-

BTC’s on-chain activity surged, with transaction volume exceeding 180,000 BTC for the first time in seven months.

BTC has remained in the $62,000 price region.

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed my fair share of market fluctuations and trends. The recent surge in Bitcoin [BTC] whale activity and on-chain movements has piqued my interest, as it aligns with patterns I’ve observed during periods of significant market shifts.

In recent times, large Bitcoin holders (often referred to as ‘whales’) have increased their purchasing of Bitcoin, taking advantage of the market’s fluctuating prices.

The increase in whale (large bitcoin holders) behavior aligns with the return of previously idle Bitcoins to circulation, implying a possible change in market patterns.

Bitcoin whales accumulate more BTC

Data from Lookonchain revealed that Bitcoin whales have become more active over the last two days.

On October 8th, a specific digital wallet amassed about 250 Bitcoins, which was equivalent to around $15.6 million in value at the time.

After that, the same bitcoin address received another 750 BTC, approximately equivalent to $46.8 million, raising its total to 1,000 BTC within a day.

It’s worth noting that this whale’s Bitcoin wallet has been inactive for the last six months, following an accumulation of more than 10,000 Bitcoins earlier this year.

A resurgence in purchasing from significant investors might indicate a strengthening belief among them about the market’s promising future prospects.

Increased activity spurs on-chain movements

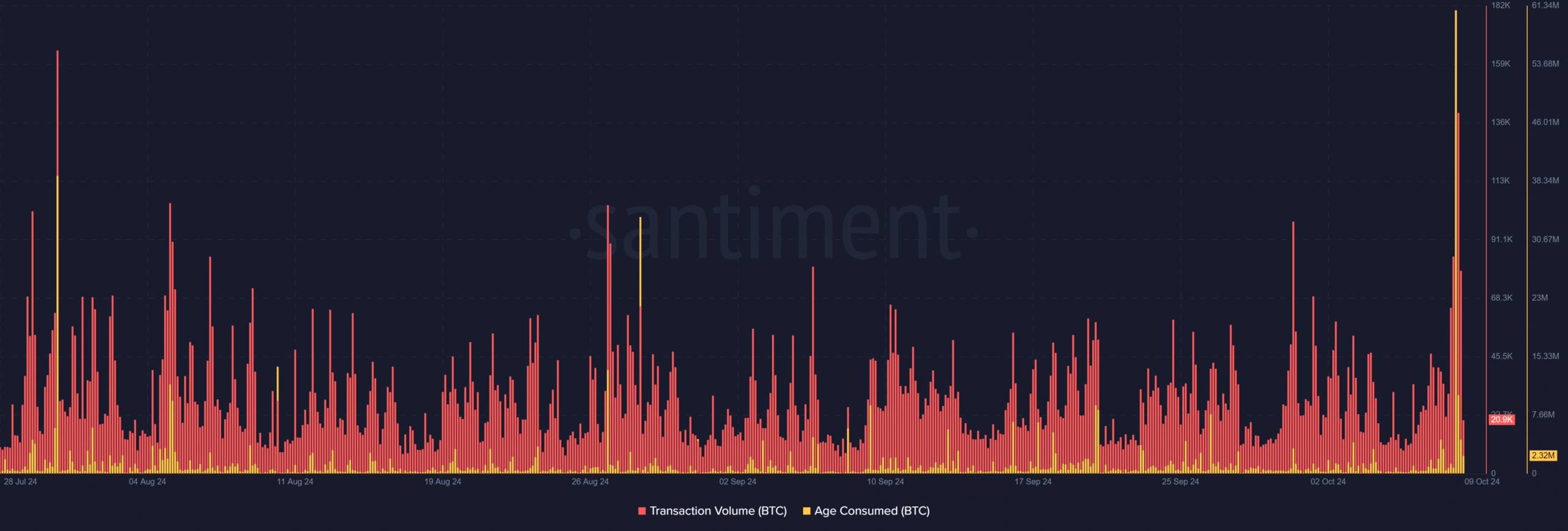

Based on data from Santiment, the surge in Bitcoin whale transactions has resulted in a significant boost in BTC transaction volumes as well.

The analysis reveals a significant increase in Bitcoin transactions, totaling approximately 180,000 BTC, which is equivalent to around $37 billion. Remarkably, this surge represents the highest volume recorded in transaction activity over the past seven months.

Furthermore, the metric that monitors the movement of Bitcoin held for a long time, or “age-consumed,” reached more than 60.7 million Bitcoins, a figure not observed in several months.

In the past, an increase in Bitcoin that was previously dormant re-entering circulation has often been seen as a promising indicator for future price increases.

