- Sentiment across the crypto sphere has been bearish and fearful, but the crowd isn’t always right

- Short-term indicators remain bearish, but an uptick in accumulation is encouraging

As an analyst, I’m reporting that Bitcoin [BTC] was currently valued at approximately $94,500 at the time of press. On Tuesday, 7th January, we witnessed Bitcoin facing its third rejection within a month near the $100k mark. This has led to some unease among market participants, who are now pondering if this dip could potentially trigger a full-blown downtrend and herald the onset of the next bear market.

🛑 Market Warning: EUR/USD May Collapse on Trump Tariffs!

Top analysts urge immediate attention to shifting forecasts!

View Urgent Forecast

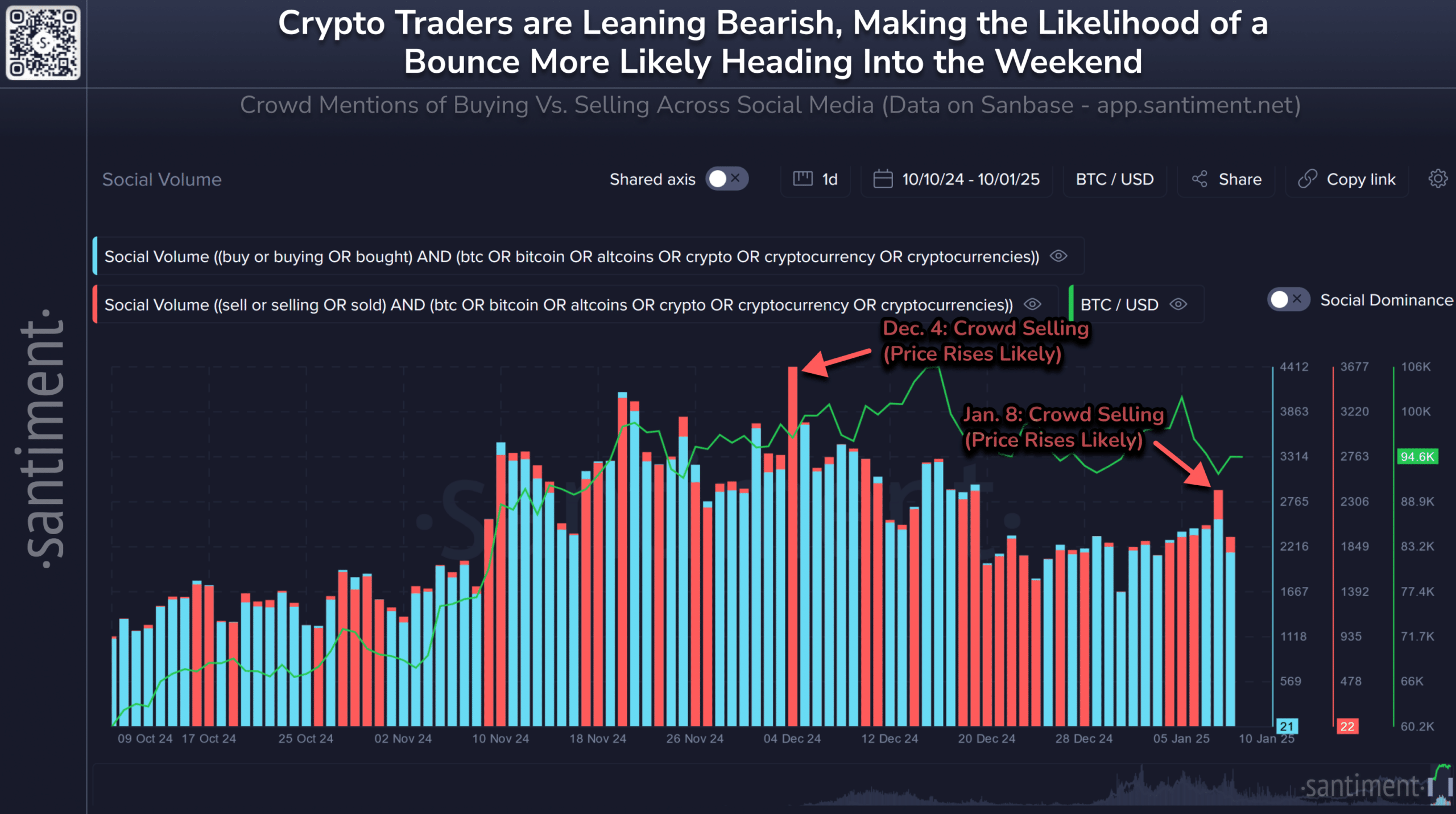

According to a Santiment Insights post, the level of social activity related to crowd selling significantly increased on January 8th, a pattern last seen on December 4th. Following that previous instance, the price surged and peaked at an all-time high of $108.3k.

