-

There have been significant fluctuations in Bitcoin’s long-term holders’ profits.

BTC has remained at the $57,000 price level.

As a seasoned crypto investor with a knack for spotting trends and capitalizing on them, I find myself intrigued by the current state of Bitcoin (BTC). The fluctuations in long-term holder profits have created an interesting scenario: potential accumulation opportunities for those who can read the market right.

Presently, those who have held Bitcoin (BTC) for a long time find themselves in a tricky situation. Yet, this predicament might offer a substantial chance for potential investors to amass more Bitcoin.

Bitcoin SOPR hit low points

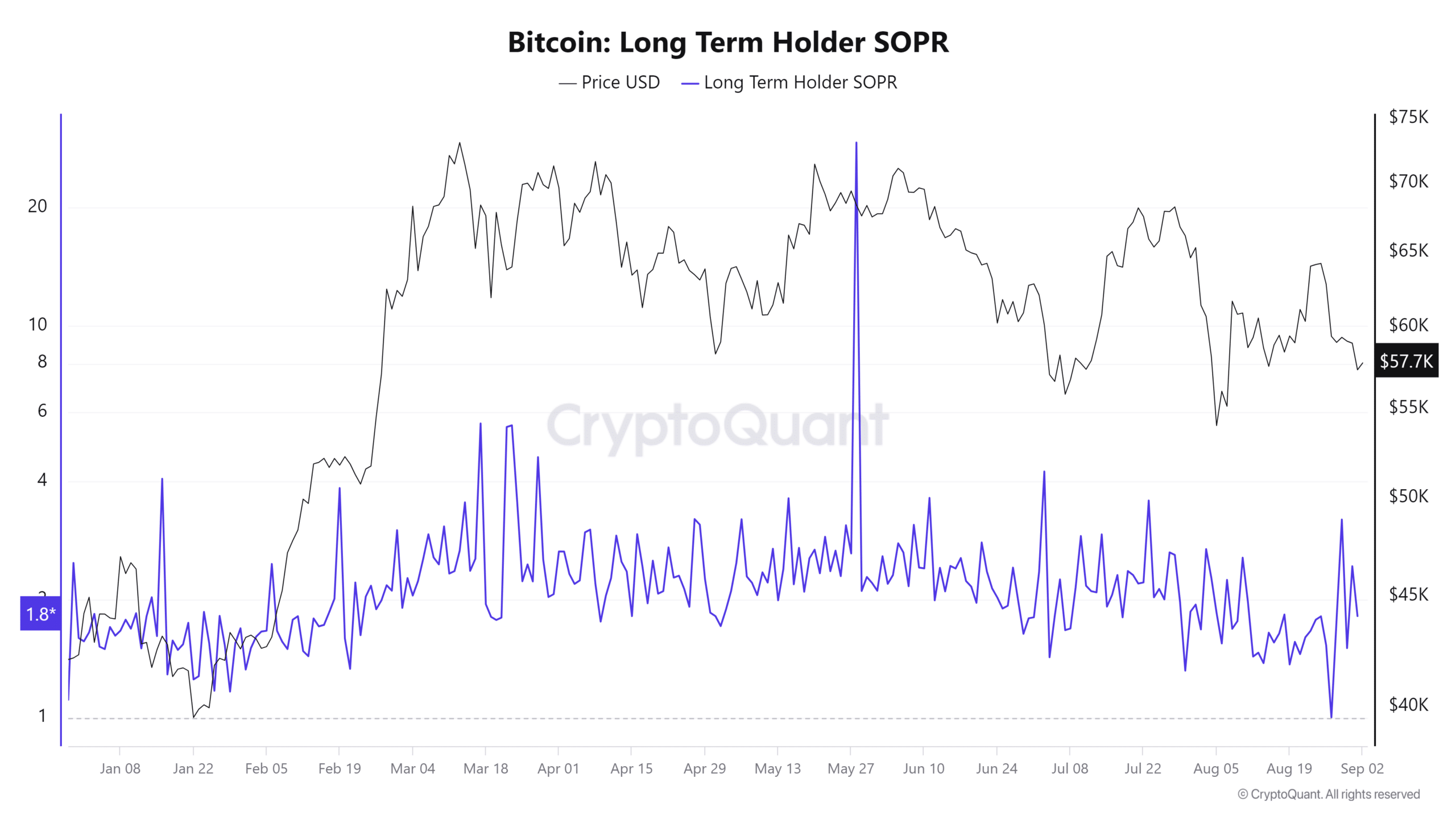

As a researcher, I recently delved into an analysis of the Long-Term Holder Spent Output Profit Ratio (SOPR) on CryptoQuant, and my findings suggest that Bitcoin’s current price hovers around $57.7K at this moment. Notably, the LTH SOPR indicates relatively low values in our study.

A notably low Long-Term Holder SOPR suggests that these owners aren’t cashing out on sizeable profits when they decide to sell their assets.

Instead, they could choose to sell off their investments because they worry about potential drops in prices or as a reaction to market instability.

Should this pattern persist and additional long-term investors opt for selling, it might exert additional force pushing Bitcoin’s value lower.

The SOPR (Spent Output Profit Ratio) is key for understanding the profitability of Bitcoin sales. Specifically, the LTH SOPR focuses on coins held for an extended period, typically more than 155 days.

A SOPR value above one indicates that long-term holders are selling at a profit. In contrast, a value below one suggests selling at a loss.

A low SOPR (Spent Output Profit Ratio) among long-term holders suggests they’re not taking advantage of substantial profits, potentially indicating they’re selling because of apprehensions regarding the immediate future of the market.

