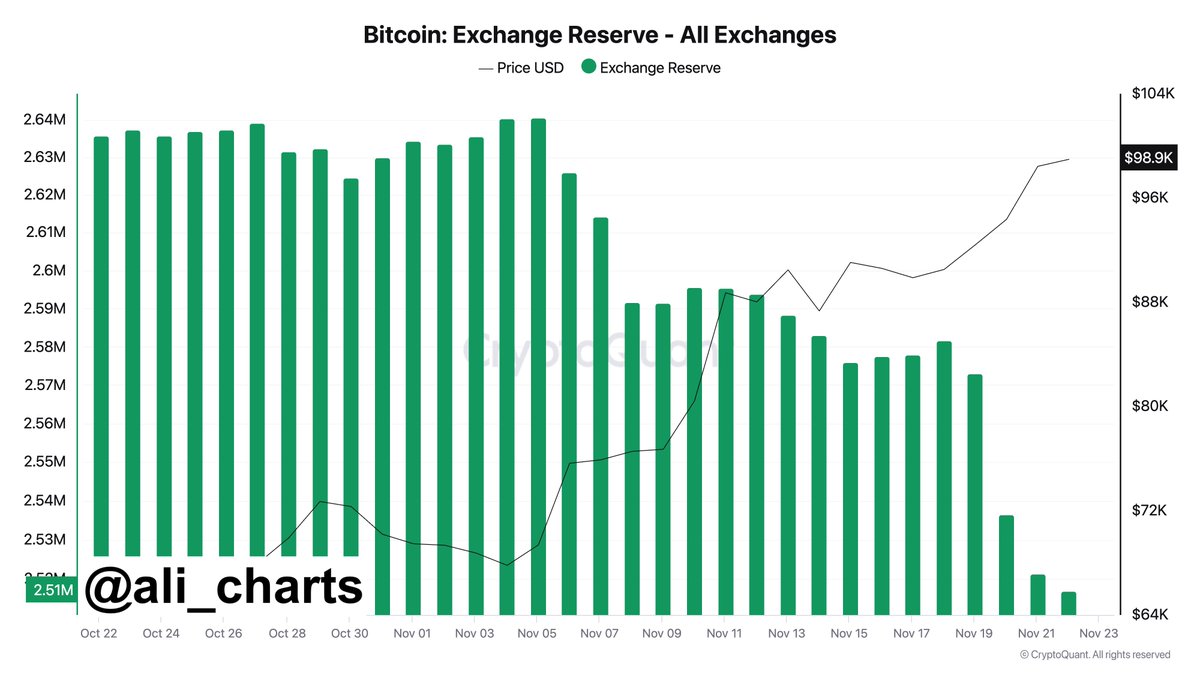

- Bitcoin withdrawals from exchanges have totaled $6.37 billion in the 96 hours.

- Social media mentions of $100K Bitcoin have hit a record high as well.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles. The current surge in Bitcoin’s [BTC] price action, coupled with significant exchange withdrawals and record-high social media mentions of $100K Bitcoin, is reminiscent of the euphoria that preceded past price rallies.

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastThe ascent of Bitcoin (BTC) towards a six-digit price tag is almost within reach, and this climb could potentially be accelerated by significant transactions withdrawing from major exchanges.

A well-known analyst posted on Twitter that approximately 65,000 Bitcoins, worth around $6.37 billion, were recently withdrawn from major cryptocurrency exchanges.

Historically, these substantial withdrawals suggest that owners are moving their assets into ‘cold storage’, which indicates a decrease in the urge to sell.

On trading platforms, a reduction in supply (or “supply squeeze”) typically comes before increases in prices, because less supply encourages a rise in prices due to increased demand.

For instance, in earlier BTC cycles, large exchange withdrawals preceded significant price rallies.

Continued outflows indicate that investors are becoming increasingly optimistic about Bitcoin’s future price increase, especially since it has surpassed its all-time high of $99K.

