-

There’s increasing analysts’ consensus that BTC’s recovery could extend to $70K.

However, the recent BTC bounce was preceded by over-leverage–a potential price risk.

As a seasoned crypto investor with years of experience navigating the volatile and unpredictable world of digital assets, I find myself cautiously optimistic about Bitcoin’s potential recovery to $70K. Having witnessed multiple bull and bear cycles, I can attest that this market is never short of surprises.

As reported by Glassnode’s co-founders Jan Happel and Yann Allemann (also known as Negentropic on X), Bitcoin [BTC] appeared poised for a potential retest of the price level at around $70,000. They cautioned that traders attempting to short the crypto at prices near $68,000 or $69,000 could face significant losses and be forced to exit their positions.

Those who are keeping a close watch on Bitcoin’s prolonged compression phase may see their positions closed out if the price exceeds the $68,000 to $69,000 mark.

In simpler terms, the compressed transmission pathway formed part of the “megaphone” structure that had been drawn up for Bitcoin (BTC), as it moved into a period of consolidation after reaching its highest point in March.

Why BTC could rally to $70K

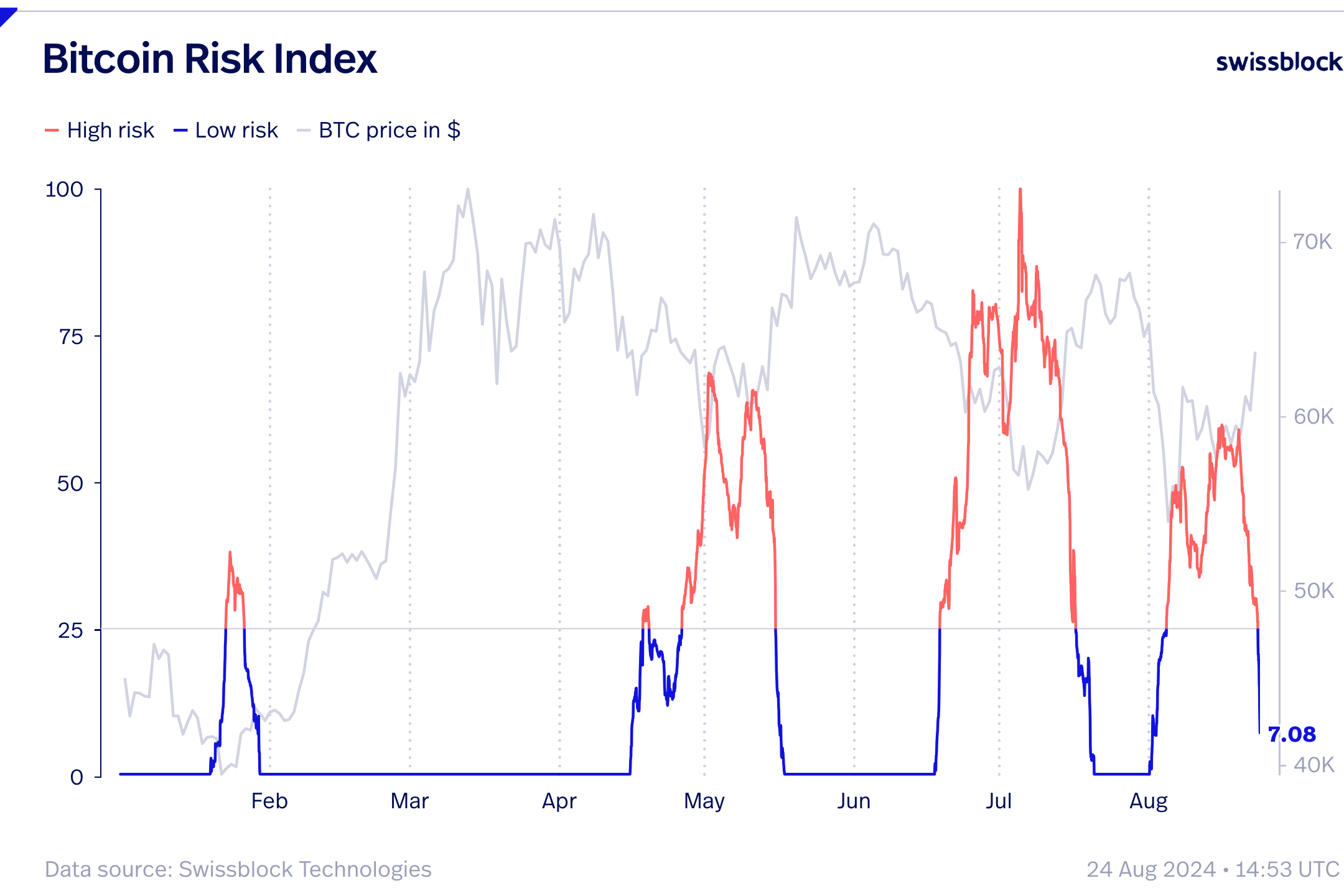

Based on the analysis by the founders of Glassnode via their cryptocurrency insights platform Swissblock, Bitcoin (BTC) might reach $70,000 due to reduced risk factors and increased activity on the network.

