- Bitcoin experienced a sharp decline, falling below $60K, with analysts predicting a potential recovery due to a CME gap.

- Whale activity has increased despite the price drop, indicating strong market interest and possible bullish momentum.

As a seasoned crypto investor with over a decade of experience navigating the volatile landscape of digital assets, I find myself both intrigued and cautiously optimistic about the recent price action of Bitcoin [BTC]. The sudden drop below $60K has certainly caught many of us off guard, but the potential recovery due to the CME gap is something that has piqued my interest.

As a researcher in the field of cryptocurrencies, I’ve observed an unexpected and substantial decline in the value of Bitcoin (BTC) over the past day, leaving quite a few of us in the crypto community taken aback.

Yesterday morning, Bitcoin momentarily surpassed $63,000 before experiencing a significant drop, falling approximately 6% and reaching around $57,000.

Despite a slight recovery that brought its current price to $59,103, the cryptocurrency experienced a decrease of approximately 5.7% in the last 24 hours.

As an analyst, I find myself joining the chorus of professionals within our field, as we reassess our near-term expectations for this digital asset due to its recent bearish price trends.

Quick recovery ahead?

Surprisingly low levels have prompted various well-known analysts to express revised opinions regarding Bitcoin’s potential path moving forward.

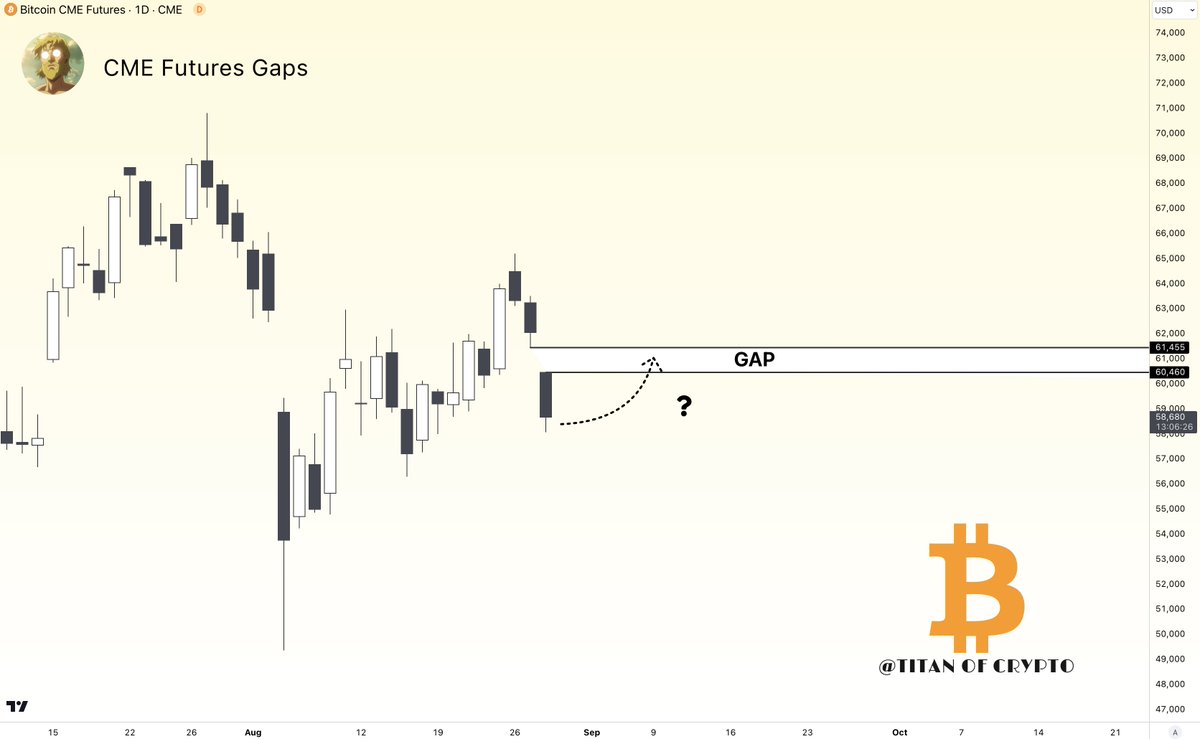

One such analyst, Titan of Crypto, took to X (formerly Twitter) to suggest that Bitcoin might recover quickly to the $61,000 region.

