-

Ethereum has recorded low capital inflows since January compared to Bitcoin.

ETH’s long-term holders continue to wait for a new all-time high.

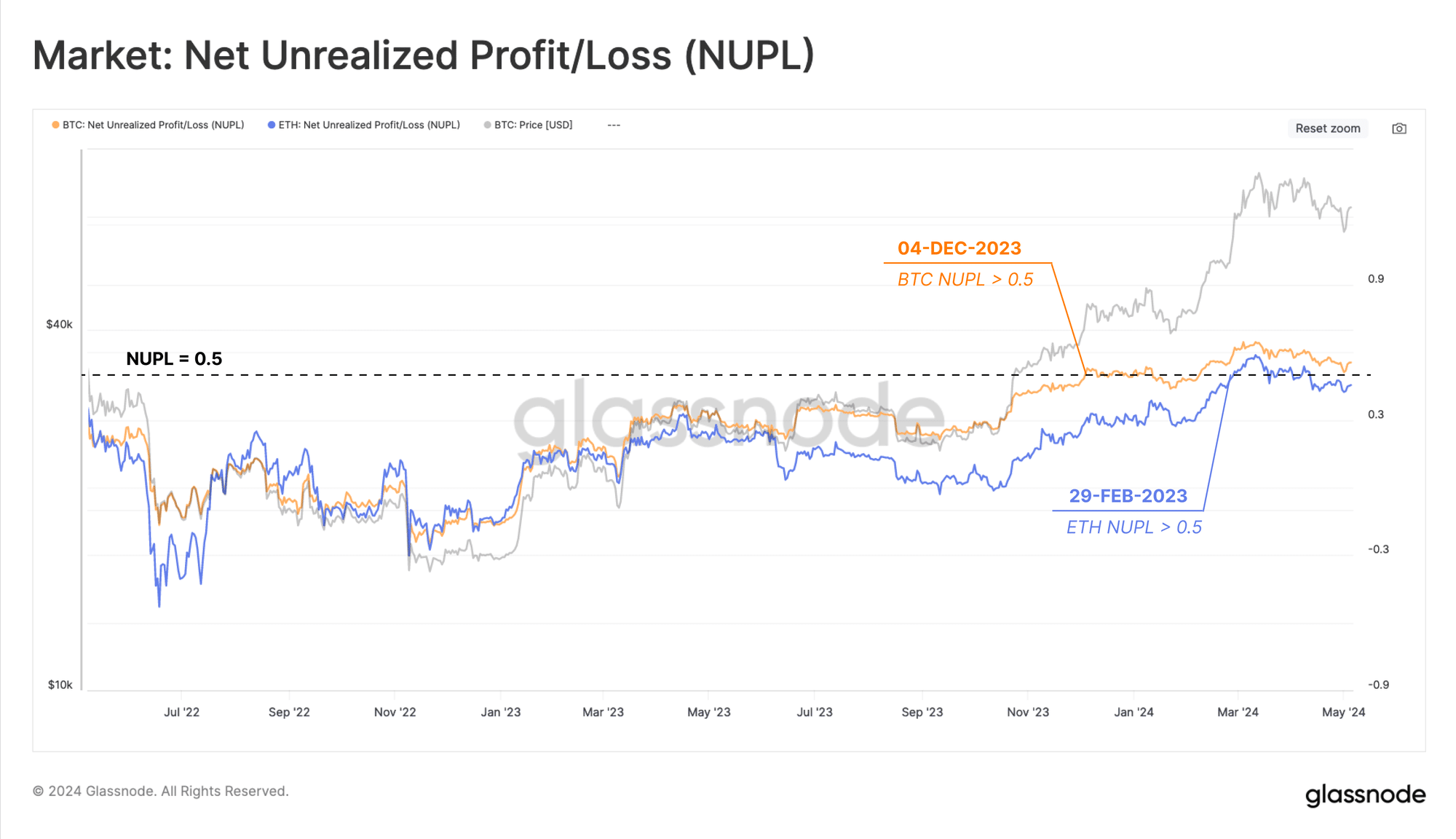

As a researcher with a background in blockchain and cryptocurrency analysis, I find it intriguing that Ethereum (ETH), the second largest cryptocurrency by market capitalization, has underperformed Bitcoin (BTC) since January. According to recent data from Glassnode, ETH’s net unrealized profit/loss (NUPL) has been significantly lower than BTC’s since the approval of the US spot Bitcoin ETFs.