Over the past few days, there’s been a 8% drop in the market, suggesting that fear has been widespread among investors. A dip below $92k could trigger a market recovery, or a potential increase following Donald Trump’s inauguration (often referred to as a “Trump pump”). Over the last month, the dollar index [DXY] has risen significantly, which might be contributing to the struggles faced by bullish investors.

Bitcoin traders – Buy the fear, sell the greed

Occasionally, a saying that’s used so frequently can make people groan before it’s even finished. However, it’s worth noting that there are instances where this saying rings true. As for Bitcoin, the current on-chain metrics aren’t suggesting we’ve reached a market peak yet.

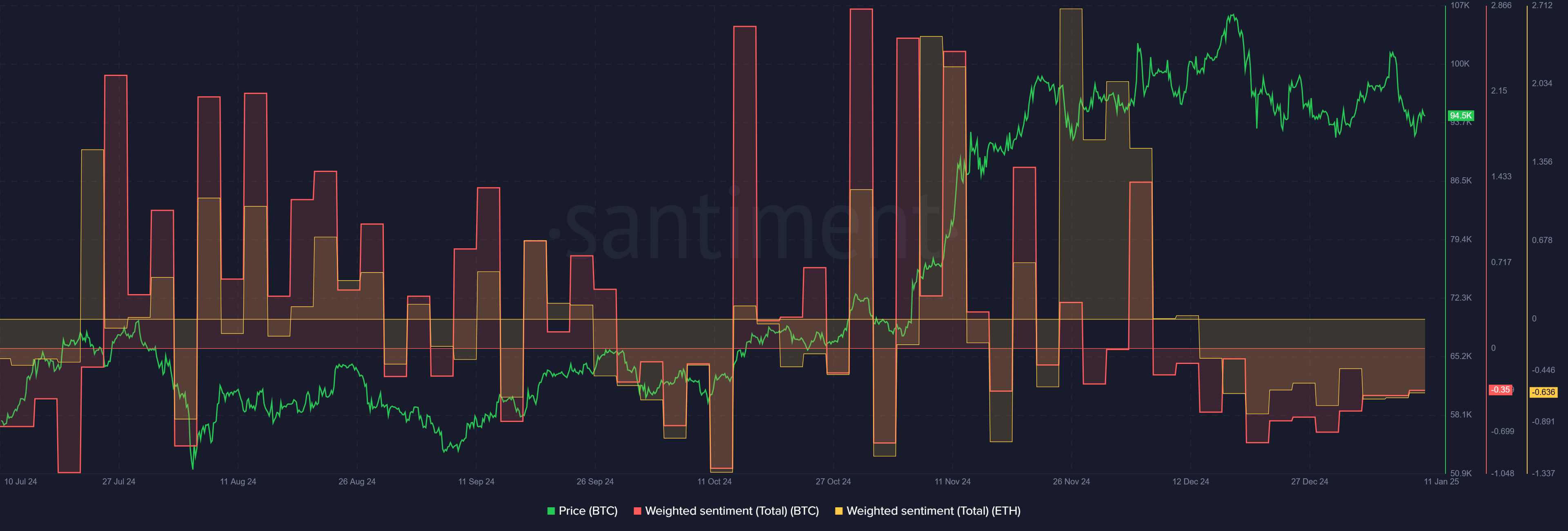

In simpler terms, we looked at the overall attitude towards Bitcoin (BTC) and Ethereum (ETH), and found that many traders and investors were pessimistic about the market following a significant price decrease on December 19th. So far, neither digital asset has regained its original price level.