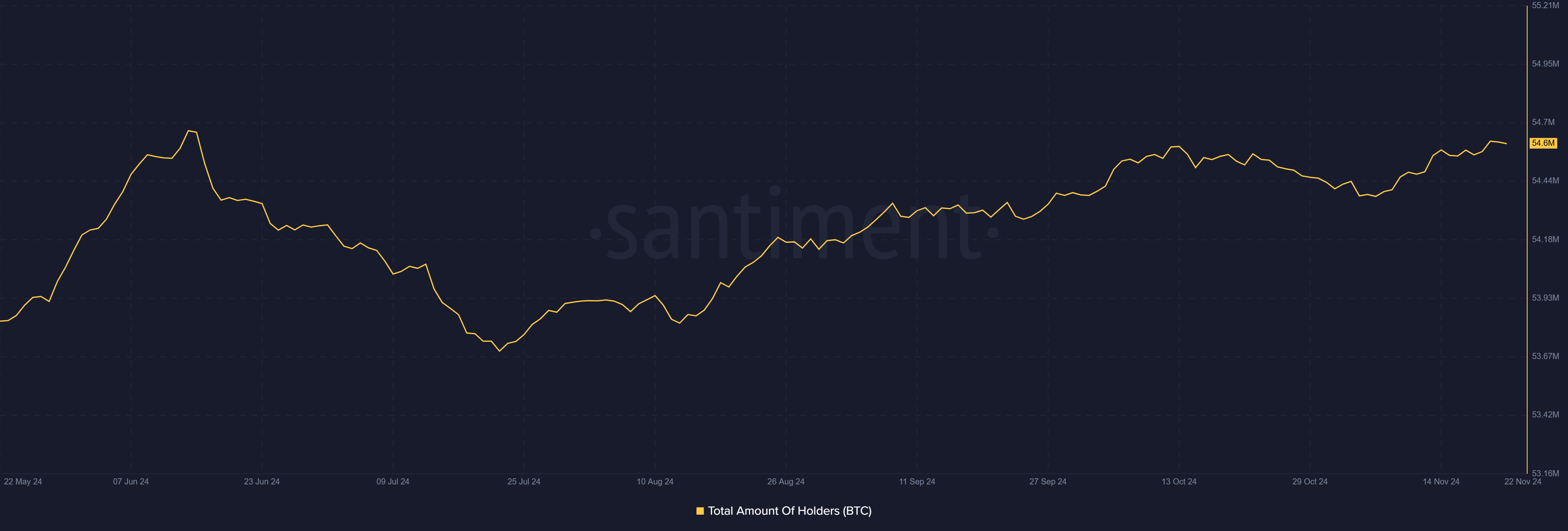

Bitcoin rising holders and record social mentions

Based on AMBCrypto’s interpretation of Santiment’s statistics, there was a significant increase in the number of Bitcoin owners over the past day.

As a researcher, I’m observing an escalation in discussions surrounding the potential reach of $100,000 for Bitcoin across various platforms like X, Reddit, and Telegram. The chatter about Bitcoin’s six-figure valuation has soared to unprecedented heights, reaching levels not seen before in our historical records.

Remarkably, the anxiety about not participating in potential gains has grown stronger, as certain traders anticipate a swift increase surpassing the $100K mark.

Conversely, references to lower price points, like $60,000 to $79,000, suggest lingering apprehension about a potential short-term correction.

What next for BTC?

As a researcher, I’ve observed historically that Bitcoin’s value typically spikes following extended phases of increased withdrawals and diminished exchange reserves. The next significant hurdle on the horizon appears to be the psychological threshold of $100K.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If this bullish momentum continues, it could strongly propel Bitcoin into new highs.

Yet, as the desire to not miss potential gains drives market movements, the apprehension about possible corrections might prompt investors to sell off their profits during this crucial stage.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-23 11:03