- BTC is forming a similar technical pattern on the chart to the one seen in 2020, which preceded a market rally.

- At the same time, multiple liquidity clusters above and below the current price levels place BTC at a crossroads.

As a seasoned analyst with over two decades of market analysis under my belt, I have seen my fair share of market trends and patterns. Observing Bitcoin [BTC] right now, it seems to be treading familiar territory reminiscent of 2020. The symmetrical triangle pattern, the gradual rally followed by a pullback, all point towards a potential significant upward move, should BTC manage to breach the $100,000 resistance level.

Over the past week, Bitcoin (BTC) experienced a minor setback with a dip of approximately 2.54%. This downturn was due to a wider market slump. However, it’s since bounced back, recording a daily increase of 1.48%, which has once again piqued the interest of investors.

Despite a noticeable improvement in the market, it’s unclear where Bitcoin will head next. AMBCrypto offers some insightful perspectives on potential future directions for Bitcoin.

Is BTC following the 2020 pattern?

According to analyst Mr. Crypto’s perspective, Bitcoin appears to be following the same technical trend it showed in 2020. This pattern, if continued, could result in a substantial increase in value once BTC surpasses the previous resistance level of $20,000.

Following this trend, Bitcoin initially surges, then falls to establish a base, which is later followed by another surge that shapes a symmetrical triangle pattern. This pattern often precedes a powerful upward spike.

At present, Bitcoin seems to be going through this particular pattern. Following an upward surge, it has now experienced a pullback and is shaping up as a potential base – remarkably mirroring the previous trend.

Should this trend persist, it might indicate that Bitcoin could ultimately surpass the significant resistance at around $100,000.

BTC faces two-way pressure amid liquidity clusters

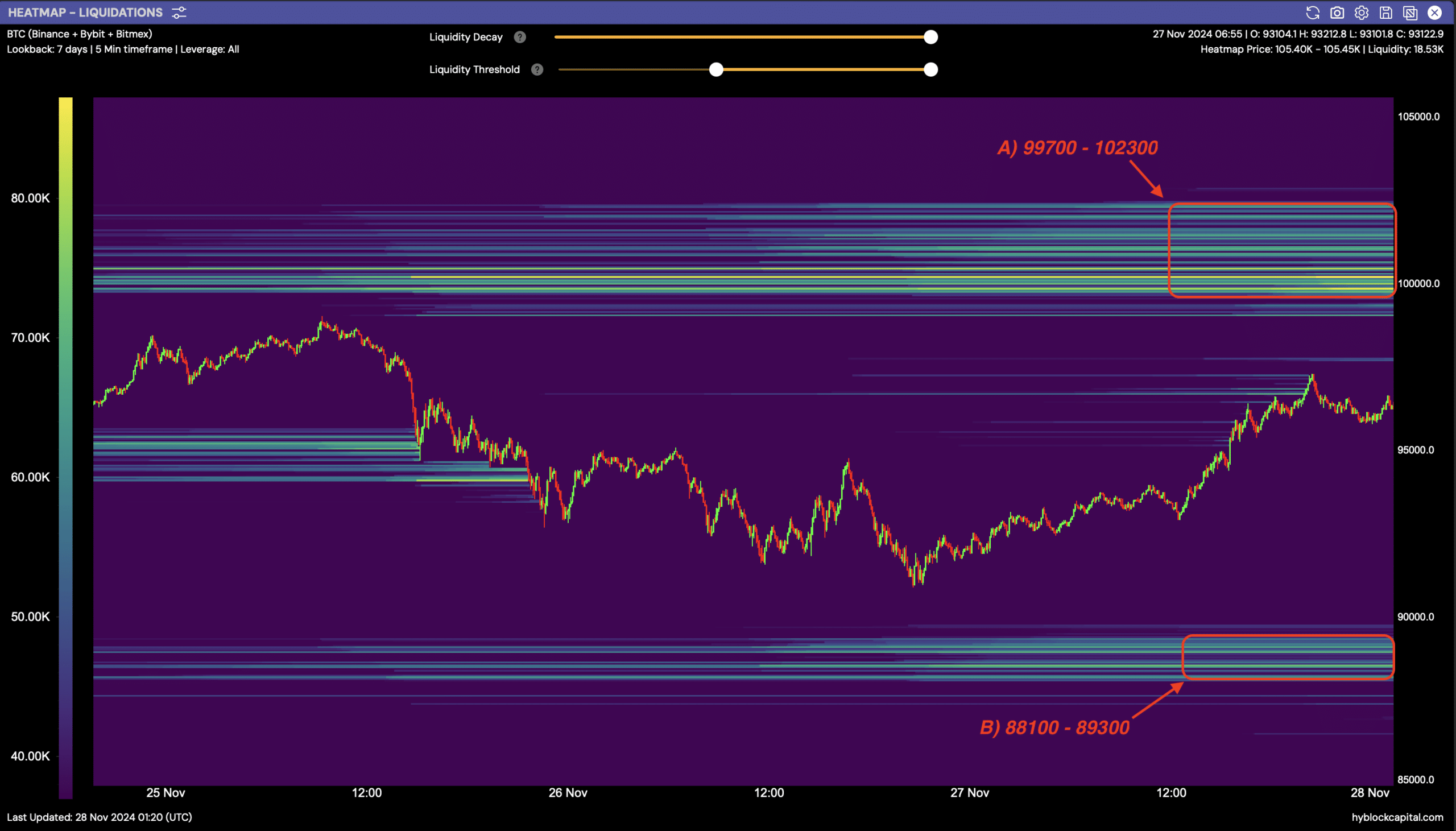

As per Hyblock Capital’s analysis, Bitcoin is experiencing considerable stress right now. There are concentration points for liquidity both above and below its current value, which means the digital currency might head up or down based on market movements.

