-

Both BTC and ETH have a bearish outlook based on technical analysis

On-chain metrics showed more consistent accumulation for ETH than BTC recently

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the current state of Bitcoin (BTC) and Ethereum (ETH). Based on my analysis of technical indicators, on-chain metrics, and market sentiment, it appears that Ethereum might have a slight edge over its counterpart.

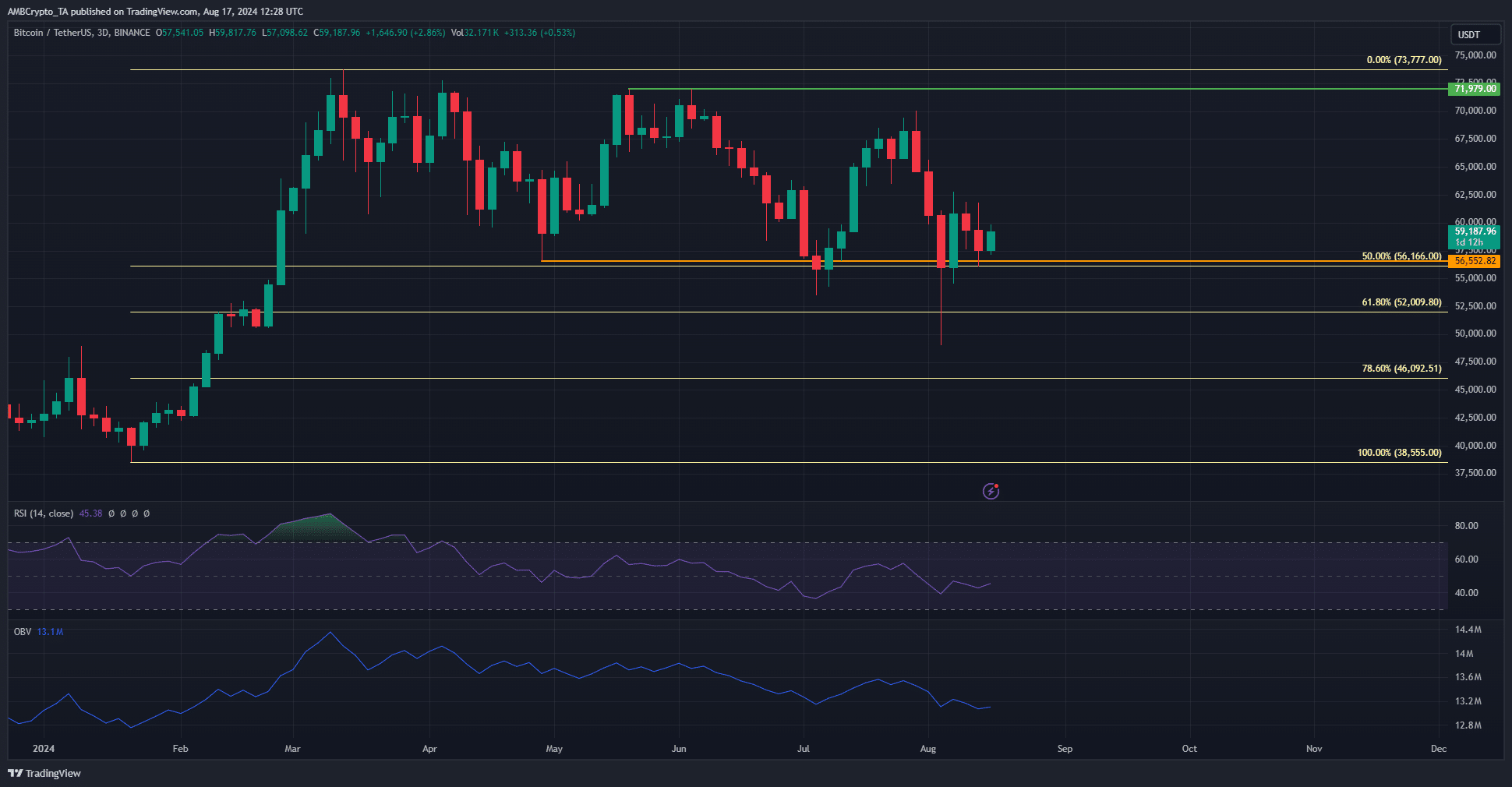

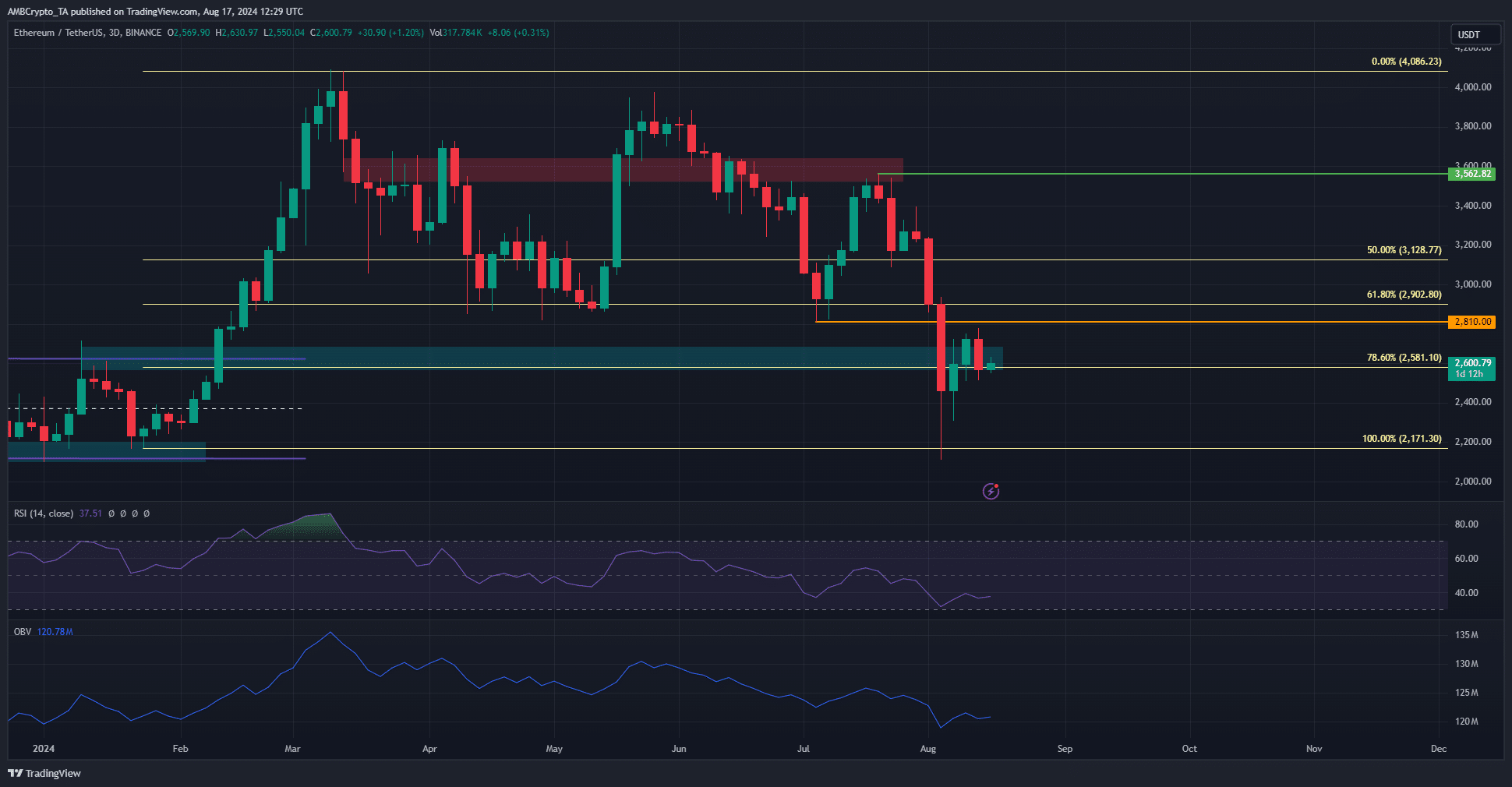

At the moment of reporting, Bitcoin (BTC) and Ethereum (ETH) were found trading below crucial resistance points at approximately $60,000 and $2,600 respectively. Over the 3-day and weekly charts, their market trends appeared to be bearish as well.

In early August, a quick drop in prices caused fear among investors, yet it also offered an opportunity for them to invest more heavily in leading cryptocurrencies. AMBCrypto studied these patterns to gauge market feelings, and our analysis showed that Ethereum held a distinct edge.

Price action and technical indicators showed seller supremacy

On the graph, the orange symbol indicates a break in the bearish pattern, while the resistance at $72k, despite attempts to lower it, has held strong. Adding to this, the bearish RSI on the daily chart and the downward trend of On-Balance Volume (OBV) suggest that sellers may push Bitcoin below the $56.1k mark again.

