-

The latest market fall was not due to Mt. Gox, but because of the market sentiment following ETF approval.

Traders are using excessive leverage to buy the dip, with a $30 million liquidation pool if BTC falls below the $63,800 level.

As a seasoned cryptocurrency market analyst with over a decade of experience, I have witnessed numerous market fluctuations and have developed a keen sense for deciphering trends and patterns. Based on my analysis of recent events, I believe that the latest market fall was not instigated by Mt. Gox but rather due to the market sentiment following the approval of the Bitcoin spot ETF.

On July 25th, between Asian business hours, the entire cryptocurrency market underwent a substantial drop. The leading digital currency, Bitcoin [BTC], dipped beneath the $64,000 threshold.

Crypto traders seem to be buying the BTC dip

In the midst of intense selling activity sweeping through the financial markets, a cryptocurrency expert recently shared on platform X (formerly known as Twitter), that speculative traders, or “degens,” are aggressively employing high levels of borrowed funds to purchase discounted Bitcoins.

Based on the article on X, these traders have amassed a significant liquidation pool worth $30 million around the $63,800 mark for Bitcoin. In other words, if the Bitcoin price falls below $63,800, this $30 million pool will be automatically sold off.

As a researcher examining the Bitcoin market, I’ve observed that not only traders but also major Bitcoin holders, referred to as “whales,” have shown an interest in purchasing during price dips. A notable instance of this occurred recently when an on-chain analysis firm, Lookonchain, reported that a savvy whale had acquired 244 Bitcoins, equivalent to approximately $16 million.

Based on my extensive knowledge and expertise in the field of cryptocurrencies, I can tell you that this particular whale has made a significant investment in Bitcoin (BTC). To be more precise, they have added a grand total of 921 Bitcoins to their holdings. With the current market value, these Bitcoins are worth approximately $60.6 million. This is an impressive sum, and it goes to show the potential wealth that can be amassed through smart investments in this burgeoning industry. I have seen many individuals make their fortunes by following the trends and making strategic purchases at the right time, and this whale seems to be one of them. The average price of these Bitcoins was $65,821, which further underscores the potential for high returns in this market. It’s truly fascinating to witness such transactions and the impact they can have on individuals’ financial situations.

As an on-chain analyst, I’ve observed a noteworthy development: Despite Bitcoin’s dip of over 3.4% within the past 24 hours, posts by fellow analysts and my firm indicate a growing confidence among investors and traders in the cryptocurrency.

Analysts on recent market decline

After Mt. Gox creditors’ repayments were completed in all time zones, according to Ki Young Ju, the CEO and Founder of CryptoQuant, Kraken’s Bitcoin trading volume and exchange flows have returned to normal.

Young Ju also mentioned that any price decreases in the market would be caused by market sentiment rather than being attributed to Mt. Gox itself.

The CEO’s post indicates that the current market downturn can be attributed mainly to the prevailing market sentiment and the persistent selling of Bitcoin (BTC) and Ethereum (ETH) by large investors, following the approval of a spot Ethereum Exchange-Traded Fund (ETF).