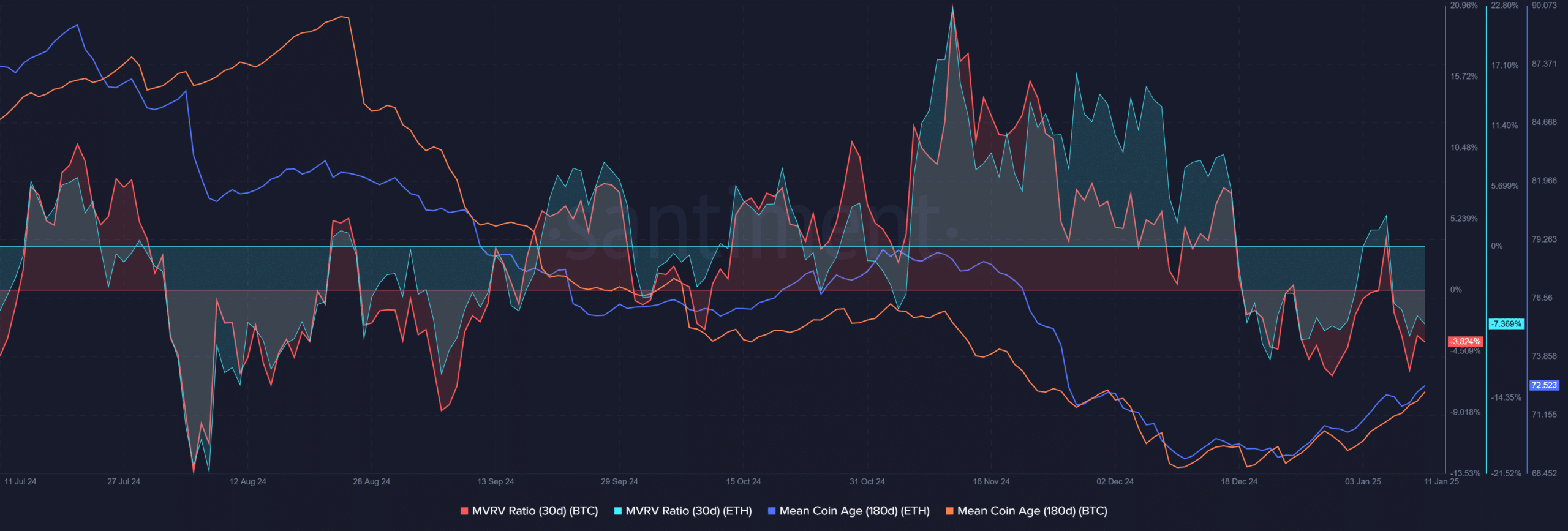

Over the past 30 days, the MVRV ratios for Bitcoin and Ethereum showed a negative value, indicating that their short-term holders have experienced losses so far. On a more positive note, the average age of coins for both assets has been increasing noticeably over the last three weeks.

This suggestion indicated it could be a good time to purchase when prices dropped. The increased holding and large investors selling at a loss implied less immediate pressure to sell, suggesting a possible price recovery.

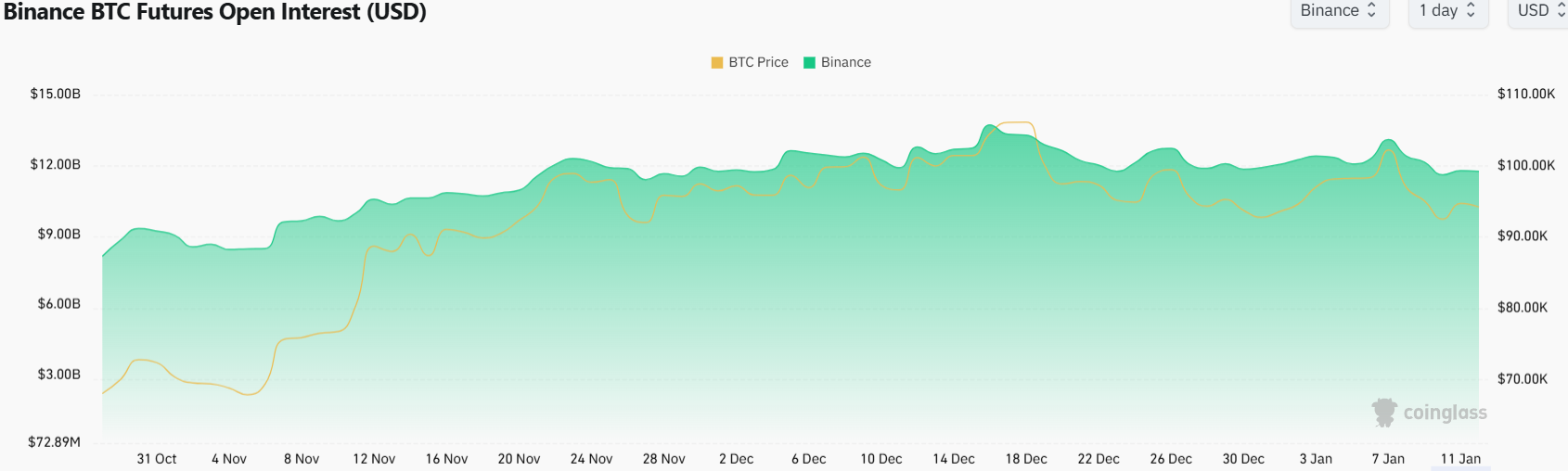

As an analyst, I’ve noticed a consistent uptrend in Open Interest since early November that peaked around mid-December, reaching approximately $13.7 billion. However, over the past few days, there’s been a slight downturn, with the Open Interest currently standing at about $11.72 billion, as I write this.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a crypto investor, I’ve noticed that the decrease in Open Interest (OI) is yet another signal that speculative enthusiasm is dwindling. This trend suggests a short-term bearish outlook. However, it’s important to remember that when these short-term indicators eventually flip positive, Bitcoin’s price might have already begun its rebound. So, keeping a close watch on the market will be crucial in this case.

Investors should carefully consider the balance between potential gains and possible risks, then determine if they are willing to invest at a level slightly above the $92k level that serves as a key support.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-12 07:03