- Bitcoin ETFs faced significant outflows amid U.S election uncertainties and market volatility

- BlackRock’s IBIT defied trends, attracting inflows while cumulative BTC ETF stood with outflows

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless market cycles and trends. The current state of Bitcoin ETFs is indeed intriguing, to say the least.

As the U.S Presidential election is approaching, there’s been an increase in cryptocurrency market turbulence.

On specific days like the 1st and 4th of November, there has been a noticeable withdrawal of investments from Bitcoin Exchange-Traded Funds (ETFs) in particular.

As Election Day unfolds, there’s ongoing speculation about possible changes in political climate, which further contributes to the fluctuations in the Bitcoin ETF market scenario.

Bitcoin ETF analyzed

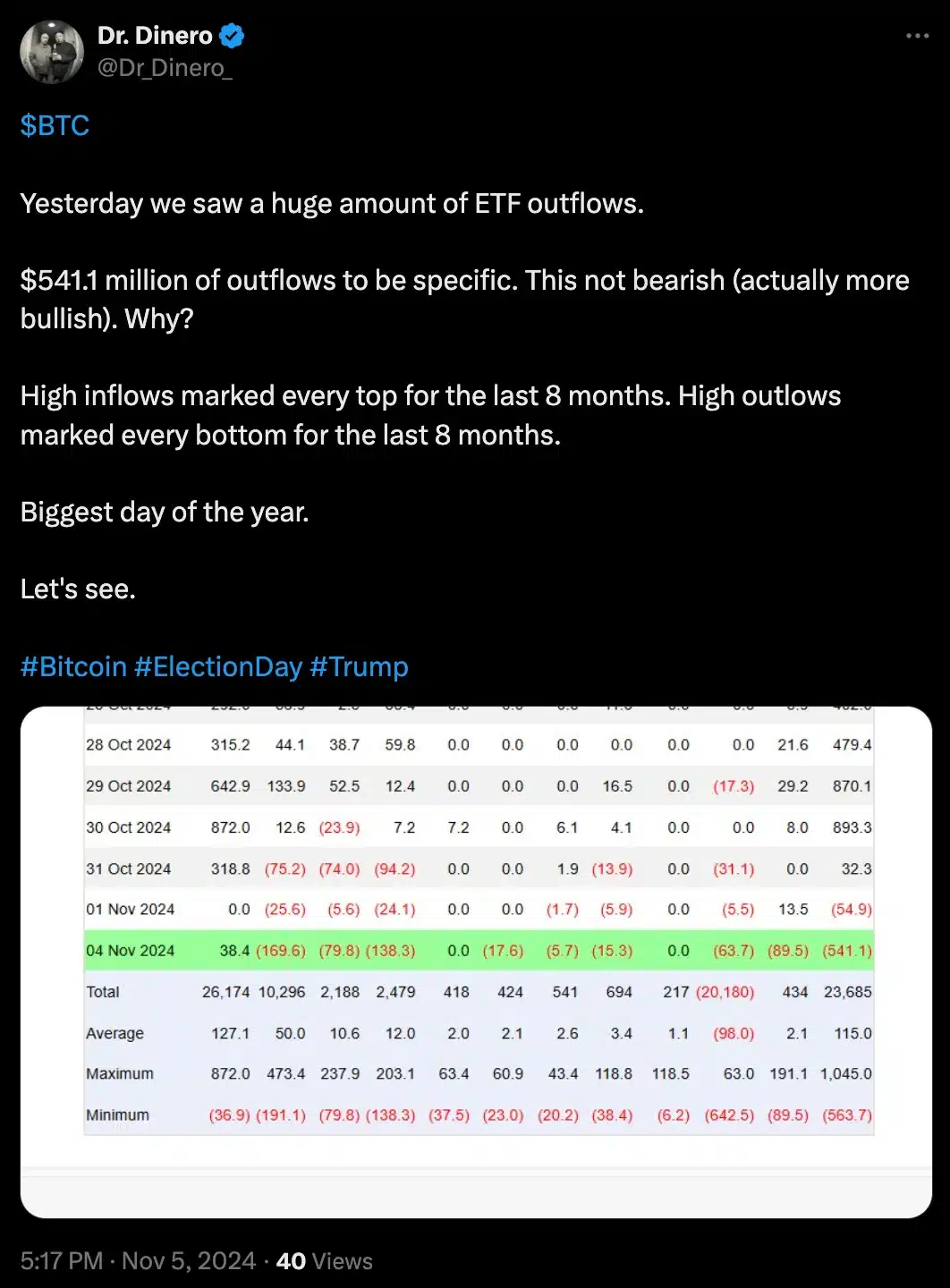

As per the most recent figures reported by Farside Investors on November 4th, there were substantial withdrawals from Bitcoin ETFs amounting to approximately $541.1 million.

Fidelity’s FBTC took the lead in terms of investment withdrawals, totaling $169.6 million. Ark 21Shares’ ARKB was a close second with outflows amounting to $138.3 million. Additionally, Grayscale’s BTC and Bitwise’s BITB experienced significant declines as well, recording outflows of $89.5 million and $79.8 million respectively. Meanwhile, Grayscale’s GBTC also reported outflows of $63.7 million.