A notable indicator of improvement might be consistently surpassing the $60k mark. Yet, as I’m writing this, there doesn’t seem to be enough demand to trigger such a reversal.

The forecast for ETH suggests a more pessimistic technical trend. Its intrinsic value lies approximately in the $2,800 area, and a significant Fibonacci resistance is found at $2,900. This could pose major challenges for Ethereum supporters.

Based on the RSI and OBV, it appears that downward pressure might build up. This situation could potentially lead to a price drop towards approximately $2.2k.

Netflows revealed accumulation trends more consistent for Ethereum

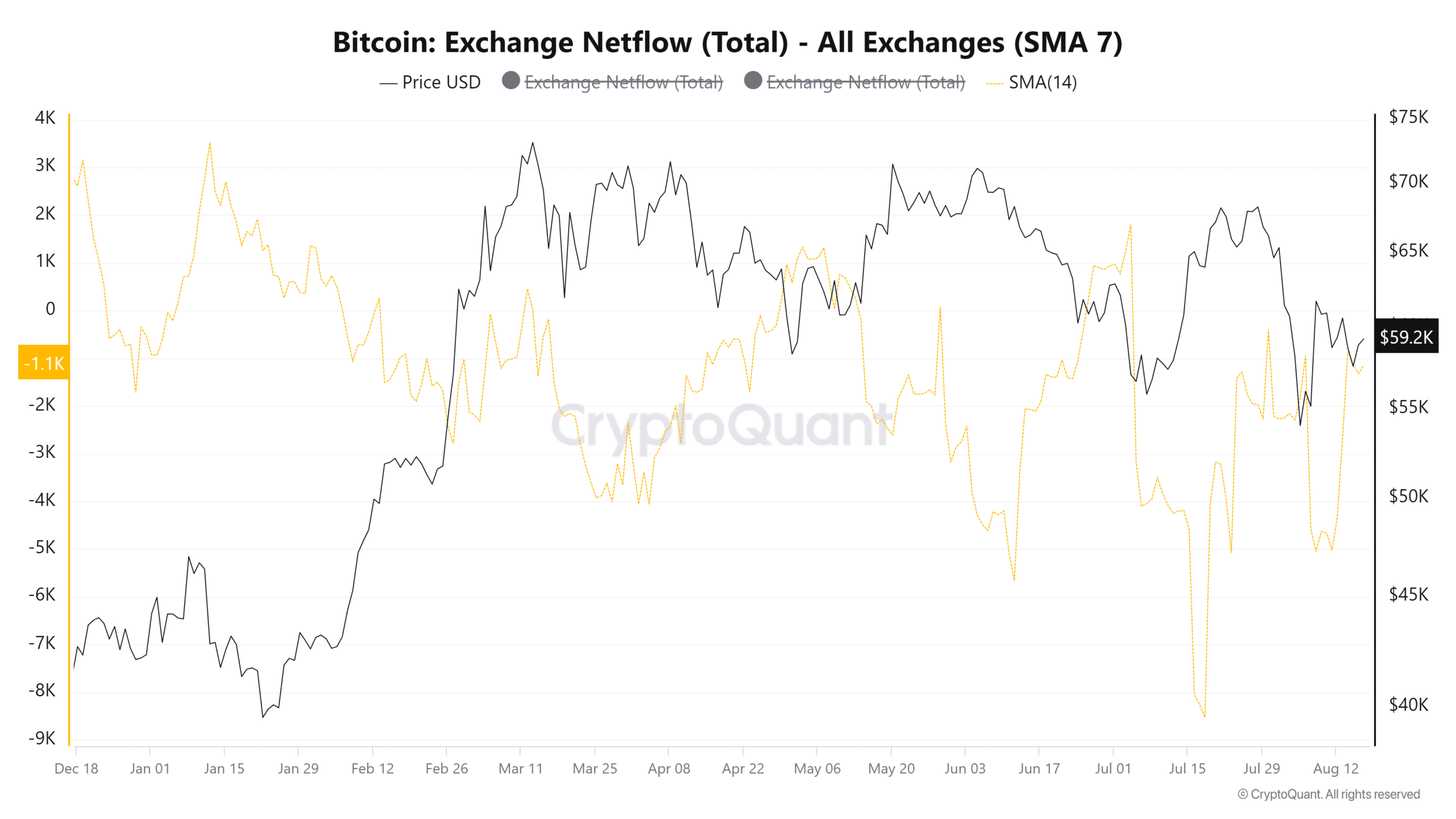

The hike in stablecoin reserves covered in an earlier report highlighted the climbing buying power in the crypto market. Just after the massive price drop on 5 August, the BTC netflows were negative.