Titan of Crypto pointed out the emergence of a CME Futures gap on the daily timeframe, stating,

“Recent Bitcoin Short-Term Analysis: There’s a gap in CME futures on the daily chart. It’s possible that Bitcoin could drop towards approximately $61,400 to fill this gap.”

On the Chicago Mercantile Exchange (CME), a Bitcoin Futures price gap happens when the opening price for the new trading day differs noticeably from the closing price of the preceding trading day.

As a crypto investor, I’ve noticed that these noticeable absences in Bitcoin’s price chart, often referred to as gaps, are closely monitored by traders. They seem to believe that Bitcoin has a tendency to “retrace its steps” and move back to the original level where these gaps were formed.

According to the analysis by the Crypto Titan, there could be a possibility for Bitcoin’s price to increase towards approximately $61,400, potentially offering a brief chance for recovery.

On the other hand, some analysts are taking a more conservative stance due to the recent drop in prices.

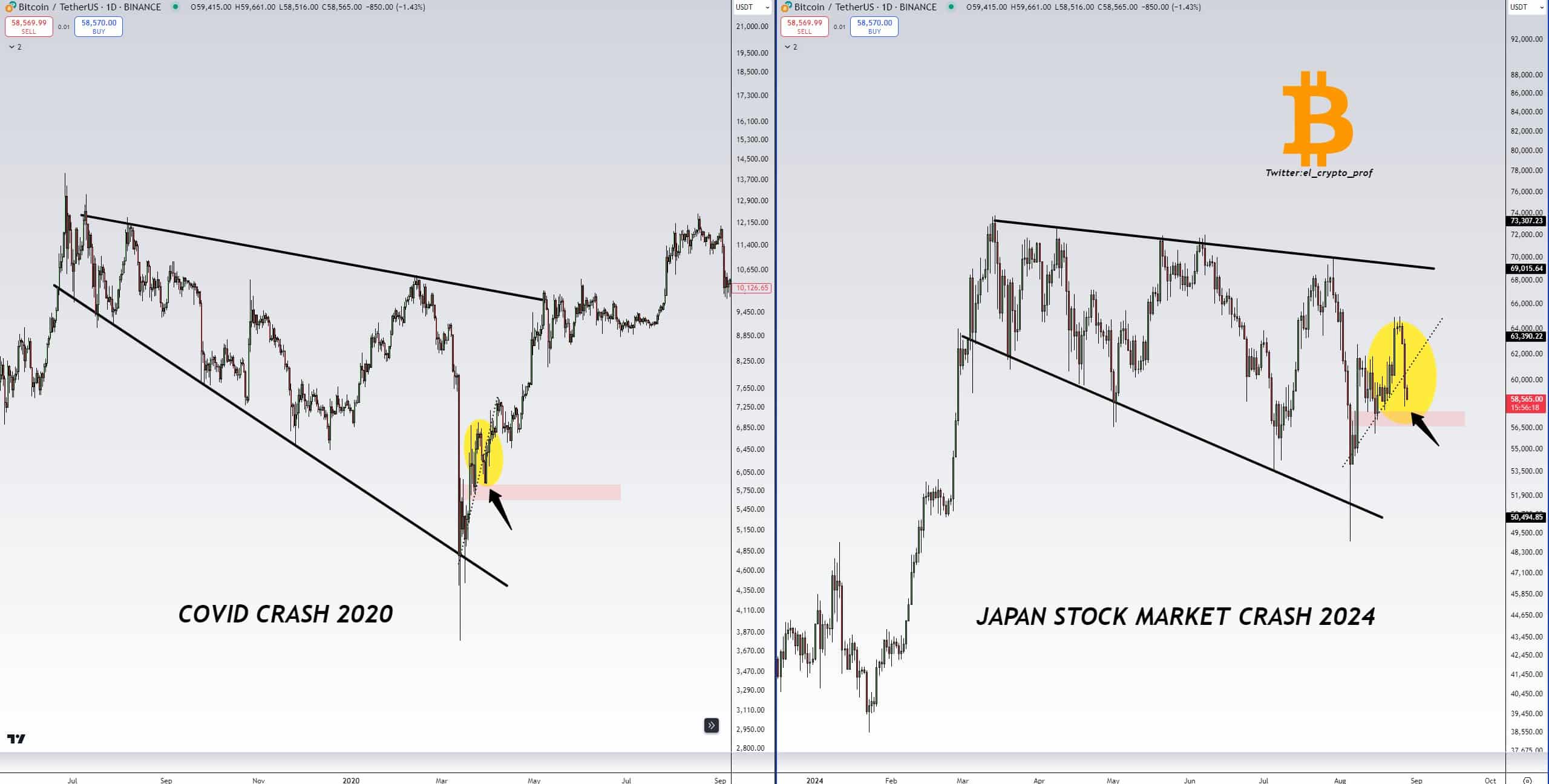

Moustache, a notable figure in the crypto world, advised tranquility by making comparisons between the present market scenario and previous incidents.