Despite many ETFs experiencing withdrawals, Invesco’s BTCO and WisdomTree’s BTCW bucked the trend by preserving consistent inflows, avoiding any outflows.

Despite the broader downturn, however, not all updates were negative.

BlackRock’s IBIT notably bucked the trend by attracting $38.4 million in inflows.

Community reaction

Expressing similar enthusiasm within the cryptocurrency sphere, Dr. Dinero offered an upbeat viewpoint, emphasizing the presence of positive feelings even amidst the recent volatility in the market.

Another X user noted,

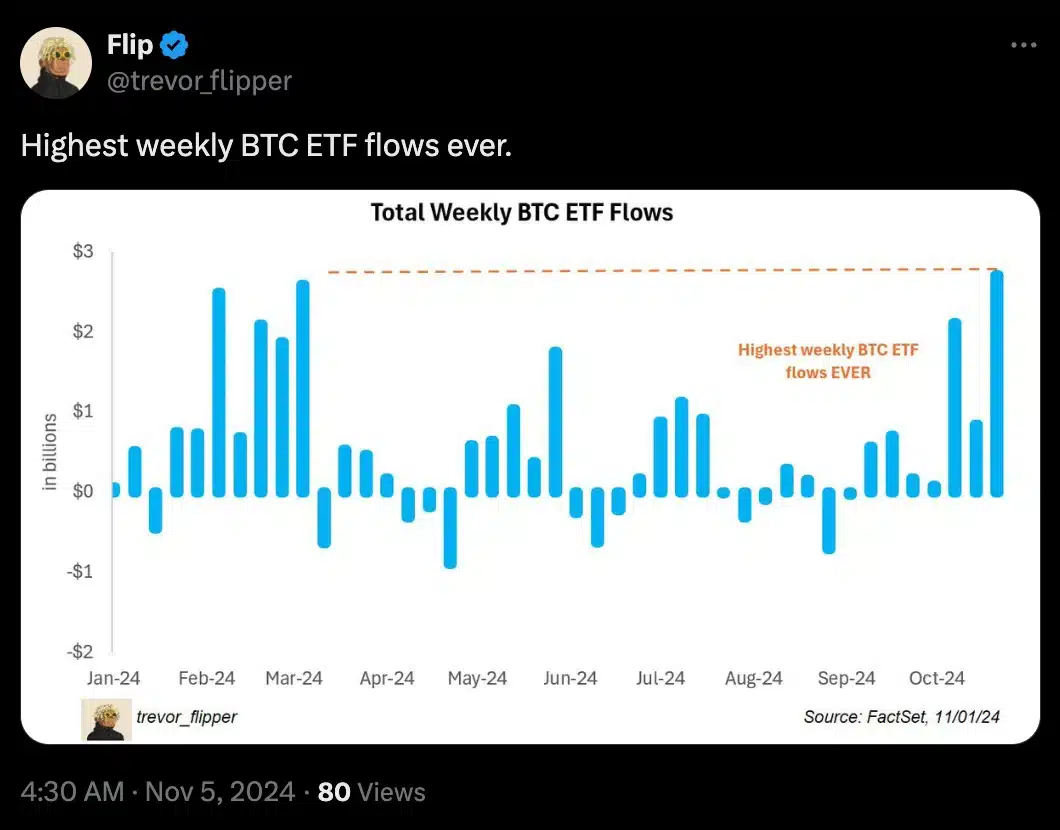

Over time, Bitcoin ETFs have seen substantial investments pouring in ever since they were introduced. Specifically, the total investment amounts to a staggering $23 billion. It’s worth mentioning that BlackRock’s IBIT specifically attracted an impressive $26 billion in investments.

Will Bitcoin ETFs cross Satoshi’s holdings?

Eric Balchunas, a senior analyst at Bloomberg for ETFs, previously predicted that Bitcoin ETFs could soon surpass the amount of Bitcoin held by its creator, Satoshi Nakamoto. It was anticipated that this achievement would be reached around mid-December.

Meanwhile, BlackRock’s latest transaction of 12,127 Bitcoin on a single day has sped up the expected timeframe.

Responding to this substantial build-up, Balchunas offered his perspectives regarding X. He emphasized the rapid progress that Exchange Traded Funds (ETFs) have made in the Bitcoin market.

If the current trend continues, they’re likely to surpass Satoshi within the next fortnight. However, it seems challenging for them to sustain such a record-breaking speed like that of Joey Chestnut, don’t you think?

Bitcoin’s price action

Lately, increased Bitcoin ETF action seems to be happening at the same time as significant fluctuations in Bitcoin’s price. Not so long ago, it reached a high of $73,000, but now it’s fallen below the $70,000 mark.

As I pen this analysis, Bitcoin is currently being exchanged at approximately $68,807.31. Over the past day, it has experienced a minor decrease of 0.10%. Viewing the weekly chart, we can see a more substantial drop of around 3%.

Therefore, with the election season bringing additional unpredictability, it seems that the cryptocurrency market may experience increased volatility over the next few days.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-06 07:36