- Bitcoin vs. altcoins — a tussle emerges in volume and price.

- While Bitcoin shows dominance in these areas, the altcoin index has shown volatility.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I have witnessed firsthand its unpredictable nature and the intricate dance between Bitcoin [BTC] and altcoins.

Throughout the festive period, there’s been plenty of action in the cryptocurrency world, as Bitcoin [BTC] and alternative coins engage in a fierce competition for supremacy.

Historically, during this time, the market has shown distinctive patterns where Bitcoin is frequently seen as a secure investment option, while alternative cryptocurrencies (altcoins) tend to attract speculators who are willing to take on higher risks in pursuit of substantial profits.

Examination uncovers the complex dance between these two parts, providing glimpses into which might triumph during the festive period.

Bitcoin: A steady performer amidst market flux

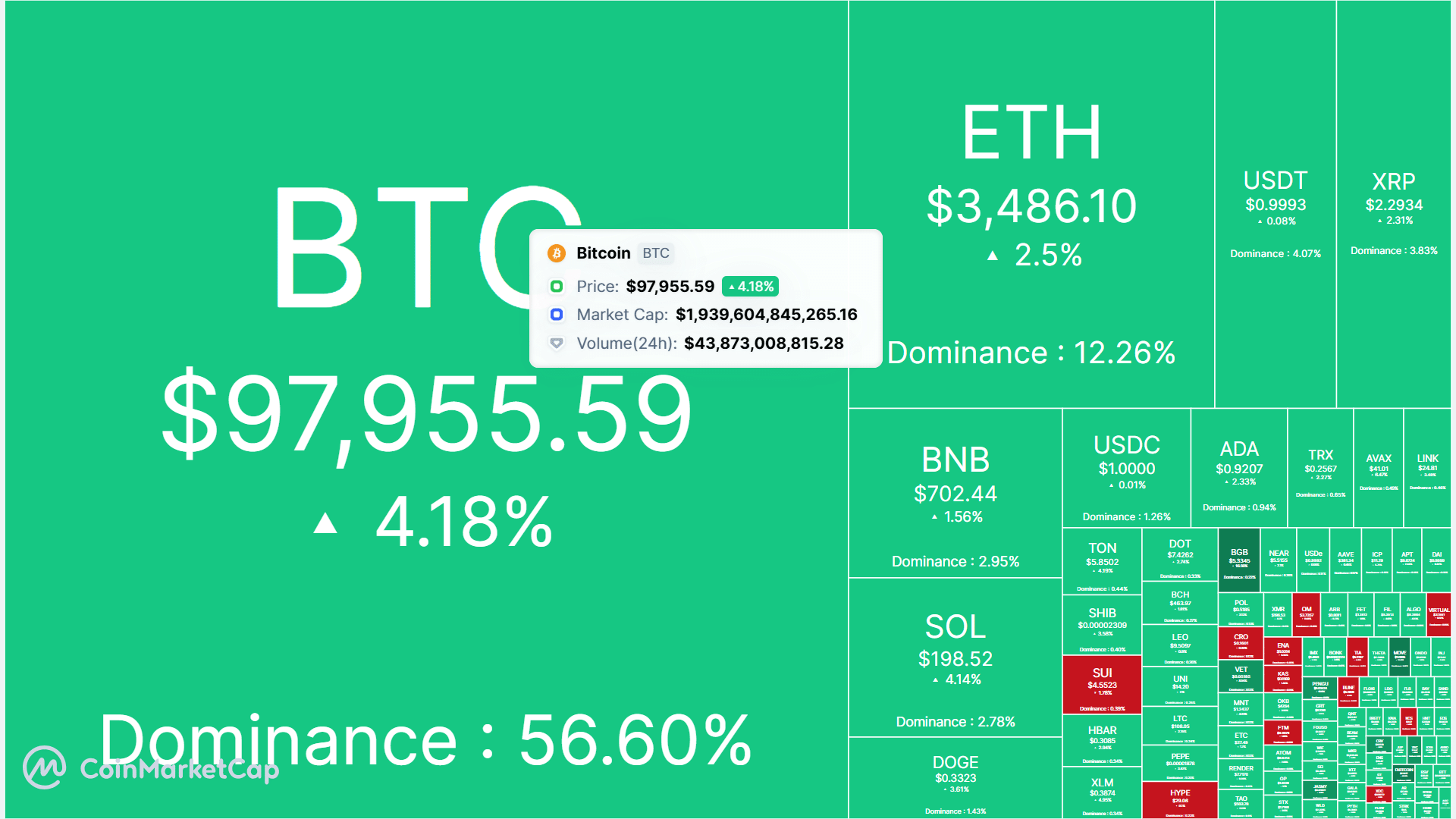

During the recent holiday season, Bitcoin has proven its strength by maintaining its value at approximately $97,955, and even managing to increase by 4.18% on a daily basis.

The market dominance chart showcases Bitcoin’s stronghold at 56.60%, indicating a clear preference among investors for the leading cryptocurrency.

This leadership clearly demonstrates Bitcoin’s resilience during financial upheavals, consistently providing steady gains.

The market heatmap further highlighted Bitcoin’s consistent performance, with trading volume exceeding $43.87 billion in the last 24 hours.

Such robust activity reflected sustained institutional interest and retail confidence in Bitcoin’s role as a “safe-haven” asset during volatile times.

Even with the challenge posed by other cryptocurrencies, Bitcoin’s persistent rise reinforced its reputation as a dependable investment, especially for those aiming for reduced risk over the long term amidst the usual volatility in the crypto market during this time of year.