The founders also noted that BTC’s rally to $64K flipped the asset’s risk profile from high to low.

As I’ve observed, it appears that the market recovery in May, June, and July occurred following periods where the asset demonstrated a low-risk profile. If this pattern holds true, we could potentially see a repetition, which might push the cryptocurrency towards a new high of $70K.

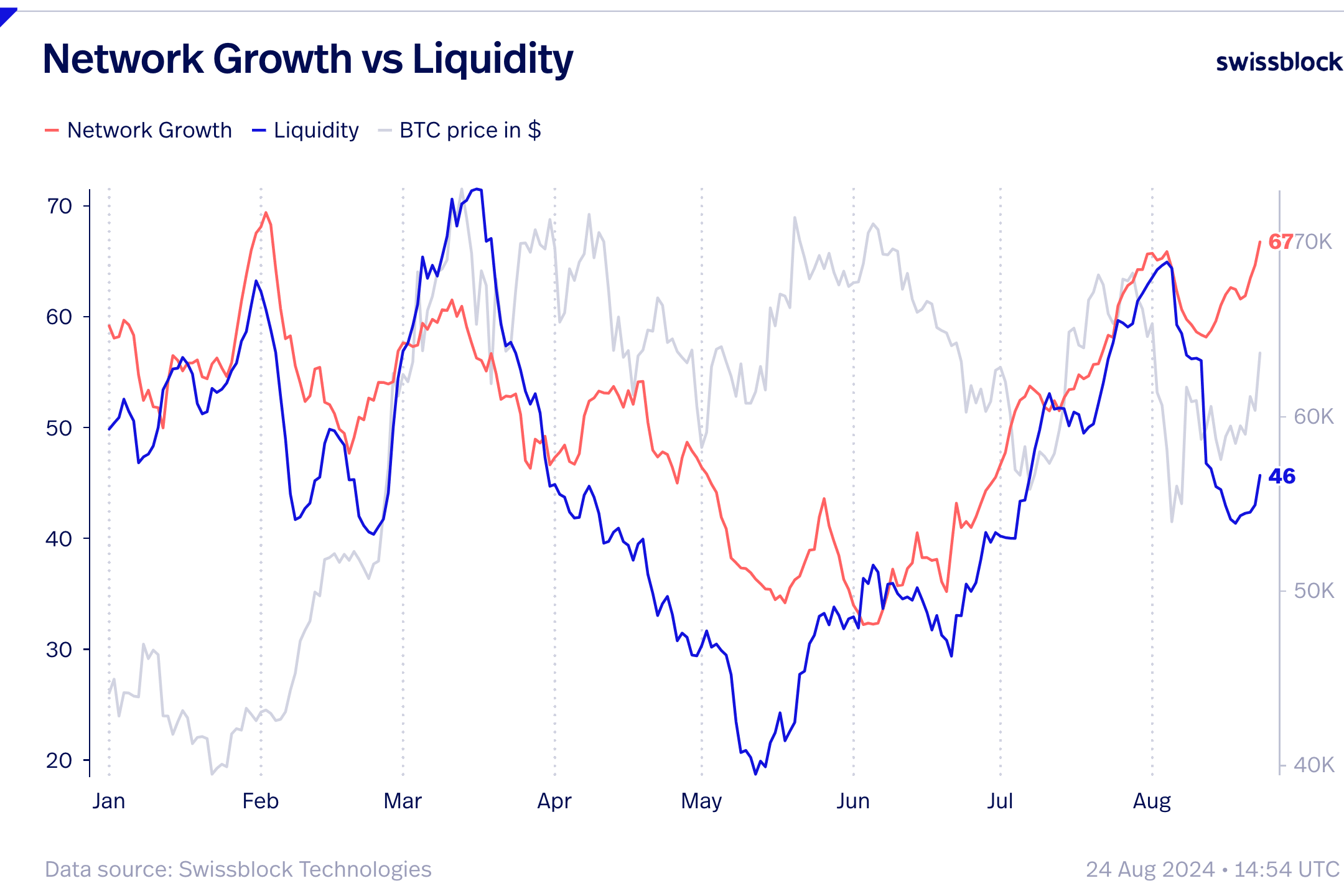

Furthermore, Swissblock highlighted accelerated expansion within the Bitcoin network as potential evidence supporting its continued upward trajectory.

As a researcher, I’m observing an intriguing trend in the network growth. Not only is it climbing steadily again, reminiscent of its trajectory in July, but it has also surpassed those previous highs. Moreover, this resurgence seems to have overturned the downward trend that emerged following the halving event.

Network liquidity lagged growth, but the analytic platform highlighted signs of slow improvement that could boost BTC.

Additionally, the persistently low funding rates for Bitcoin perpetual contracts, as suggested by Swissblock, might contribute to a faster market recovery.

