- ETF buzz focuses on Ethereum and Bitcoin, with BlackRock challenging Grayscale’s dominance.

- Bitcoin’s price fluctuates amid ETF excitement, with analysts eyeing potential market shifts.

As a researcher with a background in finance and experience following the crypto market closely, I find the recent developments surrounding Exchange-Traded Funds (ETFs) and their impact on Bitcoin (BTC) and Ethereum (ETH) particularly intriguing.

ETFs are generating a lot of buzz due to the upcoming potential approval of Ethereum [ETH] spot exchange-traded funds.

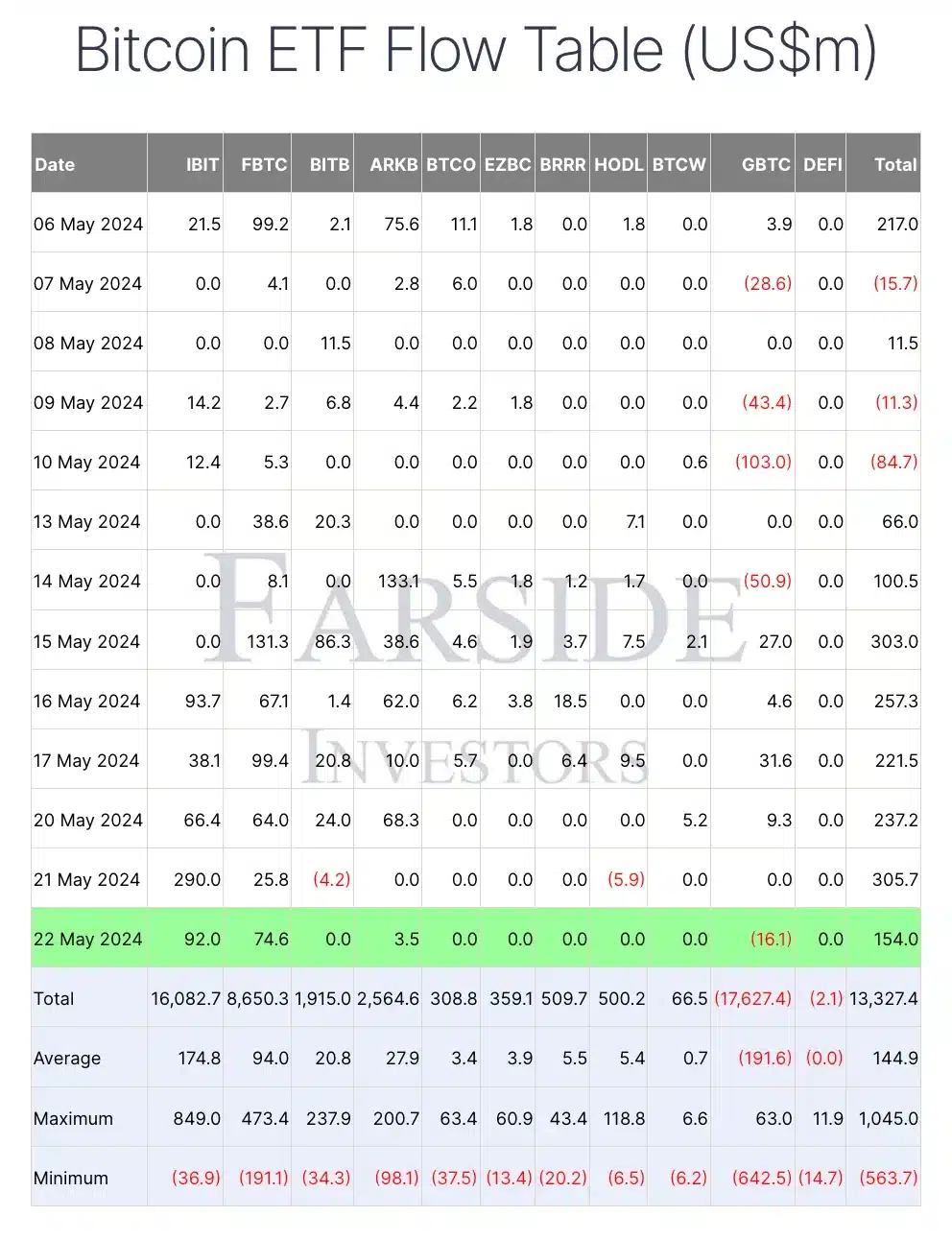

On the 22nd of May, there was a notable influx of $154 million into Bitcoin [BTC] spot ETFs, representing the eighth consecutive day with such investment. According to Farside Investors’ data.

BlackRock overpowers Grayscale

“Notable among the ETFs was Grayscale’s GBTC, which saw a net withdrawal of approximately $16.09 million.”

On that particular day, BlackRock’s IBIT attracted investments to the tune of $91.95 million, whereas Fidelity’s FBTC recorded a inflow of $74.57 million.

A significant query among investors arises: Could BlackRock soon surpass Grayscale Bitcoin Trust (GBTC) as the Bitcoin ETF with the greatest assets under management?

BlackRock steps ahead in Ether ETF approval

As a researcher studying the developments in the crypto space, I’ve noticed an intriguing turn of events regarding Ethereum ETFs and BlackRock’s recent actions. The Securities and Exchange Commission (SEC) has recently asked for public comments on spot Ethereum ETF applications, and in response, BlackRock has taken a notable step forward.

On May 22nd, BlackRock and other filers modified their 19b-4 forms in response to this, eliminating the language regarding ether staking which raised regulatory concerns.

Sharing his remarks on the same, an X user said,

“I have confidence in BlackRock’s success with ETF applications, as they’ve only experienced a loss on this front once. Excitingly, an Ethereum spot ETF is imminent!”

BlackRock’s conviction in its capabilities is evidently robust, as demonstrated by its successful history in obtaining ETF approvals.

Commenting on the impressive performance of BTC ETFs, HODL15Capital took to X and noted,

“Reaching a new peak, Bitcoin ETFs now hold approximately 850,000 Bitcoins. With the global accumulation approaching the 1 million Bitcoin mark, this represents a significant investment in the cryptocurrency through these financial instruments.”

From the US to the UK

As a crypto investor, I’m excited to share that the ETF fever isn’t just confined to the US markets. On the 22nd of May, WisdomTree made an important announcement. They revealed they had secured approval from the UK Financial Conduct Authority (FCA) to launch Bitcoin and Ethereum Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE). So, us Europeans can now invest in these digital assets through traditional investment channels as well!

As a researcher examining the cryptocurrency market, I’ve noticed an intriguing development – Bitcoin ETFs have demonstrated remarkable success. However, my attention has been drawn away from this progress as Bitcoin itself retreated from its $70,000 peak this past week.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-23 19:04