-

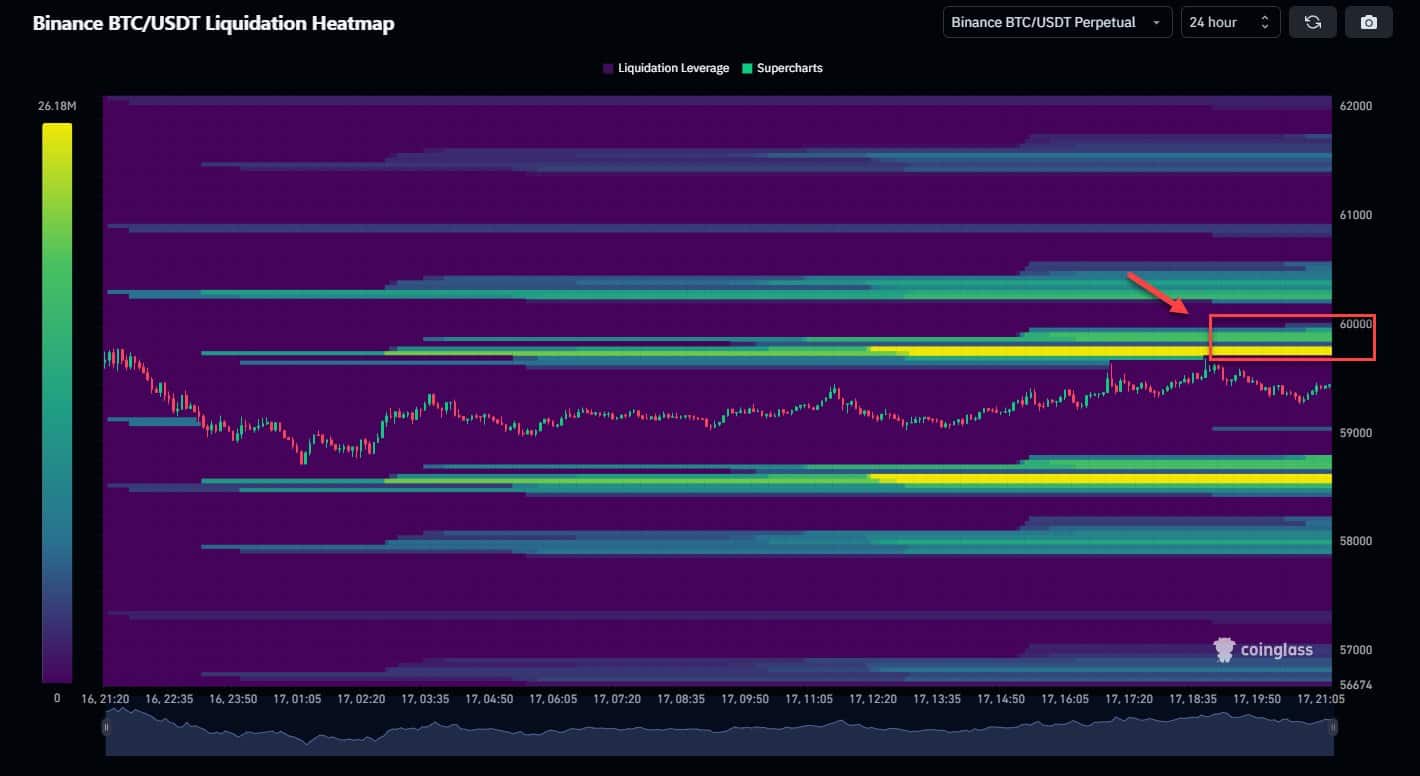

$244M Bitcoin in new shorts will be liquidated at $61K, and $9.17B Bitcoin at $68K.

