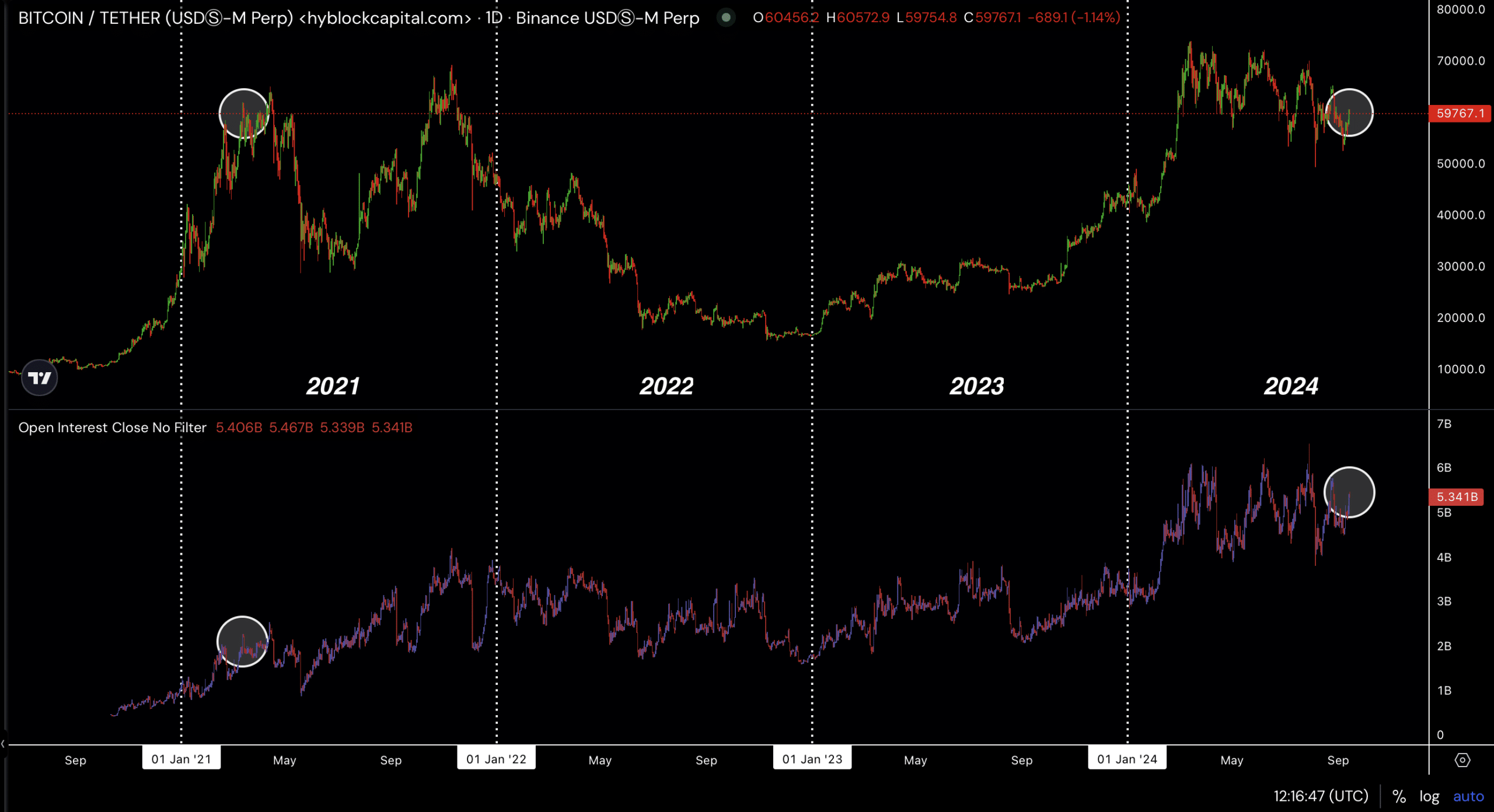

- Bitcoin open interests higher than in 2021.

