-

BTC has declined by around 1% at press time.

Short-holders remain in profit despite the decline in the last 24 hours.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless market fluctuations and trends. The recent Bitcoin [BTC] surge has been particularly intriguing, given its rapid rise above the $60,000 price barrier.

🛑 Market Warning: EUR/USD May Collapse on Trump Tariffs!

Top analysts urge immediate attention to shifting forecasts!

View Urgent ForecastBitcoin [BTC] has recently lifted the mood of the crypto market, breaking through the $60,000 price barrier and moving closer to another key resistance level. This surge has enabled some whales to secure significant profits and liquidated numerous short positions.

Bitcoin whales take profit

Examining the daily Bitcoin graph reveals that it surpassed its temporary resistance level on September 17th. This resistance was created by its short-term moving average (represented by a yellow line), which was breached when Bitcoin increased by approximately 3%, reaching roughly $60,300.

After breaking out, Bitcoin saw a series of upward movements, ending its latest trading day around $63,362.

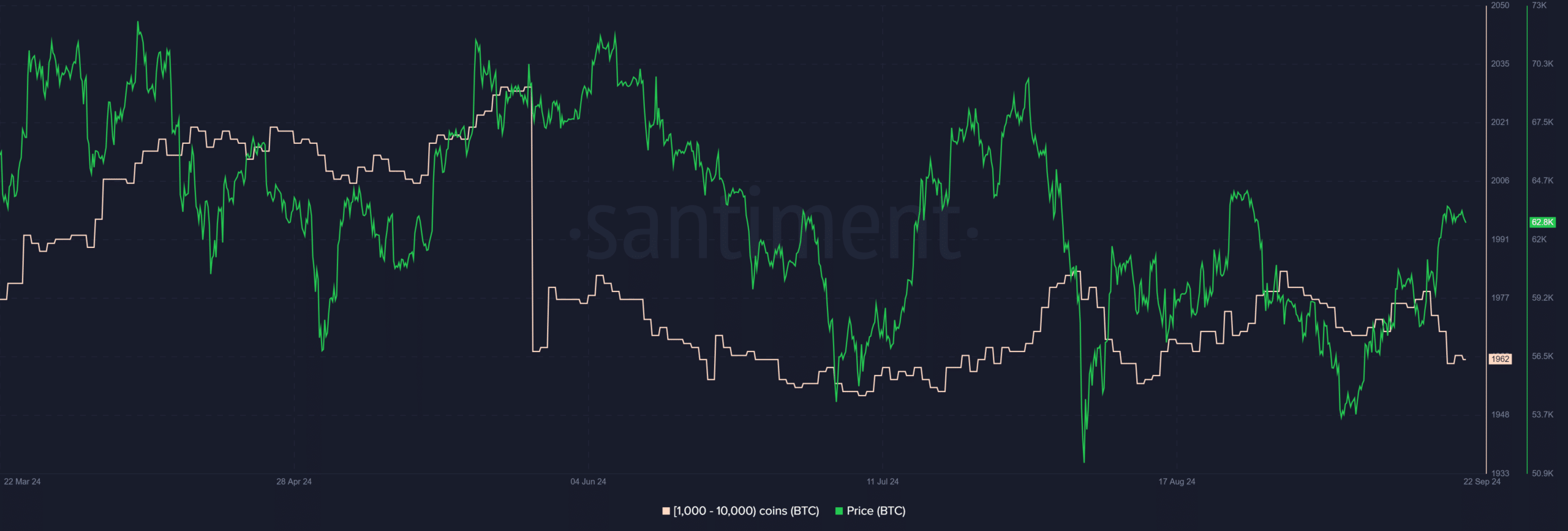

According to data from Santiment, the recent surge in Bitcoin’s price led a number of significant investors (Bitcoin whales) to cash out their profits. Over the past three days, these big investors have offloaded more than 30,000 BTC, equating to approximately $1.86 billion.

Despite this significant sell-off, Bitcoin remains bullish, as evidenced by its Relative Strength Index (RSI), which has stayed above 60.