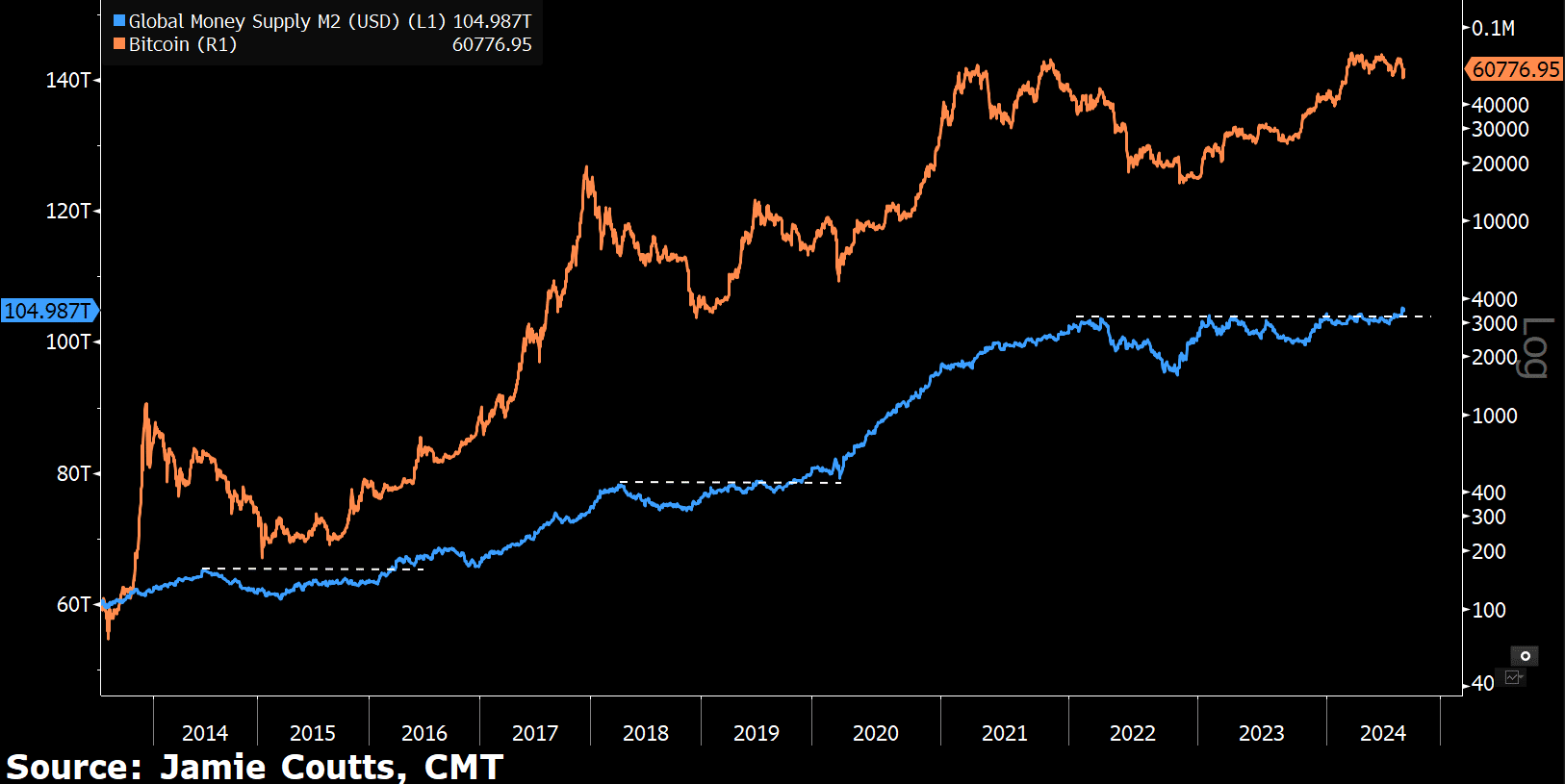

Still, the realized price, high whale ratio, and new ATH in money supply suggest buying BTC.

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find myself intrigued by the current state of Bitcoin [BTC]. The market is like a rollercoaster, with moments of exhilarating highs and nerve-wracking lows.

At the moment, the Bitcoin market is experiencing some uncertainty, as it’s finding difficulty in consistently moving upwards following its recovery from the dip that occurred on August 5th. This dip was triggered by a crash in the Japanese stock market.

