-

BTC’s key on-chain metric hinted at price volatility.

However, technical indicators on a price chart refuted that claim.

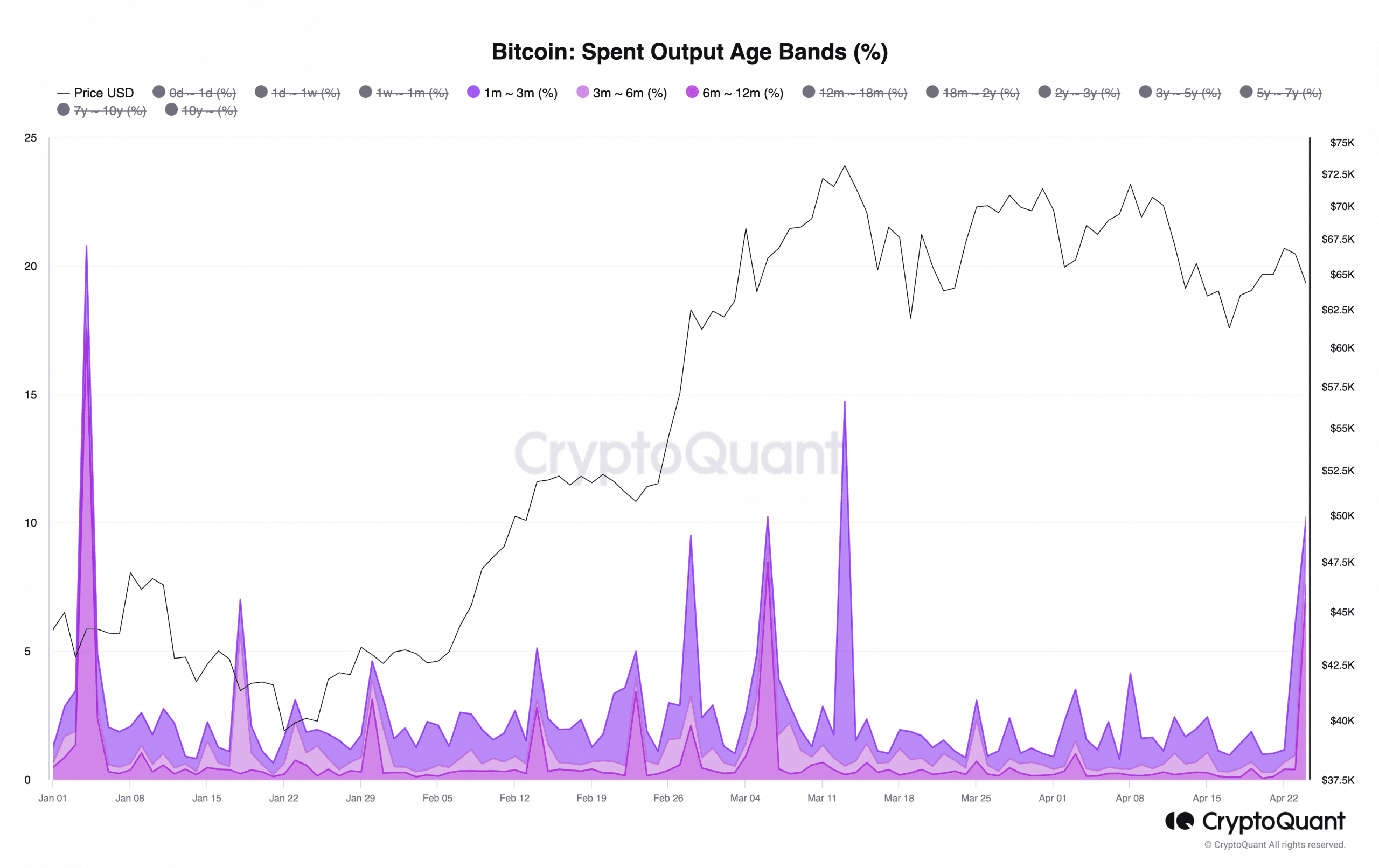

As an observer with a background in finance and cryptocurrency analysis, I find the current state of Bitcoin’s [BTC] market intriguing. Based on CryptoQuant’s data, we see that spent outputs for short-term investors have spiked, which could indicate an increase in volatility. However, upon closer examination of technical indicators such as BTC’s Average True Range (ATR) and Chaikin Volatility, I find that the market is experiencing a decline in volatility instead. This contrast between on-chain metrics and technical indicators raises some questions about the accuracy of each data source and their respective applications in predicting market trends. It will be essential to monitor these indicators closely as they could provide valuable insights into potential price swings or trends in the near future. Overall, Bitcoin’s current stable price movement is a positive sign for investors looking for long-term growth opportunities.

The data from CryptoQuant indicates that the amount of Bitcoins [BTC] previously invested by holders, who have kept their coins for a period between one and twelve months, has seen a significant increase. This uptick suggests the potential for a price shift in the cryptocurrency market.

The spending patterns of Bitcoin investors can be inferred from analyzing the age groups associated with the coins that have been spent as outputs in transactions.

For instance, the system is capable of monitoring if short-term coin holders are transferring their assets, which might suggest a rise in profits being realized.

Volatility in the BTC market?

As a researcher studying Bitcoin markets, I’ve observed that an uptick in spending from short-term holders tends to indicate heightened volatility in the market.

