- BTC has surged by 5.91% over the past month.

- Analyst finds 350k new addresses are critical for Bitcoin to see a sustained uptrend.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen Bitcoin [BTC] soar and plummet like a rollercoaster ride. The recent surge by 5.91% over the past month has certainly caught my attention, but I remain cautiously optimistic.

After reaching its lowest point at around $58,000, Bitcoin (BTC) has demonstrated a robust uptrend on monthly graphs, peaking at a new local high of approximately $69,000.

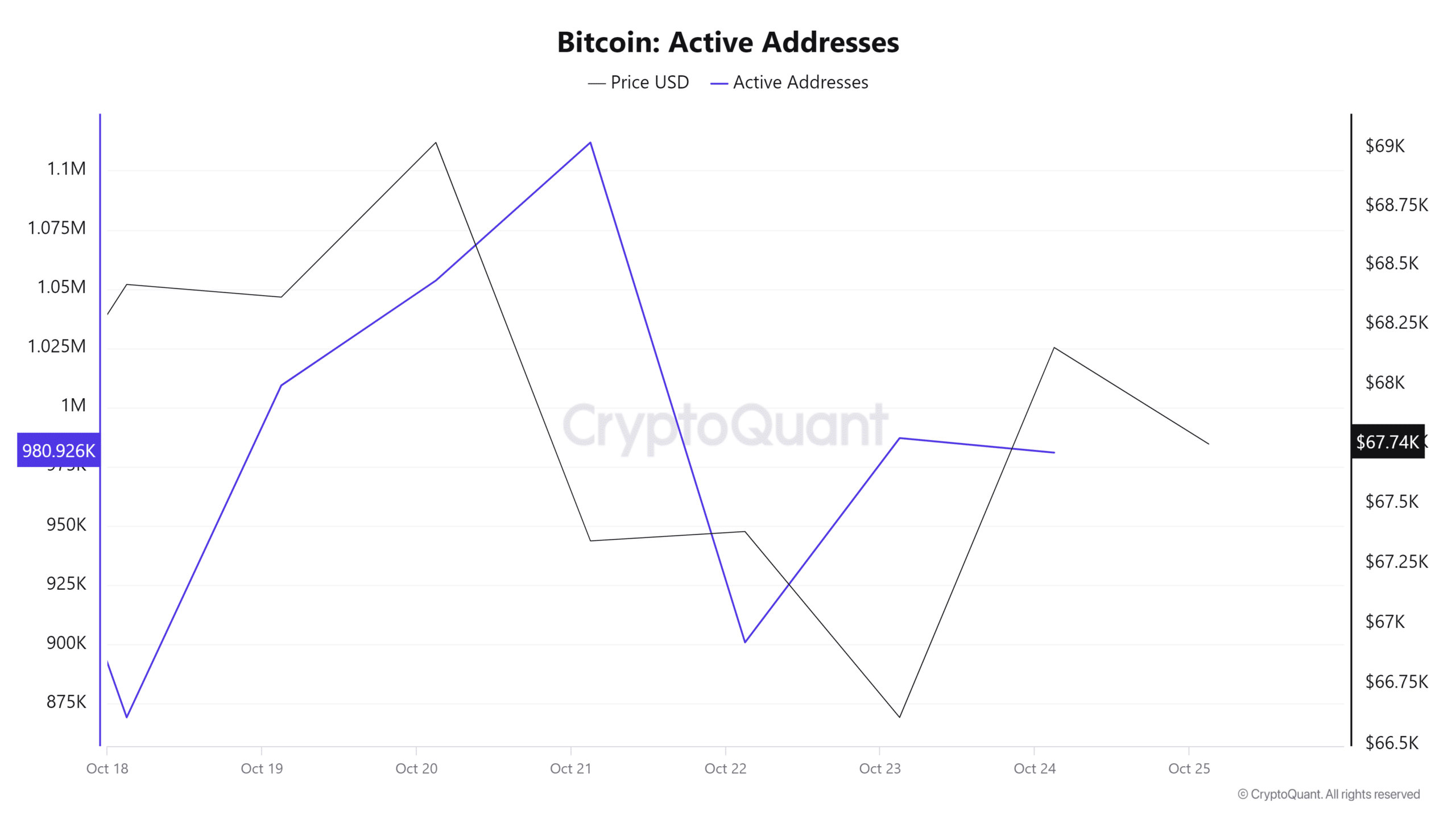

Nevertheless, the rise in Bitcoin’s performance, there’s been a significant decrease in the number of daily active addresses. In fact, these addresses dropped from a peak of 1.1 million to 980k. This decline in active addresses has sparked discussions among analysts.

