- Bitcoin raises mixed sentiments among traders as its price trends between $70k and $71k.

- Skeptics argue that Bitcoin is unfit to be considered even close to traditional asset classes.

Although experiencing a temporary dip, Bitcoin’s price has rebounded and reached an all-time high of $71,000. This surpasses previous predictions following the halving event. However, as Bitcoin continues to gain popularity, critics remain vocal in their skepticism, frequently drawing comparisons between its value and that of traditional asset classes.

What is the perspective on Bitcoin’s valuation and meaning within the larger financial world?

Bitcoin’s resilience amidst growing skepticism

At the Bitcoin Investors Day in New York, Yassine Elmandjra, Digital Assets Director at Ark Invest, joined the ongoing discussion. He highlighted that one significant hurdle in assessing Bitcoin lies in its inability to produce yields, unlike bonds. In simpler terms, since Bitcoin doesn’t generate income like bonds do, evaluating its worth becomes more complex.

“I think much of bitcoin’s skepticism stems from, you know, its inability to fit neatly within traditional asset class frameworks especially from a fundamental valuation standpoint.”

Chris Kuiper, the Research Director at Fidelity Digital Assets, pointed out separately that Bitcoin’s price fluctuations have shown strong correlation with shifts in inflation anticipation, specifically when observed through a five-year lens.

If your anticipated annual inflation rate shifts from 3% to 6%, this represents a significant increase. Notably, Bitcoin’s price behavior mirrored this trend remarkably well during and after the COVID-19 pandemic, reflecting the massive monetary expansion that ensued.

On remarks that Bitcoin is not an inflation hedge, Kuiper exclaimed,

“I think it is!”

The Woodbull Charts added evidence to the observation that Bitcoin’s inflation rate decreased significantly over the years, dropping from 3.72% in 2020 to only 1.7% by 2024.

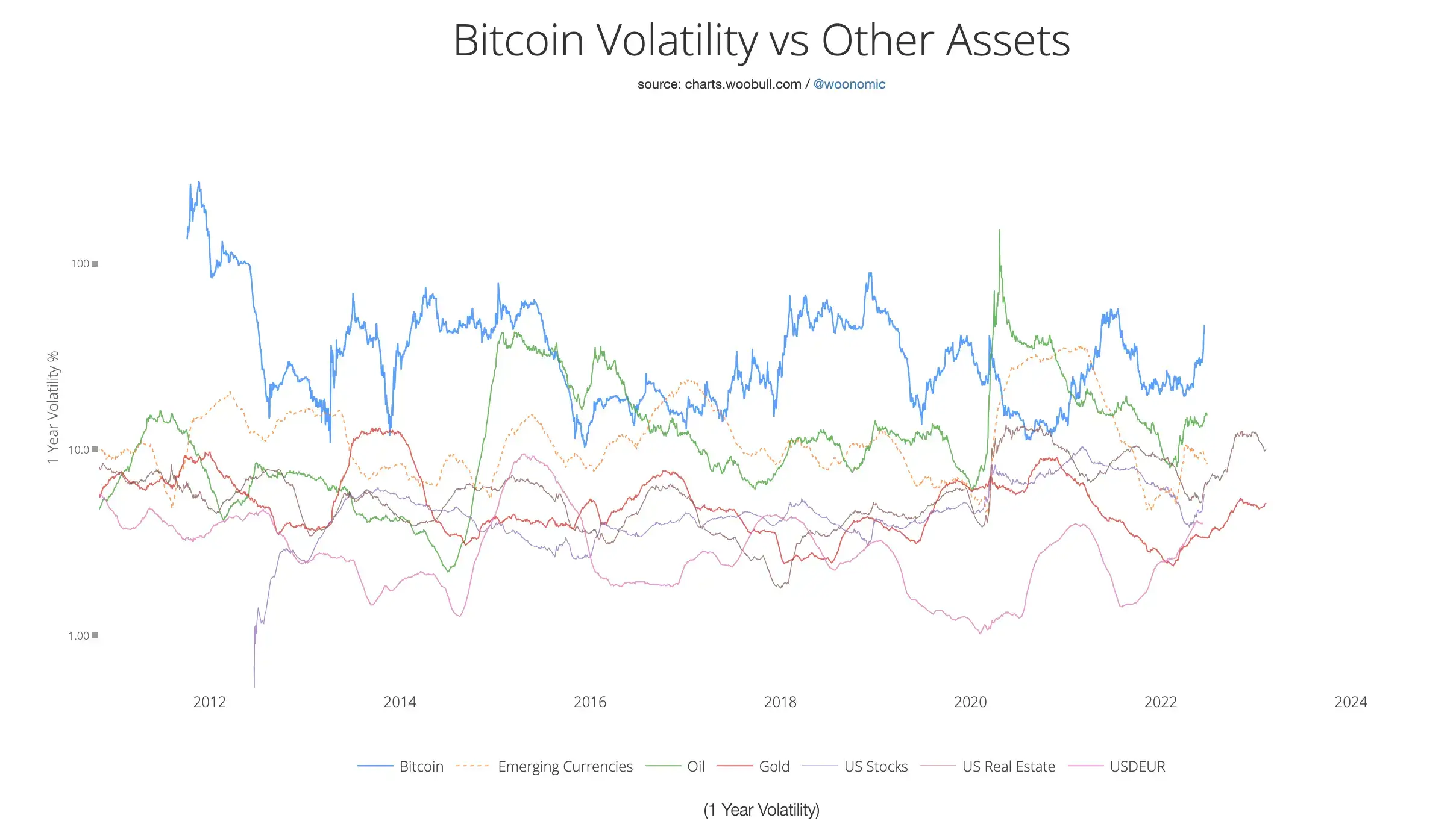

When comparing the 1-year volatility charts of Bitcoin and other assets, such as gold, a notable difference is observed. The volatility of Bitcoin is much higher at 46.95%, whereas gold displays a relatively low volatility rate of only 5.6%.

The comparison highlights the significant price changes between Bitcoin and gold during the last twelve months.

In reply, Matthew Siegel of VanEck pointed out that Bitcoin’s ability to shield against inflation could have taken a short-term hit due to recent policy actions.

“It’s important to keep in mind that we’re dealing with an emerging or frontier market asset. The appeal for many Americans lies in the ease of investing through available ETFs for potential speculation.”

What lies ahead?

The forthcoming Bitcoin halving raises questions about its potential impact on pricing, as past events have varied. According to Kuiper, this occurrence intersects with election periods and liquidity fluctuations. This suggests that various elements can shape price movements.

In simpler terms, although there is no previous situation to draw a direct comparison from, the experts are convinced that the halving event will help reduce some price fluctuations.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-04-12 19:03