-

Global m2 money supply has turned positive.

Historical patterns indicate BTC might be set to surge on the charts now

As a seasoned crypto investor with a knack for spotting trends and deciphering market signals, I find myself intrigued by the current state of Bitcoin. The global M2 money supply turning positive is a historical pattern that has often signaled a bull run for BTC, and we might be on the cusp of such a surge.

The globally recognized digital currency, Bitcoin (BTC), is causing a stir among investors, large-scale investors (whales), and financial institutions, due to its unpredictable nature. This uncertainty persists, particularly as the trading community anticipates improved market conditions during the last three months of the year.

Historically, Bitcoin tends to rise when the global M2 money supply grows. With the global M2 now increasing again, traders are predicting a possible price surge similar to those observed in late October 2023 and early January 2024, periods during which BTC reached unprecedented highs.

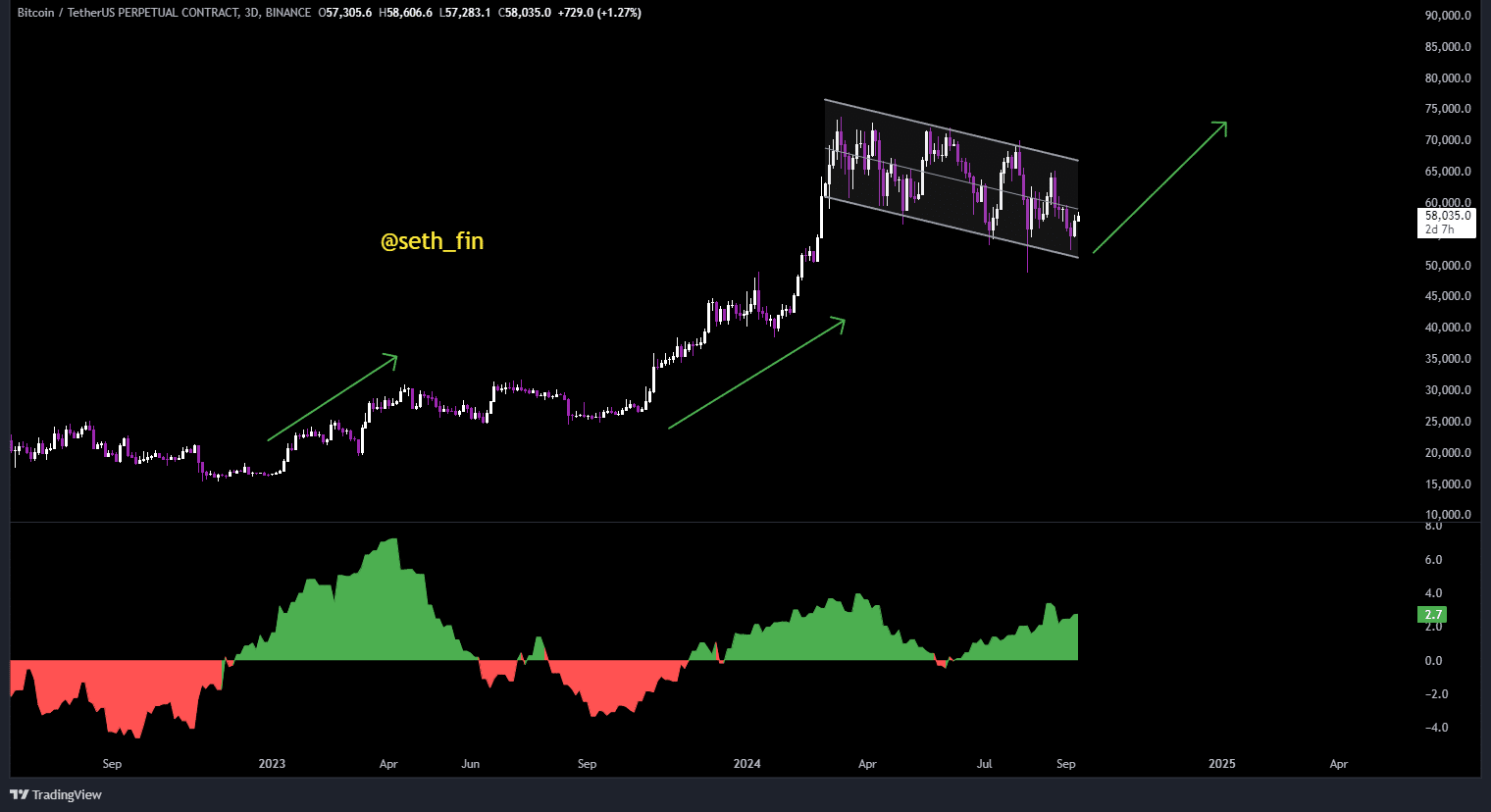

As I compose this text, Bitcoin (BTC) appears to be forming a bullish flag pattern when it comes to its price against Tether (USDT). This formation might indicate another potential increase in Bitcoin’s value, especially considering the expected reduction in interest rates by the Federal Reserve, which could significantly influence the market.