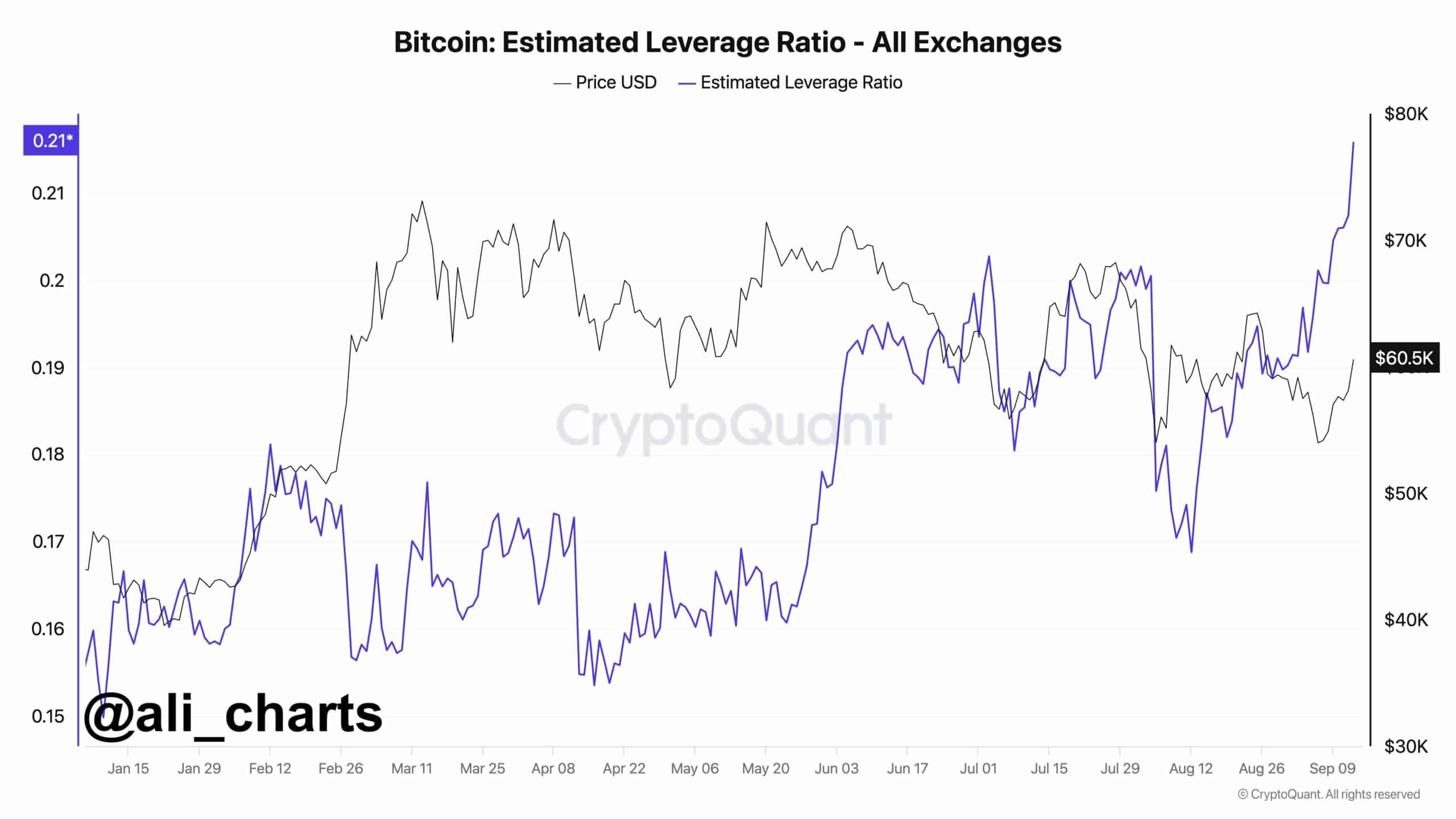

- Estimated leverage ratio across exchanges reaches a new yearly high.

As a seasoned researcher with a background in financial markets and cryptocurrencies, I find myself intrigued by the current state of Bitcoin and the broader crypto market. The higher open interests and the surge in estimated leverage ratios across exchanges are reminiscent of pre-bull run conditions, hinting at potential growth if market conditions improve.

Over the past five months, Bitcoin (BTC) and the wider cryptocurrency market have been on a rebound after experiencing a prolonged downturn, which concluded in March, marking the end of the previous cycle.

Even though there seems to be less enthusiasm for the entire cryptocurrency market compared to past market fluctuations, the current prices bear a striking resemblance to those seen in 2021. During that time, the market underwent a substantial decline before bouncing back.

In simpler terms, there are more ongoing Bitcoin (BTC) contracts available now compared to last year, suggesting that the price might increase if market circumstances get better.