This showed coins leaving exchanges – A sign of accumulation.

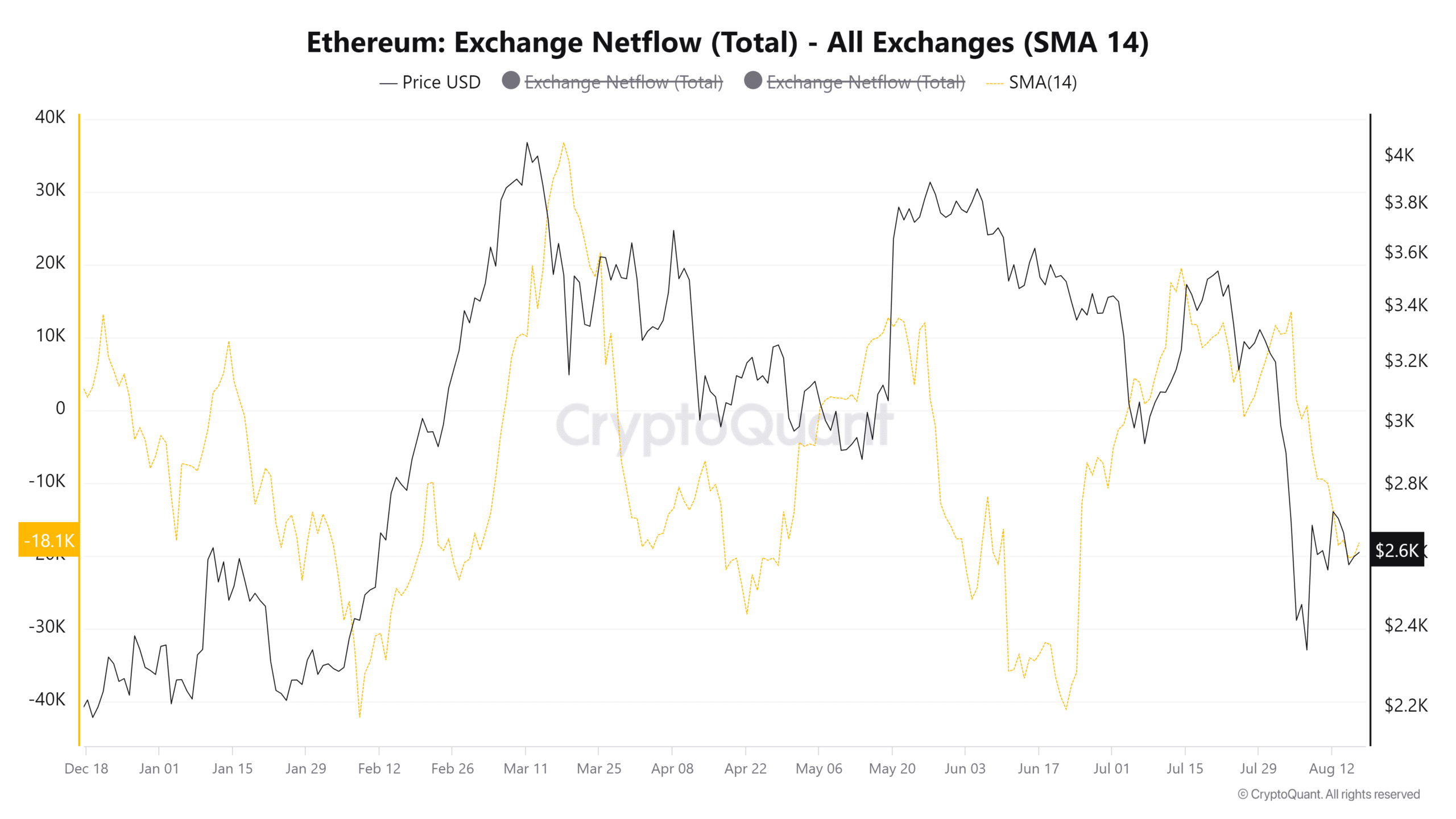

Since the end of July, Ethereum has been experiencing a buildup as well. Compared to Bitcoin, its netflow trend has shown a more consistent decrease.

