- Bitcoin must stay above $100K for the uptrend to continue.

- BTC has experienced a slight pullback over the past day, dropping by 2.55%.

Yesterday, I witnessed an extended surge that propelled Bitcoin [BTC] to reach $106K. However, as I write this, Bitcoin is currently being traded around $102K, reflecting a 2.55% drop in its value on the daily chart.

Before this recent decline, Bitcoin was experiencing a steady rise, increasing by 8.85% according to weekly charts. As such, CryptoQuant analyst Crazyyblock proposed that Bitcoin should maintain its position above the $100K support level, here’s their reasoning.

Why $100K is critical for Bitcoin

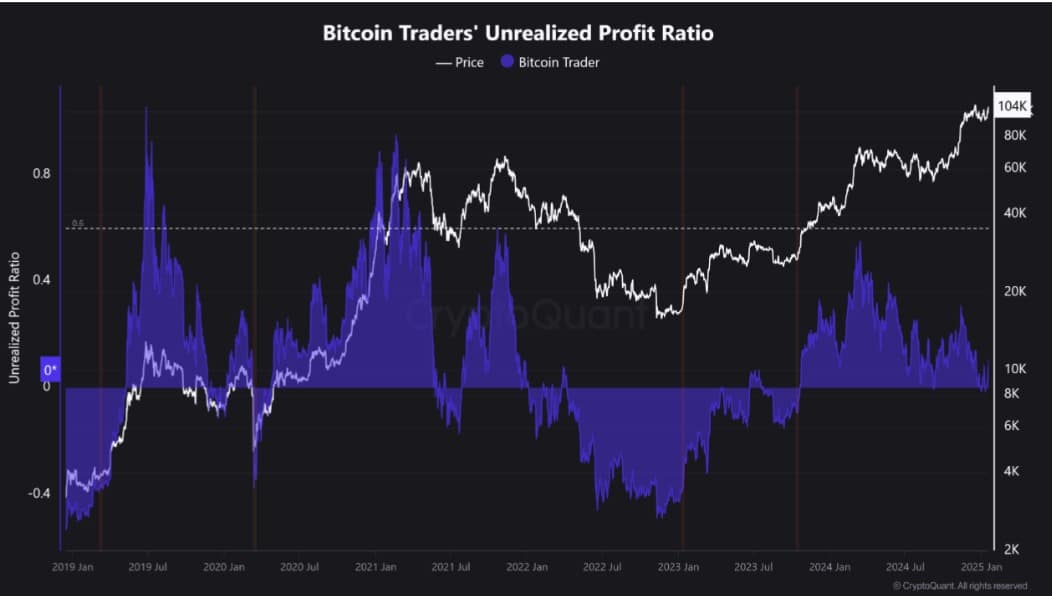

As suggested by Crazyyblock, it’s crucial for Bitcoin to remain above $100K, as the profits of existing investors largely depend on sustaining this price point.

Not maintaining this crucial psychological threshold might lead market participants to sell in a panicked manner or forcefully offload their assets due to losses, which could potentially impact the market negatively.

These investors own Bitcoin for a period of 1 to 3 months. This particular group is known for making quick decisions based on market fluctuations, which often leads to emotional selling and the implementation of short-term trading strategies.

Consequently, should Bitcoin fall below the $100K mark, some investors may decide to offload their holdings at a loss, potentially causing increased selling pressure in the market.

Consequently, whether the King Coin can hold its current position will significantly influence the market’s trend, determining if we’re headed upwards or downwards. This level is crucial as it could signal a turning point.

Can BTC maintain the uptrend?

Based on AMBCrypto’s assessment, Bitcoin has been maintaining a bullish trend, even following the recent dip. Importantly, the current market situation seems to suggest another rise is imminent as we speak.