It appears that a reduction by 0.25 percentage points is probably on the horizon. But, it’s important to remember that significant changes often take time to become noticeable within the financial market; they must first stabilize before their impact becomes clear.

Bitcoin trading back at mid range

Currently, Bitcoin is being exchanged close to the midpoint of its price band, which is part of a downward-sloping trending channel.

A surge upward might propel the price near the top of the range, potentially breaching it. At the base, the floor was $51,000, while $66,000 served as a significant resistance level.

Currently, while Bitcoin appears to be stabilizing, its power is still clear. Notably, bears have struggled to breach the downward trendline, suggesting resilience.

Should Bitcoin surpass its current trendline and maintain that level, we might witness a substantial increase in its value, possibly reaching new peak prices. This bullish outlook could be reinforced by comparing the Bitcoin price with the global M2 money supply chart.

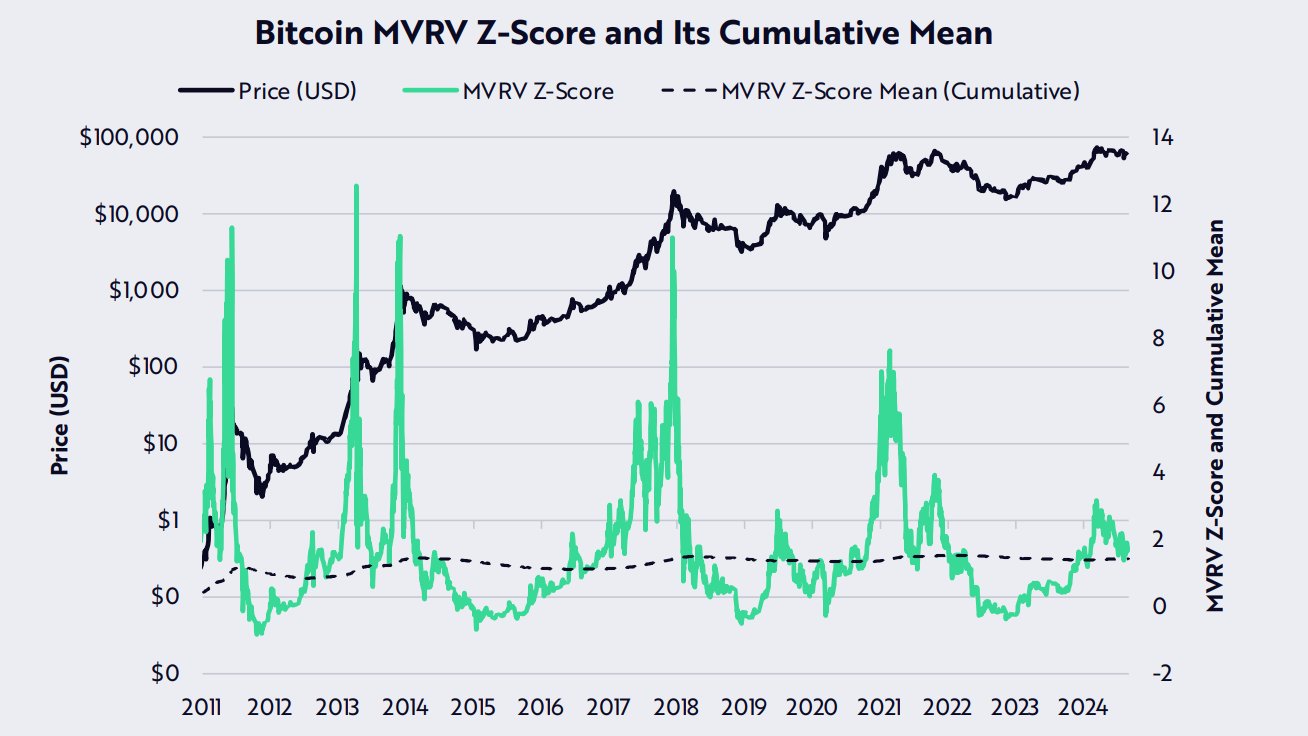

MVRV z-score highlights low unrealized profits

At the current moment, the MVRZ (Market Value to Realized Value Z-score), a crucial marker of market sentiment, stood approximately at 1.9. This implies that Bitcoin’s price trend might be gradually decreasing, while the typical network’s on-chain cost basis seems to be increasing.

