- Whales have increased to a 3-year high, holding nearly 4 million BTC.

- Retail holding has seen a slow pace of growth, but will the trend trigger a new ATH?

As a seasoned crypto investor with a keen eye for market trends and a knack for spotting patterns, I find myself intrigued by the recent surge of whales holding nearly 4 million BTC – a 3-year high! This is reminiscent of the build-up before the $69K ATH in 2021. However, unlike retail investors who have seen a slow pace of growth, I can’t help but wonder if this trend will indeed trigger a new all-time high for Bitcoin.

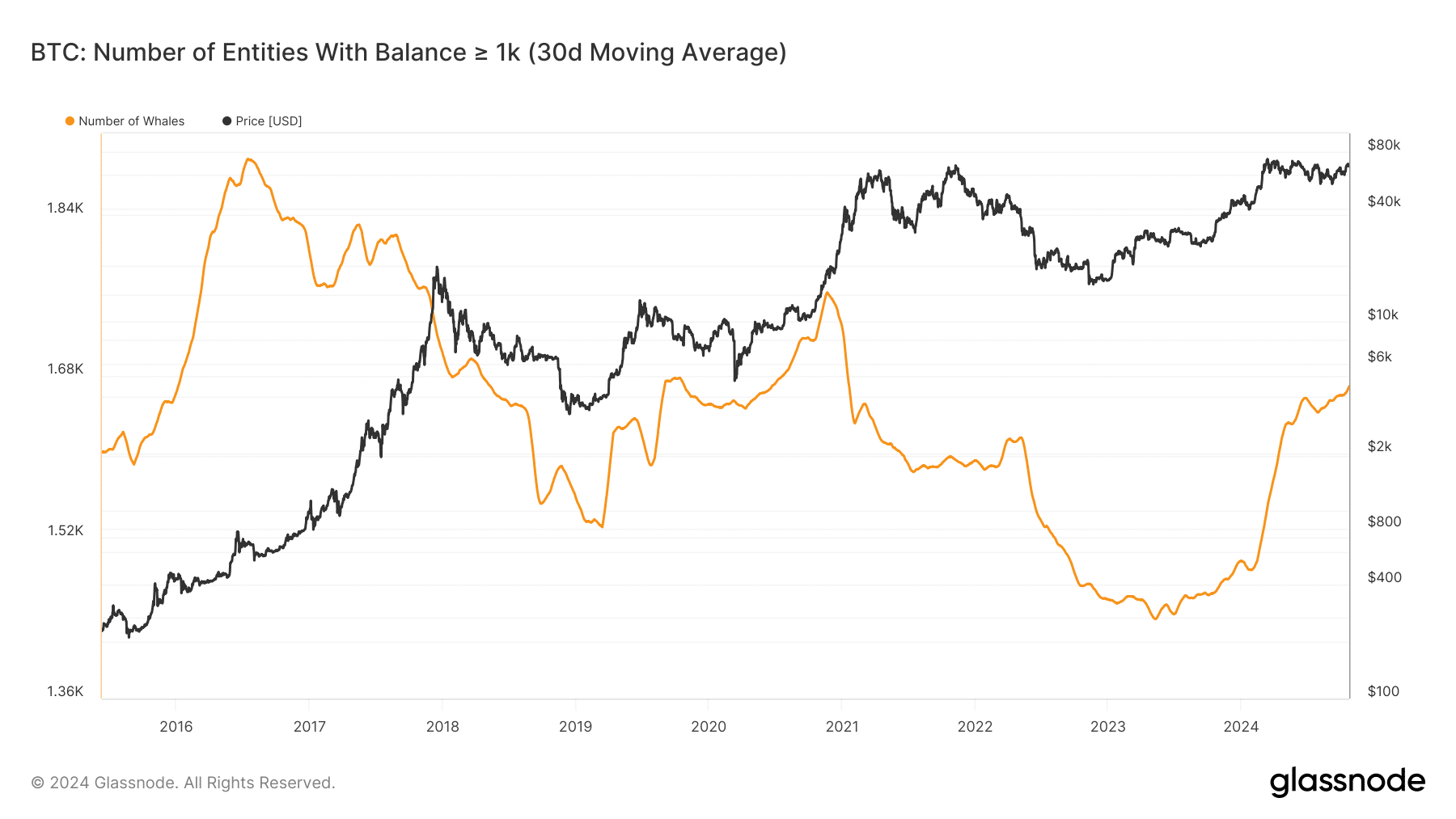

2024 has seen an increase in large Bitcoin [BTC] holders, or those possessing more than 1,000 coins. This trend mirrors levels not witnessed since early 2021, a time preceding the asset’s peak of $69K in value during its previous cycle.

According to Glassnode data, the whale entities were over 1660 as of the 23rd of October.

In response to an increase in significant Bitcoin investors, Andre Dragosch, head of research at Bitwise, pondered if this trend might indicate a potential new record high (peak) for Bitcoin.

“Total number of #Bitcoin whales just reached the highest level since Jan 2021! New ATHs incoming?”

In 2020, the number of whales (a term used in cryptocurrency to refer to large investors) increased from approximately 1650 to more than 1760. After this rise, Bitcoin reached a new all-time high (ATH) the next year. It’s still uncertain if this pattern will continue in 2024.