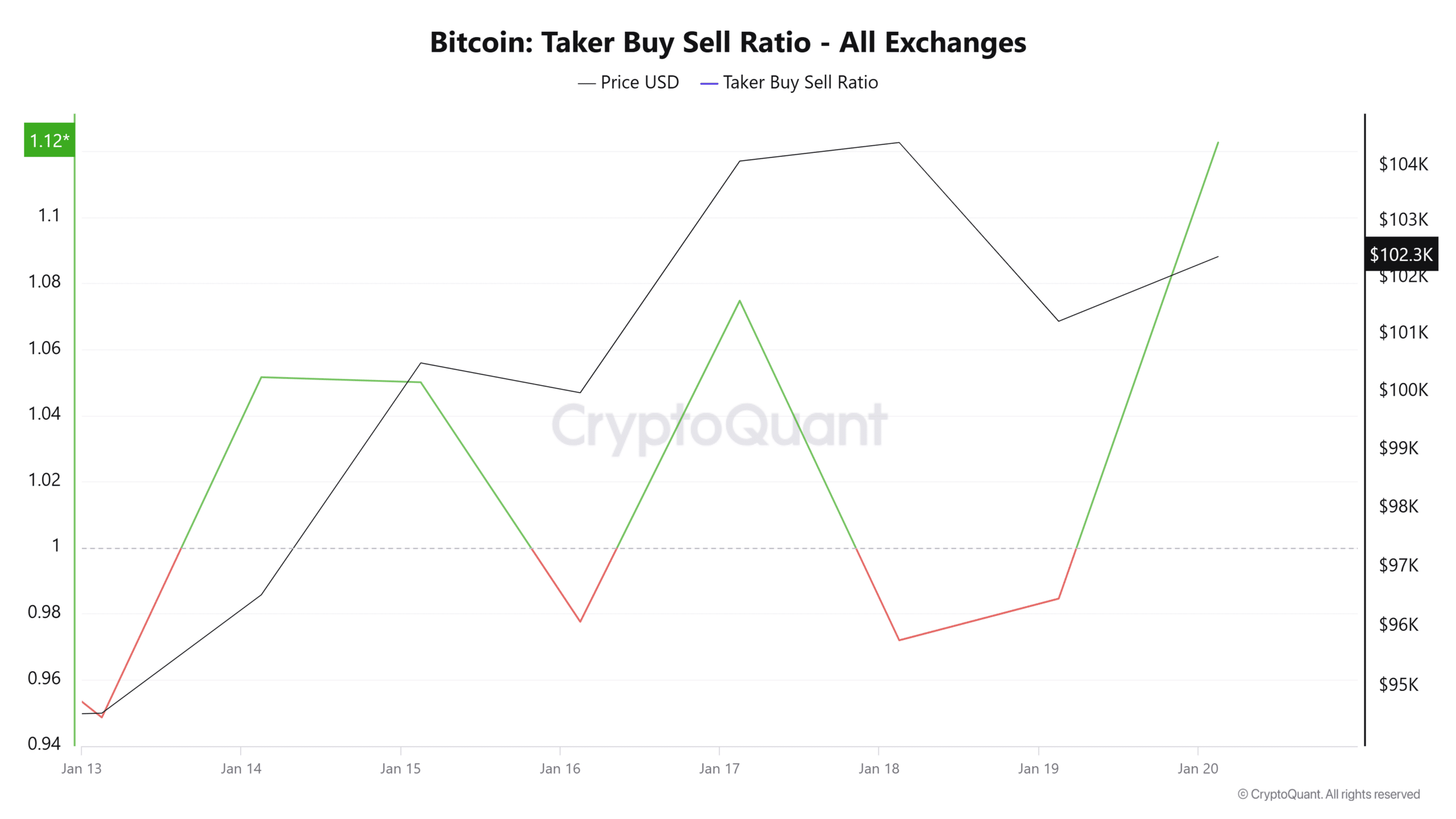

In simpler terms, the Buy-Sell ratio for Bitcoin stayed at 1.12, implying that more buyers than sellers were active in the market. This meant there was a stronger demand to buy, leading to increased purchasing pressure.

This reflected bullish sentiments as investors accumulated BTC, anticipating further gains.

Concurrently, Bitcoin was showing a significant surge in value, which could be seen by the increasing Relative Volume Gradient Index (RVGI) and Average Directional Range (ADR). At this moment, the RVGI had climbed higher since it made a bullish crossover four days prior.

This showed a clear surge upward, as the bearish sentiment appeared to dwindle. Additionally, Bitcoin’s Average Directional Movement Rating (ADR) indicated that BTC was experiencing more growth than declines.

Essentially, it appears that the recent drop is just a corrective phase in the market, setting up for another upward trend. This assumption arises from the fact that many investors still maintain a positive outlook and anticipate further price increases.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Given the present trend, if this sentiment persists, Bitcoin could regain the $105,000 mark and make an effort to surpass $106,000, a level where it has previously experienced numerous refusals.

However, if the correction prolongs, it might drop below $100K, resulting in a further dip to $98K.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2025-01-20 11:03