There’s an old saying about Mark Twain’s investments: “He was always earnest, occasionally lucky, and mostly out of money.” Judging by what’s going on with Bitcoin (BTC), it seems I’m not the only one with a taste for high-stakes riverboat gambling disguised as “market analysis.”

Now, picture this: It’s Monday, August 4, 2025. Bitcoin, looking a little worse for wear, dusts itself off and tries to swagger back up from its mighty fall. The BTC/USDT duo stumbles upward almost 1 percent, gripping tight to that 50-day Moving Simple Average (which, I assure you, is anything but simple if you’ve ever tangled with math on a Sunday morning). By mid-New York session, they’re toeing the $114,981 line-just enough to make a fella squint at his portfolio and mutter something Twain wouldn’t print.

Turns out, this much ado wasn’t just about Bitcoin. There’s been a stampede into artificial intelligence (AI)-which seems destined to create either a race of helpful robot butlers or, more likely, an even more confusing stock market. U.S. stocks added $1 trillion in value, because why not? And Bitcoin’s Funding Rate has been clinging to the green side longer than my uncle hangs around the poker table after losing his shirt.

When the Whales Come Out to Play (And Folks Panic)

Coinpedia reports that certain Satoshi-era “whales”-cryptocurrency veterans with more Bitcoin than sense-have started stirring from their deep-sea naps, causing retail traders to gnaw their fingernails clean off 🤯. These whales seem pretty sure Bitcoin will outwit both inflation and uncertainty, which is probably easier than outwitting a Mississippi steamboat captain, but not by much.

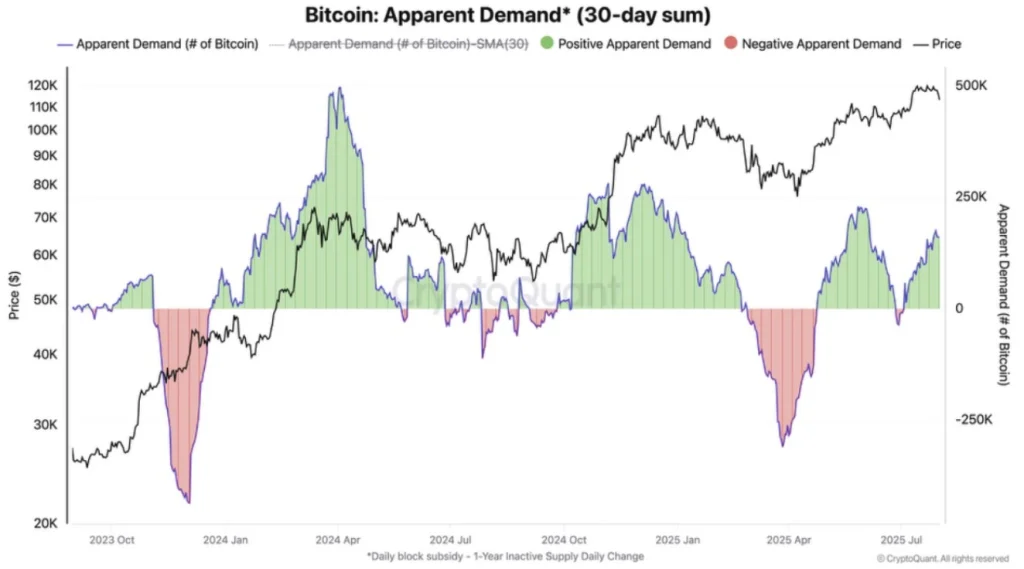

The grand tally from Bitcointreasuries says we’ve picked up 23 new treasury entities in the past 30 days, and their Bitcoin stashes have ballooned by 4.4%, swimming around the 3.64 million mark. CryptoQuant claims demand looks strong-nearly 160,000 shiny new BTC squirrelled away in just the last month. That’s a heap of digital gold for folks who’d apparently rather not trust the dollar, the pound, or their neighbor with their money.

BTC/USDT Midterm Targets: Higher Than Huck Finn’s Raft

For those keeping score, Bitcoin’s been sliding down a mighty logarithmic slope ever since its wild ride to an all-time high of $122,296 on July 14, 2025. Seems volatility is ready to kick its boots up later this week, especially with the Bank of England (BOE) planning to slice their interest rate to 4 percent-no doubt causing trouble for both bankers and insomniacs.

Glancing at the four-hour chart (and wishing I’d paid more attention in math class), we see Bitcoin just bounced off the bottom rung in the last 24 hours. If it can stagger above $115,000 and not trip over its own shoelaces, there’s a good chance of a rambunctious sprint to $117,800. Of course, don’t be shocked if BTC takes a detour at $112,000 before making another lunge for that mountain peak all-time high. 📈😅

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Goat 2 Release Date Estimate, News & Updates

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Felicia Day reveals The Guild movie update, as musical version lands in London

- Best Thanos Comics (September 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 10 Movies That Were Secretly Sequels

2025-08-05 01:22