- Whale cohorts have tried to absorb aggressive selling, seizing the “dip”.

- However, they may not have established a market bottom, yet.

As a seasoned analyst with over a decade of experience navigating the volatile cryptocurrency markets, I find myself intrigued by the current state of Bitcoin [BTC]. The whale cohorts have shown an impressive display of confidence, purchasing significant amounts of BTC during periods of pressure, potentially setting the stage for a short-squeeze.

As a researcher studying the cryptocurrency market, I find myself standing at an important juncture in Bitcoin‘s [BTC] journey, with the bulls striving tirelessly yet struggling to surpass the resistance levels following a robust September surge that brought us tantalizingly close to $65,000.

Currently priced at approximately $60,480, it hasn’t been observed yet that the usual pattern recurring in late July will happen. Instead, what we’re seeing is bears pulling back while bulls aim for the next potential barrier at around $68,000.

Bearish pressure remains, raising fears of a deeper pullback; if bulls falter, BTC could retrace to around $55K. However, a significant event has sparked optimism, fueling speculation that this influx of demand could catalyze a short-squeeze.

Bitcoin whale confidence rises

1,000 to 10,000 Bitcoin whale groups have shown faith in Bitcoin’s potential price increase by buying around 50,000 Bitcoins worth about $3.14 billion over the past ten days.

As a researcher, I found it intriguing that during a time when Bitcoin was under pressure from short-selling, causing its price to hover around $63K, there was an unexpected surge in purchases. These acquisitions seem to have thwarted a substantial dip, thereby supporting Bitcoin’s upward trajectory towards the $65K resistance level.

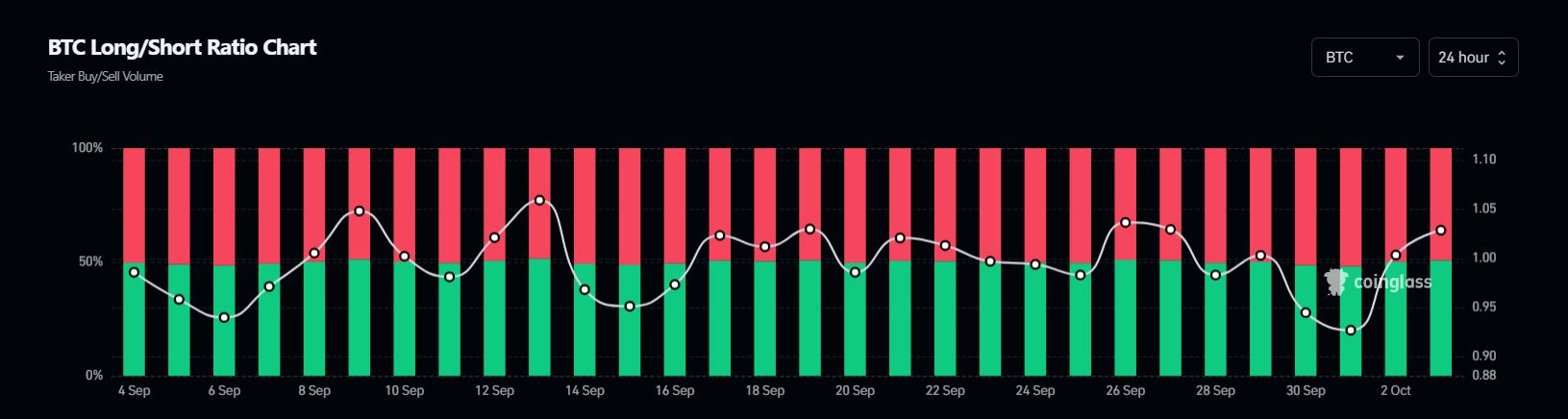

Source : Coinglass

During the September stock market surge, shorts gained dominance in the futures market, pushing Bitcoin towards a correction. Yet, large investors buying up Bitcoin (whales) counteracted this force, setting up conditions that could trigger a short squeeze.

If the pattern repeats, rapid selling might be set off, which could act as a spark for a strong market recovery.

