-

Dormant Bitcoin worth $681M was moved, pushing $37.4B in on-chain volume—the highest in seven months.

Bitcoin inflows to exchanges rise, suggesting potential selling pressure as BTC stabilized around $61K.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself intrigued by the recent events unfolding in the Bitcoin [BTC] ecosystem. The sudden move of $681 million worth of dormant BTC into circulation and the subsequent surge in on-chain volume to its highest level in seven months has raised eyebrows across the industry.

A significant transfer of Bitcoins worth around $681 million, held in an inactive digital wallet, was activated and brought into active use, moving 10,158 units of Bitcoin.

As a seasoned cryptocurrency investor with years of experience under my belt, I have witnessed numerous significant transactions in the digital asset market. However, the recent large transfer that resulted in $37.4 billion in total on-chain volume stands out as the highest recorded in seven months. This is an impressive feat, especially considering the volatility and uncertainty that often characterizes this fast-paced industry. It’s moments like these that remind me why I continue to closely monitor and participate in the ever-evolving world of cryptocurrencies.

It has been noted by Santiment, a blockchain analysis tool, that this particular action is generating buzz within the market. Previously, when dormant Bitcoins have been activated, it often leads to an increase in their market price.

This occurrence highlights a change in long-term Bitcoin holders’ habits, with a significant portion of previously dormant BTC now back in circulation again.

The deal appears to be linked with information from Lookonchain as well, implying that it might influence or create a domino effect in the market.

Surge in on-chain activity

On a single day, there was a staggering $37.4 billion worth of transactions processed through blockchain networks, making it the busiest day for transactions since March 12, 2024.

This surge can mainly be attributed to previously idle Bitcoins entering the market, implying that significant investors might be increasing their activity.

Santiment pointed out that the “Age Held” metric, which monitors the transfer of Bitcoin that has been inactive for an extended period.

As a researcher, I noticed an upward trend in the Age Consumed metric, indicating that a substantial proportion of the Bitcoin transactions were originating from older, dormant coins.

As an analyst, I’ve noticed a surge in whale account activities, which could potentially influence the trajectory of Bitcoin’s price movement.

Bitcoin network metrics show mixed signals

While on-chain volume has spiked, some key metrics for Bitcoin addresses have seen a decline.

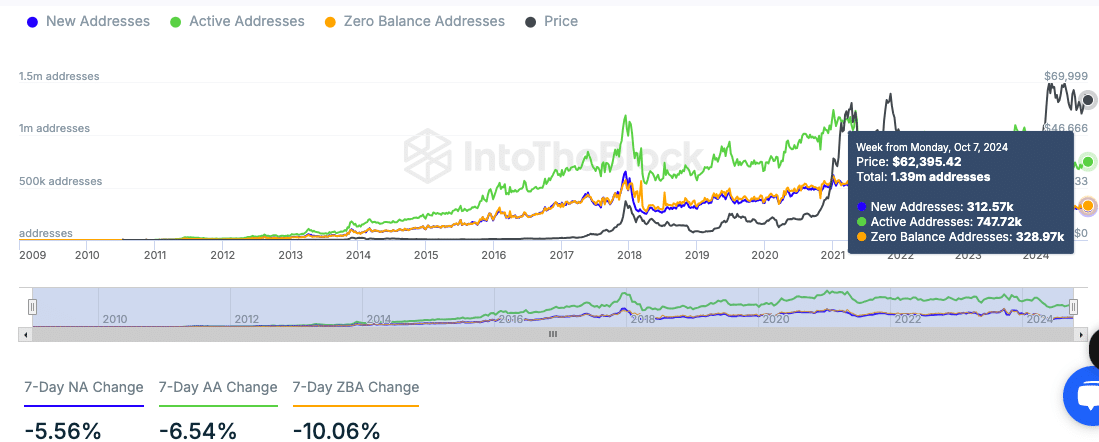

Information from IntoTheBlock indicates a decrease in newly created, currently active, and dormant wallets over the last seven days.

On the 7th of October, there was a decrease of 5.56% in new addresses, 6.54% in active addresses, and a more significant drop of 10.06% in zero-balance addresses. The total number of active addresses currently stands at approximately 747,720.

This decline in address activity could indicate short-term cooling in network participation. However, Bitcoin’s price remains relatively strong, with recent market activity showing resilience.

Possible selling pressure

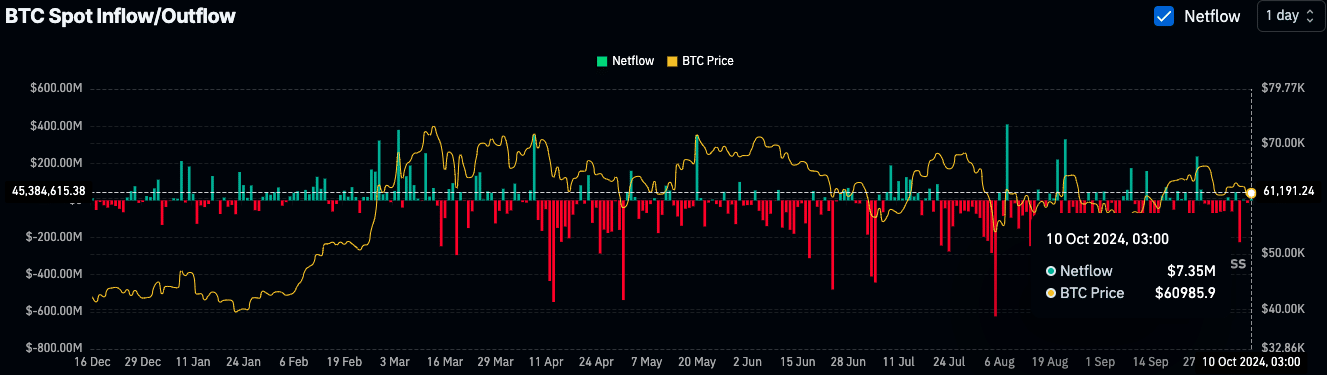

According to AMBCrypto’s examination, it was observed that a larger amount of Bitcoins were being transferred into cryptocurrency exchanges around the 10th of October, totaling approximately $7.35 million in net inflows.

Generally speaking, when more Bitcoin is being moved into exchanges (positive inflows), it might indicate that sellers are preparing to offload their Bitcoin, potentially leading to increased supply and possible price decreases.

A small increase in selling activity hints that certain traders might be preparing for further sales, yet this influx isn’t substantial enough to indicate a major change in the market trend.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Bitcoin’s price stood at $60,947 at press time, showing a slight dip from the previous week.

Even with incoming funds, the price has generally held steady, indicating that the demand might not yet be intense enough to trigger significant drops in the market right now.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-10-10 22:16