-

Despite fundamental differences, Bitcoin and Dogecoin share a strong correlation

Short-term trajectory pointed to a DOGE price increase and a BTC decline

As a seasoned crypto investor with years of experience in the market, I’ve learned to keep an open mind when it comes to analyzing different digital assets. However, I must admit that I’m often perplexed by the similarities and differences between two seemingly disparate coins like Bitcoin and Dogecoin.

Fewer than twenty cryptocurrencies have persisted for over a decade since their inception. Among them are Bitcoin [BTC] and Dogecoin [DOGE], which have been around for over ten years each. However, it’s surprising how many people remain uninformed about the fundamental distinctions between these two digital currencies.

As a crypto investor, I’m excited to explore the intricacies of Bitcoin and Dogecoin in this informative piece by AMBCrypto. The article will delve into the striking resemblances and notable differences between these two popular cryptocurrencies. Prepare to gain valuable insights about their price trends and on-chain conditions.

Bitcoin vs Dogecoin: Who takes the crown?

Both Bitcoin and Dogecoin share a similarity in their underlying consensuses mechanisms: specifically, Proof-of-Work (PoW).

The reason why many blockchain projects continue to rely on mining rather than validators lies in their shared characteristics. Nevertheless, it’s essential to note that a significant distinction exists between them: their approaches to supply generation.

As a crypto investor, I’d explain it this way: Dogecoin has an infinite supply, whereas Bitcoin is limited to only 21 million coins. This scarcity makes Bitcoin more valuable compared to Dogecoin, which was currently trading at around $0.12 per coin.

The increase in value represented a 38.19% rise on a Year-To-Date (YTD) basis for the unspecified asset. Regarding Bitcoin, its price reached $61,579, marking a 39.42% growth during the same timeframe.