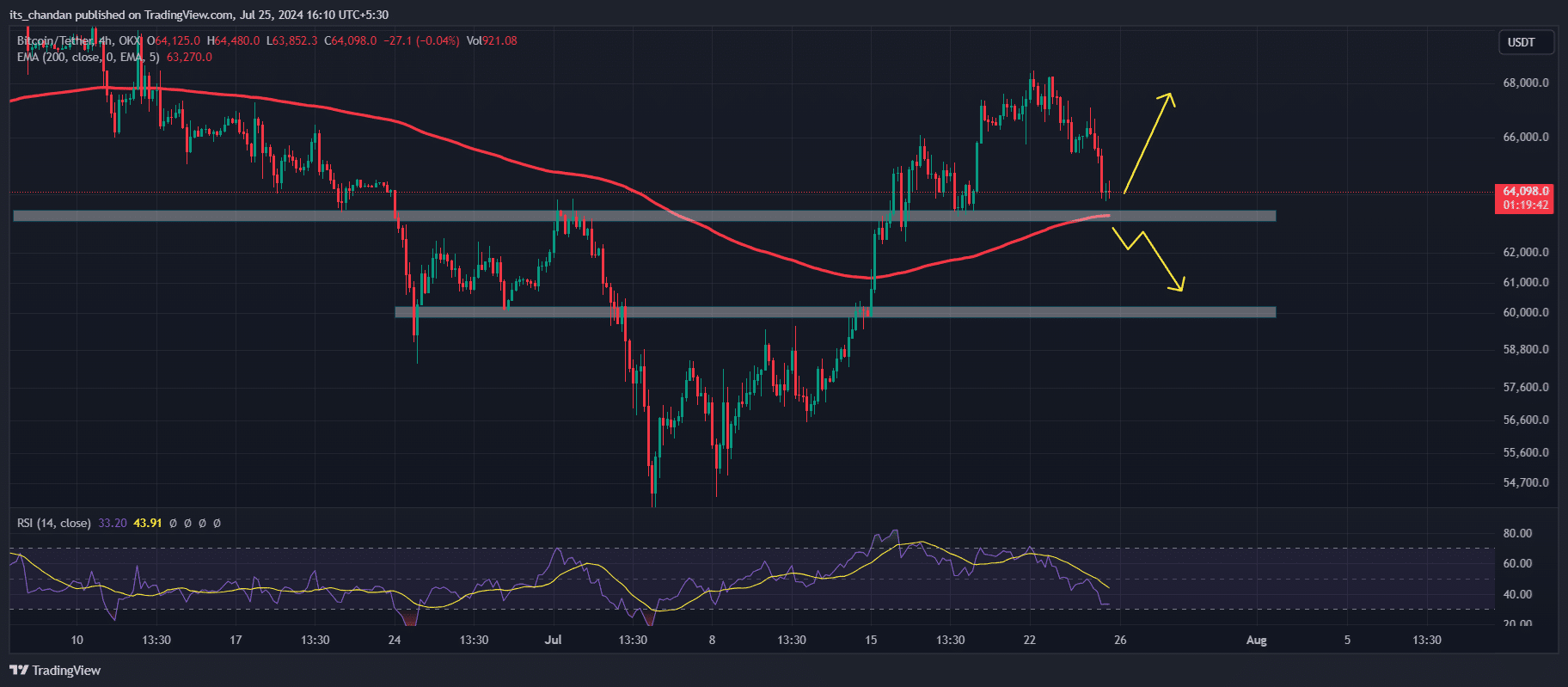

Bitcoin technical analysis and upcoming levels

An alternate crypto analyst has shared their perspective, pointing out that based on the technical indicators, there’s a possibility for Bitcoin (BTC) to bounce back. This assessment is supported by a buy signal appearing on the hourly chart.

Based on the technical assessment of industry experts, Bitcoin’s bullish trend persists, with a crucial support at $63,350. Moreover, the cryptocurrency continues to surpass the 4-hour 200 Exponential Moving Average (EMA) mark.

The BTC price above the 200 EMA signals bullishness on the chart.

As a market analyst, I often employ various technical indicators to assess market trends and potential price movements. One such tool is the Relative Strength Index (RSI), which currently indicates an oversold condition. This signifies that the security’s recent price declines have been more pronounced than typical for its historical price action. Consequently, an RSI reading in the oversold zone may foreshadow a potential price recovery.

Based on current market trends, if Bitcoin (BTC) continues to exhibit negative sentiment and can’t maintain its position above the 200 Exponential Moving Average (EMA) and the $63,350 mark, a significant price drop could occur. The value of BTC might then decrease to around $60,300.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying Bitcoin’s price movements, I would express that level of $60,300 could be the next line of defense for the cryptocurrency should it fail to maintain its position above the current price of $63,350.

At present, Bitcoin is approximating the $64,200 mark in current market transactions, representing a 3.4% decrease in value over the past 24 hours. The cryptocurrency dipped as low as $63,770 during this period. Furthermore, there has been a notable surge of 10% in trading volume, indicating heightened involvement from both investors and traders.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-26 07:04