- Bitcoin will hit a new ATH of $86600 if $67400 resistance is flipped.

- Bitcoin is showing a strong upward momentum with increased accumulation.

As a seasoned researcher with over a decade of experience in financial markets, I find myself intrigued by the bullish sentiments surrounding Bitcoin [BTC] and its potential to hit a new all-time high (ATH) of $86,600. The recent surge from $58k to $67k is undeniably impressive, with a 14.57% increase within just one week – a testament to the market’s renewed optimism for Uptober.

In the last seven days, Bitcoin [BTC] has seen a significant rise from its low of $58,000 to $67,000, marking an increase of approximately 14.57%.

This increase has renewed market enthusiasm for the much-anticipated October rise, leading many market participants, particularly analysts, to envision reaching a new all-time high.

Among these analysts, there’s a well-known cryptocurrency expert named Ali Martinez, who posited that the leading digital currency might soon reach its all-time high (ATH).

Bitcoin’s new ATH, when?

In his analysis, Martinez pointed out that BTC can reach a new high if it remains above $67400.

As he explains, if Bitcoin surpasses $67400, it could potentially reach its next nearby peak at approximately $86600. Under this scenario, we might expect a 28.49% increase in the cryptocurrency’s value.

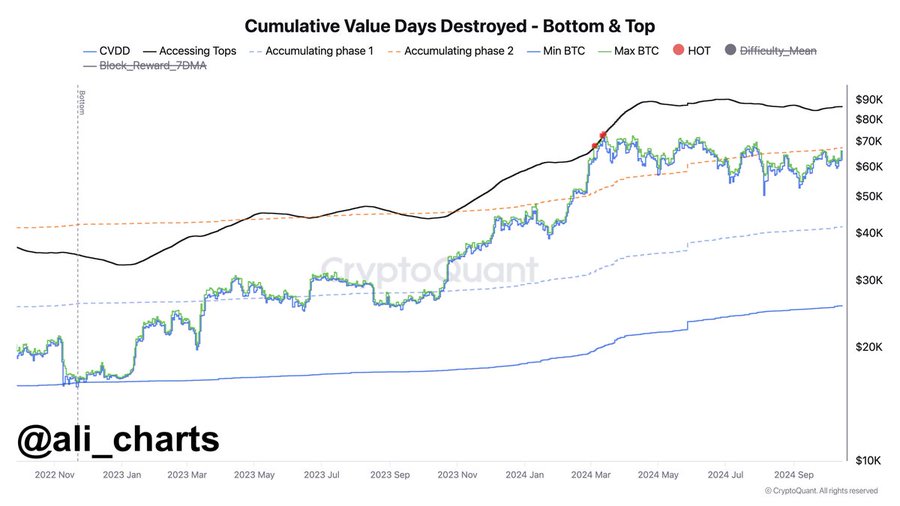

Back in early 2024, Bitcoin experienced a continuous growth phase that took its value from around $38,500 to a repeated all-time high of $73,794. This represented an impressive rise of approximately 91.65% over the period between January and March that year.

Therefore, compared with the previous cycle, the argument is quite plausible.

What Bitcoin’s charts says

While Martinez anticipates a rise towards a new peak, the query arises: Does the broader market’s underlying strength align with this prediction?