Even though Bitcoin has already experienced a dip, it’s uncertain if it can match its impressive performance from Q4 2021 by having another significant increase towards the end of 2024.

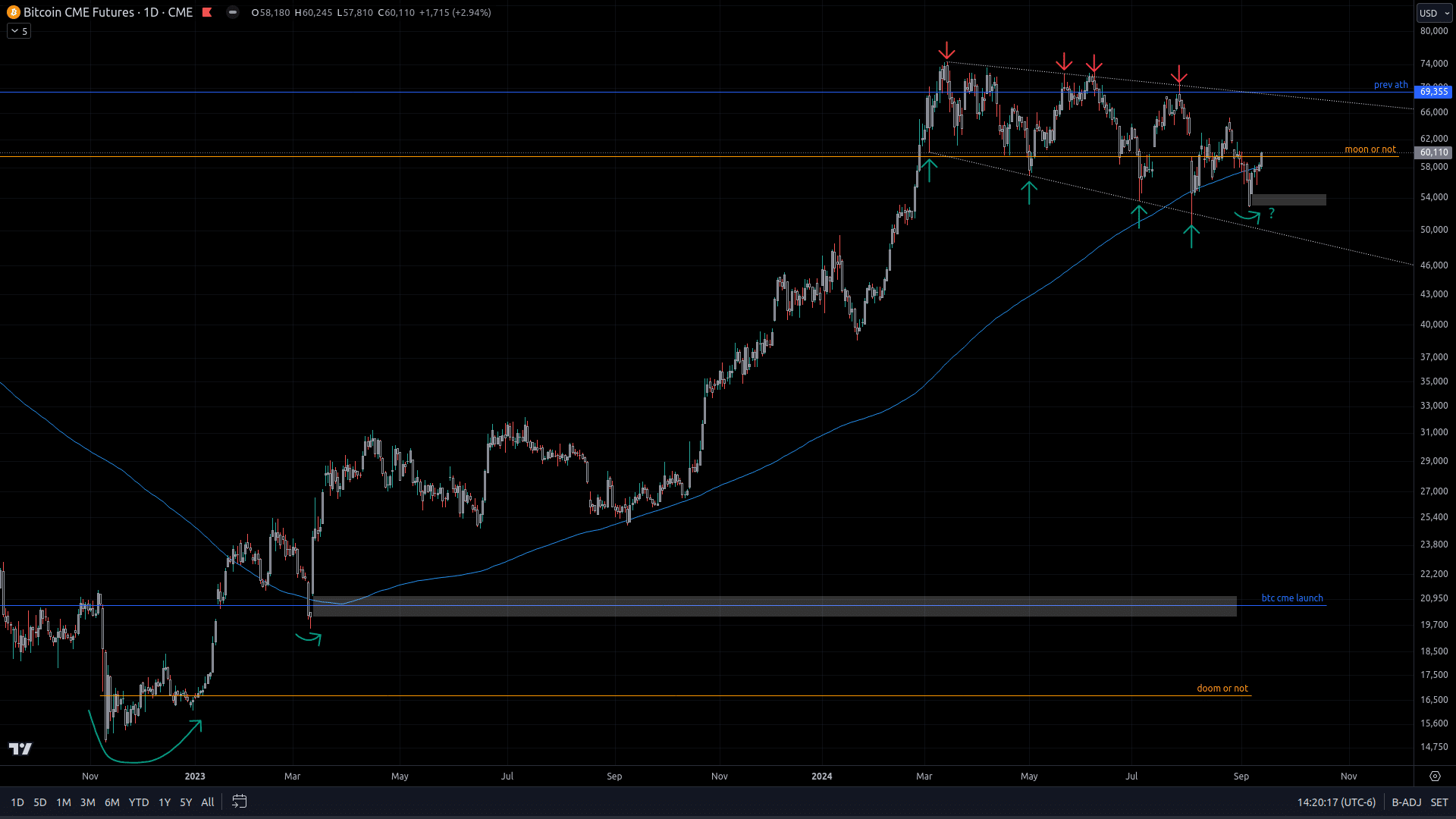

Bitcoin CME price action

Keeping an eye on the price fluctuations of Bitcoin in the Chicago Mercantile Exchange (CME) is significant, particularly during this Bitcoin ETF period, as it provides valuable insights into Bitcoin’s movement trends.

