-

Bitcoin’s trading volume soared by 37.72% as prices hiked by 1.48% in 24 hours.

Three whales accumulated 2814 BTC worth $157.3 million.

As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of market volatility and trends. The recent surge in Bitcoin’s trading volume and price hike, despite the overall market downturn over the past month, is a phenomenon that catches my attention.

For several months now, the cryptocurrency market has seen significant ups and downs. During this volatile period, Bitcoin (BTC), the leading cryptocurrency, has taken the hardest hit. In fact, over the last thirty days, its value has decreased by 9.14%.

Currently, Bitcoin is being traded at approximately $55,182, representing a 1.48% rise in value over the past 24 hours. At the same timeframe, the trading volume of Bitcoin has significantly increased by about 37.72%, reaching an impressive $22.6 billion.

Also, its market cap increased by 1.47% to $1.09 Trillion.

Before these increases, the cryptocurrency had been on a downward trend for a while, falling by approximately 5% during the last seven days.

In simpler terms, when the market drops, it offers a favorable situation for significant investors (like ‘whales’) to purchase at lower prices. These investors often gather more assets during a decline, with the aim of later reselling for a profit.

Inasmuch, Lookonchain has revealed how whales have turned to accumulation during the dip.

Whales buying the dip

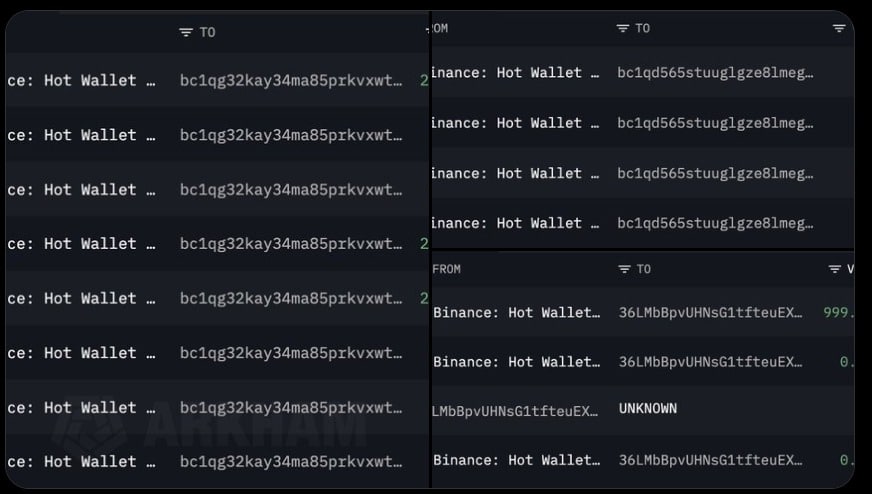

Based on their findings in the report, Lookonchain has discovered instances where large investors (whales) have been purchasing Bitcoin during market dips. Specifically, it is stated that these three whales have amassed approximately 2814 Bitcoins valued at about $157.3 million since September 1st, 2024.

Through its X (formerly Twitter) page, Lookonchain reported that,

Three significant investors, known as whales, have been purchasing Bitcoin (BTC) following the market downturn! Since September 1st, these whales have acquired approximately 2,814 BTC ($157.3 million) from Binance at an average price of around $55,887 each.

In periods of market decline, purchasing whales (large investors) demonstrate their faith in the asset’s future growth prospects.

In periods when the market is not performing well, large investors (whales) see these situations as chances to buy at reduced costs, anticipating potential profits in the future.

Investing in this way attracts more players into the market, leading to a more balanced market situation and potentially reversing the current trend.

What Bitcoin’s charts suggest

As noted by Lookonchain, whale activities have increased for the past week.