As an analyst, I’ve discovered through recent research conducted by Glassnode that Ethereum [ETH], a prominent altcoin, hasn’t kept pace with Bitcoin [BTC] since the beginning of this year.

Based on information from a data provider that specializes in on-chain analysis, Bitcoin, fueled in part by the introduction of US spot exchange-traded funds (ETFs), has experienced a notable increase in investment since the start of the year. In contrast, Ethereum has shown a decrease in trading activity as per the available data.

ETH remains in BTC’s shadows

As a crypto investor, I’ve been closely monitoring the market since the approval of spot Bitcoin ETFs on January 10th. Recently, Glassnode data has caught my attention due to a notable divergence in Net Unrealized Profit/Loss (NUPL) between Bitcoin and Ethereum. In simpler terms, this means that while Bitcoin holders have been experiencing more profit-taking than loss realization, the opposite trend is happening for Ethereum holders. This could indicate different market sentiments or trends for each cryptocurrency.

The on-chain analysis company observed in its study that Bitcoin investors have claimed a greater portion of earnings than their Ethereum counterparts since that time.

The NUPL index evaluates if investors in a particular asset are currently facing realizations of profits or losses on their holdings. This assessment is achieved by contrasting the average cost basis of all tokens owned by investors with the present market value.

As a crypto investor, when the market price of my holdings is higher than my purchase price, I’ve made a net profit that hasn’t been realized yet. Conversely, if the market price is lower than my purchase price, I’ve incurred a net loss that remains unrealized.

Based on Glassnode’s analysis, an asset reaches a notable milestone when its NUPL (Net Unrealized Profit Ratio) surpasses 0.5. This indicates that more than half of the asset’s total market value is derived from its unrealized profits.

Glassnode said,

Amidst the excitement and stock market surge following the approval of spot Bitcoin ETFs, the potential profits of Bitcoin investors grew at a quicker pace than those of Ethereum investors. Consequently, the NUPL (Network Upgradability Price Lag) indicator for Bitcoin reached 0.5 and entered the “euphoria” phase three months earlier than the same metric for Ethereum.

As a researcher studying the cryptocurrency market, I’ve observed that Ethereum (ETH) has not experienced significant influxes of fresh investment like Bitcoin (BTC) following the approval of spot Bitcoin exchange-traded funds (ETFs) for trading in the United States.

According to Glassnode’s analysis, the realized capital gains from selling for Ethereum held by short-term investors have remained relatively low compared to other cryptocurrencies.

The behavior of short-term coin investors appears to be less active, which can have a considerable impact on an asset’s price fluctuations.

The report further stated,

“This paucity of fresh investments in Ethereum can be attributed to its underperformance compared to Bitcoin, in several aspects. Likely contributing factors include the heightened focus and convenience offered by the approved Bitcoin spot ETFs.”

On why this might be happening, Glassnode added:

As a crypto investor, I’m keeping an eye on the anticipated decision from the SEC regarding the approval of a collection of Ethereum (ETH) Exchange-Traded Funds (ETFs). The community is holding its breath with expectations running high that this announcement may come as soon as the end of May.

Because of the varying returns offered by Bitcoin (BTC) and Ethereum (ETH), long-term investors (LTHs) have chosen distinct approaches for each cryptocurrency.

As a researcher studying the behavior of large-scale crypto investors, I’ve noticed an intriguing contrast between Bitcoin (BTC) and Ethereum (ETH) in recent market trends. While BTC’s long-term holders (LTHs) have decided to sell some of their coins to secure profits after BTC reached a new peak, Ethereum’s LTHs have shown a more resilient stance. These observations are based on my analysis of wallet data and market trends.

“Appear to still be waiting for better profit-taking opportunities.”

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-09 05:12