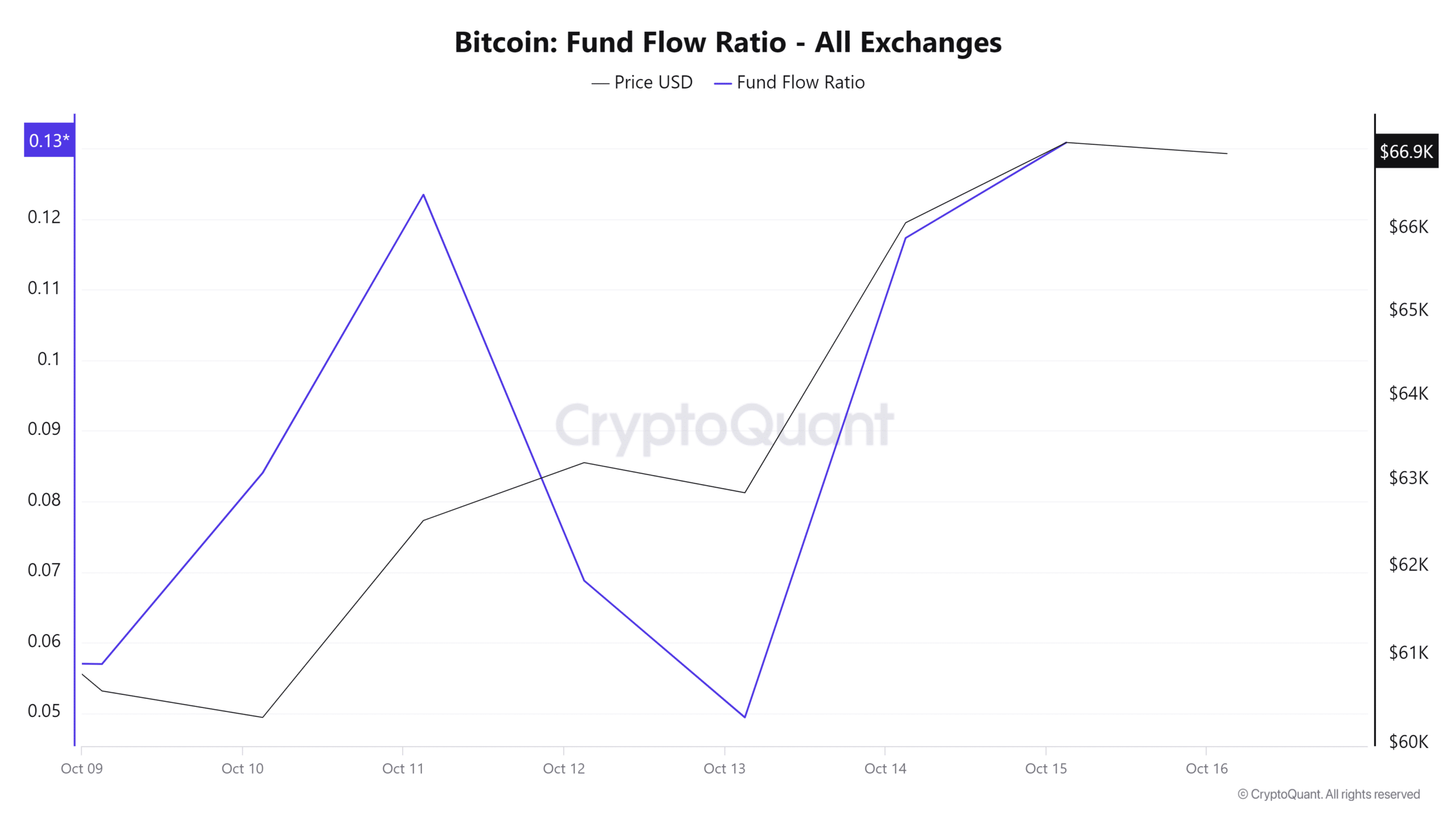

The first indicator to consider is the fund flow ratio, which measures the capital inflow into an asset. According to CryptoQuant, the Fund flow ratio has surged from a low of 0.04 to 0.13 at press time.

An increase in the Fund Flow Ratio indicates that there’s been an influx of funds into Bitcoin, which means that demand for purchasing it is growing, leading to increased buying pressure.

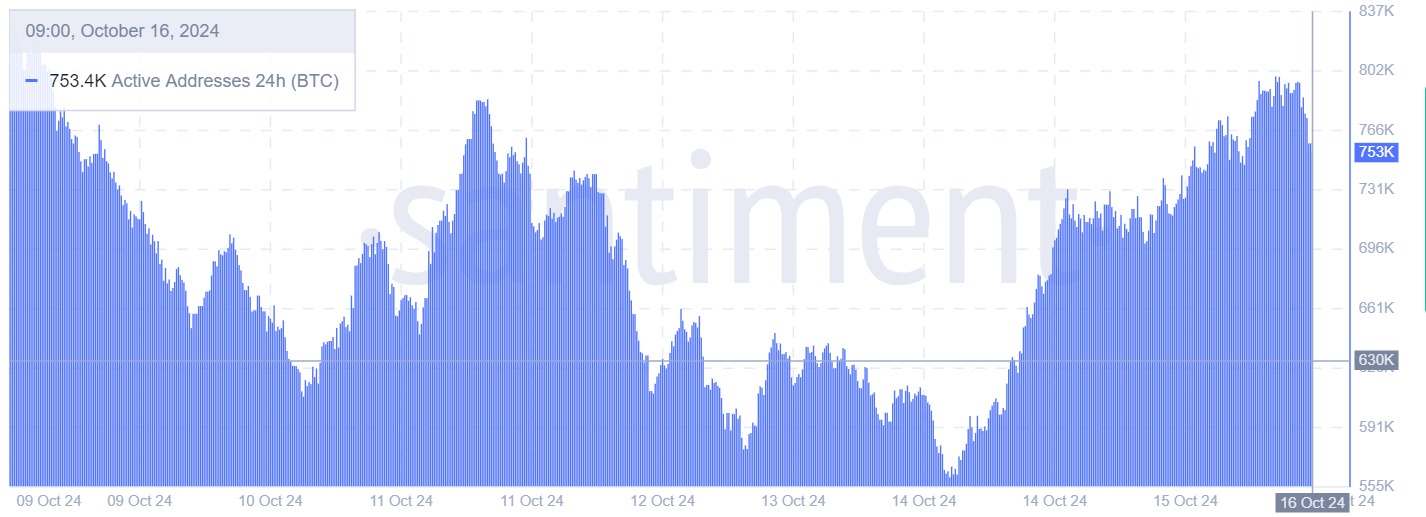

Over the past week, there has been a noticeable increase in the number of active Bitcoin addresses, climbing from approximately 567,900 to about 753,000 as we speak.

Engaging more with the network suggests a solid foundation for the current upward trend, rather than it being driven solely by market speculation.

What’s next for BTC?

At the moment, Bitcoin (BTC) is being traded for approximately $67,548. As you can see, it appears that Bitcoin is experiencing a robust uptrend and favorable market feeling at this time.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a crypto investor, I’m keeping a close eye on the market trends. If the current conditions persist, I believe we might witness another attempt to breach the $70,000 resistance level. This is a price point where the crypto has encountered several setbacks in the past.

A significant surge from the current position could potentially push Bitcoin to a fresh all-time high (ATH). In order for this to happen, Bitcoin needs to exceed the $70,000 mark initially.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-16 21:11