Altcoin season index: A shift in momentum

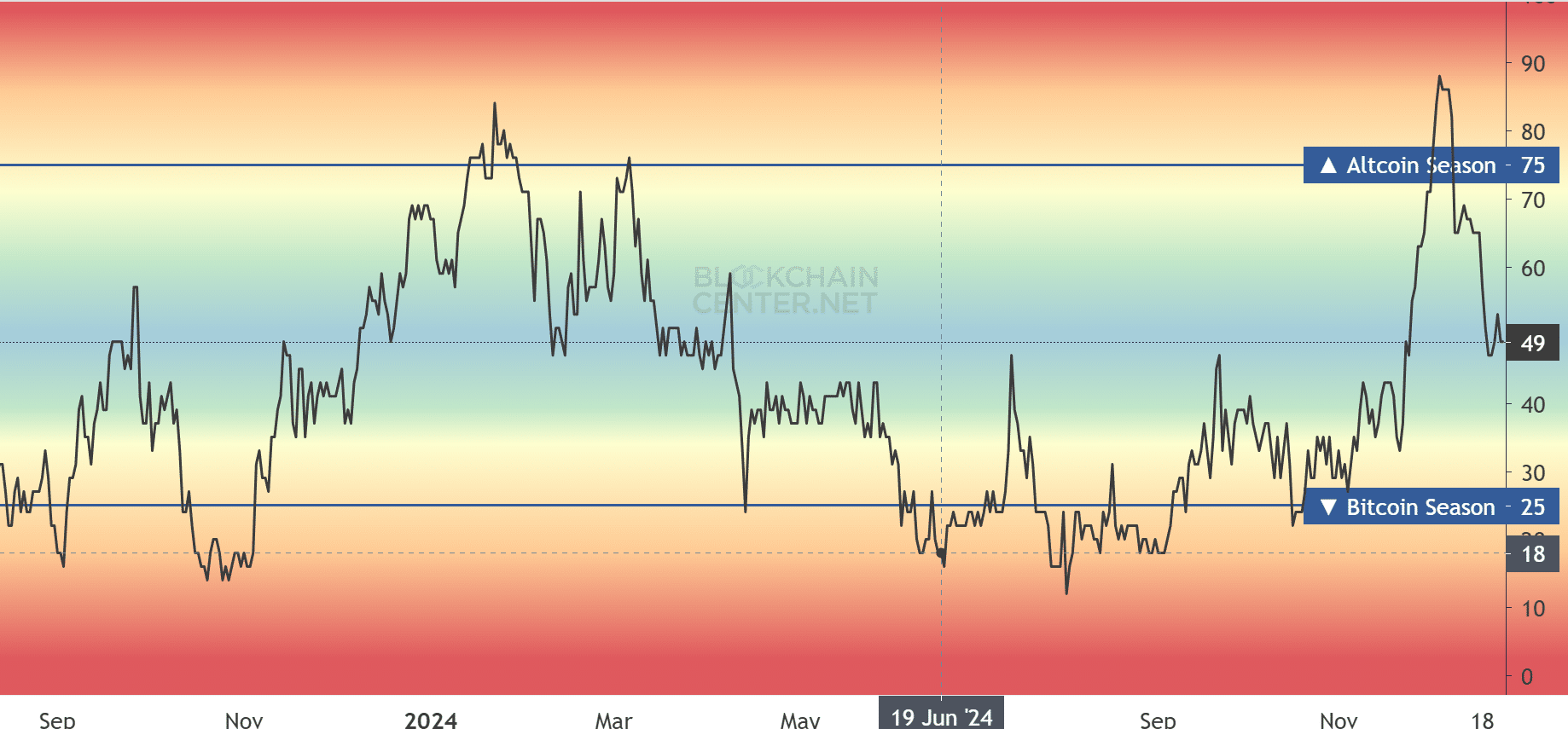

As a crypto investor, I’ve been keeping an eye on the Altcoin Season Index to understand the broader trends in the market. At the moment, the index stands at 49, suggesting a balanced position between Bitcoin and other altcoins – neither one dominating over the other at this time.

As I analyze the current state of the cryptocurrency market, it’s evident that we’re experiencing a downturn following a significant peak at 75, which signaled a robust altcoin surge. This decline seems to indicate a change in investor sentiment, with Bitcoin once again gaining traction as the preferred choice among digital assets.

Mixed performances within the altcoin sector accompany the index’s decline.

Significant cryptocurrencies like Ethereum [ETH] (rising by 2.5%) and Solana [SOL] (increasing by 4.14%) are showing positive growth, but overall, the wider alternative coin market continues to show signs of division.