At the moment of publication, Bitcoin was hovering slightly below the $60K mark, yet obstacles persisted. Approximately 4,000 short positions are poised, with buy orders for the spot market situated around $61K.

Overnight, Bitcoin might surpass the $60K barrier, only to halt at $61K. The potential downside arises from the impending high-leverage long liquidations near the $58K price point.

Furthermore, if Bitcoin rises to $68,000, there’s a potential for $9.17 billion worth of short positions to be closed out, potentially hindering its progress towards even higher prices.

As a crypto investor, I’m optimistic about Bitcoin’s future. There are indications that suggest its ongoing recovery, possibly leading to a new All-Time High (ATH) by the end of Q4 2024 or even as early as Q1 2025.

Bitcoin: Buying opportunity ahead?

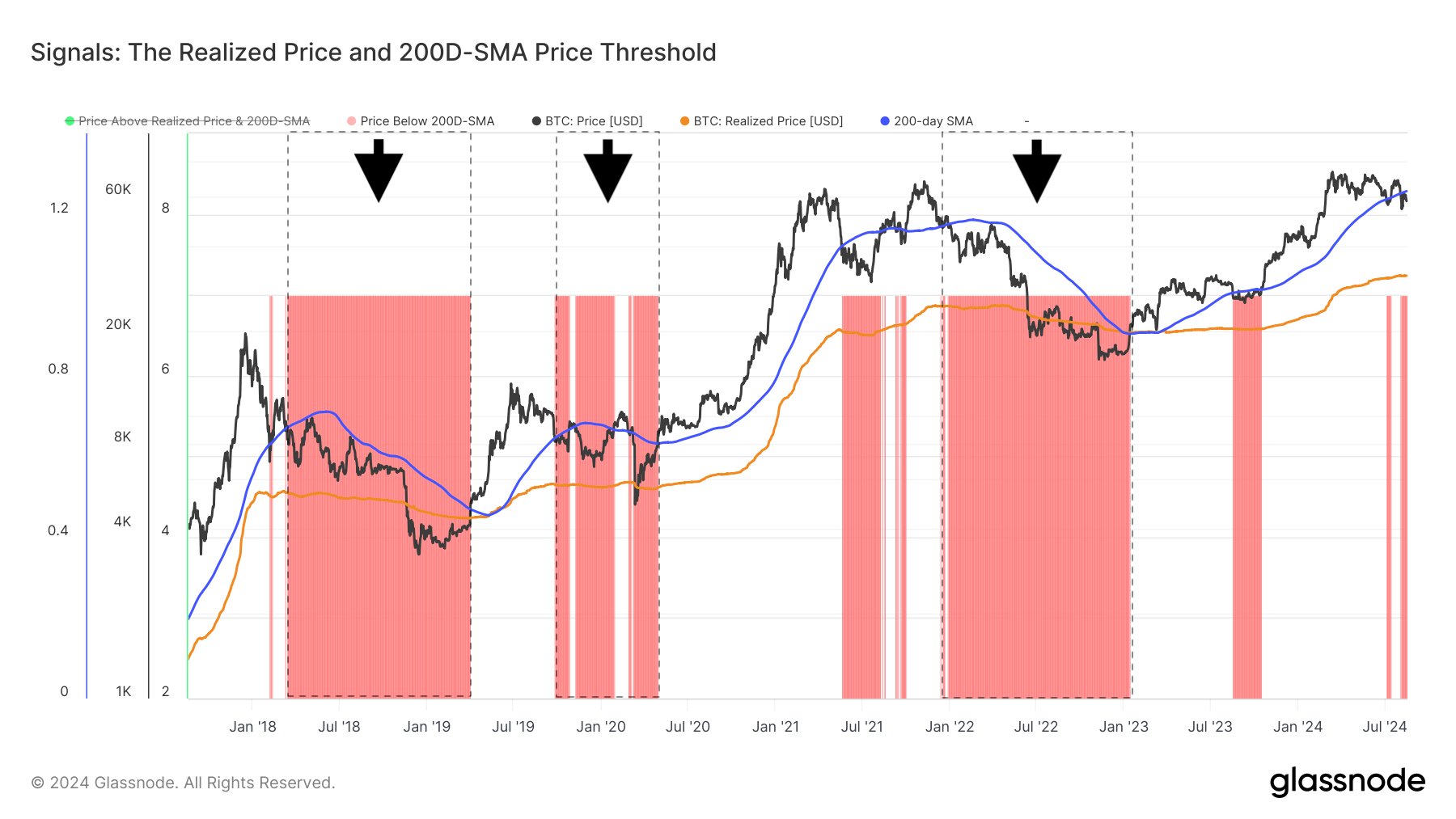

Recently, Bitcoin dipped beneath its 200-day moving average, a significant line in the sand, but it has since formed a ‘double bottom’ pattern – a signal often associated with the prolongation of an existing trend in the long run.

In a bull market, this dip can present a buying opportunity, suggesting a potential rebound.

If Bitcoin’s price stays under its 200-day Simple Moving Average (SMA) for a prolonged duration, this might be indicative of an approaching bear market.

