- Bitcoin whales continued to accumulate despite the price surge, signaling long-term confidence in its potential.

- Bitcoin ETFs saw massive inflows, boosting market confidence and raising questions about future trends.

As a seasoned analyst with over two decades of experience in financial markets, I must admit that the recent crypto market developments have left me both intrigued and cautiously optimistic. The surge in Bitcoin price, nearing the $100,000 mark, is reminiscent of the dot-com bubble days, albeit with a more robust underlying technology.

The effect of recent elections on the cryptocurrency market has been noticeable and significant, particularly for Bitcoin [BTC]. At the moment of reporting, BTC was being traded at approximately $93,515.07, representing a substantial 29-fold increase in value over the past month according to CoinMarketCap.

Approaching the psychologically important level of $100,000, numerous individuals are predicting that the cryptocurrency might achieve this threshold imminently.

Bitcoin whales’ move signals…

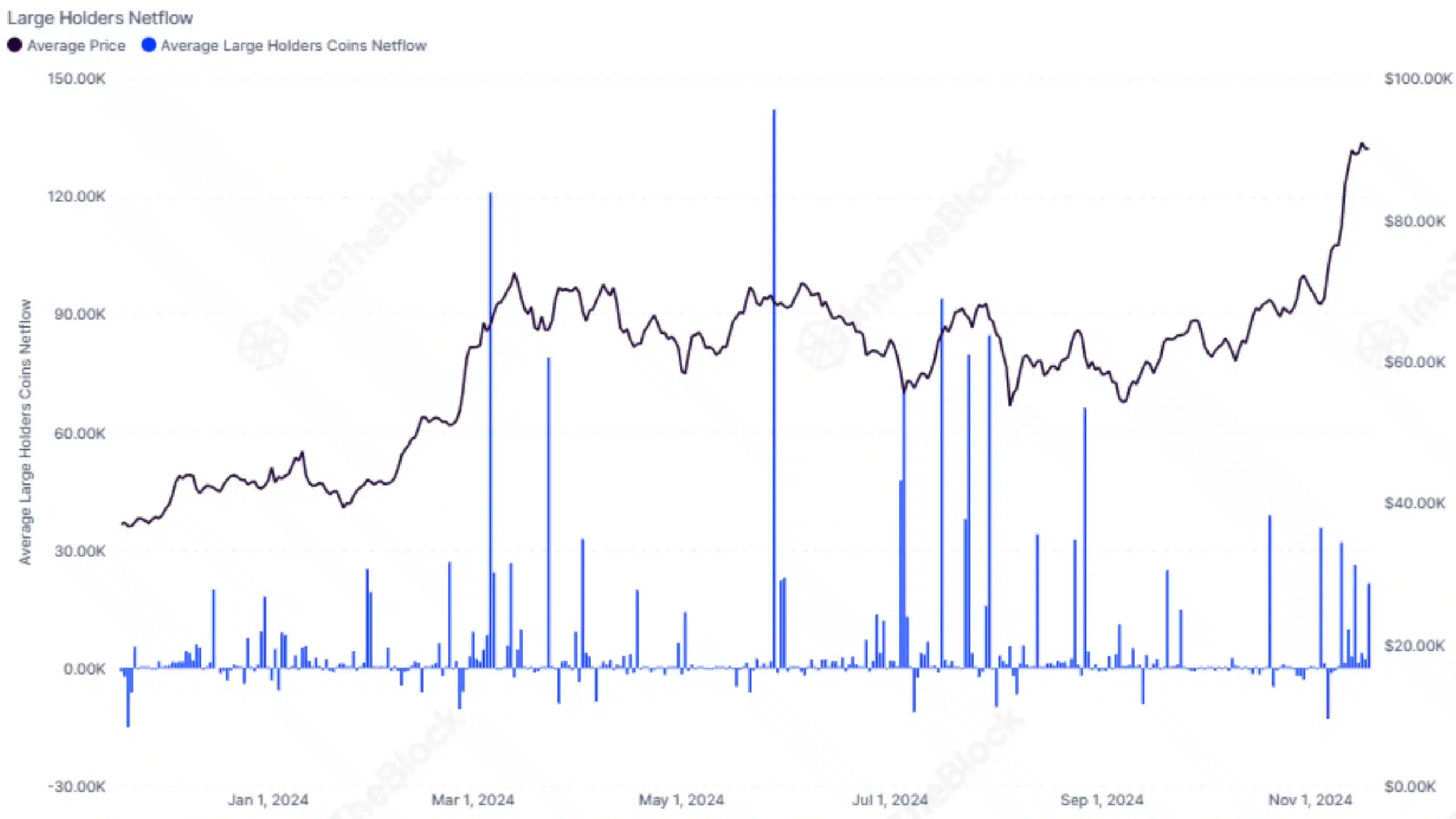

On the other hand, even though Bitcoin has experienced a significant surge in value, those who hold large amounts of it, commonly known as “whales,” have yet to take advantage of these price increases by cashing out their profits.