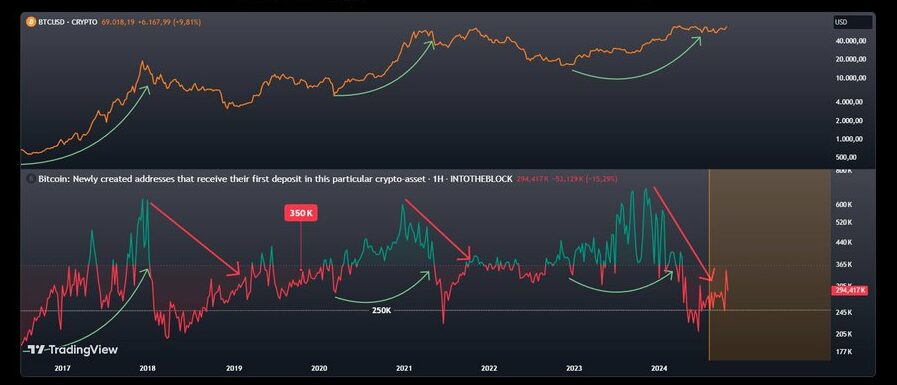

According to Burak Kesmeci, a crypto analyst at Cryptoquant, it’s essential for Bitcoin to maintain an upward trend for approximately 350,000 new user accounts or addresses to be created.

Why 350k addresses are critical

The analyst posited that new addresses are essential for Bitcoin bulls to gain market strength.

According to him, the market is healthy only if the number of new Bitcoin addresses increases.

As a cryptocurrency investor, I find that the 350k level serves as a critical turning point for the bulls and bears in our market. When the number of new addresses dips below this mark, it often signals a significant downward trend. This is because the bears, sensing an opportunity, seize control, effectively initiating what I call a “bearish season.

If prices continue to stay above this point, it suggests that the bulls are growing stronger and the upward trend is solid.

Historically, Bitcoin addresses have been instrumental in observing both periods of growth (bull markets) and decline (bear markets). To illustrate, during the last six years, there have been three instances where the number of Bitcoin addresses dropped below 250,000, which typically corresponds to a downturn in Bitcoin’s value.

2018 saw a significant fall from $19,000 to $6,000, followed by another drop in 2021 from $64,000 to $30,000, and yet another decline in 2024 from $73,000 to $49,000.

Consequently, when the number of new addresses exceeds 350,000, the market will be robust enough for investors. While there was a significant increase in new addresses in 2024, it did not surpass the 350k mark. As a result, the number dropped to 210K in June 2024 and then rose to 349K on October 14, 2024. However, it has since decreased again to 249k.

According to this analogy, the BTC market is not strong enough for a sustained rally.

What it means for BTC charts

Despite not yet surpassing 350,000 new Bitcoin wallets, the cryptocurrency is presently exhibiting a robust upward trend. Given this momentum, the general feeling among investors currently leans toward further increases in Bitcoin’s price.

