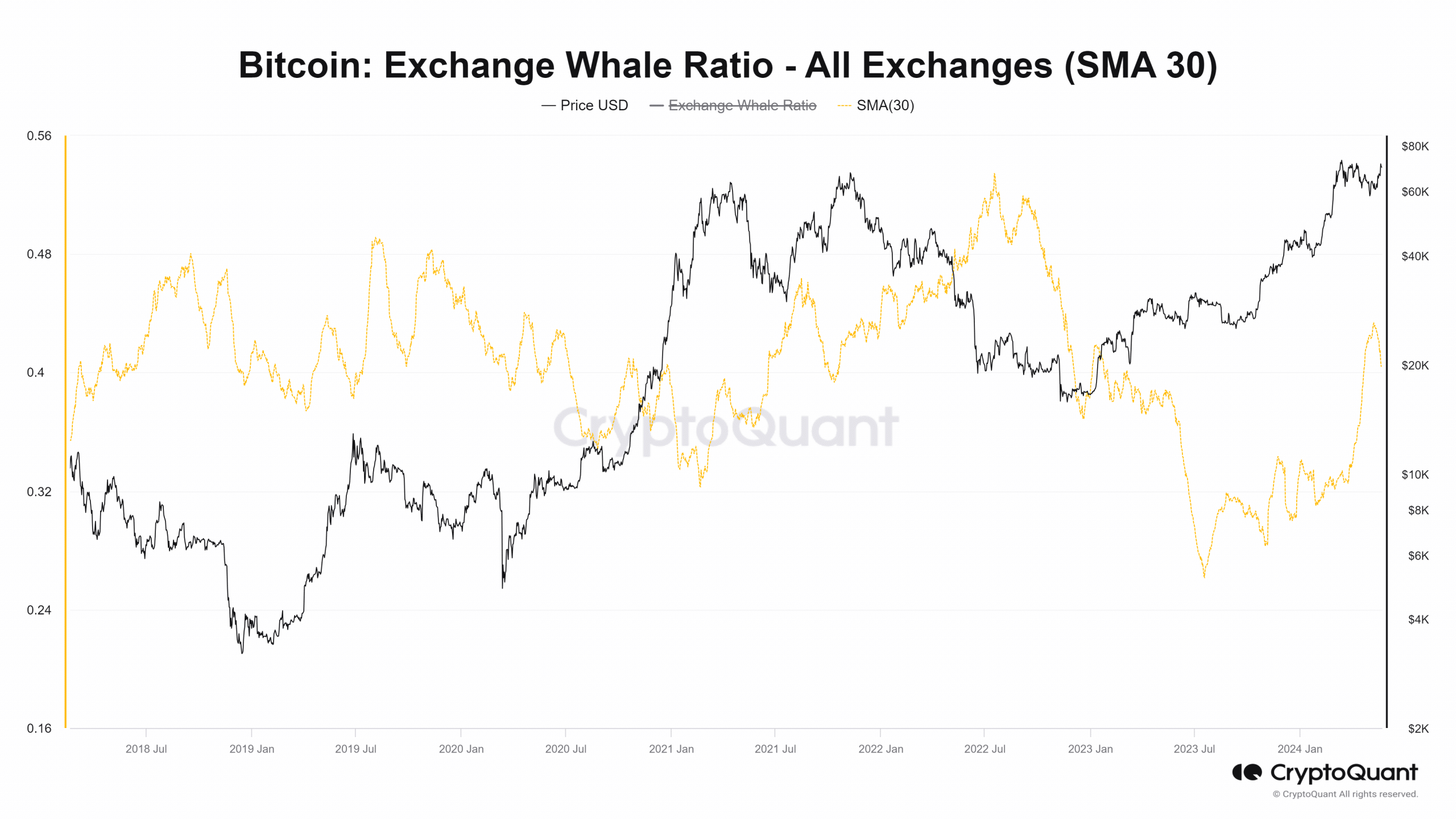

- Bitcoin whale activity saw an uptick, which usually does not occur during this part of the cycle.

- The realized price gradient oscillator showed bulls need to maintain their momentum.

As a researcher with a background in cryptocurrency analysis, I’ve been closely monitoring Bitcoin’s price action and on-chain metrics over the past few months. The recent uptick in Bitcoin whale activity is something that piqued my interest, as it’s not a typical occurrence during this part of the cycle.

As a Bitcoin analyst, I’ve observed an uptick in the cryptocurrency’s price action, with values nearing their all-time high. Recently, we experienced a minor setback, resulting in a 4% decline over the past two days. This dip brought prices back to the crucial support level around $69,000. Despite this temporary retreat, my technical analysis continues to suggest a bullish outlook for Bitcoin.

Accumulation continued apace, while prices stagnated in April and the first half of May.

According to a recent analysis by AMBCrypto, Bitcoin may be gearing up for a prolonged bull market lasting approximately 300 days, as indicated by the data presented. This theory is strengthened by the current market conditions.

