- Bitcoin tested the $61K level twice in two weeks but failed to sustain a bullish trend.

- Analyst hints at a possible Bitcoin reversal.

As a seasoned researcher who has witnessed the crypto market’s ups and downs since its early days, I find myself cautiously optimistic about Bitcoin’s current position at $61K. The repeated tests of this level suggest a significant resistance, but the bulls are not yet ready to give up.

As a researcher observing the Bitcoin market, I’ve noticed that over the past fortnight, the $61K level has served as a significant support point twice. However, on both occasions, the buying pressure from the bulls seemed to wane, causing the price to retreat into another phase of consolidation instead of pushing through to higher levels.

On August 21st, the most recent effort was undertaken. This coincided with Bitcoin (BTC) experiencing an increase of 3.36%, concluding its day at $61,156.

Afterward, AMBCrypto examined if this signaled the beginning of a bullish recovery or if the bears would regain control yet again.

BTC volume indicators support the Fibonacci prediction

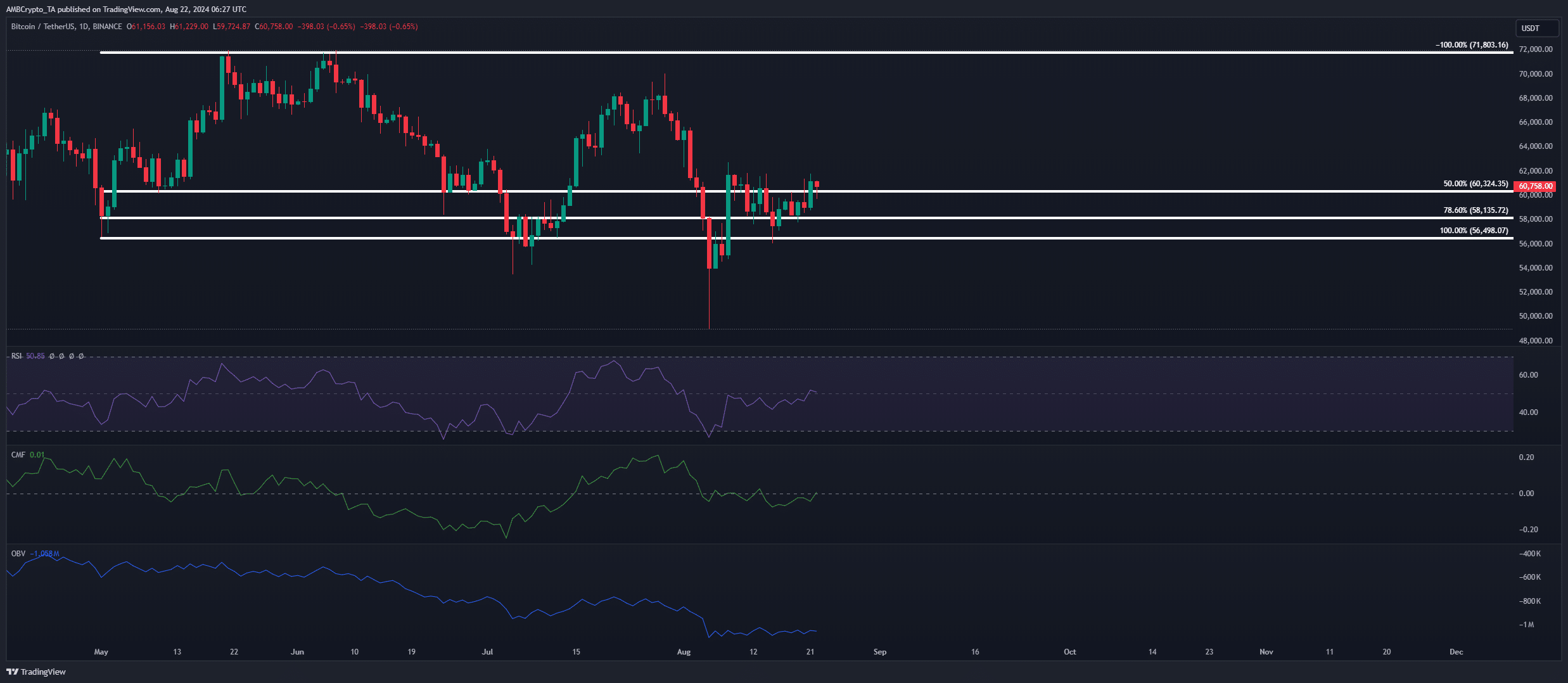

Source : BTC/USDT on Trading View

Over the day-to-day chart, the full Fibonacci retracement level of $56,500 has been probed on four occasions since May.

For the initial test, the market displayed a positive response, as Bitcoin surpassed the $70K resistance barrier within a span of twenty days.

After that, the bulls have been making efforts to maintain the same pace. Yet, a recent candlestick’s wick on the price graph touched the 50% Fibonacci level at $60,300, suggesting that the bears have effectively undermined the bullish optimism.

historically, this period holds significant importance for Bitcoin’s future development; it is here where market forces decide whether Bitcoin will trend upward (bullish) or downward (bearish).

Examining volume indicators has proven useful indeed. Starting from the 5th of August, the RSI (Relative Strength Index) and CMF (Chaikin Money Flow) on the daily chart suggested a gradual upward trend, indicating an increasing momentum. On the other hand, the OBV (On-Balance Volume) showed signs of consolidation.

In simpler terms, for bulls to follow Bitcoin’s path from early May, they need significant volume. Yet, having high volume alone isn’t sufficient; other factors are also important.