In other words, this implies that potential earnings in the market remain untapped, providing scope for further price increases.

In the past, when the MVRV z-score has reached these specific levels, Bitcoin has consistently experienced substantial upward movements. The instances in 2012, 2020, and 2023 serve as compelling evidence of this trend.

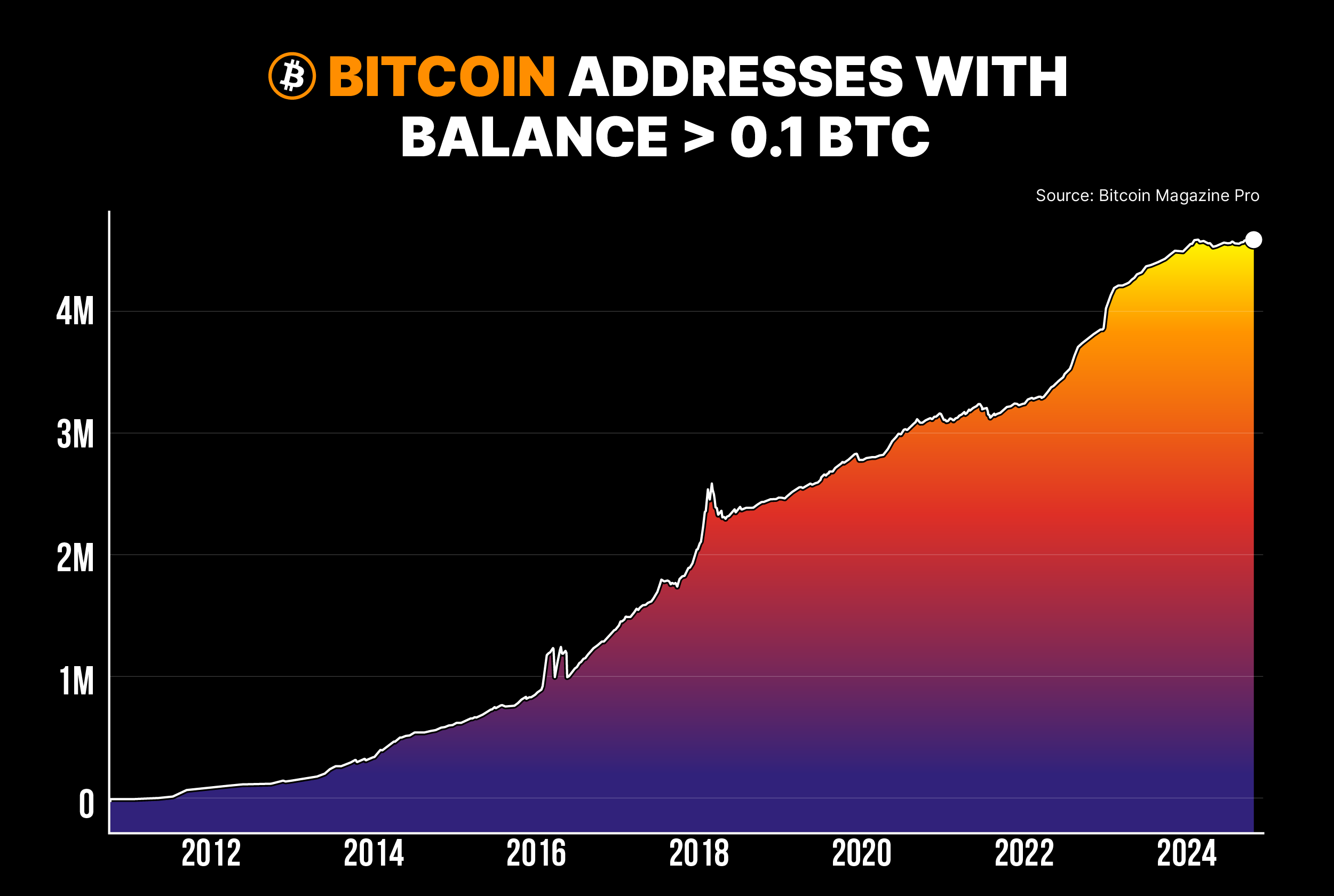

Addresses with more than 0.1 Bitcoin near ATH

Moreover, the count of Bitcoin wallets containing at least 0.1 BTC is almost reaching a record peak.