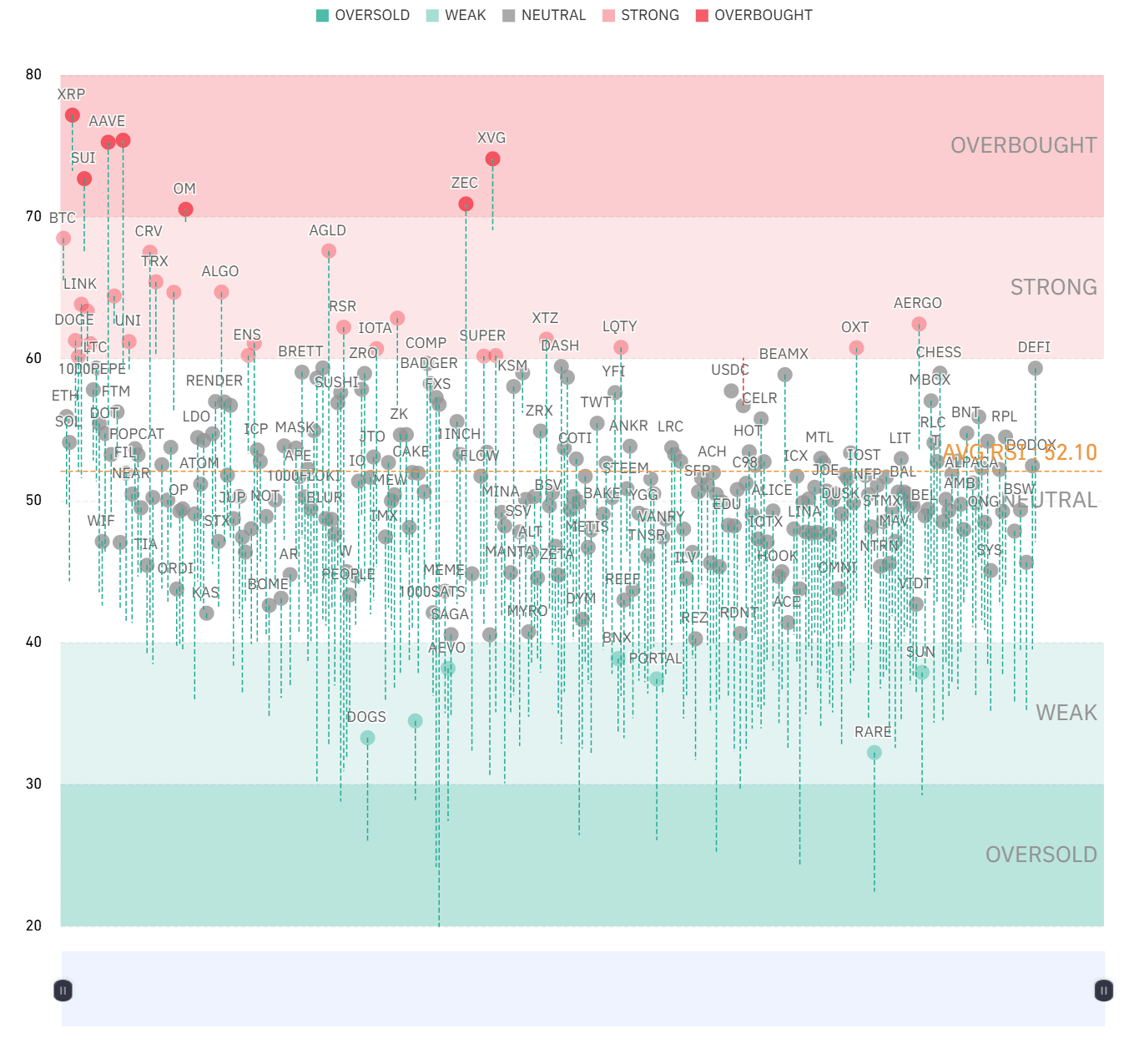

The oversold/overbought chart offers additional insight, showing a divergence in performance.

In simpler terms, the prices of XRP and Aave (AAVE) have risen too much, suggesting that they might experience a decrease (correction), whereas assets that are undervalued (oversold) could present attractive investment opportunities for traders taking on a more risky approach.

Overbought vs. oversold: A tale of divergence

According to AMBCrypto’s examination, the oversold/overbought chart shows a significant difference between Bitcoin and other cryptocurrencies (altcoins).

In other words, Bitcoin was showing a balanced outlook with no clear bias, but various other cryptocurrencies were found in both overbought (indicating excessive buying) and oversold (indicating excessive selling) regions.

In simpler terms, the digital currencies such as Zcash (ZEC) and Ripple (XRP) seem too expensive for their current value, which may indicate a lack of room for further growth and could lead to investors taking profits.

Conversely, during the holiday season, altcoins that were overpriced offered chances for investors seeking underpriced assets to potentially profit from this situation.

The difference between Bitcoin and altcoins underscores their speculative character, as altcoins tend to exhibit greater price fluctuations than Bitcoin.

Investing in altcoins under volatile market circumstances can yield immediate benefits but simultaneously amplifies the perils associated with such investments.

Bitcoin’s vs. Altcoin: Stability vs. volatility

The market heatmap underscored Bitcoin’s dominance in trading activity and market capitalization, reflecting its role as a stabilizing force.

In certain situations, altcoins tend to provide a greater return on investment; however, they are often subject to significant fluctuations in price because of their reduced market liquidity and high levels of speculation.

Bitcoin’s continuous trading activity and market dominance suggest a more settled investor attitude compared to the fractured and conjectural character often associated with alternative cryptocurrencies.

A balanced view on the Altcoin Season Index indicates that certain altcoins have had their own triumphs, but overall, Bitcoin continues to be favored across the crypto market as a leading investment choice.

The holiday season winner

Based on the analysis, Bitcoin appears to have the edge during this holiday season.

This investment option is highly preferred by both long-term investors and cautious traders due to its solid reliability, growing influence, and substantial transaction activity.

On the other hand, the world of altcoins holds pockets of potential gains for those prepared to handle its ups and downs. Overvalued coins could offer chances for entry, making them interesting prospects.

The ultimate winner depends on investor objectives. For those prioritizing stability and sustained growth, Bitcoin remains the champion.

Choosing certain alternative cryptocurrencies might offer unexpected benefits to investors who are willing to take on more risk in search of increased returns. As the festive period unfolds, monitoring key performance indicators will help understand the shifting relationship between Bitcoin and other altcoins.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

2024-12-25 19:04