-

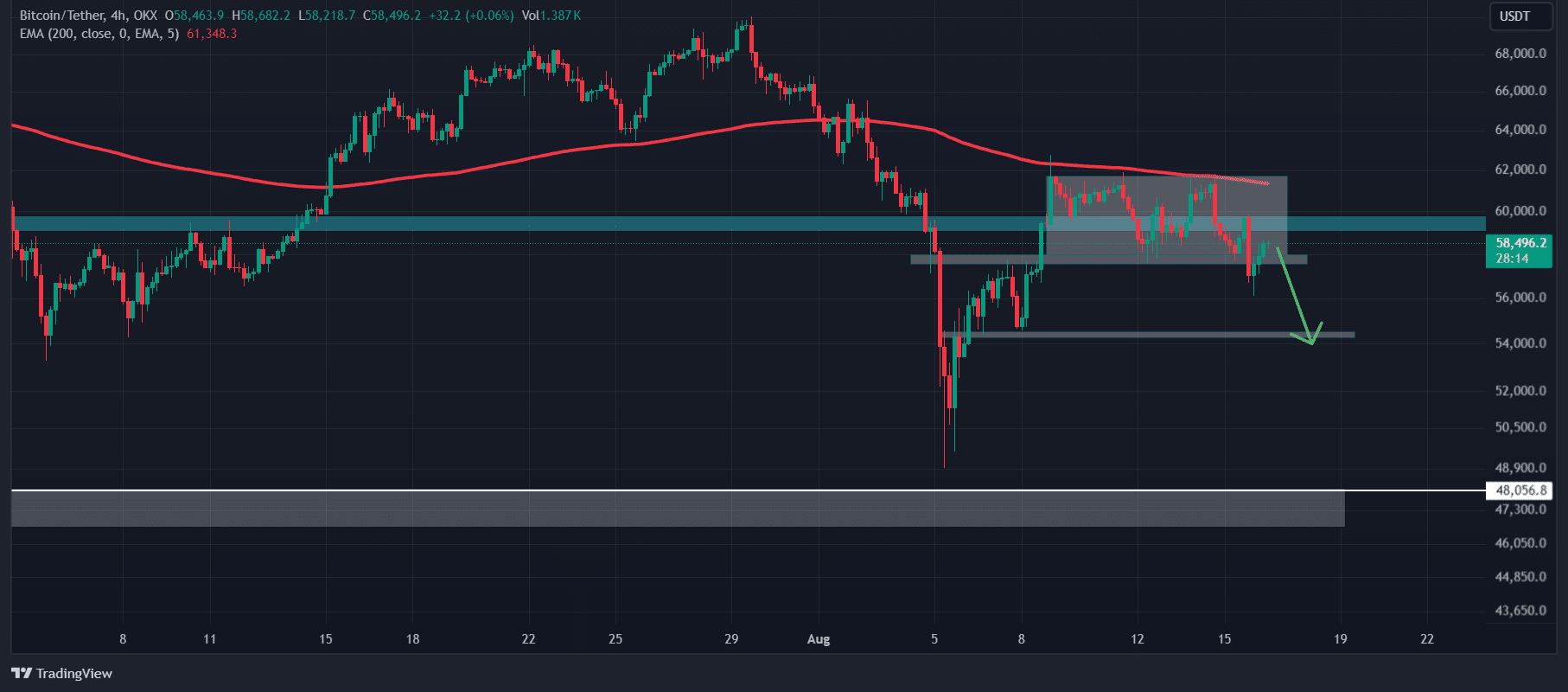

Following the consolidation breakdown, there is a high possibility that BTC could fall to the $54,600 level.

