- Bitcoin poised to retrace to $66K before a bounce.

- Global liquidity to potentially continue rising up to 2026.

As a seasoned analyst with over a decade of experience in financial markets, I find myself drawn to the intriguing dynamics unfolding in the Bitcoin market right now. The price action suggests that we might be looking at a retracement towards the $66K range before another potential surge. This is not uncommon in such volatile markets – it’s like watching a rollercoaster ride, albeit with much higher stakes!

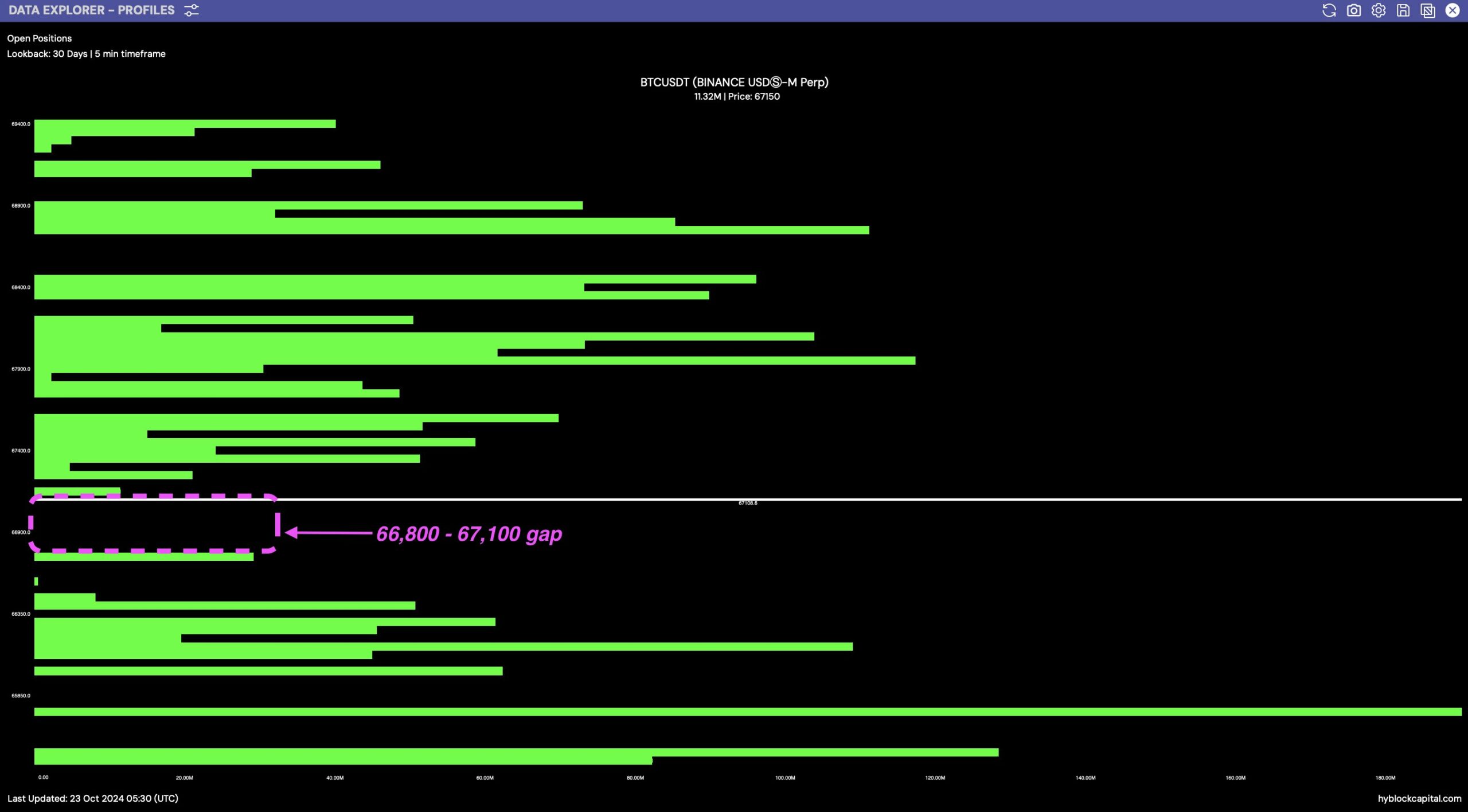

At the moment of reporting, Bitcoin [BTC] was moving within a crucial price band, and investors were eagerly waiting for its next action. On Bitcoin’s graph, the region between $66,800 and $67,100 shows less activity, suggesting a potential price difference.

Historically, price tends to gravitate toward such gaps to fill them before continuing a trend.