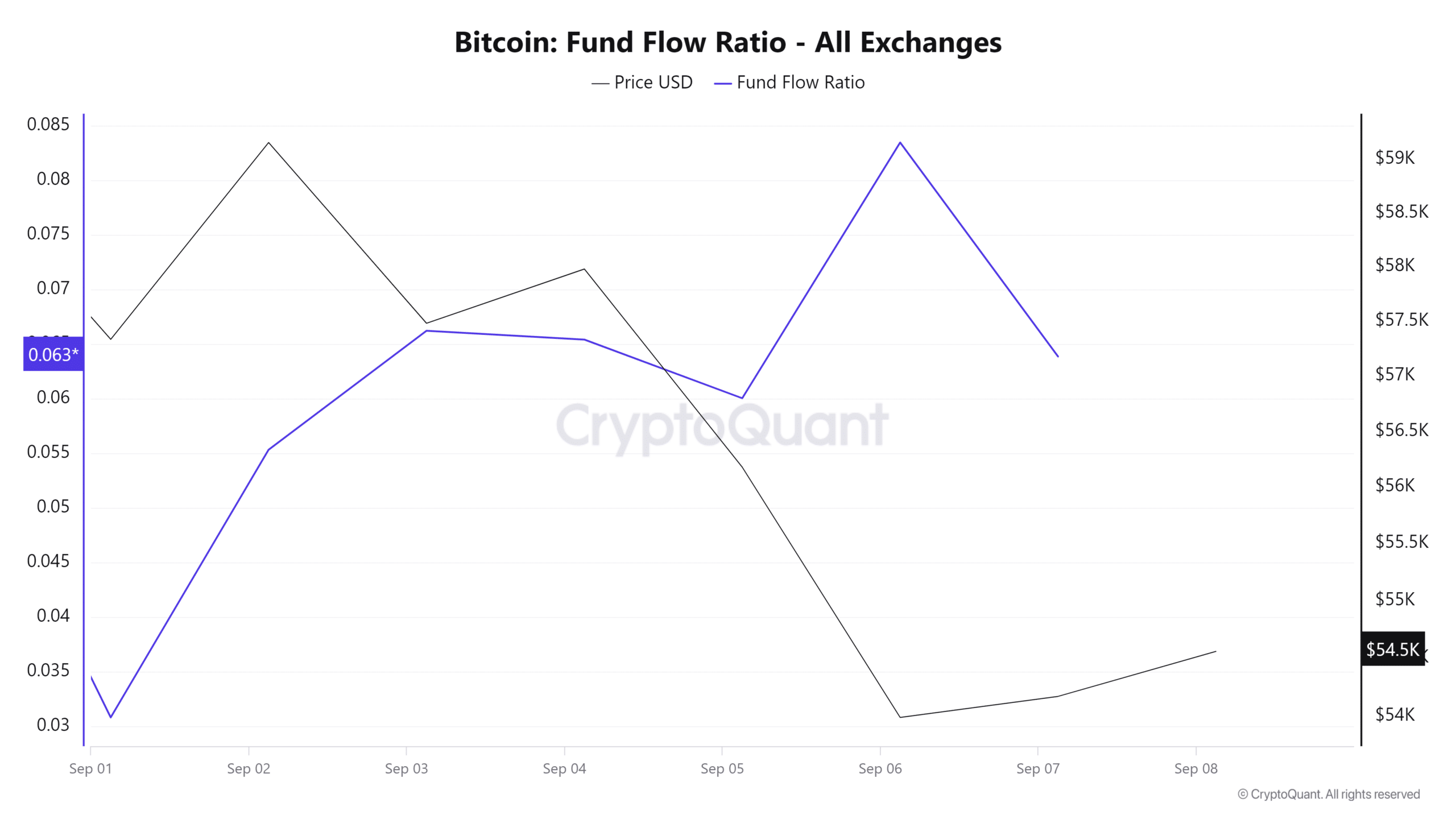

This is further supported by the decreasing fund flow ratio

As reported by Cryptoquant, the Fund Flow Ratio currently stands at 0.04, having dropped from an initial 0.08. This decrease might indicate that large investors, or ‘whales’, are buying assets off-exchange, which could be interpreted as a positive or bullish signal.

This indicated investor confidence in Bitcoin’s future prospects.

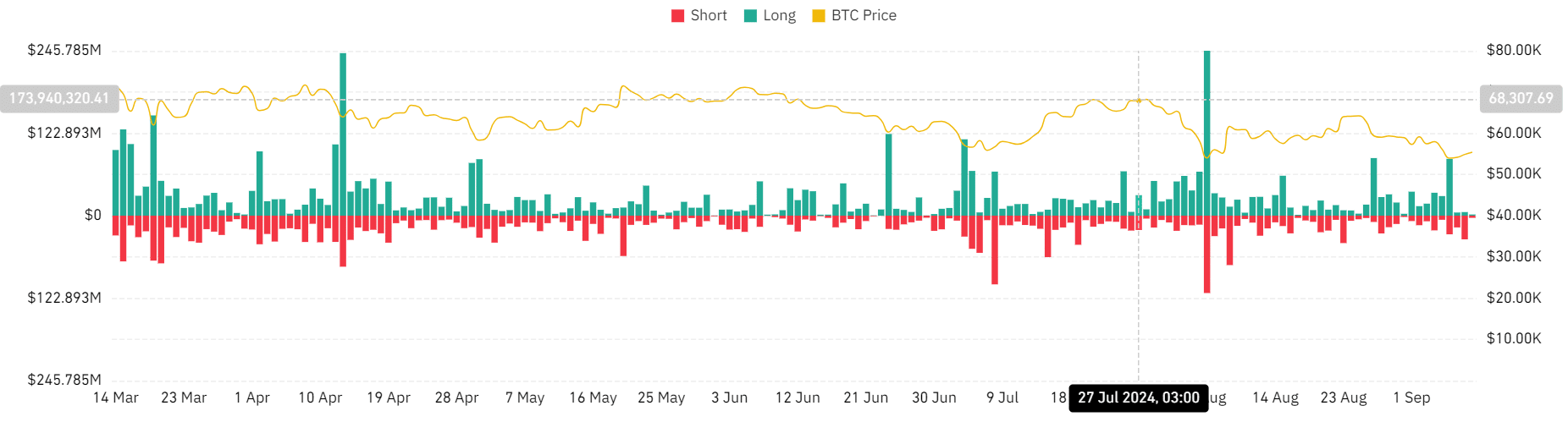

Over the last three days, there was a significant increase in the liquidation of short positions amounting to approximately $38.5 million, while the liquidation of long positions decreased to about $7.3 million.

