- BTC could outperform gold by an extra 122%.

- The market’s expectation of a US BTC reserve jumped by 10 points.

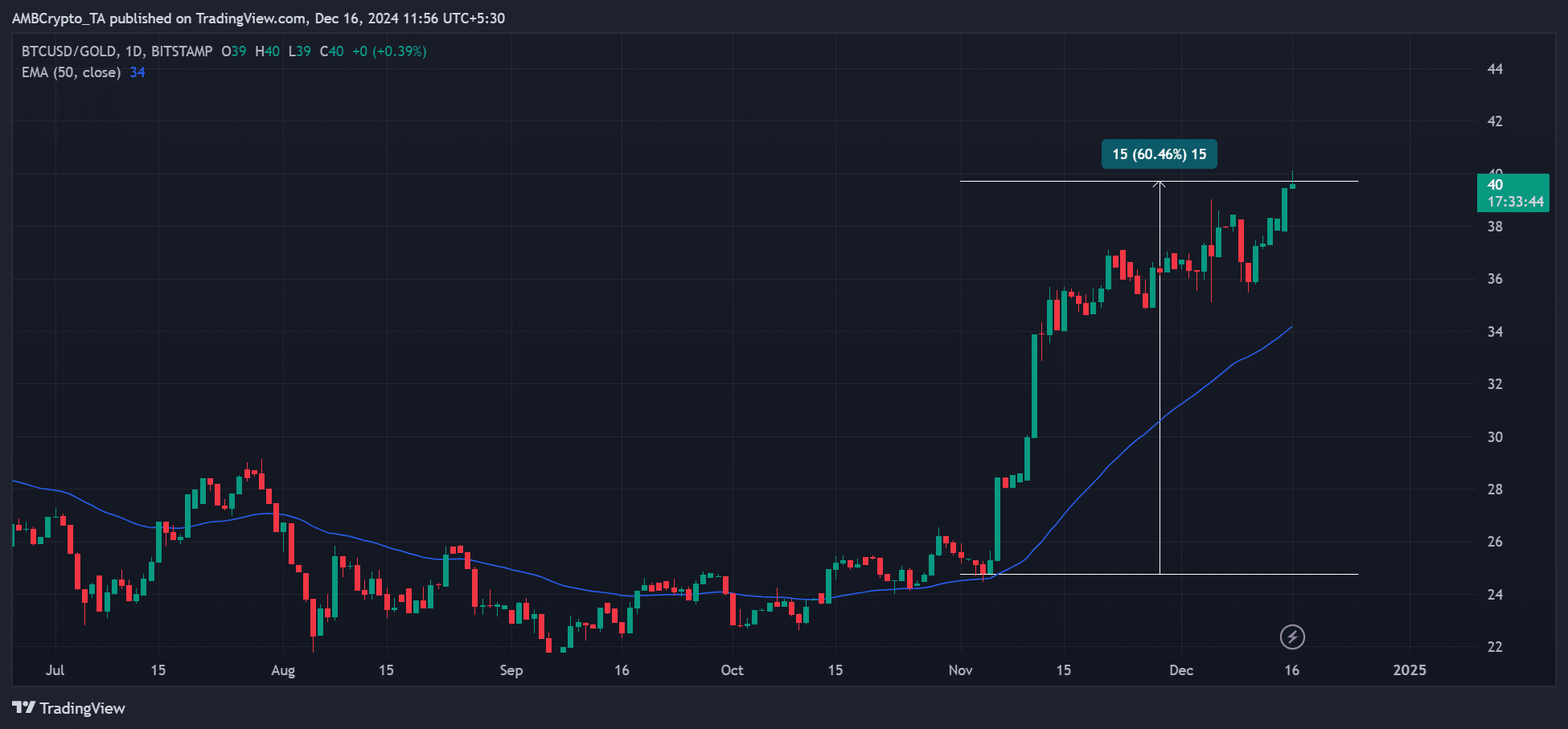

As a seasoned analyst with over two decades of market experience under my belt, I find the recent performance of Bitcoin (BTC) against gold intriguing and potentially groundbreaking. The 60% outperformance of BTC since November is not just impressive; it’s downright remarkable.

As a researcher studying financial markets, I’ve observed that Bitcoin (BTC) has surpassed gold in performance since November. Interestingly, this trend is forecasted to continue by some analysts, who predict an additional 122% increase for BTC compared to the traditional global reserve asset.

As a researcher delving into the realm of cryptocurrencies, I’ve come across an intriguing prediction by the esteemed technician and trader, Peter Brandt. He posits that in the near future, it might take approximately 89 ounces of gold to acquire a single Bitcoin coin.