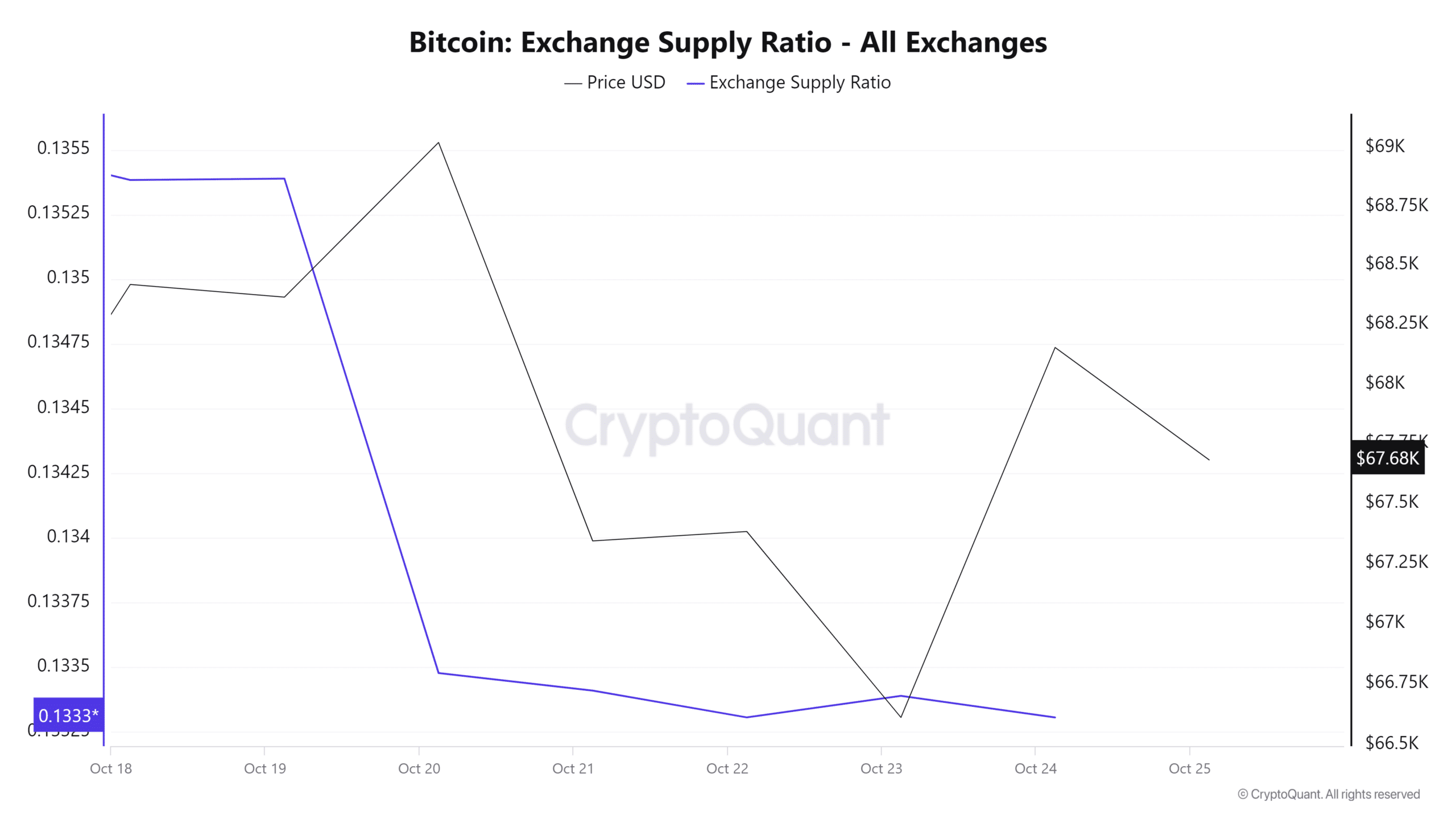

Over the last week, there’s been a significant drop in the exchange supply ratio. This implies that Bitcoin holders might be hoarding their cryptocurrency off exchanges, indicating they don’t plan on selling it anytime soon.