The future trajectory of Bitcoin relies on its ability to bridge this gap, either by climbing upwards or pulling back to accumulate more resources (liquidity).

BTC heading towards a gap

The price movement of Bitcoin indicates a minor adjustment following its surge past the $70K mark, which marks a significant achievement in the world of cryptocurrencies.

The rebound hints that Bitcoin might be building strength for another price surge. However, before this happens, it could possibly revisit the $66,800 to $67,100 range to fill an existing gap.

In simpler terms, this area is located beneath a significant double bottom structure in the Bitcoin to Tether (BTC/USDT) pair’s 6-hour chart. This pattern suggests that there could be a strong possibility of an increase once the current void is filled.

The weekly chart remains bullish, with the structure broken to the upside, indicating strong market support.

Many traders are closely monitoring Bitcoin’s current price fluctuations, as they anticipate it may stabilize around the $70,000 – $71,000 range. If this holds, it could initiate further exploration of unprecedented prices and potentially reach a new record high.

In simpler terms, bridging the void in pricing here might function as a ‘liquidity catch’, enabling Bitcoin to accumulate power and then make a significant upward leap.

Reaching and surpassing $70K could mark the beginning of a fresh bull run, suggesting that Bitcoin might be venturing into unexplored price realms.

Profitability and global M2 supply

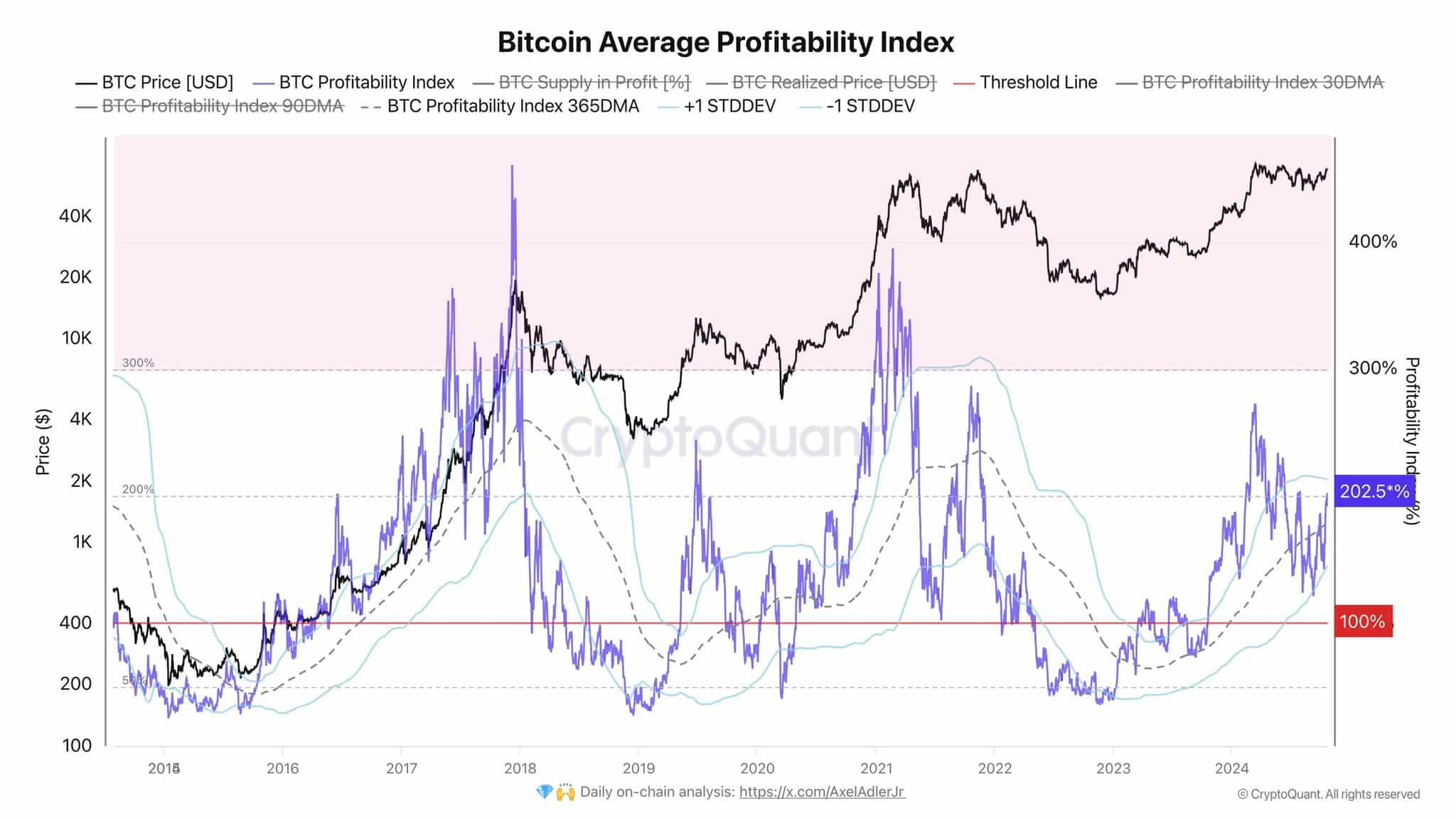

The Bitcoin Average Profitability Index reinforces this perspective, as it’s currently at 202%. This indicates that the current price of Bitcoin is over twice its actual price.