As a researcher, I’ve observed an accelerated buildup of Ethereum, contrasting with more hesitance among Bitcoin holders. However, this pattern does not necessarily imply that Ethereum has been more bullish in an absolute sense.

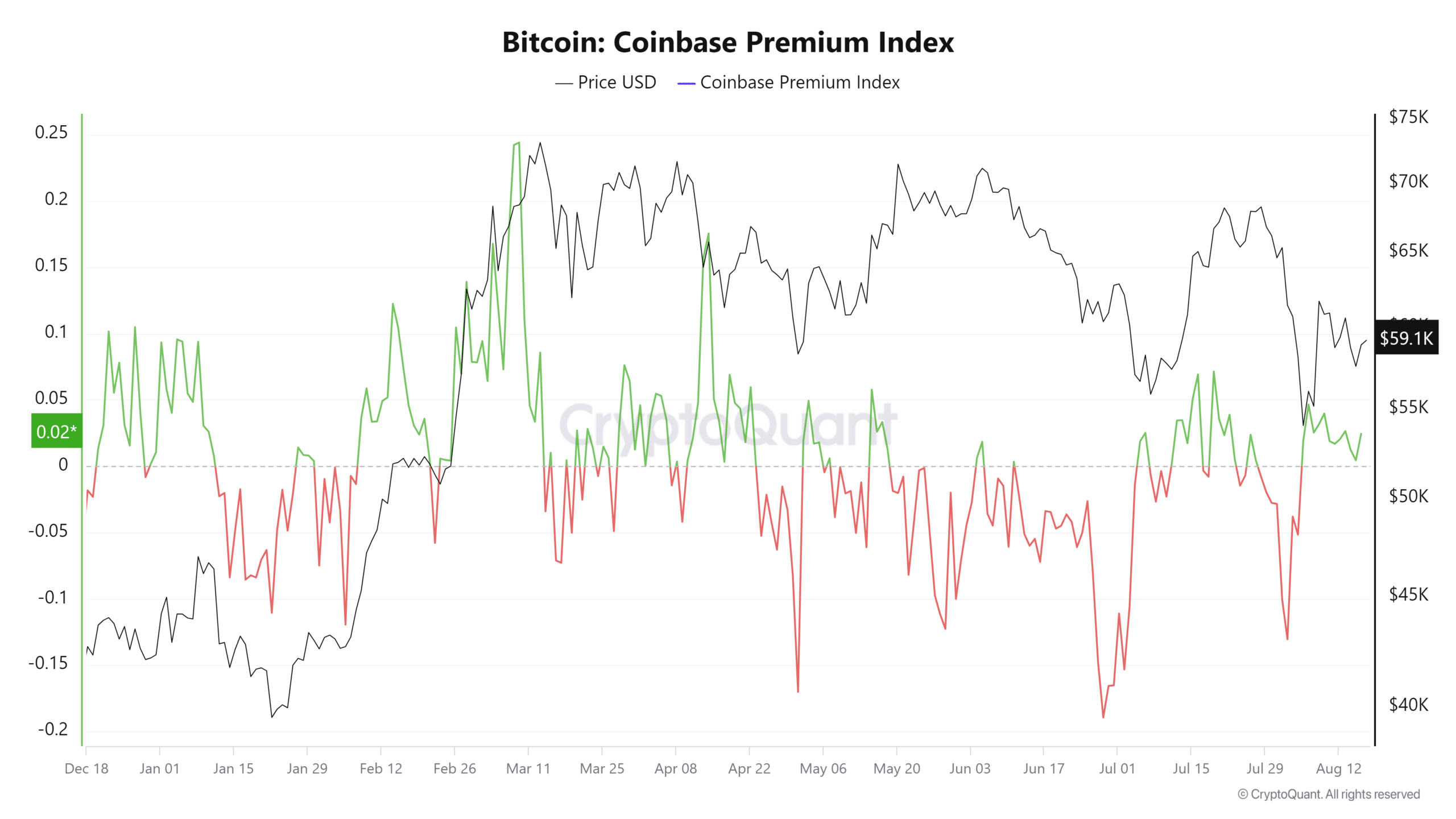

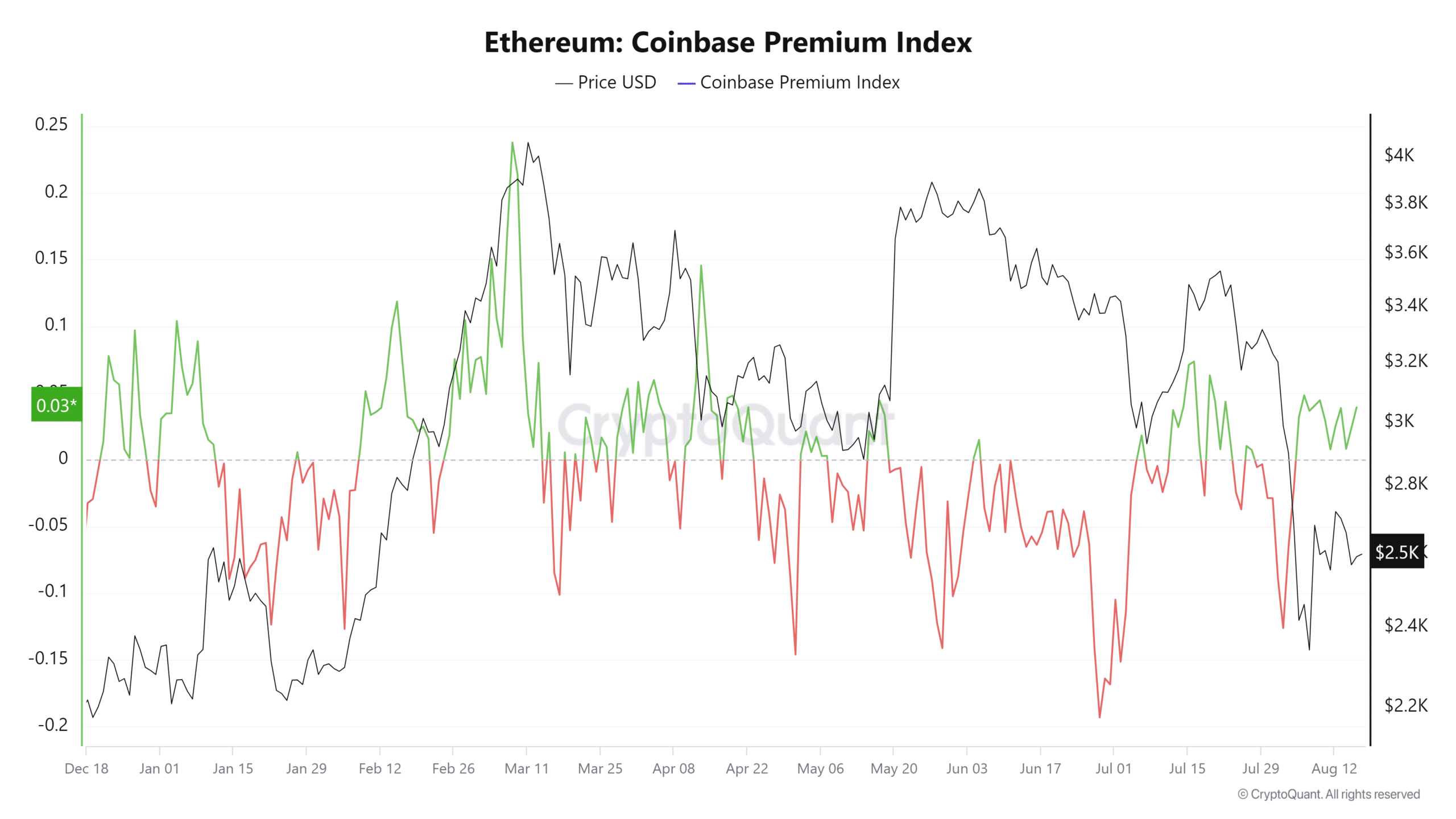

In the end, both the Coinbase Premium for Bitcoin and Ethereum showed a positive trend. This suggested a stronger appetite among American investors for these digital assets.

Even so, the premium has fallen for Bitcoin over the past two weeks.

Over the last ten days, I’ve noticed a slightly elevated Ethereum Coinbase Premium compared to Bitcoin, hinting at a stronger demand for Ether (ETH) in comparison to Bitcoin (BTC).

Read Bitcoin’s [BTC] Price Prediction 2024-25

In summary, the data indicates that Ethereum holds a lead over Bitcoin in most areas, but when it comes to price movement, Bitcoin took the upper hand during the specified periods. However, both digital currencies displayed bearish trends.

A move past the key resistances at $60k and $2.6k could inspire confidence in the crypto markets.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-08-18 09:11