Instead of directly reflecting the current market value of Bitcoin, these Exchange-Traded Funds (ETFs) instead follow the price of Bitcoin on the Chicago Mercantile Exchange (CME). At present, the CME’s chart depicts Bitcoin as being in a descending broadening wedge formation, which is generally considered a bullish signal.

Furthermore, Bitcoin has regained its significant 200-day moving average, which is often interpreted as a sign of market robustness.

If there’s an empty space on the Bitcoin chart that isn’t filled, this would be the second instance since the market’s major recovery point where BTC skips over such gaps. This pattern strengthens the optimistic outlook for Bitcoin prices.

Estimated leverage ratio

Furthermore, data from CryptoQuant indicates that the calculated loan-to-value (leverage) ratio on cryptocurrency exchanges has hit a fresh annual peak this year.

As an analyst, I find myself observing a trend where Bitcoin traders appear to be progressively embracing higher risks. This potentially indicates a bullish outlook for the cryptocurrency market.

When traders become more comfortable with investing a larger amount of capital in Bitcoin and other cryptocurrencies, this can lead to increased prices if the market momentum indicates a rise. Essentially, a greater appetite for risk could draw additional funds towards Bitcoin, potentially boosting its value.

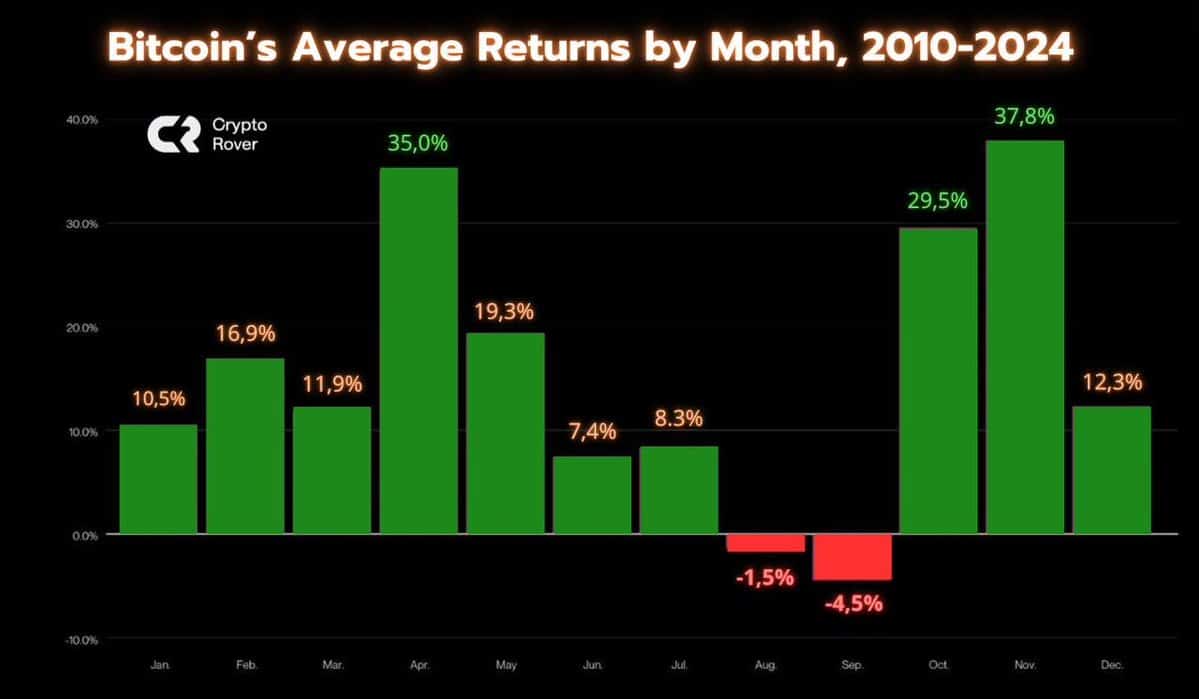

Bitcoin average returns by month

Furthermore, historical data indicates that August and September tend to be the least profitable months for Bitcoin, with these months recording the smallest average returns compared to other months since 2010.

Regardless, those traders willing to persevere through the current tough times, often referred to as “Rektember,” might anticipate a more profitable period known as “Uptober.” Historically, this month has shown stronger returns for Bitcoin compared to others, as evidenced by its past performance.

If history repeats itself, Bitcoin’s price could rise higher in the final quarter of 2024.

