-

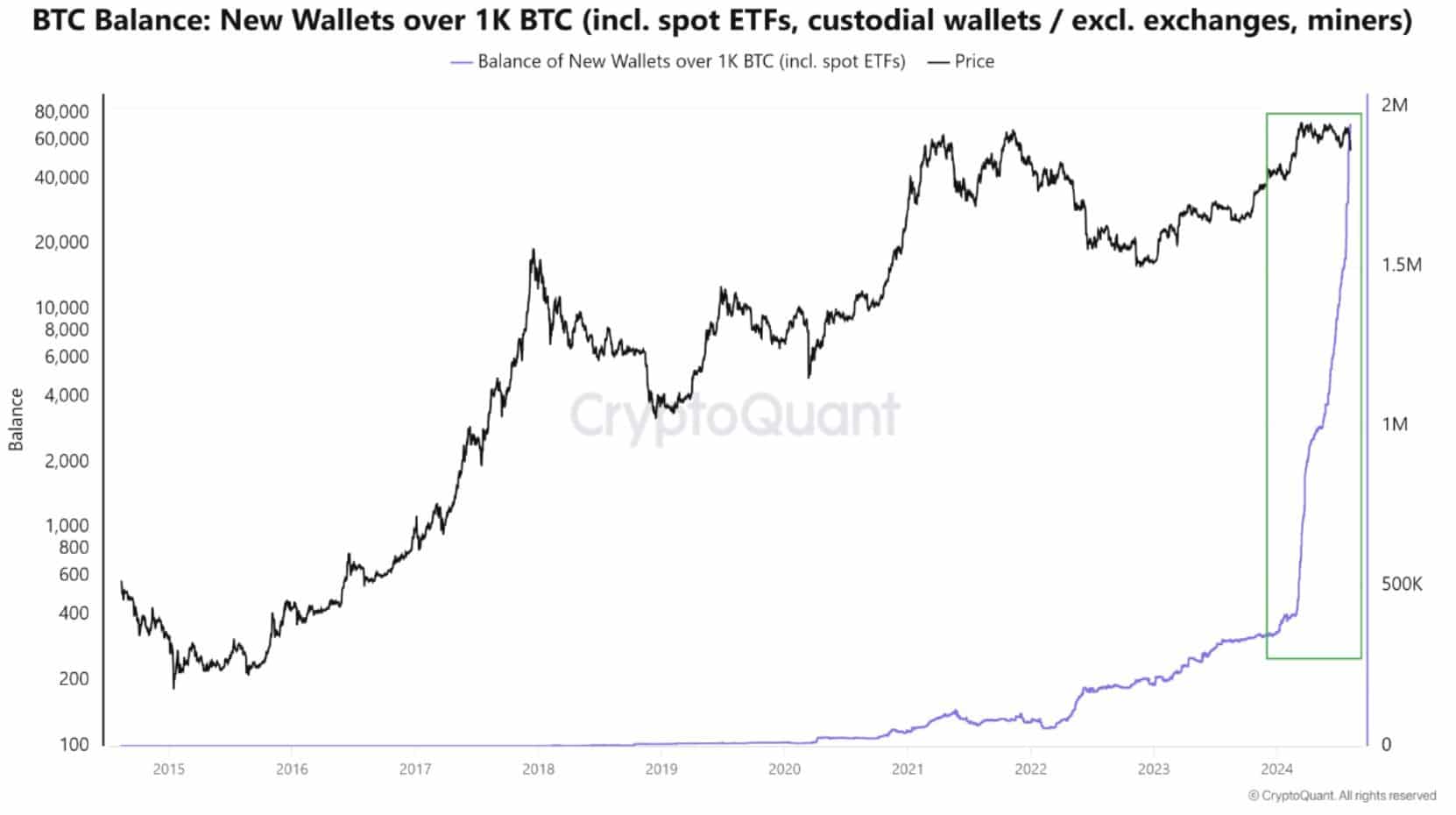

Whale accumulation of BTC surges as over 1.9M BTC moves to mega wallets since the start of 2024.

More metrics show why BTC is a good bet for long-term investors.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I must say that the recent surge in whale accumulation of Bitcoin is music to my ears. The fact that over 1.9 million BTC has moved into mega wallets since the start of this year is a clear indication that we’re on the verge of something big.

A substantial number of Bitcoins (BTC) have just moved into big digital wallets, suggesting increased activity from prominent Bitcoin investors, commonly known as ‘whales’.