In simpler terms, the prices at which these long-term future contracts are funded have stayed below zero and have actually grown larger since our last check. This is quite unexpected during a period of optimism, as it’s usually the opposite. If these contracts get liquidated, it could potentially lead to an even more significant price surge.

The lower Bitcoin funding rates can be attributed to the prevalence of US spot Bitcoin ETFs, as these have a more significant influence on pricing compared to derivative markets.

As an analyst, I hypothesize that the recent Bitcoin staking activities on the Babylon platform may have contributed to the observed negative funding rates.

Recently, VanEck has expressed a comparable optimistic viewpoint about Bitcoin’s recovery, pointing out that the risk appetite for Bitcoin during this market recovery appears to mirror past instances of recovery.

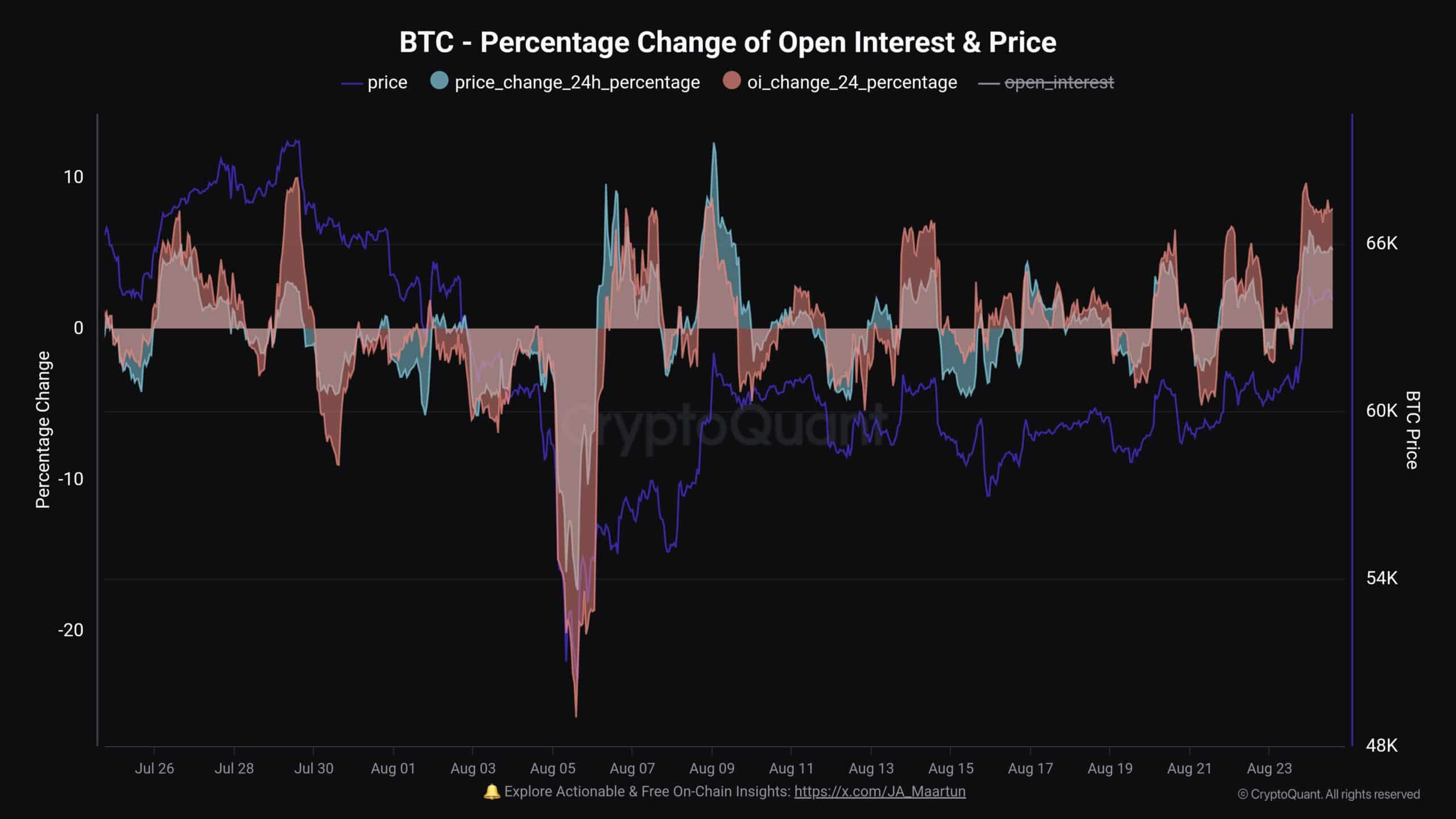

Yet, a CryptoQuant analyst has raised concern that high Open Interest rates might be fueling Bitcoin’s price, potentially leading to a price correction similar to historical patterns if the over-leveraging persists.

Let’s try this setup once more: The rise in Open Interest surpassed that of Bitcoin prices. In the past two instances, a swift profit followed.

Read More

2024-08-26 02:16