! 🥳

Infrastructure and Employment Powerhouse (Or, How I Learned to Stop Worrying and Love the Blockchain)

The American Bitcoin ecosystem is not only financially dominant but also a significant driver of innovation and job creation. With 150+ companies headquartered in the U.S. and 40+ mining sites operating at over 10 megawatts, the sector has become an engine of economic activity. Since 2021, over $30 billion has been invested in U.S.-based mining infrastructure, while the industry now employs 20,000+ Americans. So, that’s good, right? Unless, of course, the robots take over. Then we’re all doomed. But let’s not dwell on that.

Institutional Confidence (Or, When the Suits Get Involved)

Major institutions, including university endowments (Harvard, Yale, MIT), hedge funds (Citadel, Millennium, Mariner), and insurance giants (MassMutual, TIAA), are increasingly active in Bitcoin and Bitcoin ETFs—further reinforcing the country’s leadership and long-term confidence in the asset. Which means that even the people who wear ties and use words like “synergy” are getting in on the action. The end is nigh! (Just kidding. Probably.)

A Strategic Advantage (Or, Why Bitcoin Might Save Us All)

The implications of this dominance extend far beyond finance. As the digital economy expands, Bitcoin offers the U.S. a strategic asset—strengthening its geopolitical position, bolstering economic resilience, and paving the way for a new era of innovation and prosperity. Or, you know, it could all collapse in a heap of digital dust. But let’s stay positive, shall we? 🤞

In an age where financial power is increasingly decentralized and digital, America’s head start in Bitcoin could well become one of its defining economic advantages in the 21st century. Or, it could just be a really complicated way to buy pizza. Only time will tell. And possibly a very large, very powerful supercomputer. 🤔

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-05-21 07:53