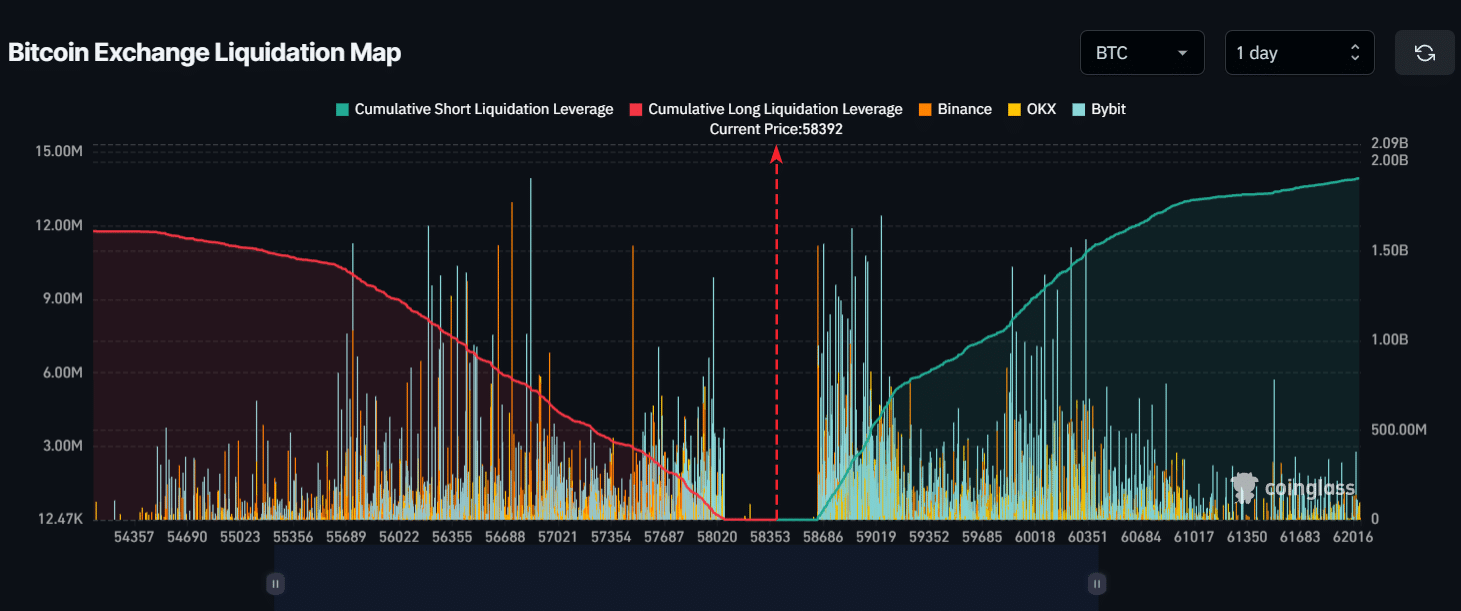

If BTC falls to the $56,850 level, nearly $721 million worth of long positions will be liquidated.

As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I find myself intrigued by the current state of Bitcoin (BTC). The recent consolidation breakdown suggests that we might see BTC plunge towards the $54,600 level, a move that could potentially liquidate nearly $721 million worth of long positions.

As the cryptocurrency market continues to struggle, whales have increased their buying activity.

As a researcher delving into the intricacies of the digital currency market, on August 16th, an freshly minted digital wallet executed a substantial withdrawal of approximately 533.5 Bitcoins [BTC], equivalent to around $31 million USD. This transaction occurred at Binance [BNB], the globally recognized leader in cryptocurrency exchanges, when the Bitcoin price stood at approximately 58,188 units, as reported by Spot On Chain.

Whales’ interest in Bitcoin

Based on my years of immersion in the cryptocurrency world, I have noticed that whenever the market takes a dive, it tends to generate quite a buzz among crypto enthusiasts. As a seasoned investor, I can tell you that such periods often present opportunities for strategic purchases. Currently, it appears that whales are viewing this price decline as just that – an opportunity. They are likely scooping up digital assets at lower prices, anticipating future growth and potential profits. This is not uncommon in the volatile world of cryptocurrency, and I have personally benefited from similar situations in the past. So, while it’s understandable to feel concerned when the market takes a dip, remember that it also presents opportunities for those who are prepared to make calculated moves.

Furthermore, it was pointed out by Spot On Chain that this week, six whales have amassed approximately 4,046 Bitcoin and Wrapped Bitcoin, with a total value of around $239.5 million, through centralized cryptocurrency exchanges (CEXes).

Over the past day and the previous week, Bitcoin’s reserve on exchanges has decreased by about 0.37% and 0.47%.

Conversely, because of its volatility, there’s been a 27.6% decrease in the number of active addresses over the past 24 hours, as reported by the crypto analytics company, CryptoQuant.

How is BTC faring?

Currently, Bitcoin is being exchanged around $58,430, maintaining a steady state for the past day. Over this timeframe, the trade volume has risen by 6%, signaling an uptick in investor activity.

Moreover, there was a 2% increase in Open Interest for Bitcoin within the past day, indicating heightened interest from traders over this period.

Based on the technical assessment by AMBCrypto, Bitcoin appeared to be in a downtrend because it was being traded below its 200-day Exponential Moving Average (EMA), as viewed on a daily chart.

Additionally, the analysis provided by the King Coin indicates a potential drop in Bitcoin (BTC) prices, as it has breached the consolidation range between approximately $61,800 and $58,500. This breakout suggests that BTC may experience a decrease of around 6.5%, potentially reaching the level of $54,600 in the near future.

Currently, as reported by the data analytics company Coinglass, the estimated support and resistance levels for the market are approximately $56,850 (lower) and $59,000 (higher).

Should the negative outlook persist and the price drops down to $56,850, approximately $721 million in long positions will have to be sold off.

If the sentiment shifts and Bitcoin’s price surges to around $59,000, approximately $581.3 million in short positions would be forced to close.

Read More

2024-08-17 08:07