Brandt’s projection was based on the bullish cup and handle formation on the BTC/gold ratio chart.

In simpler terms, the Bitcoin-to-Gold ratio reflects how Bitcoin compares to gold in value. Lately, it reached a record high at 39 and surpassed its previous barrier, suggesting that the potential for an increase toward the optimistic forecast of 89 might occur.

BTC: Next global reserve?

Starting in November, Bitcoin (BTC) has been performing significantly better than gold, increasing by 60% compared to gold’s growth. Consequently, the ratio of Bitcoin’s value to that of Gold Shares (GLD) has risen from 25 to 40. This impressive performance of Bitcoin was boosted by Donald Trump’s victory in the U.S. presidential elections, which is favorable news for cryptocurrency supporters.

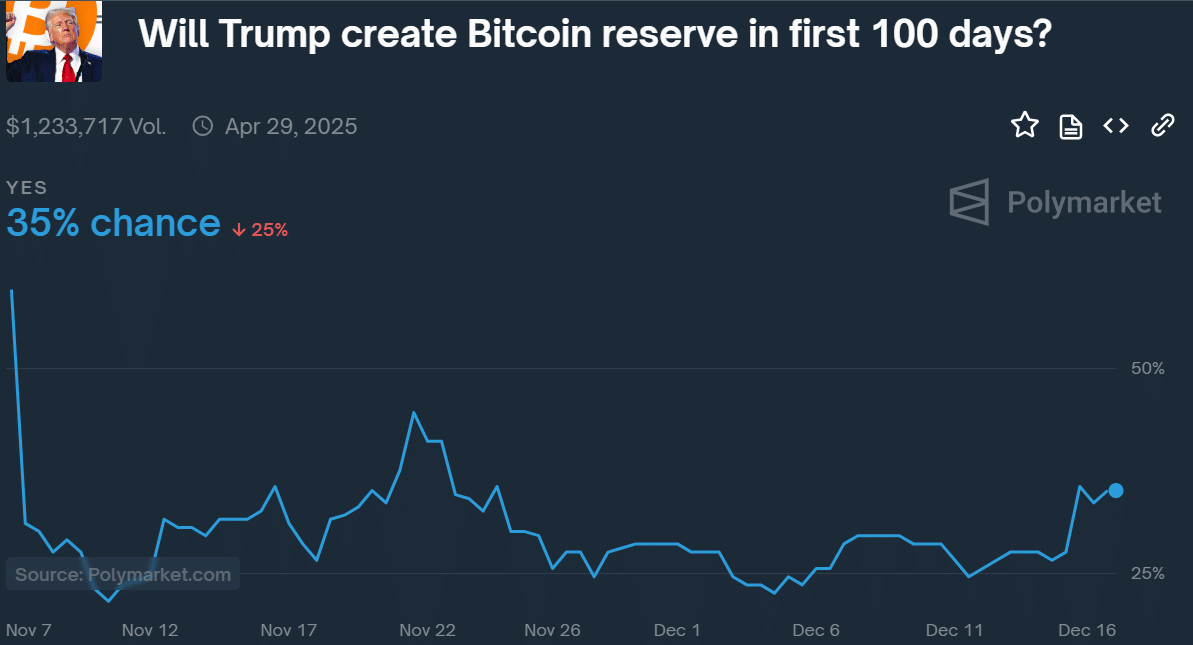

As a crypto investor, I’m excited about the possibility that the incoming administration might establish a national Bitcoin reserve right from the get-go. Many industry experts share this optimism.

As per Jack Mallers, CEO of Strike, the newly elected President was considering issuing an executive order on his first day in office to establish a Bitcoin reserve.

If realized, this development might significantly speed up Brandt’s prediction that Bitcoin (BTC) will reach a value of 89 relative to gold. If it does, each Bitcoin could potentially be worth approximately 230,000 dollars.

As I currently stand, at the moment of my observation, prediction market estimates place a 35% likelihood that President Donald Trump would establish a Bitcoin reserve within the initial hundred days of his term in office.

Last week’s odds saw a significant 10% rise, implying that the market is growing more hopeful about this particular result occurring. If it comes into existence, Bitcoin might challenge gold fiercely for the position as a worldwide reserve asset.

It is uncertain if Brandt’s prediction of $230,000 per BTC will become reality in this market cycle. However, many investment professionals have set their expectations between $150,000 and $200,000 for the current market phase.

Currently, Bitcoin reached an unprecedented peak of $106,600 and stood at approximately $105,000 as we await the Federal Reserve’s interest rate decision on the 18th of December.

Read More

2024-12-16 16:07