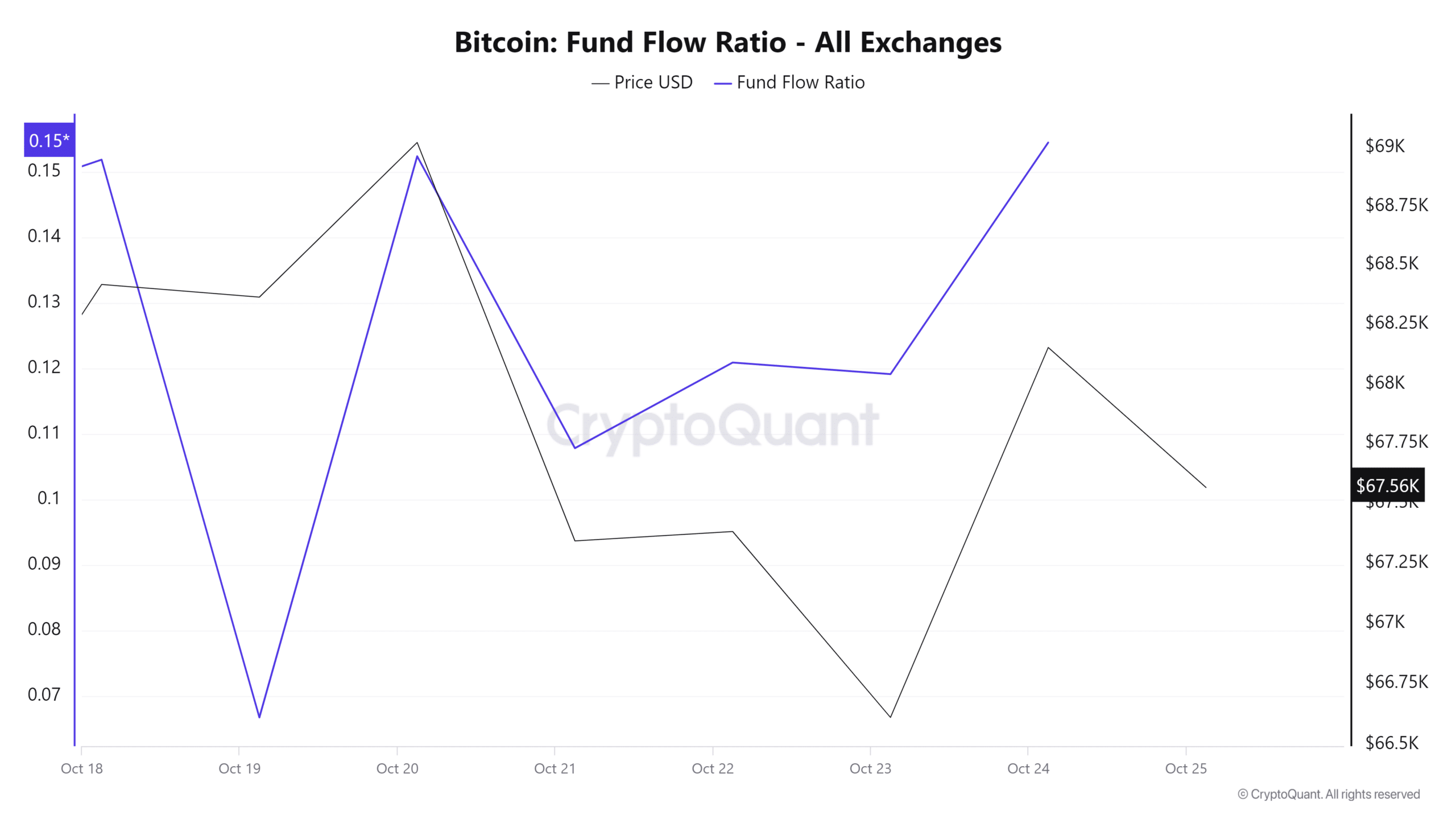

Furthermore, the Bitcoin Fund Flow Ratio has risen significantly in the last week, moving up from 0.06 to 0.15. This suggests that more individuals are purchasing Bitcoin, which is a clear indication of heightened demand and a positive outlook for the market.

Is your portfolio green? Check the Bitcoin Profit Calculator

Currently, Bitcoin is being traded for approximately $67,714. This represents a rise of 5.91% in its value over the course of the past month when viewed on a monthly chart.

Consequently, should the current market trend persist, BBC may encounter resistance at approximately $69,400, a level where it has been rejected on several occasions.

Read More

2024-10-25 16:08