Typically, investors cash out their gains when this index surpasses 300%, indicating a potential slowdown. However, presently, its level indicates that the market isn’t heavily engaged in profit-taking just yet.

After bridging the price gap, Bitcoin might carry on rising further along its positive trend, as long-term investors remain hopeful of even greater value increases.

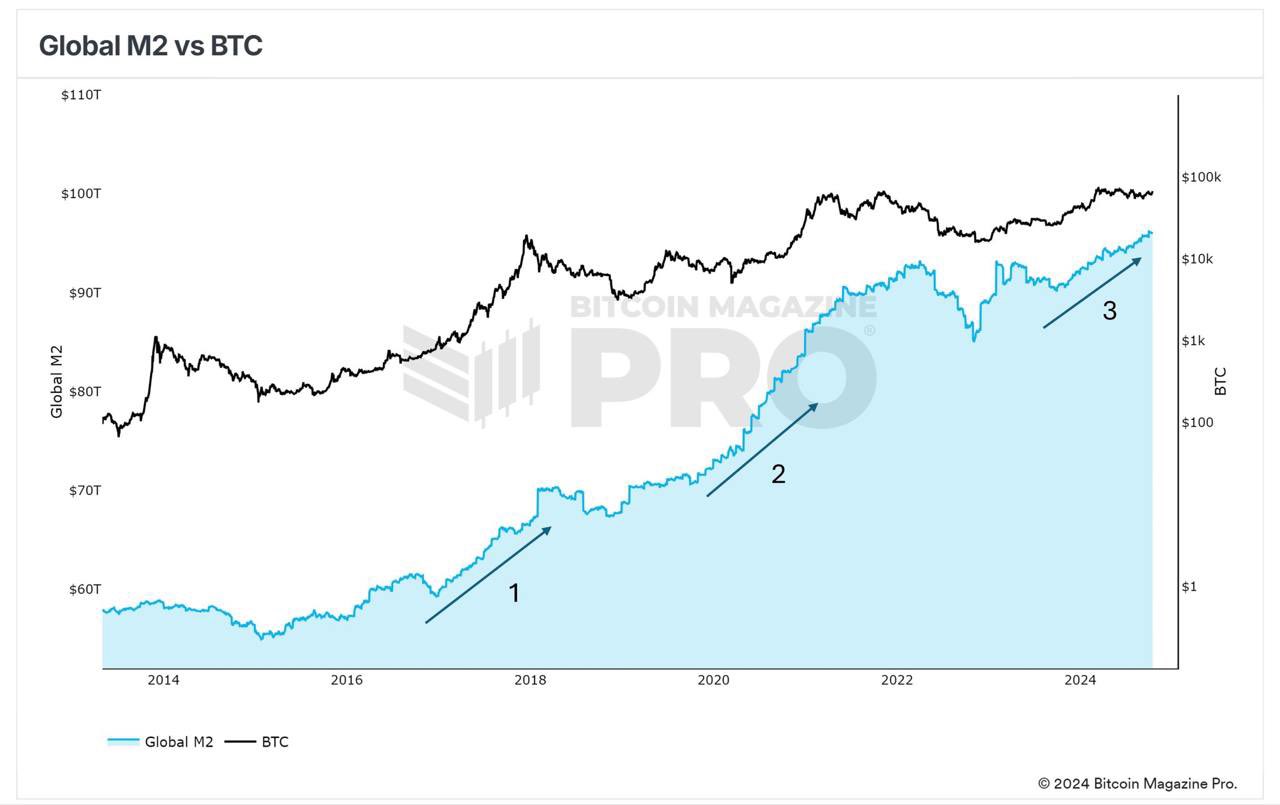

Beyond these measures, the worldwide M2 money supply statistics also provide valuable perspectives on Bitcoin’s wider possibilities.

In past periods of rising Bitcoin prices, like during 2016-2017, an increase in the M2 money supply also occurred.

In 2021, a comparable growth spurt took place, however, external influences such as the downfall of FTX and increasing interest rates slowed Bitcoin’s progression.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-23 22:15