Putting short positions at risk

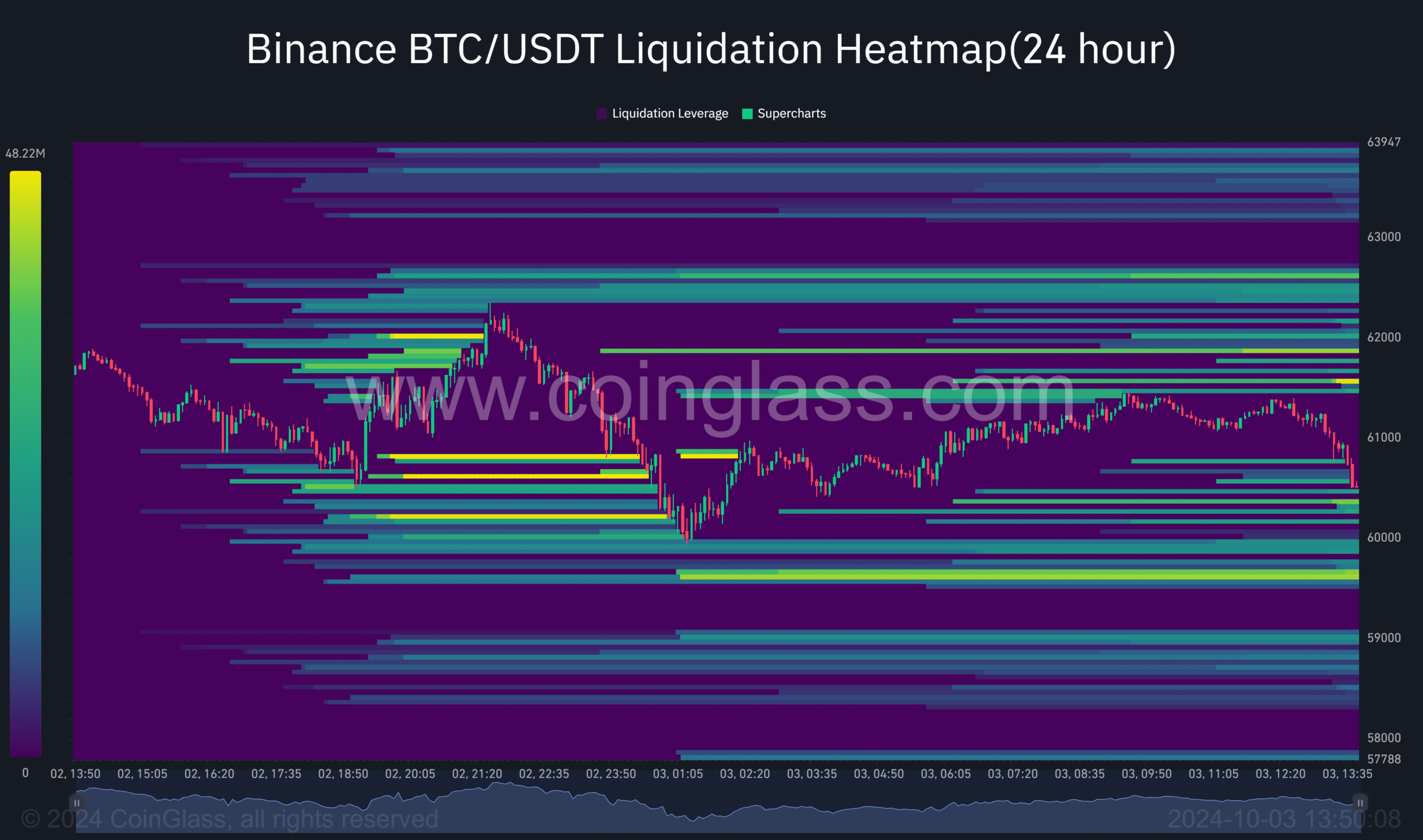

Currently, a bounce back to around $61,000 offers a substantial area of high liquidity, containing roughly $40 million worth of leverage. Closing in this vicinity could potentially put pressure on short sellers, compelling them to exit their positions and thereby pushing Bitcoin’s price upward.

Source : Coinglass

Instead, if the price fails to stay within the $60,000 range, it might cause approximately $37 million in liquidations. This situation could potentially open up opportunities for short sellers, leading to an increase in shorting activity. If this isn’t checked, there could be a substantial drop in price towards $55,000, primarily due to long positions being closed out.

To put it simply, AMBCrypto suggests keeping an eye on certain indicators to prevent a drop, making $60K an attractive “buying dip” opportunity in the future.

A “flip” would signal a market bottom

Typically, whale accumulation patterns often align with Bitcoin testing a market bottom.

As reported by AMBCrypto, it seemed necessary for Bitcoin’s price to drop around $60K to force out less confident investors who had bought Bitcoin when the support level was at $55K. This action would cause them to sell off their profits and leave the market cycle behind.

Currently, our goal should be transforming the $60,000 level from a barrier to entry into a floor, thereby inviting more buyers to join the market. By doing so, we can create an opportunity for large investors (whales) to aim for the market’s lowest point and drive Bitcoin towards $66,000.