Consequently, individuals who had placed bets against the market were compelled to relinquish their stakes, whereas those with long positions were eager to pay more to maintain their trades.

This situation implies that the markets were experiencing growth, causing those who had wagered on a decline to be forced to sell their positions.

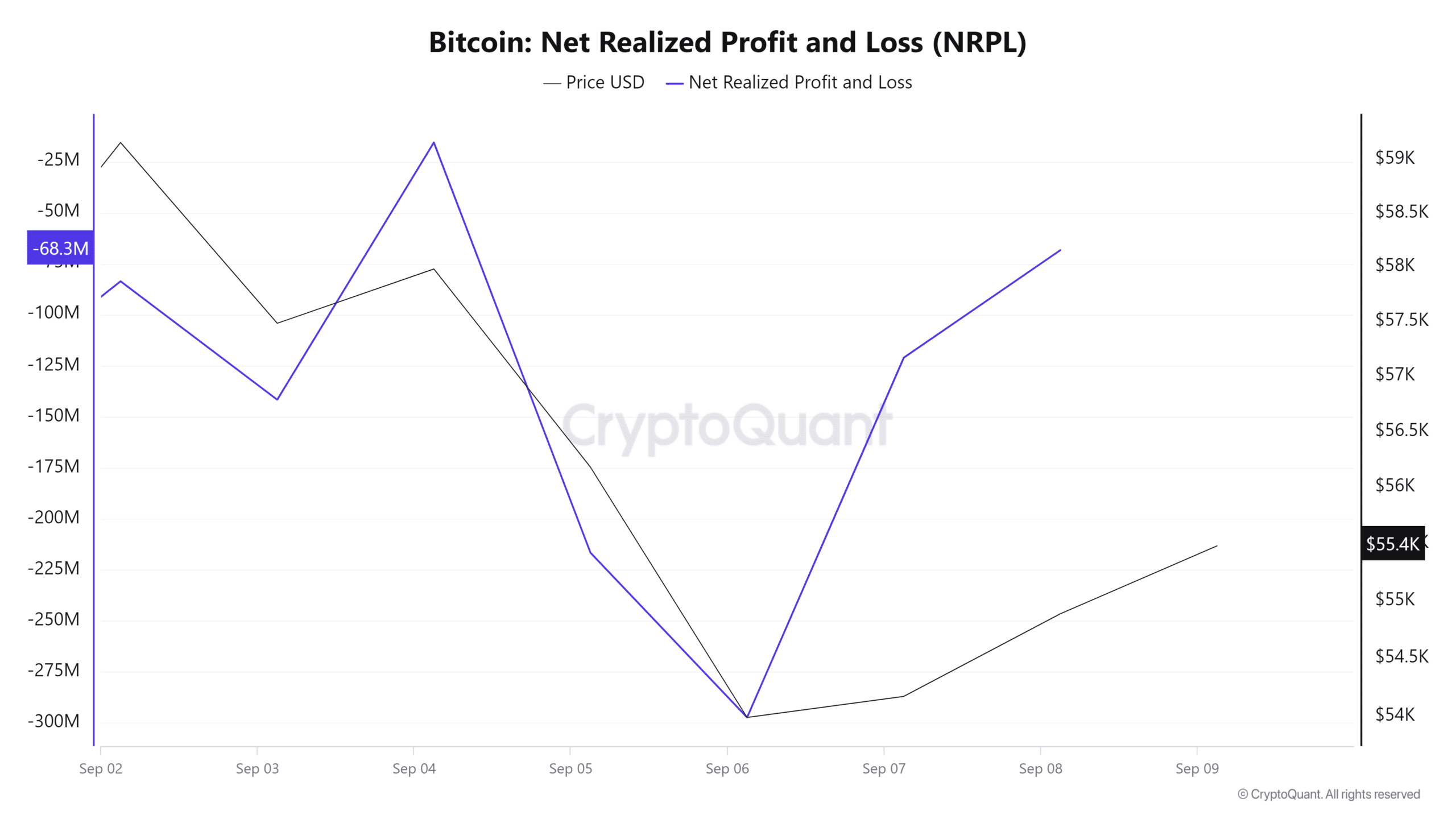

After the latest update, I’ve noticed a significant improvement in Bitcoin’s Net Realized Profit and Loss (NRPL). It has dropped from a substantial loss of -297.2 million to a more manageable -68.3 million at this moment. Although it remains negative, the drastic decrease indicates that investors are starting to buy in.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The buildup, either from whales or institutions, plays a crucial role in maintaining market stability by boosting purchasing activity.

Given the surge in purchasing due to whale involvement, Bitcoin appears primed for additional growth. Should the current market trend continue, the Bitcoin price could potentially flip and reach a new high of around $58,272.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-09-09 15:04