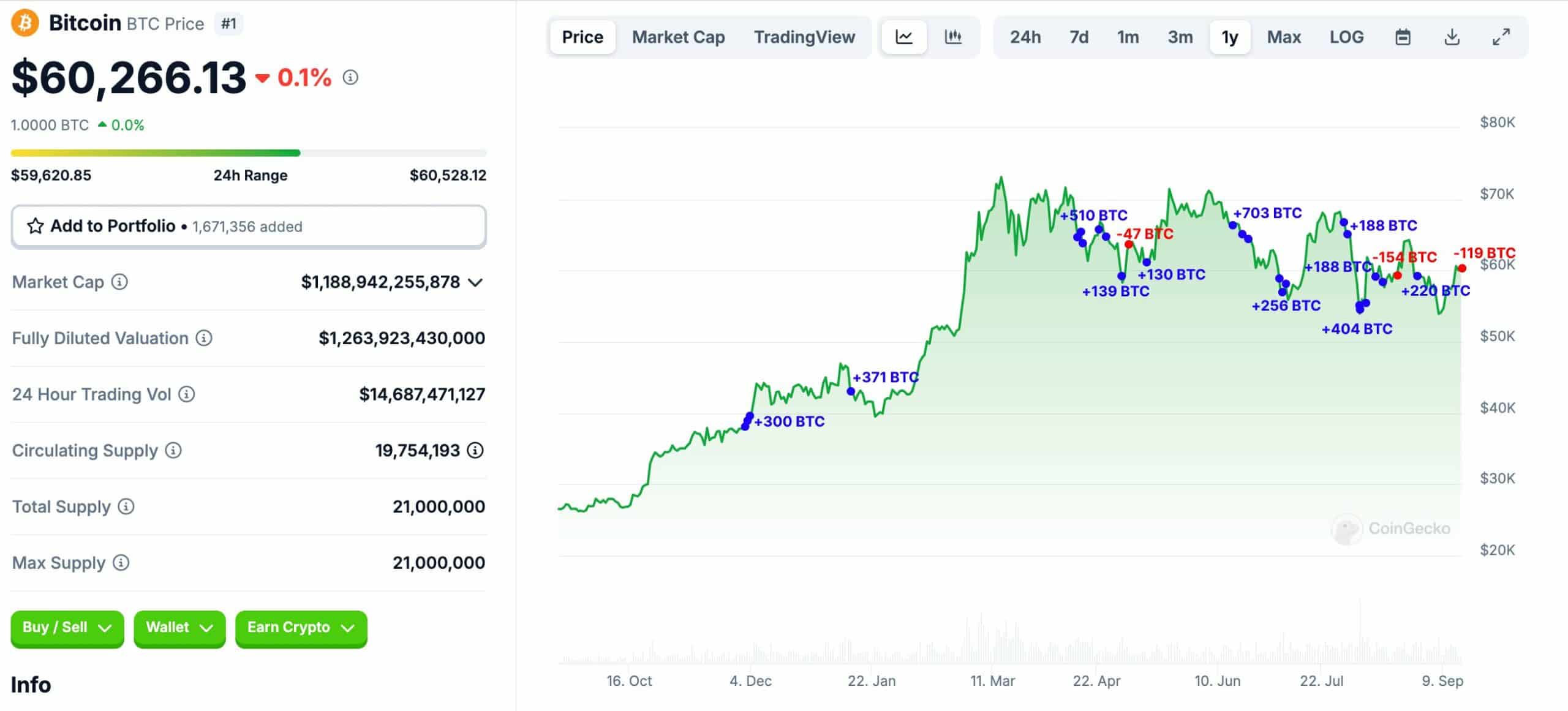

Bitcoin whales take profit

On the other hand, not every recent event is purely beneficial. For instance, some large Bitcoin (BTC) investors, known as “whales,” are starting to cash out their gains. This is evidenced by a whale transferring 119 BTC, which equates to approximately $7.14 million, to Binance for the purpose of realizing profits.

Since December 2023, this whale has taken out approximately 3,409 Bitcoins, valued at around $195.4 million, from Binance, with an average purchase price of roughly $57,319 per Bitcoin.

If additional large investors (referred to as “whales”) choose to emulate the one that’s currently earning approximately $10.5 million in profits, it might suggest a bearish trend.

Even though there may be short-term fluctuations, the overall perspective for Bitcoin remains optimistic since significant players within the industry are consistently backing it.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-15 20:08