Bitcoin MVRV shows a 5% profit

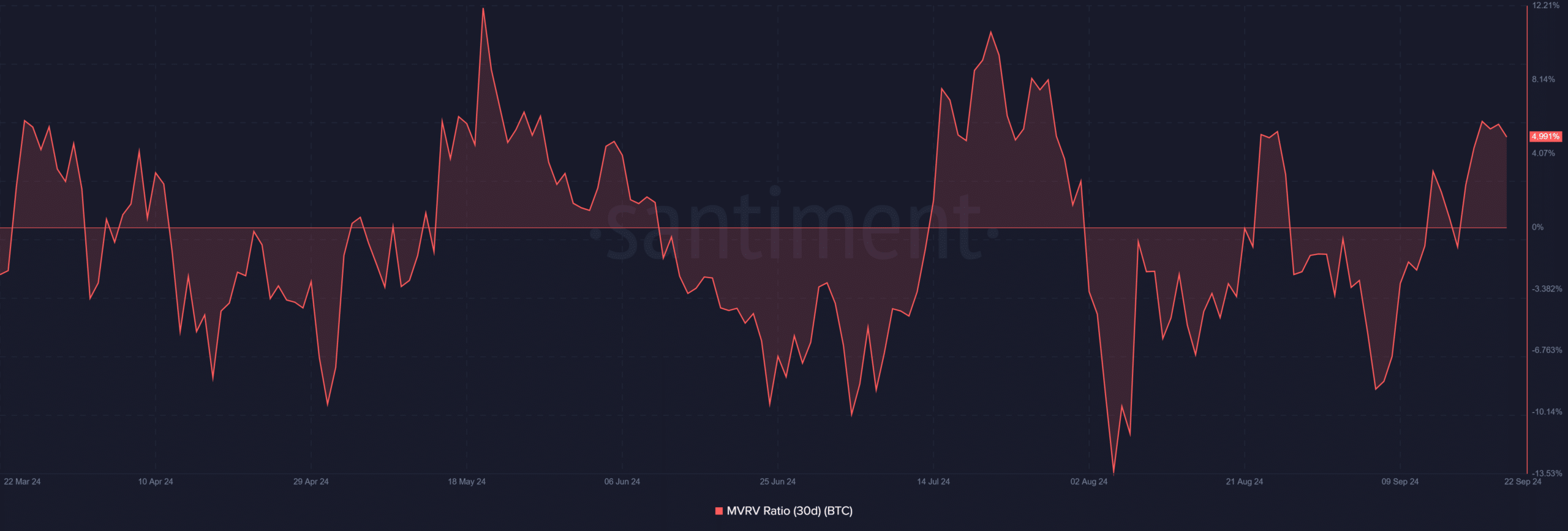

Over the past few days, Bitcoin investors who bought recently have started seeing a profit thanks to the price increase. According to an analysis of the Market Value to Realized Value (MVRV) ratio over the last month by Santiment, this ratio crossed above zero on September 17th and has now risen close to 5%. This indicates that a significant number of short-term Bitcoin holders are currently in profit.

Within this specified period, the average holder is seeing close to a 5% return, which mirrors the profits achieved by large investors (whales) over the past few days.

Short positions face increased liquidations

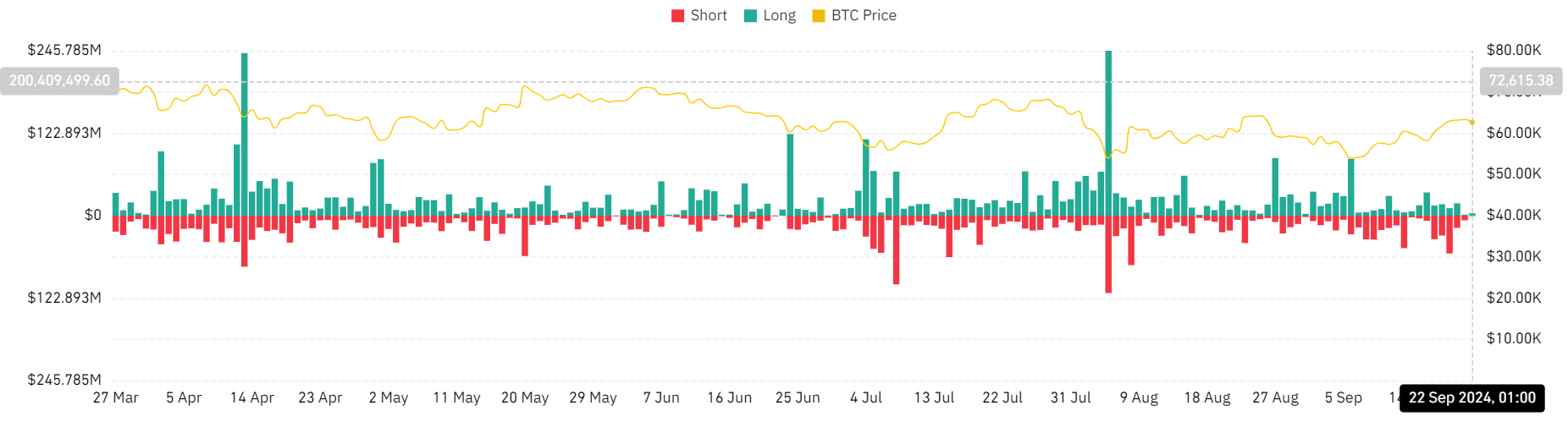

Over the past few days, as Bitcoin’s upward trend continues, there has been a substantial surge in the closure of short positions. According to Coinglass, approximately $146 million worth of these short positions were closed from September 17th to September 21st.

In contrast, long positions saw liquidations of around $63 million during the same period.

Read Bitcoin (BTC) Price Prediction 2024-25

Furthermore, the Bitcoin funding rate has stayed above zero during the recent period, suggesting that there are more individuals purchasing Bitcoin than those selling it, which is a favorable indication of Bitcoin’s performance.

This trend may help Bitcoin absorb selling pressure from whales taking profits.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-23 06:15