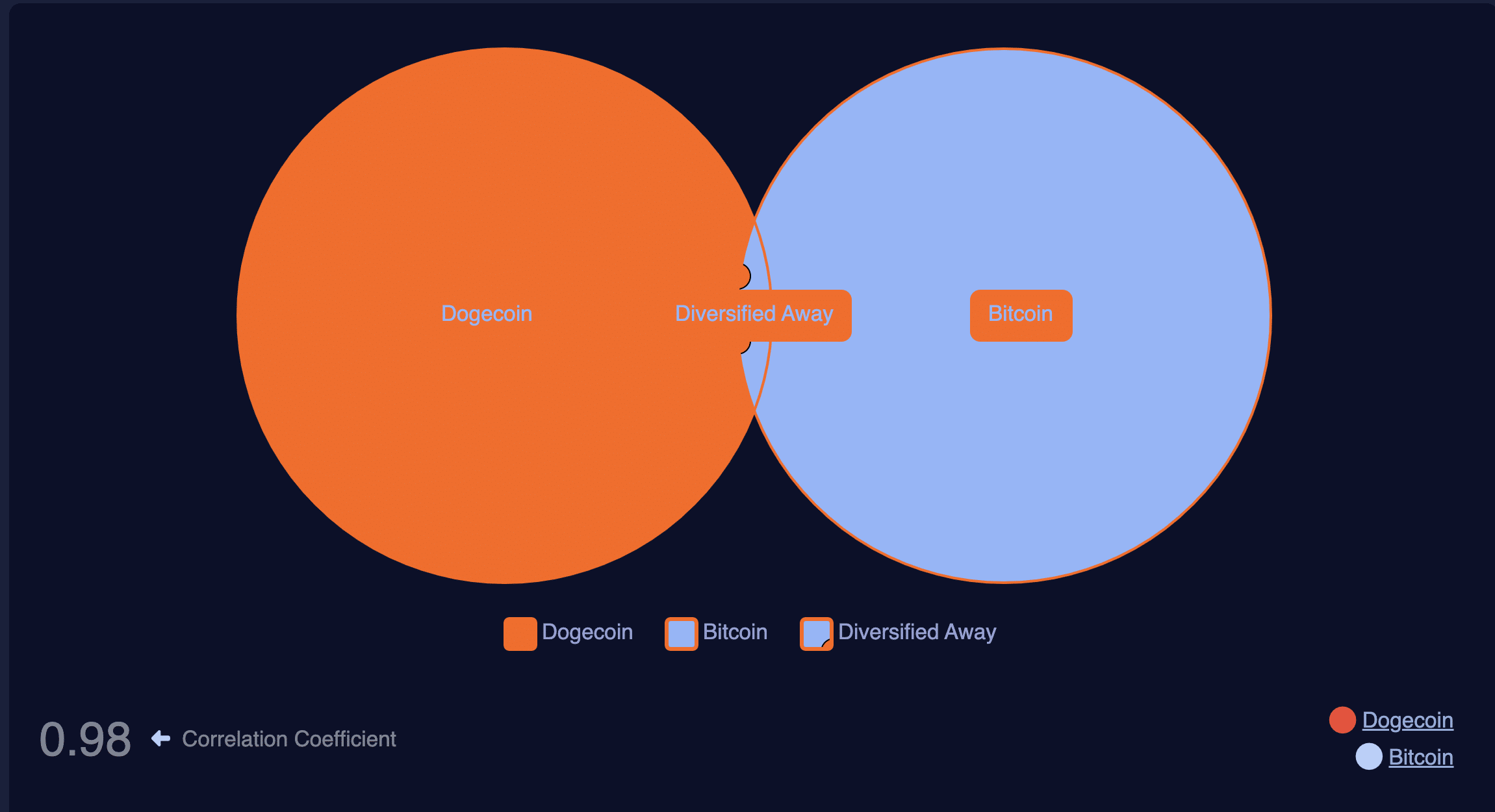

Upon examining the costs of Bitcoins and Dogecoins, we discovered a significant relationship between them. To illustrate, based on Macroaxis data, the correlation coefficient for Bitcoin versus Dogecoin was 0.98.

As a crypto investor, I’d describe it this way: The correlation coefficient measures the strength and direction of the relationship between two assets’ price movements. It ranges from a perfect negative correlation (-1), where the prices move in opposite directions, to a perfect positive correlation (+1), where they move in tandem. When the correlation coefficient is close to -1, it indicates that the assets’ price actions seldom align and often diverge significantly.

An coefficient near 1 indicates a strong positive correlation. Consequently, the relationship between Bitcoin (BTC) and Dogecoin (DOGE) was such that investing in either coin since the beginning of the year would have yielded nearly identical returns for you.

As a crypto investor, I’d consider the possibility that Bitcoin’s price trajectory could persist based on current trends. However, it’s important to note that the returns on Bitcoin might be slightly more substantial compared to other investment options. To make an informed decision, let’s examine the underlying factors influencing Bitcoin’s price movement and assess whether these conditions are likely to continue.