This momentum indicator shows bulls have to maintain the pressure or risk a slump

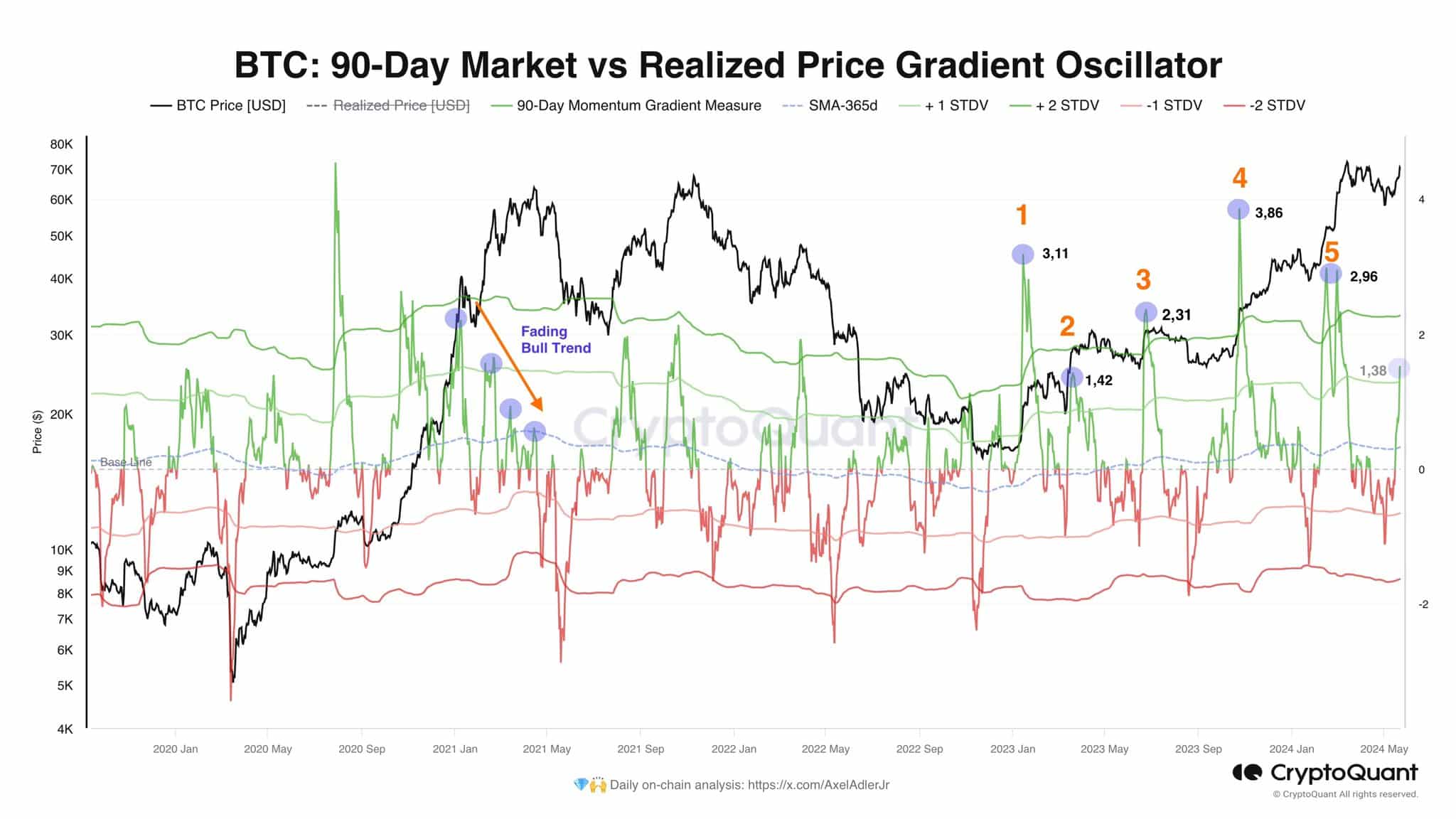

Crypto specialist Axel Adler shared on platform X (previously known as Twitter) an intriguing on-chain assessment, revealing the present surge of Bitcoin and the peak values its gradient attained over the previous 18 months.

The price gradient oscillator shown here determines the rate at which the market capitalization surpasses the realized capitalization in the market.

As I analyzed the Bitcoin market during the 2021 rally, I noticed that the oscillator started to form lower peaks just before reaching new highs. This pattern suggested to me that the bullish trend was weakening.

In the year 2024, the oscillator has created a lower peak at a value of 2.96. Therefore, a rise above this level to 3 or more would be beneficial for buyers to prevent a reoccurrence of the 2021 trend, suggesting waning bullish momentum.

At the time of writing, the oscillator reading was at 1.38.