Moustache posted two pictures side by side, demonstrating Bitcoin’s price trend in 2020 – first a steep fall followed by an impressive surge – and a similar pattern that emerged in 2024 based on current market movements, analogous to the Japanese stock market crash of that year.

Moustache commented,

2020’s Covid Crash and the 2024 Japanese Stock Market Crash – There’s no reason to fret, in my opinion. Bitcoin is closely mirroring the pattern from 2020, nearly one-to-one.

Bitcoin’s fundamentals show mixed signals

As an analyst, I’ve been closely observing the volatile nature of Bitcoin. However, amidst this turmoil, its underlying fundamentals have provided some valuable clues about its possible future trajectory.

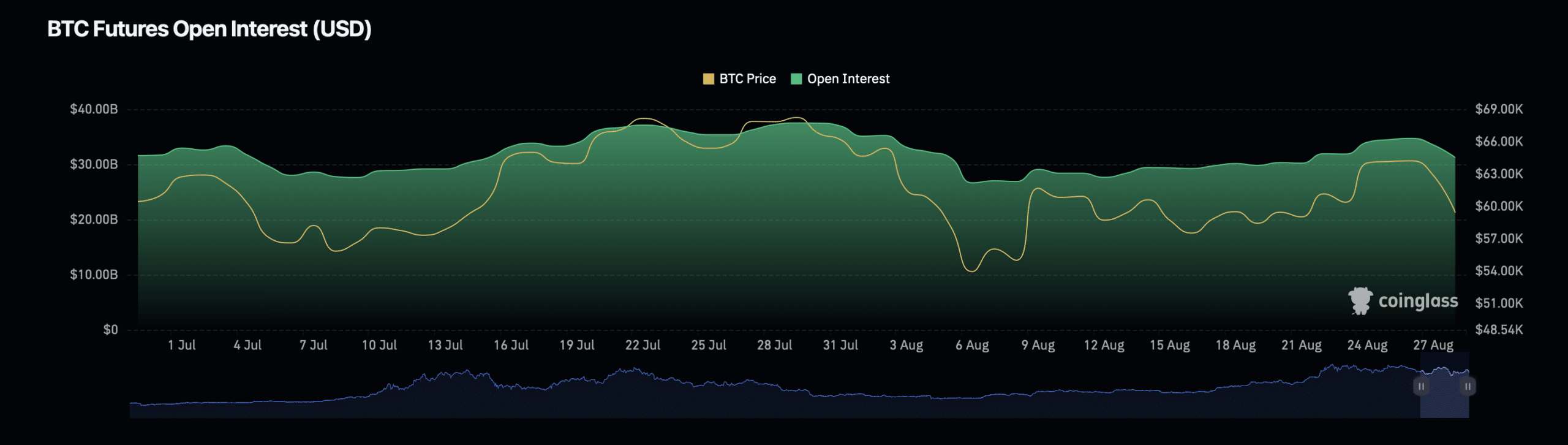

Data from Coinglass revealed an interesting trend in Bitcoin’s Open Interest, which has declined by nearly 7% over the past day, reaching a press time valuation of $31.02 billion.

On the other hand, the asset’s Open Interest value showed a contrasting trend, experiencing a significant surge of 62.93% to reach a current worth of $83.73 billion over the specified duration.

The gap between Open Interest and trade volume indicates that although fewer traders are maintaining positions, the scale and vigor of the transactions have noticeably escalated.