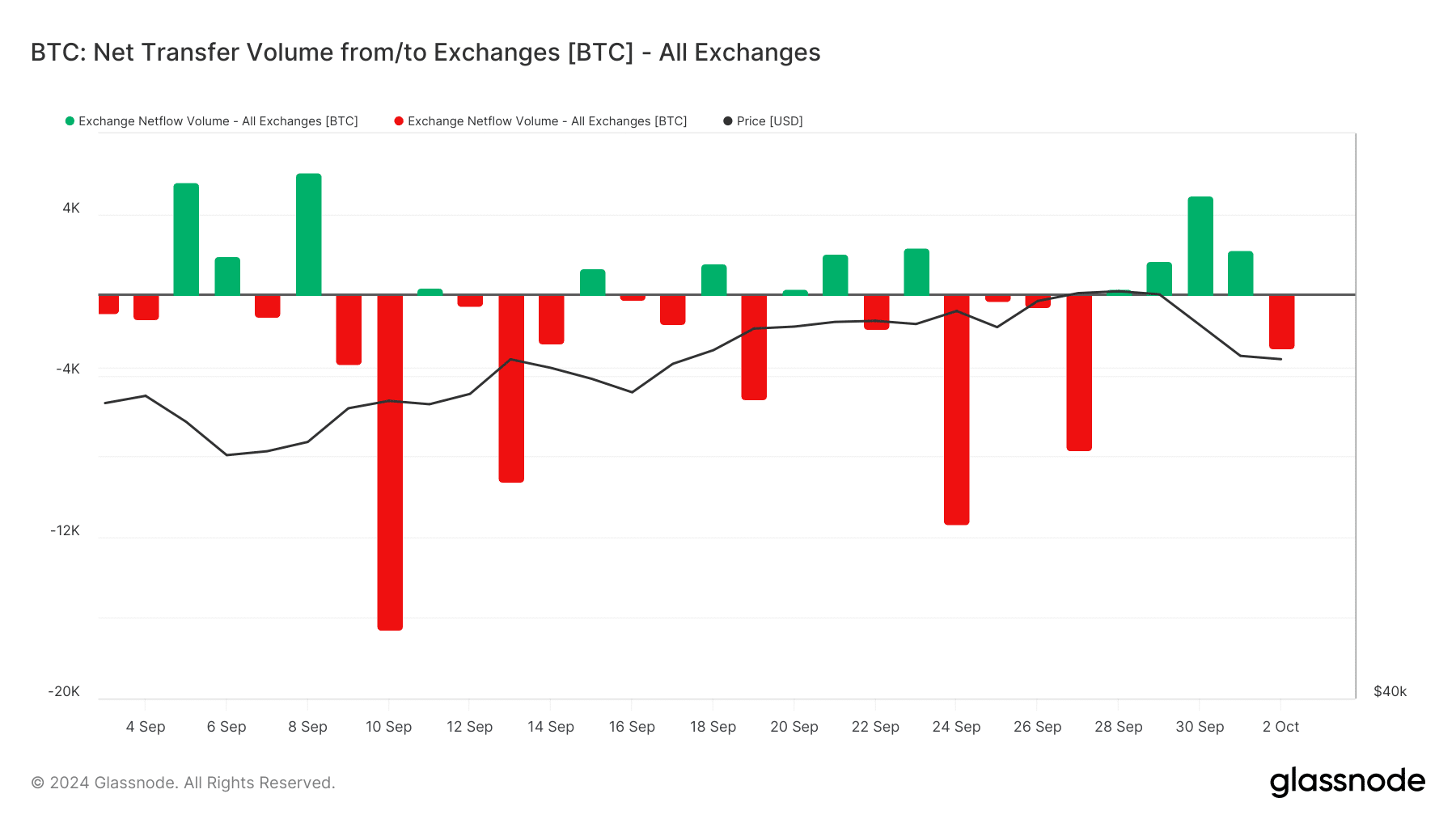

Source : Glassnode

After three consecutive days of increased Bitcoin supply leading to outflows, indicating a potential buying opportunity at around $60K, it’s important to note that a more substantial surge is required to definitively signal the start of a full-fledged bull market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If bulls take advantage of this price level by purchasing aggressively and converting $60,000 into a strong foundation, it might trigger a rally that propels Bitcoin back up to around $66,000.

If bullishness fails to persist and no one takes on the selling pressure, anxiety might lead to a wave of frantic selling. This could empower short sellers to keep dominance over the market, possibly causing Bitcoin’s price to dip towards $55K – potentially marking the next low point in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-03 16:08