In a recent report, pseudonymous CryptoQuant analyst Mignolet said,

The actions of this entity serve as indicators for confirming market volatility instead of causing price fluctuations up or down. It seems that volatility is imminent.

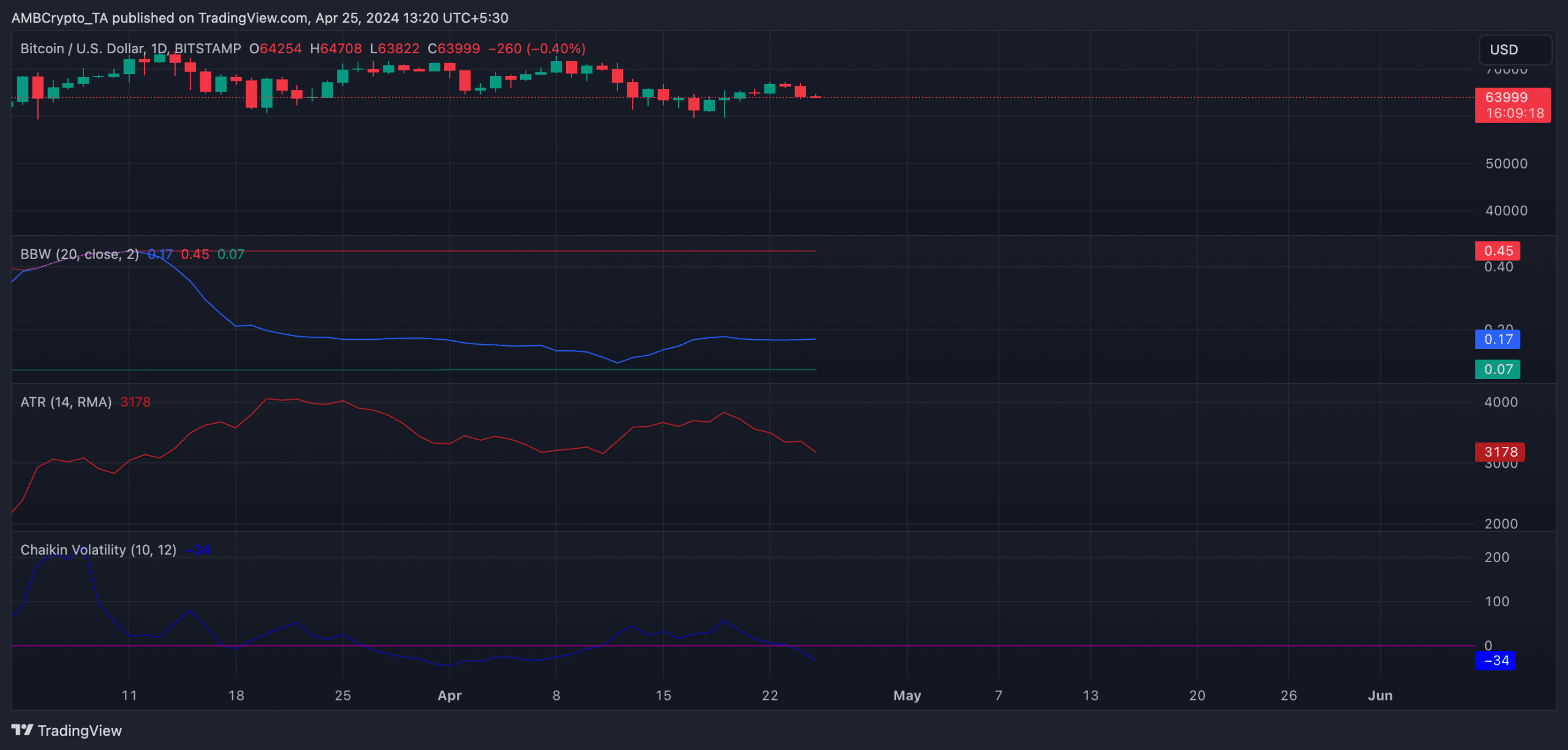

An analysis of the coin’s volatile indicators on its daily graph indicated a low likelihood of substantial price fluctuations in the near term.

I’ve noticed that the Average True Range (ATR) readings from Bitcoin’s price chart have been gradually decreasing since the 19th of April.

The average price fluctuation during a given timeframe is reflected in this metric. A decrease in its value signifies less market instability.

As an analyst, I’ve observed a significant decrease in Bitcoin’s market volatility based on its Chaikin Volatility. Specifically, since the 19th of April, this indicator has declined by approximately 162%.

I observe that this metric calculates the fluctuation in an asset’s value by assessing the difference between its current high and low prices against the price range from a prior time frame.

When the difference between an asset’s high and low prices narrows down, it implies that the market for that asset is experiencing decreased volatility.

Additionally, the Bitcoin market’s narrow Bollinger Bandwidth (BBW) supported the observation of low volatility for the cryptocurrency.

Read Bitcoin [BTC] price prediction 2024 -2025

When an asset undergoes a flattened Base Band Widow (BBW) phase, this implies that the asset’s price is exhibiting minimal volatility. Its price fluctuations are restricted and consistent within a limited range.

As of now, the dominant cryptocurrency is trading at a price of $64,241 based on CoinMarketCap’s latest figures. Over the past week, its value has experienced a notable increase of approximately 5%.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-04-26 03:03