Rather than stopping, they keep on collecting Bitcoin at these high prices, which suggests a positive or bullish trend may be ahead for this digital currency.

According to data from IntoTheBlock, the largest Bitcoin wallets have seen relatively small amounts of Bitcoin being withdrawn compared to the rest of this year.

It implies that the whales chose not to cash out on their Bitcoin holdings, even as its price skyrocketed.

Instead, their actions suggest they’re steadily increasing their holdings, which demonstrates a high level of faith in the long-term prospects of cryptocurrencies. This increase could also imply that these major investors are strategically preparing for potential larger profits down the line.

Bitcoin’s long-term viability

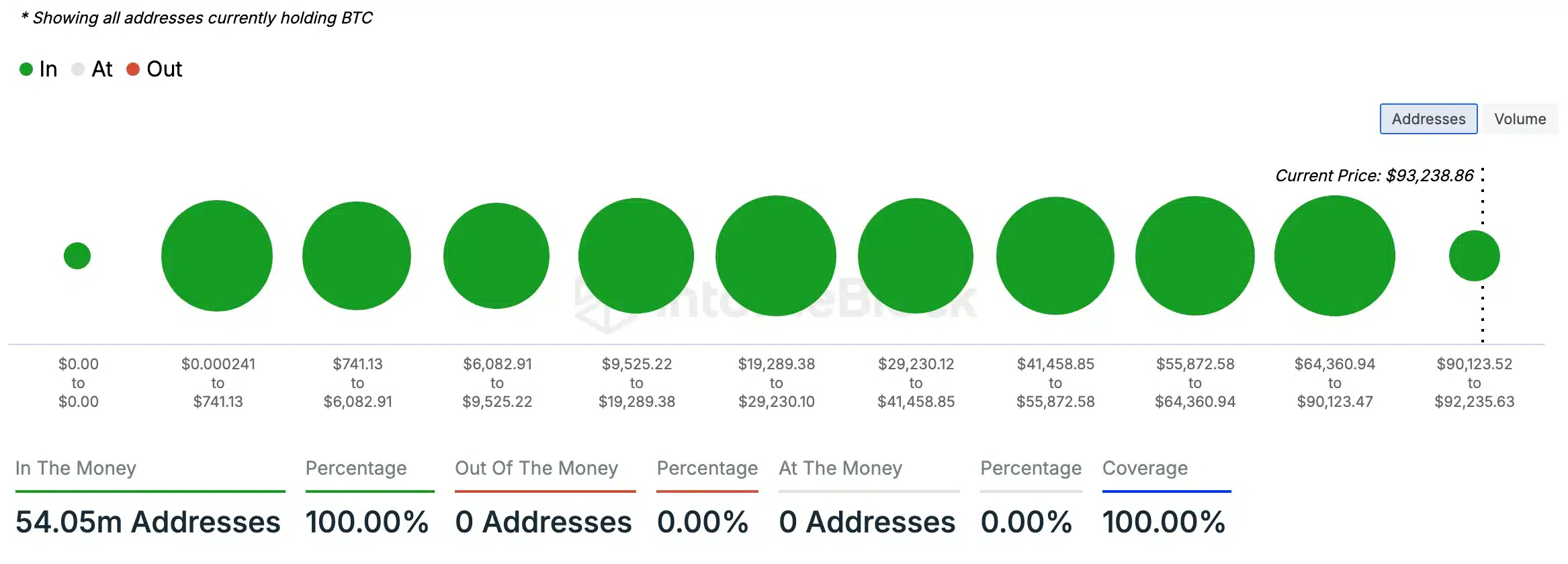

According to AMBCrypto’s interpretation of the data from IntoTheBlock, all Bitcoin owners currently possess tokens that cost them more than their initial investment, lending credence to a positive market outlook.

This means all BTC holders are “in the money,” a clear indication of widespread profitability.

Instead, it’s worth noting that there were no investors holding Bitcoins that were “out of the money.” This underscores the generally positive outlook on Bitcoin, indicating a possibility of more price rises in the near future.

Nevertheless, given the rapid increase we’re witnessing, some investors are advocating for carefulness, pointing out possible dangers that may lie ahead.

Crypto inflows spike

This follows a week when cryptocurrency investment products experienced a remarkable $33.5 billion in inflows. Over $2.2 billion flowed in just the past week.

The surge in popularity for investments in cryptocurrencies, as shown by a whopping $138 billion in managed assets, underscores an increased level of trust and faith in this market.

Bitcoin ETF also makes news

On November 19th, there was a substantial increase in investments into Bitcoin Exchange-Traded Funds (ETFs), as reported by Farside Investors, with approximately $816.4 million flowing into these funds.

A notable Wall Street company disclosed ownership of $710 million worth of Bitcoin ETFs in their latest 13F filing, with a significant portion invested in BlackRock’s iShares Bitcoin Trust.

Watching Bitcoin’s increasing influence on the market is intriguing. It will be exciting to observe how these trends reshape the overall cryptocurrency world. This transformation will undoubtedly impact the investment tactics of not only large-scale investors but also individual ones as well.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-11-21 01:11