Whales eyes 4 million BTC

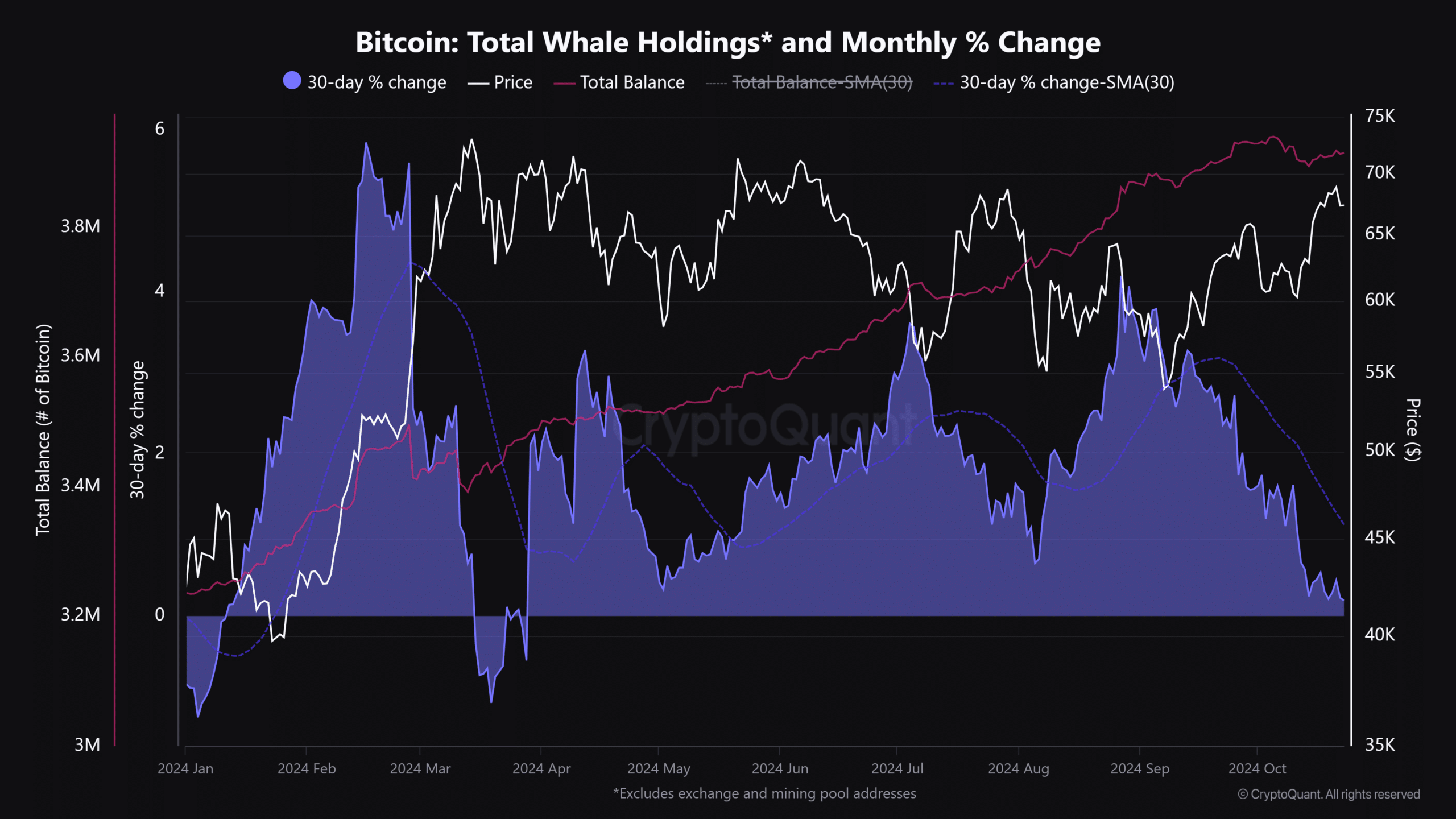

According to CryptoQuant, whales’ total holdings stood at 3.9 million BTC as of press time.

Approximately 20% of Bitcoin’s total market value is around $261 billion, and since mid-2023, these large investors (whales) have accumulated roughly 670,000 Bitcoins.