“It’s only a matter of time” for Bitcoin to hit all-time highs

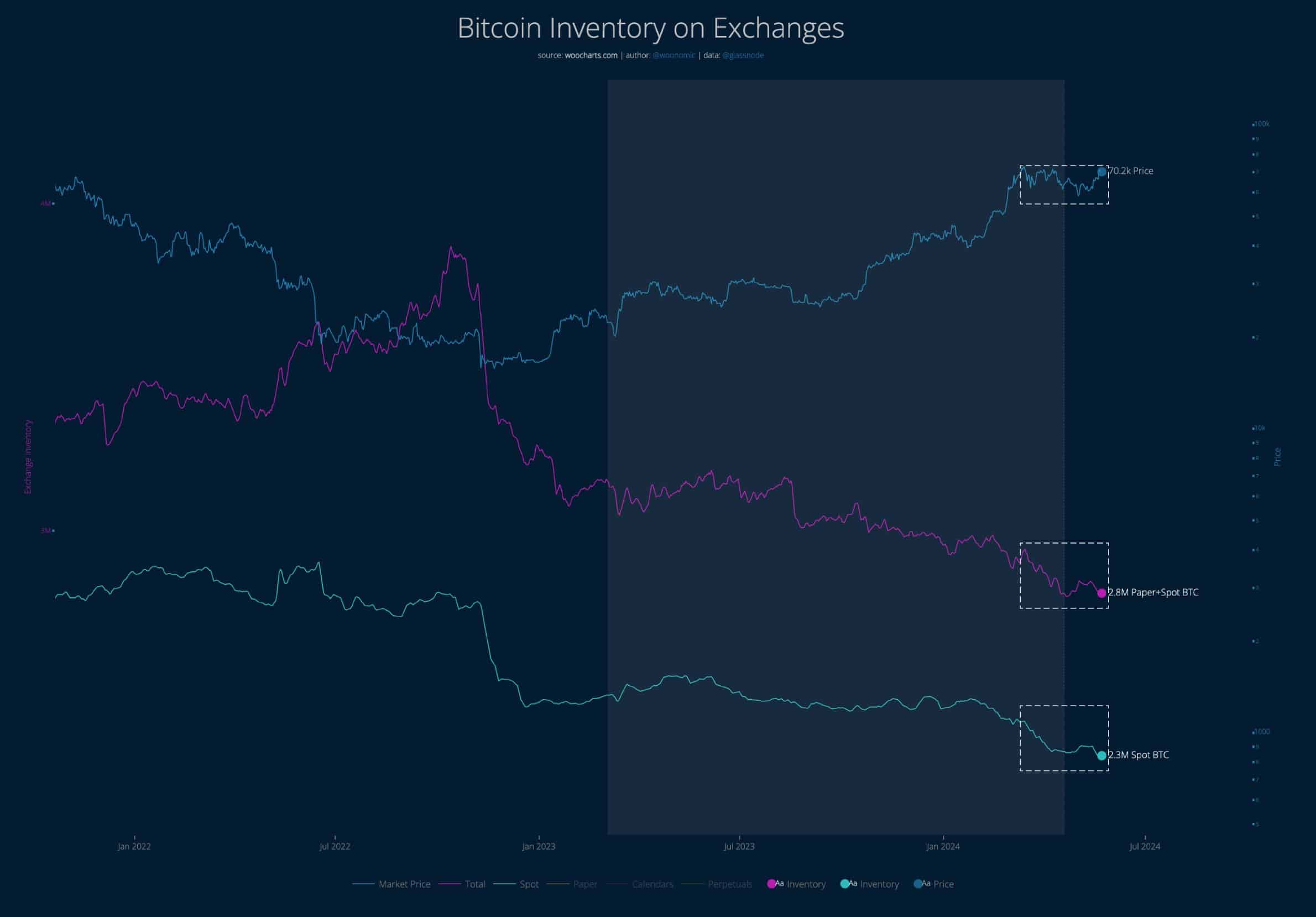

Expert analysis by Willy Woo reveals that over the past two months, Bitcoin supply has been actively bought up despite the absence of a clear higher-timeframe trend in its pricing.

This led to panic among retail holders, but the spot BTC demand was sizeable.

The analyst was convinced that the prices would eventually surpass their previous peak when compared to the US Dollar.

As an analyst, I’ve noticed an intriguing development in the exchange whale ratio over the past couple of months. Instead of declining as it typically does during a bull market, this ratio exhibited a marked upward trend in April and May. This finding suggests heightened activity among the so-called “whales” – large investors or entities with significant holdings in the cryptocurrency market. Given that whale activity tends to subside during prolonged bull runs, this abnormal behavior is noteworthy.

It picked up once the top was in and prices started sliding lower.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’ve taken note of Willy Woo’s observation about the significant outflows from cryptocurrency exchanges. This is certainly an intriguing development that could suggest bearish sentiments among large investors. However, it’s important to consider other factors as well. For instance, the recent surge in whale activity might be cause for some hesitation among potential sellers. These big players could be accumulating more coins, which could potentially lead to further price increases. Therefore, while the outflows are a valid concern, it’s essential not to overlook the potential implications of rising whale activity.

Despite the uncertainty surrounding the exchange whale ratio, the available data suggests that this bull market still has room for growth.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- ANKR PREDICTION. ANKR cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Solo Leveling Arise Tawata Kanae Guide

- Taylor Swift and Travis Kelce: A Love Story Unfolds at Chiefs’ AFC Celebration!

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-05-23 08:07