The liquidity range is found above at around $99,700 to $102,300, whereas below it stretches from approximately $88,100 to $89,300.

Clusters of liquidity frequently exert a strong pull on market movements, attracting prices towards these specific points where large quantities of buy or sell orders are waiting. These levels function like magnets, helping to balance out the supply and demand before the market resumes its original direction.

Based on AMBCrypto’s assessment, it appears that Bitcoin might surge over the resistance zone instead of experiencing a downturn. This optimistic outlook aligns with the trends observed in the funding rate and long position to short position ratio.

The cost at which long (buying) and short (selling) positions are adjusted daily, known as the Funding Rate, has risen, indicating a growing influence by buyers. This rise to 0.0206% indicates that the market’s bullish trend might continue.

Furthermore, the long-to-short ratio indicates more long trades being held compared to short ones, as represented by a value of 1.0090. This suggests a strong optimism among traders about market growth.

Bullish confluence builds for BTC

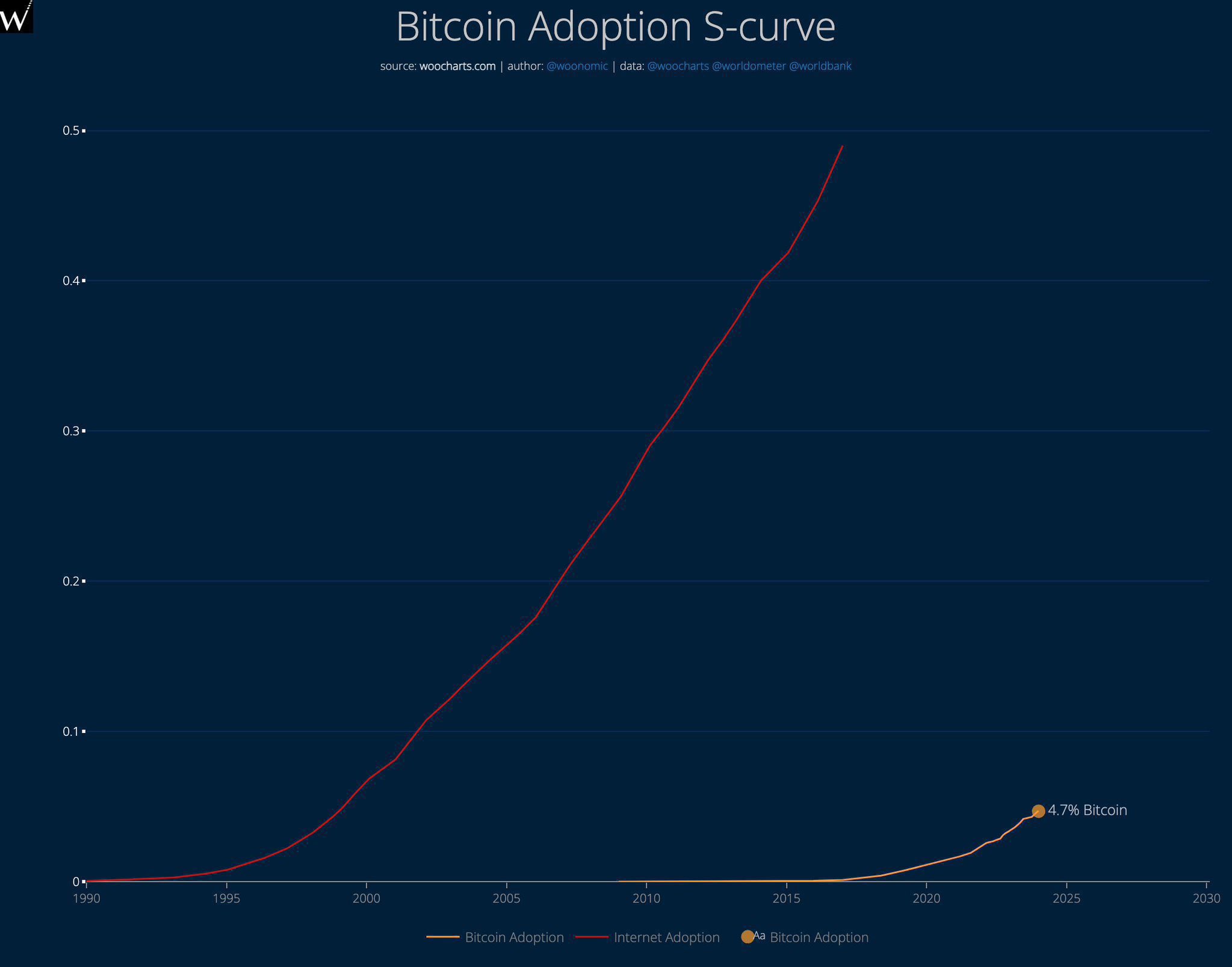

According to the Bitcoin Adoption S-Curve model, Bitcoin’s current level of adoption resembles that of the internet around the year 1999.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

It appears that Bitcoin is still not widely accepted in the market, but as more people start using it, the chances of its value increasing and more liquidity flowing into it become higher.

Collectively, these signs point towards a higher probability of Bitcoin rising steadily instead of undergoing a sudden drop.

Read More

2024-11-28 20:40