In other words, those who plan to keep Bitcoin for a longer period, commonly known as “steady investors,” are increasingly buying Bitcoin. This adds weight to the argument that Bitcoin’s price could rise in the future.

With increased purchases by confident investors, Bitcoin’s market becomes stronger, raising the possibility of a rising graph pattern.

Source; Bitcoin Magazine PRO

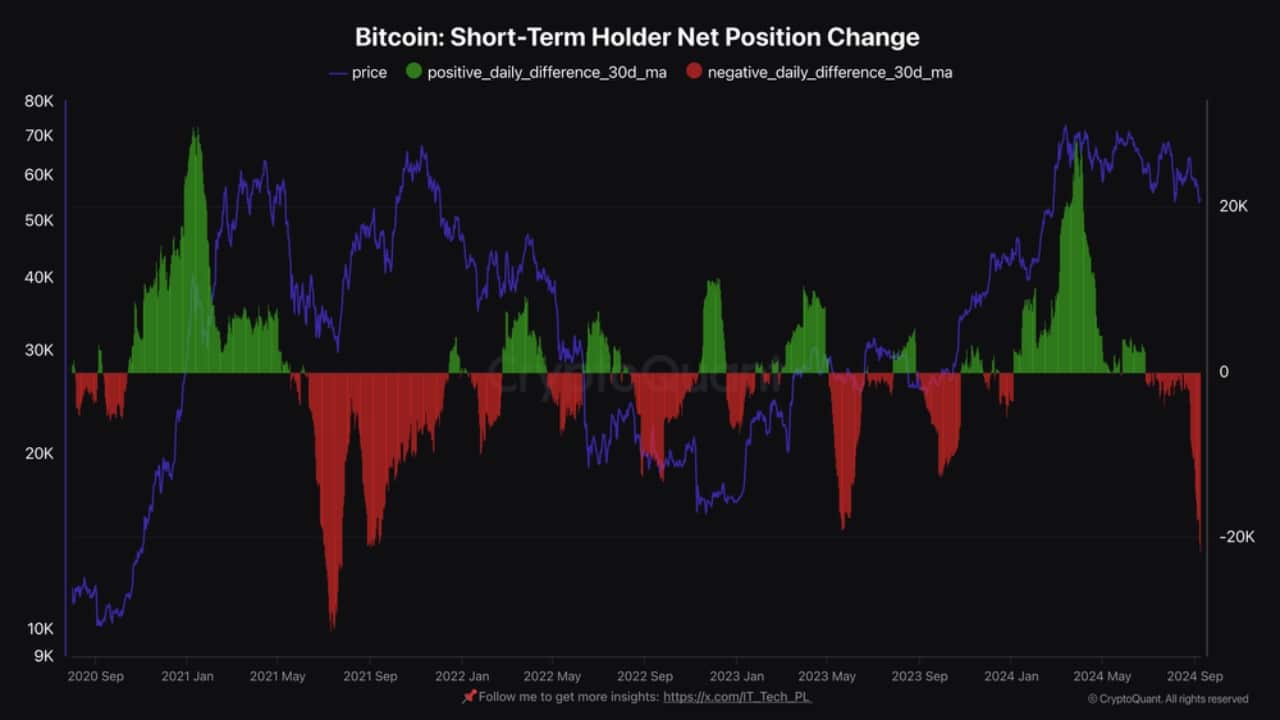

Bitcoin’s short-term holder net position change

In summary, it appears that a significant number of individuals who bought Bitcoin recently, driven by the fear of missing out (FOMO), have since decided to sell their holdings.

In many cases, this situation suggests a market collapse, which might indicate a low point. When short-term investors give up on Bitcoin (BTC), it frequently leads to an increase in its value.

To sum up, it seems that Bitcoin’s value might be ready to increase. Given its robust on-chain indicators and a pattern of upward movement in the past, Bitcoin may experience a substantial surge if worldwide market circumstances brighten and the Federal Reserve decides on a reduction in interest rates.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-14 08:08