This indicated heightened market activity that could lead to further price fluctuations.

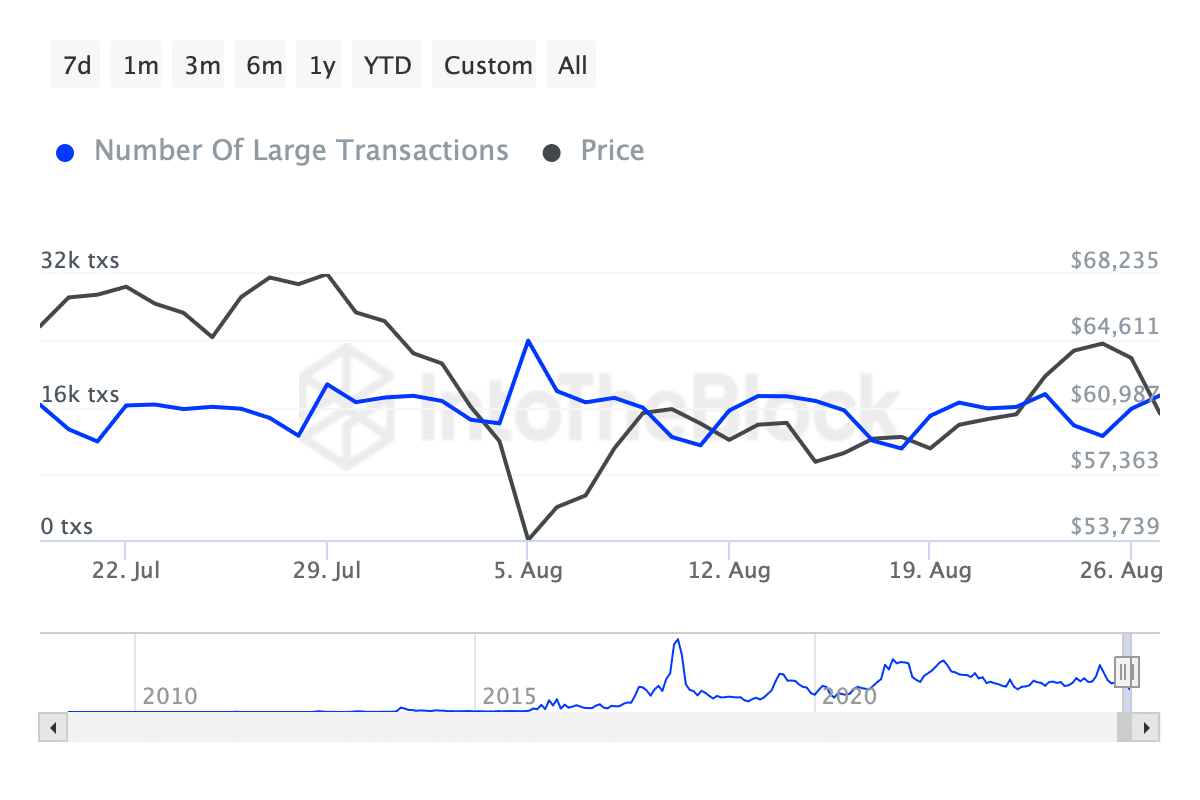

Over the last week, I’ve observed a significant rise in Bitcoin transactions made by whales – defined as individuals or entities transacting over $100,000 – based on data from IntoTheBlock.

Amidst the recent dip in prices, I’ve noticed a trend where significant players, often referred to as ‘whales,’ seem to be increasing their holdings of Bitcoin. It’s intriguing to observe this behavior, as it could potentially signal a bullish outlook for the future.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Over the weekend, there were fewer than 13,000 whale transactions, but by the time this news was published, that number had climbed to more than 17,000.

The rising whale activity implies that major investors might be preparing for a possible price surge, despite the ongoing bearish market conditions.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Your Friendly Neighborhood Spider-Man Boss Teases Surprising Doc Ock Detail

- How to get tickets to see Kendrick Lamar and SZA on their Grand National world tour

- Best Axe Build in Kingdom Come Deliverance 2

- Meghan’s Sweet Kids Tribute in Latest Vid!

2024-08-28 13:45