Long liquidations could sabotage BTC’s latest surge

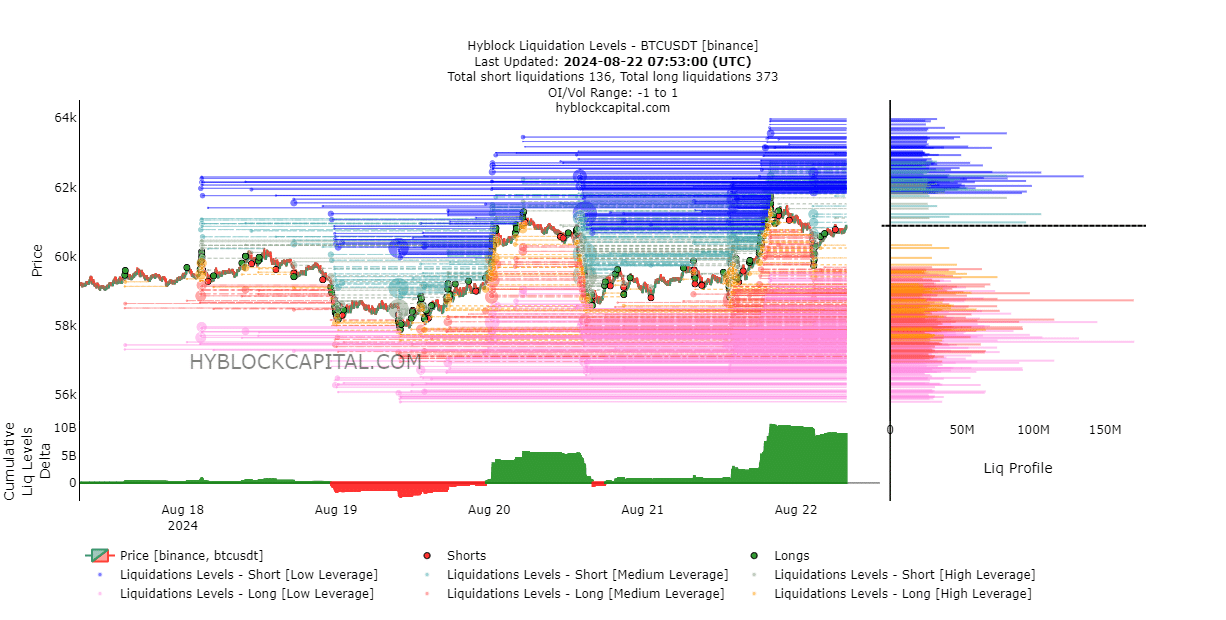

Source : Hyblockcapital

According to AMBCrypto’s examination, Bitcoin (BTC) climbed above the $61K barrier, fueled by a substantial accumulation of long positions, as underscored by the accumulated delta.

In a recent X post, renowned crypto analyst Axel Adler Jr. hinted at a possible Bitcoin reversal, suggesting that short liquidations could be the trigger, creating a perfect setup for a short squeeze.

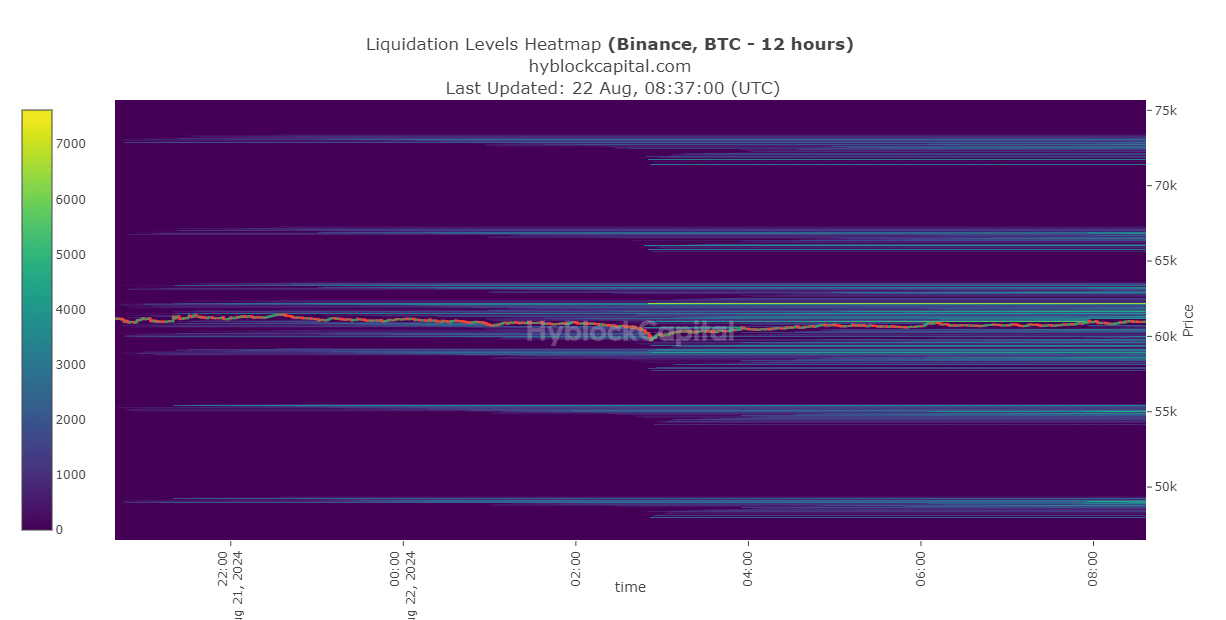

Source : Hyblockcapital

On the 12-hour lookback chart, a significant liquidity pool has formed around the $62,000 mark.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If short liquidity draws Bitcoin to this level, it could drive its price all the way to a new ATH.

On the other hand, it appears that such a result might be uncommon. As per AMBCrypto’s analysis, should short position holders regain dominance, Bitcoin may drop and trend towards the lower liquidity zone approximated at approximately $55K.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-22 19:36