After the market crash earlier this week, some analysts think this could be the cycle’s trough, signaling the beginning of an upcoming bull market.

In the realm of crypto investment, I’ve noticed an interesting trend: As of 2024, the amount of Bitcoin held in newly created wallets containing more than 1,000 BTC, including spot ETFs and custodial wallets, but not including exchange wallets, has surpassed 1.9 million BTC, according to CryptoQuant’s data. This suggests a growing interest and accumulation of significant Bitcoin holdings among investors.

Based on my personal experience and observation of the cryptocurrency market over the past few years, I have developed a growing conviction in the long-term potential of Bitcoin. The technological innovations, increasing adoption, and resilience shown by this digital currency have impressed me, making me believe that it could play a significant role in the financial landscape of the future.

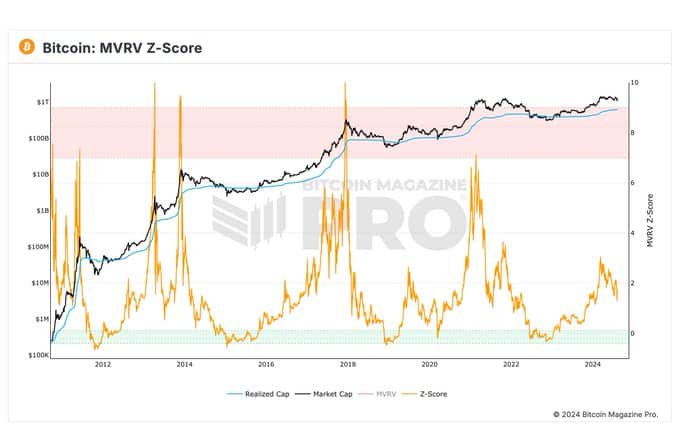

The MVRV Z-Score hasn’t peaked yet

The MVRV Z-Score, a key tool for spotting market highs and lows, is currently reading below 2. This indicated that Bitcoin is in the undervalued zone.

It seems plausible that Bitcoin’s highest point has not been attained yet, meaning those who think the peak has already occurred may miss out on potential profits. Investors and traders are gearing up for substantial rewards in the last quarter of 2024.

The Bitcoin dominance continues to rally

Furthermore, Bitcoin’s dominance reached a fresh short-term peak last week, indicating a potential upcoming bullish trend.

As an analyst, I am observing a steadily increasing dynamism in the Bitcoin market, which hints towards a substantial surge in its value in the near future, though the precise timeline remains unclear.

As a crypto investor, I’m noticing a steady climb in the market, and I believe we’re on the verge of a full-fledged bull run. When this momentum truly kicks into high gear, I anticipate that Bitcoin will undergo a sharp, parabolic surge.

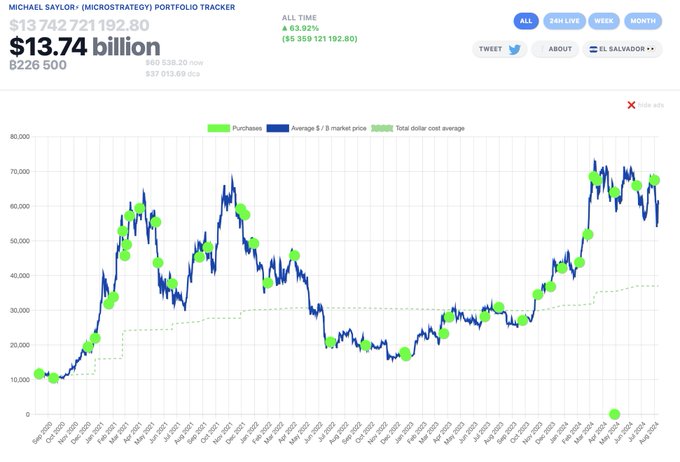

MicroStrategy BTC holdings at $13.74B

Furthermore, the substantial value of MicroStrategy’s Bitcoin holdings, currently estimated at $13.74 billion, underscores their significant investment in and dedication towards the future development of Bitcoin.

They’ve made a substantial wager, heavily investing in Bitcoin based on its promising future prospects, as suggested by their stock’s growth of 995% over the past four years.

This investment strategy highlights why Bitcoin could be a great option for long-term gains. Watching their bold move is like witnessing a financial drama unfold in real-time.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-08-12 00:07