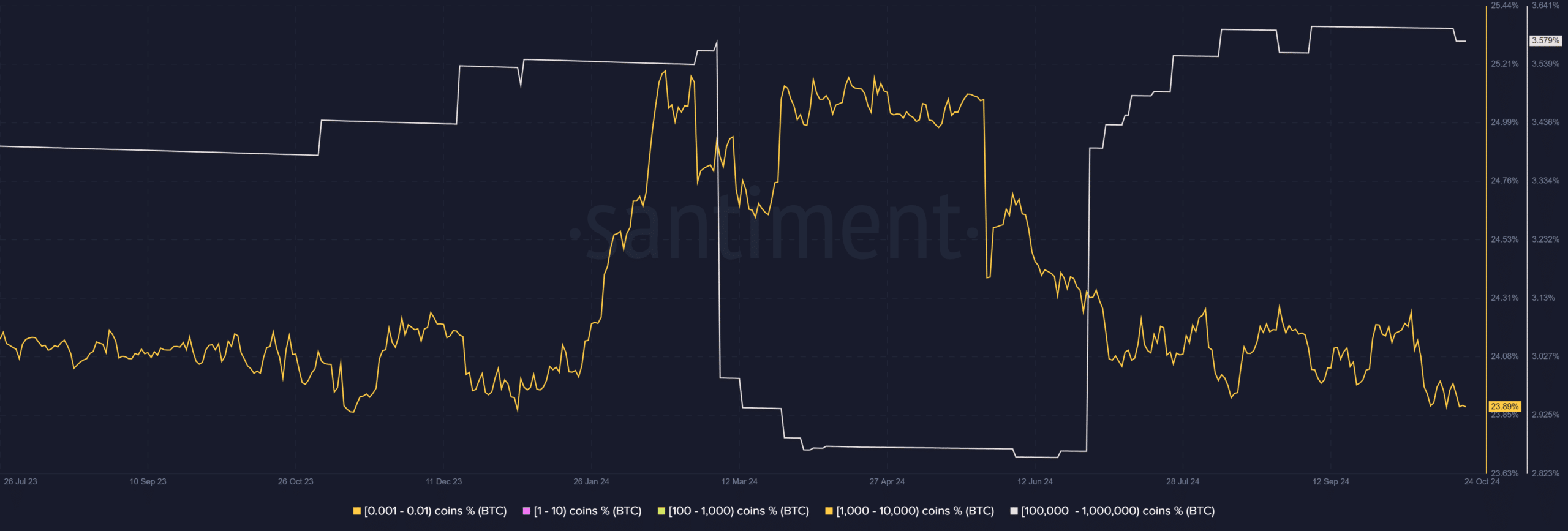

However, not all whale cohorts were heavily accumulating. According to Santiment data, those holding 100K — 1 million BTC fronted aggressive accumulation in 2024. However, those with 1K -10K BTC have reduced their exposure.