DOGE takes the upper hand this time

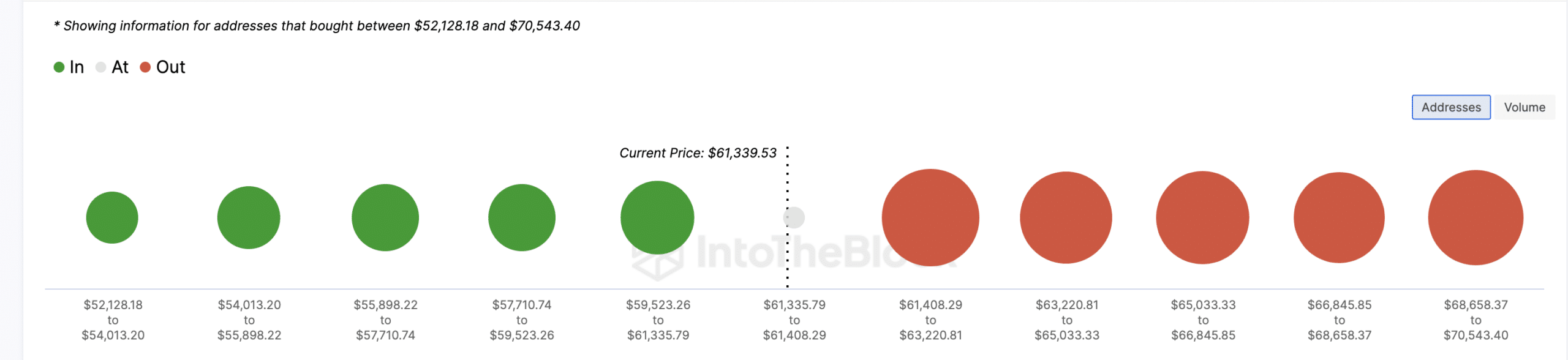

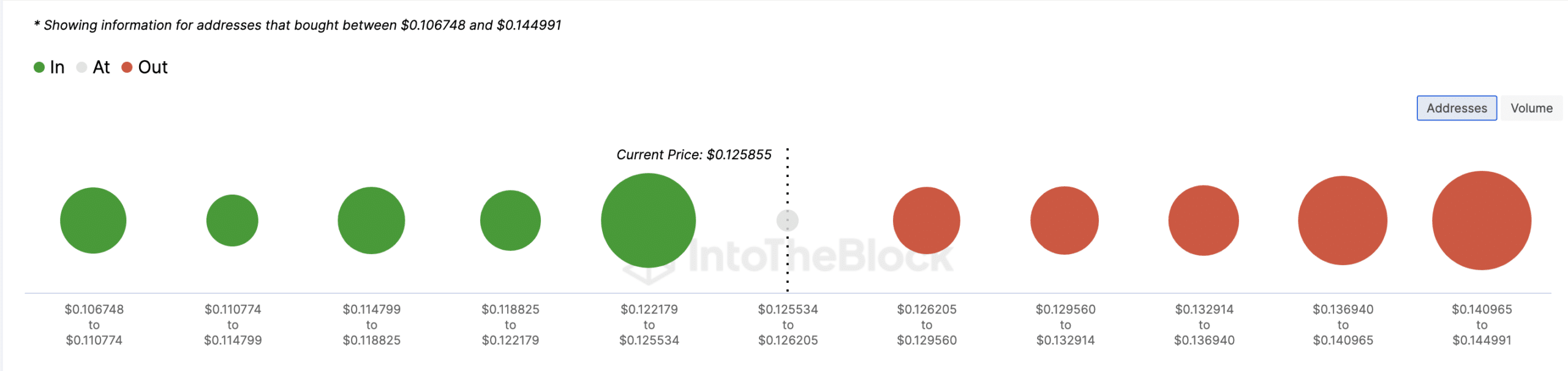

To determine if this was a feasible outcome, AMBCrypto examined the In and Out of Money Around Price (IOMAP) provided by IntoTheBlock. This tool highlights key support and resistance levels based on the token’s trading history.

This method gathers together addresses purchased within a specific price range. Among them, some will yield a profit while others will result in a loss. Generally, the bigger the cohort of addresses, the more stable the price level they represent, be it support or resistance.

As a crypto investor, I recently came across some intriguing data from AMBCrypto’s latest analysis. At the current moment, a significant sell-wall has emerged at a price level of $62,134. Interestingly enough, approximately 1.64 million Bitcoin addresses had purchased around 759,670 coins up to that point. On the other hand, 755,240 Bitcoin addresses had bought roughly 445,280 coins at an average price of $60,793 before this sell-wall appeared.

Based on the disparity, it’s plausible that Bitcoin could experience a further decrease. Should this occur, the cryptocurrency may dip below the $60,000 mark. Consequently, it might not be advisable to invest in Bitcoin at this moment.

In contrast to Bitcoin’s situation, Dogecoin experienced something unique at a price of $0.12. This was due to approximately 86,480 wallets collectively buying around 6.87 billion DOGE coins at that specific cost.

As a researcher studying cryptocurrency market trends, I discovered over 33 thousand unique wallet addresses purchased approximately 717.77 million Dogecoins at prices above their current value. This substantial buying activity could potentially influence DOGE‘s price movement in the near future, possibly causing it to trade at a higher value.

Realistic or not, here’s DOGE’s market cap in BTC terms

Furthermore, Dogecoin’s potential value lies roughly between $0.13 and $0.15. In simpler terms, investing in Dogecoin could yield higher returns compared to Bitcoin within the near future.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-29 09:11