The rise we’re seeing is strongly suggesting it could be connected to an upsurge in large Bitcoin holders (often referred to as ‘whales’), hinting at a possible change in the market dynamics.

BTC shows signs of stability

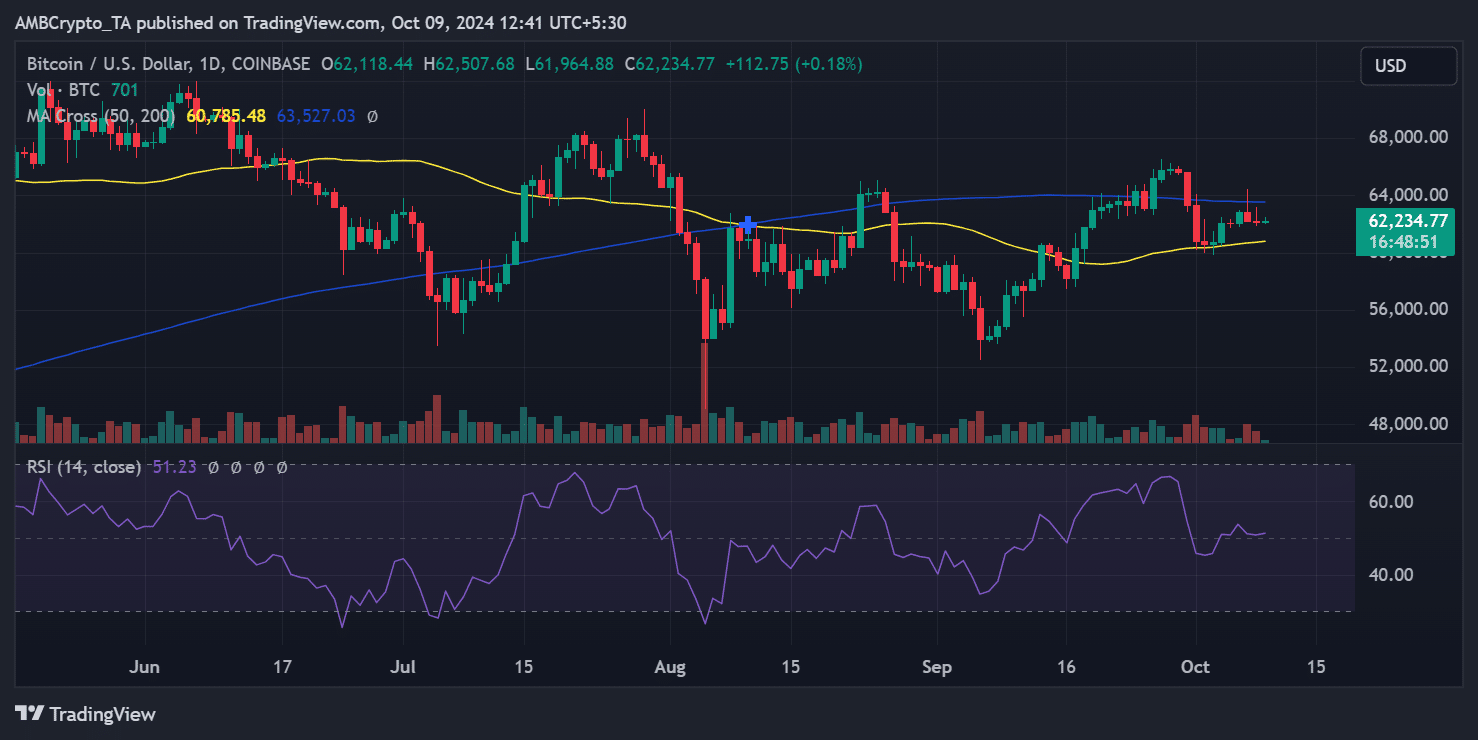

Regardless of heightened whale activity, Bitcoin’s value has remained fairly stable. Upon closer examination of the daily chart, it appears that Bitcoin concluded its latest trading session with a small drop, currently trading at approximately $62,122, experiencing a minor decrease of 0.13%.

Despite a small enhancement, the ongoing trading period indicates Bitcoin is currently valued around $62,240, representing an almost 1% rise.

The gradual build-up of Bitcoin by large investors (often referred to as “whales”) suggests a potential change for the better in the market’s price movement in the near future.

Read Bitcoin’s [BTC] Price Prediction 2024-25-

With Bitcoin’s largest investors (whales) showing increased activity and their long-term holdings entering the market, it appears that the cryptocurrency market could be gearing up for a potential change.

Despite no substantial price increase so far, the revived attention from major investors indicates that the market might soon witness a surge of positive energy.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-10-09 14:16