This might indicate a bearish sign, hinting that these owners are currently unsure about the short-term movement in its price.

What this means for Bitcoin

A low Long-Term Holder SOPR suggests that long-term Bitcoin owners are not cashing out substantial gains and might be selling off some of their holdings.

If this ongoing pattern continues, the Long-Term Holder Spent Output Profit Ratio (LTH SOPR) staying close to or below 1 might result in additional pressure on Bitcoin’s price to decrease. This situation could indicate a prolonged phase of further drops as the market adjusts to these transactions.

On the other hand, this situation could offer an amassing chance for investors aiming to get into the market at reduced costs.

Historically, when the SOPR (Spent Output Profit Ratio) stays low, there have been instances where the market has experienced recovery. This is because investors often seize the opportunity to buy Bitcoin at lower prices and stock up more during such periods.

A recent example of this type of accumulation is observed in the actions of a whale address.

According to data from Spot on Chain, it appears a whale recently bought 1,000 Bitcoins, which were equivalent to around $57 million when the price of Bitcoin reached its lowest point.

Furthermore, it’s said that the same whale had previously transferred about 7,790 BTC, which was worth around $467 million, into their wallet when the Bitcoin price fell roughly 14% a few months ago.

The current state of BTC

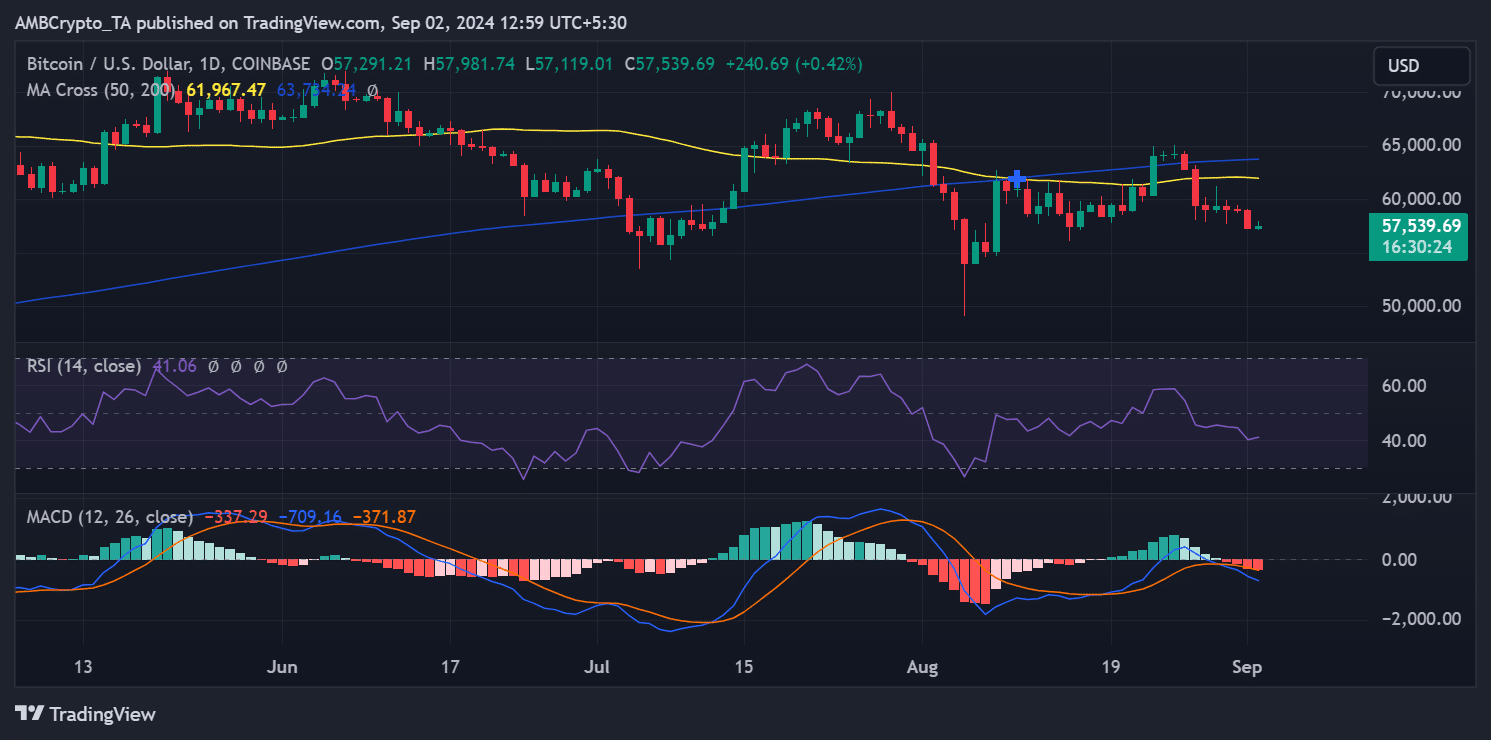

According to AMBCrypto’s analysis, Bitcoin saw a drop of almost 3% during its most recent trading day.

Read Bitcoin’s [BTC] Price prediction 2024-25

During that particular trading session, the price of Bitcoin dipped from about $59,000 down to roughly $57,299. At the moment I’m speaking, the cryptocurrency was being exchanged at around $57,500 – a minor uptick of less than 1%.

The analysis of the graph clearly indicated that due to the placement of the moving averages, Bitcoin appeared to be following a downtrend or bear market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-02 14:16