In summary, it was observed by CryptoQuant analysts that whales (large-scale investors) have contributed more Bitcoin (BTC) to the market compared to traditional retail investors.

Beginning from 2024, the bitcoin holdings of larger investors (those with 1-10K BTC) have expanded at a quicker pace than those of retail investors each year. Currently, the total amount of bitcoin held by retail investors is approximately 30,000 coins, while that of other larger investors amounts to about 173,000 coins.

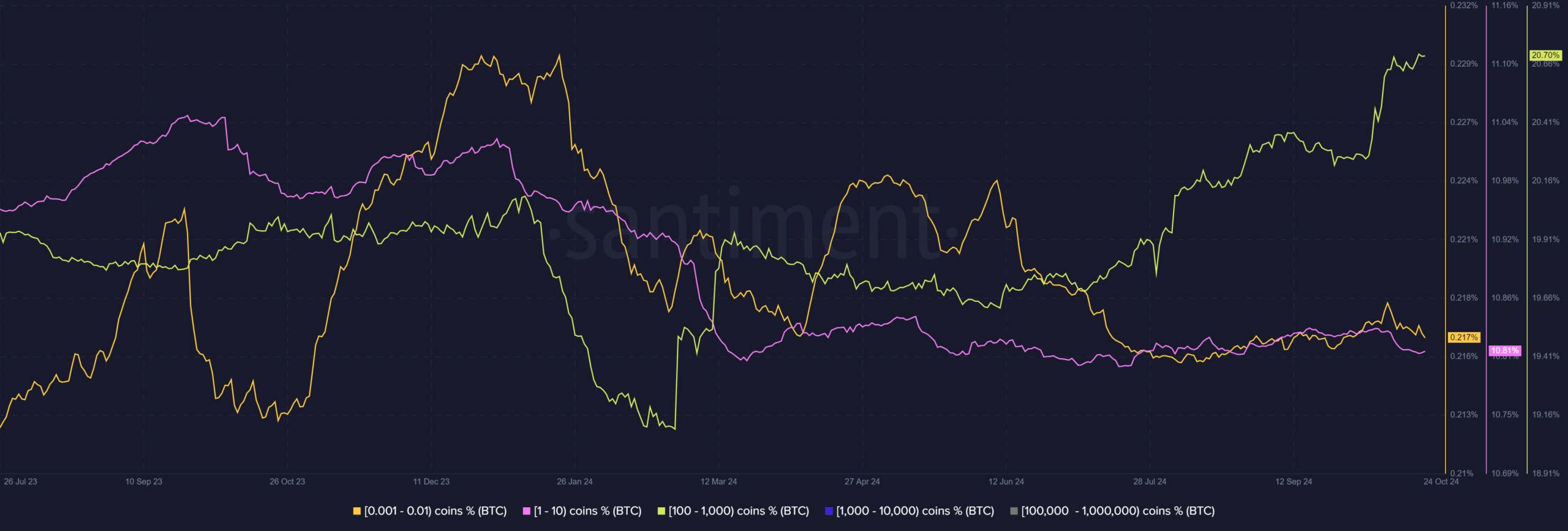

According to Santiment’s data, individuals possessing less than 10 Bitcoins have experienced a relatively sluggish rate of growth over the last several months.

Conversely, individuals holding between 100 and 1000 Bitcoins have expanded their holdings and strengthened their market control from 19% to 20%.

Although the expansion of Bitcoin’s retail holdings has been relatively gradual, it appears that a long-term holding approach is favored, as indicated by the significant increase in Bitcoin accumulation accounts.

Experts consider these developments as potential triggers for Bitcoin possibly reaching a new all-time high, though it’s yet to unfold.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-25 06:15