-

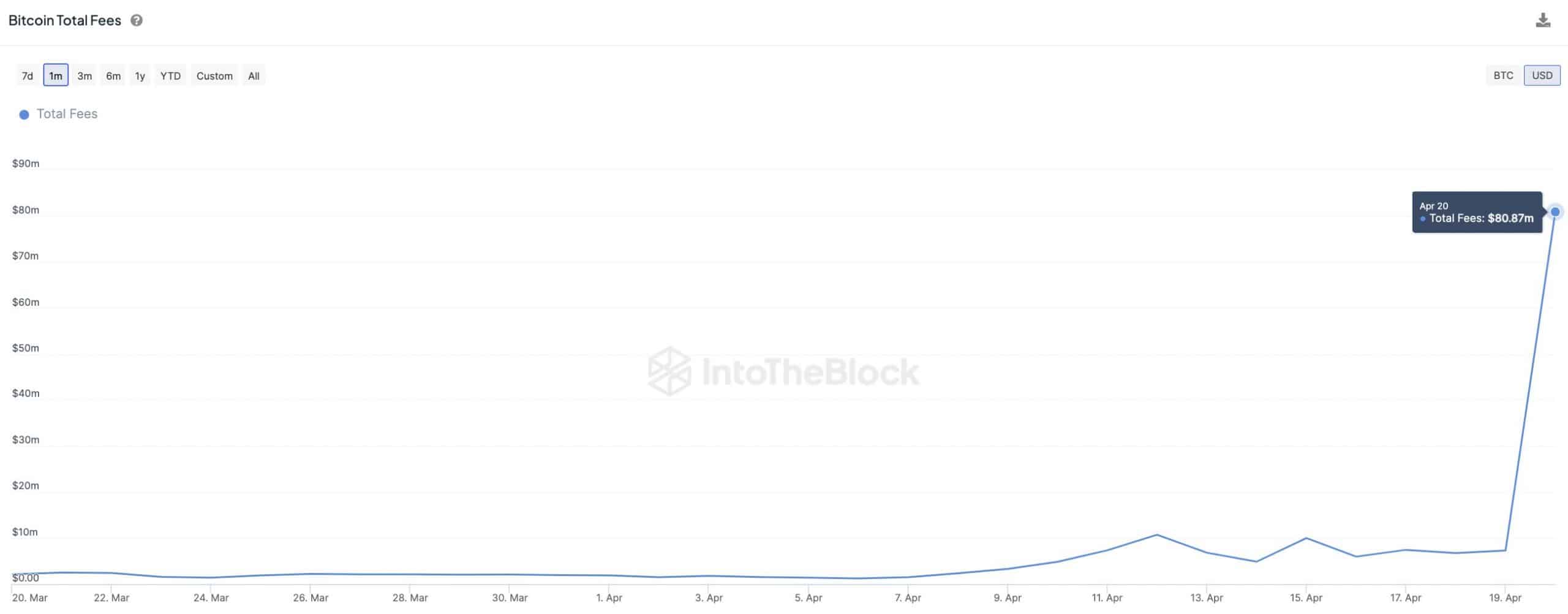

Bitcoin transaction fees hit an all-time of $80 million.

Stacks exec believes fees will go even higher as BTC L2 expands.

After the fourth decrease in new Bitcoins rewarded for mining, Bitcoin miners have seen higher profits. On April 20th, Bitcoin transaction fees reached an unprecedented high of over $80 million, surpassing their previous peak from 2017, as reported by Lucas Outumuro, Head of Research at IntoTheBlock.

“The daily fees amounting to $80 million are roughly four times greater than the all-time high (ATH) set in December 2017. Notably, the average Bitcoin (BTC) transaction fee hit an astonishing $128 – significantly surpassing the previous peak of $30 during the initial Ordinals craze.”