As an analyst, I find myself optimistic about Bitcoin’s current state, even though there are inherent risks involved. At present, I don’t foresee a protracted downturn for the digital currency.

It appears that we’re experiencing a short-term downturn instead of entering a prolonged period of decline. There’s a good chance for improvement and further progress in the future.

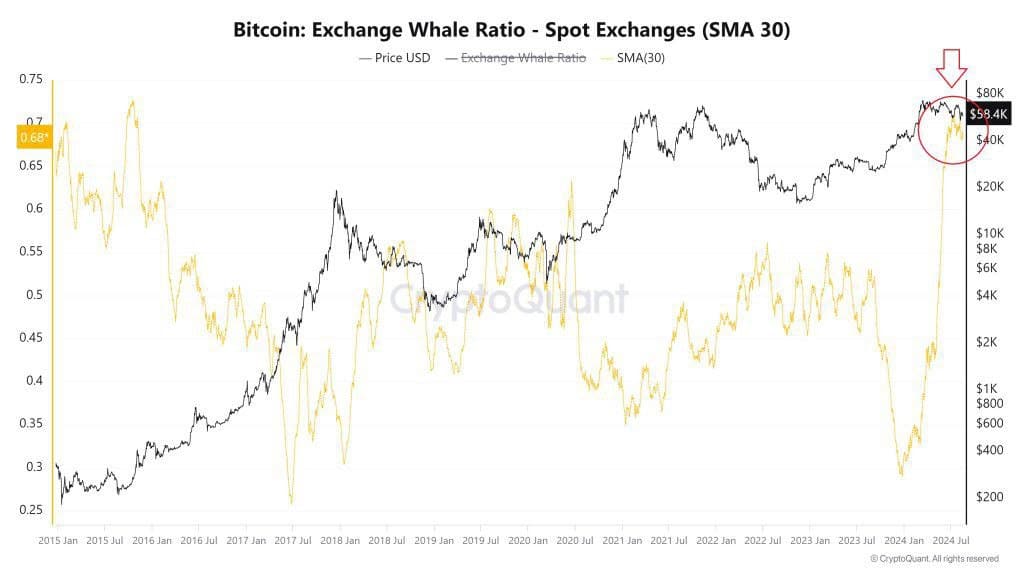

Whale accumulate as global liquidity surges

Large Bitcoin holders are also accumulating more, which could signal an upcoming price surge. Observant analysts have noted that these big investors and dealers tend to buy when prices drop, a behavior typically associated with subsequent price surges.

Given the current surge, along with past halving occurrences and increasing institutional involvement via Bitcoin ETFs, it seems likely that Bitcoin’s value might increase in the near future.

As an analyst, I find myself observing that the worldwide money supply has hit a record peak, enhancing purchasing power. This surge could potentially drive up the value of Bitcoin.

As the amount of money circulating increases, the demand for purchasing Bitcoin grows stronger, making it an attractive long-term investment due to its potential for substantial future returns. The ongoing expansion of the money supply provides a solid foundation for Bitcoin’s growth prospects.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-19 08:07