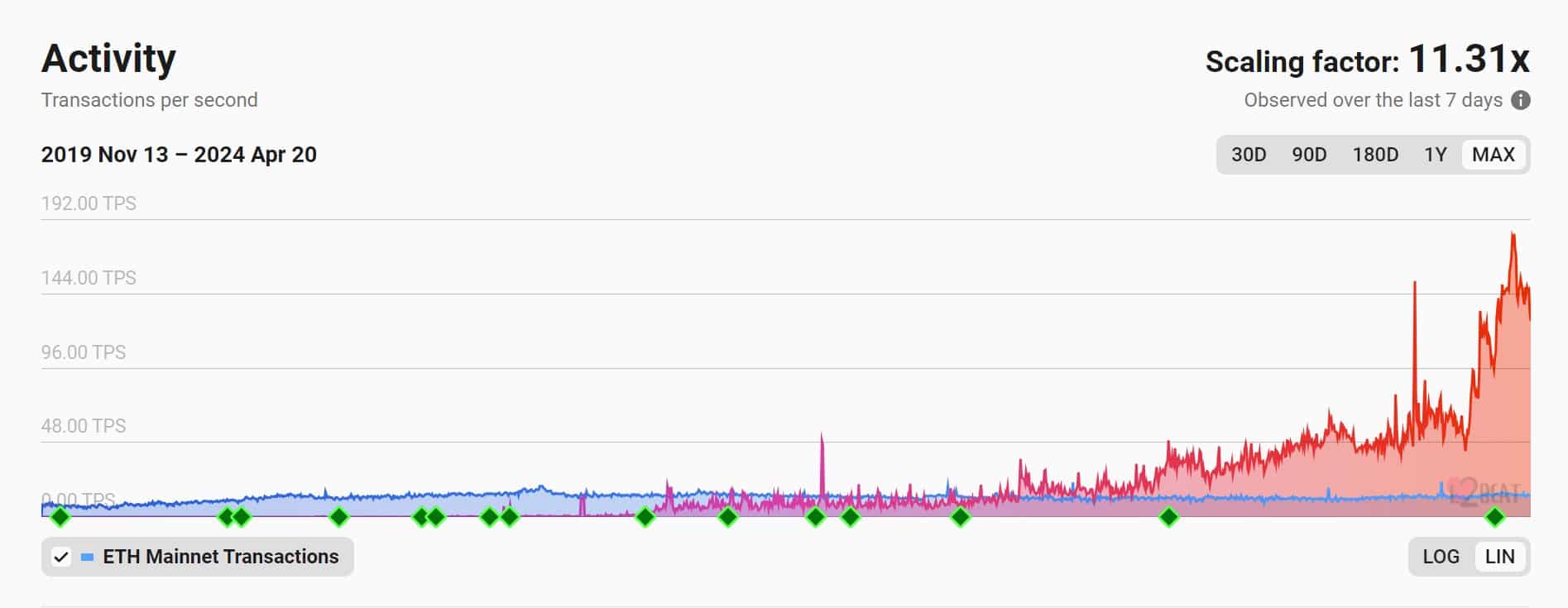

The relatively high fees for transactions on Ethereum [ETH] and Bitcoin networks have sparked discussions about the competition for limited block space between these two platforms.

BTC vs. ETH: Runes effect?

A anonymous cryptocurrency expert pointed out that the typical transaction fee on Bitcoin is currently higher than usual at around $128. This expert argued that due to this increased demand for limited block space, the Bitcoin network presently experiences more congestion than Ethereum.

“The average fee to send value on Ethereum network is about $0.50 right now (single digits gwei). On Bitcoin network it’s $20. That’s a 40x difference in demand for BTC blockspace. Huge alpha there.”

An intriguing observation is that the surge in Bitcoin transaction fees occurred around the same time as the introduction of Runes Protocol, a fresh Bitcoin standard for creating fungible tokens.

However, another user, Adriano Feria, downplayed Bitcoin’s higher fees and stated,

“BTC’s fees are still $20 because LN (Lighting Network) is garbage, and there are no other alternatives.”

Feria added that blobs have positively impacted Ethereum and shifted demand to L2s;

“Demand for transactions secured by ETH are at an ATH, but they are just shifting to L2s.”

Despite this, some experts and executives believe that Bitcoin’s transaction fees will increase as the Runes Protocol becomes more popular and second-layer solutions for Bitcoin (BTC) gain momentum.

On Runes’ impact on BTC fees, Outumuro added;

Twenty-four hours following the halving event, the inflationary rewards were reduced by half, whereas transaction fees surged by an astounding 1,200% as a result of Runes. Consequently, miners amassed an unprecedented earnings of over $100 million on April 20th.

Currently, memecoins rule the scene in Runes Protocol. But with the forthcoming Nakamoto update for Stacks [STX], a Bitcoin layer-2 scaling solution, there’s a good chance of increased action and higher fees.

Stacks co-founder, Ali Muneeb recently highlighted that;

“Remember when we told you that Bitcoin fees will do a 500x? Yeah, we’ve been working on Bitcoin L2s for a reason. Happy halving, everyone! Next stop, Nakamoto.”

Another Bitcoin Layer 2 solution called Merlin Chain was launched on April 19th and currently holds the top spot in terms of Total Value Locked, according to DefiLlama’s data.

If the secondary layer of the Bitcoin network regains popularity, Bitcoin transaction fees might continue to be expensive.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- ANKR PREDICTION. ANKR cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-04-22 19:04