- Bitcoin remains stuck below $100K, despite 81% odds of reaching it.

- Bears have shown that hitting this milestone won’t be easy—patience will be tested.

As an analyst with years of experience navigating the volatile world of cryptocurrencies, I’ve seen my fair share of market rollercoasters. The latest Bitcoin [BTC] saga is no exception – it’s like watching a high-stakes game of chess where every move counts.

Bitcoin [BTC] investors have experienced a thrilling yet tumultuous week, fueled by optimism surrounding the digital currency potentially hitting the $100K milestone for the first time. Even though prominent analysts estimate an 81% likelihood of this happening, the weekend passed without the predicted breakthrough, leaving the market tense and uncertain.

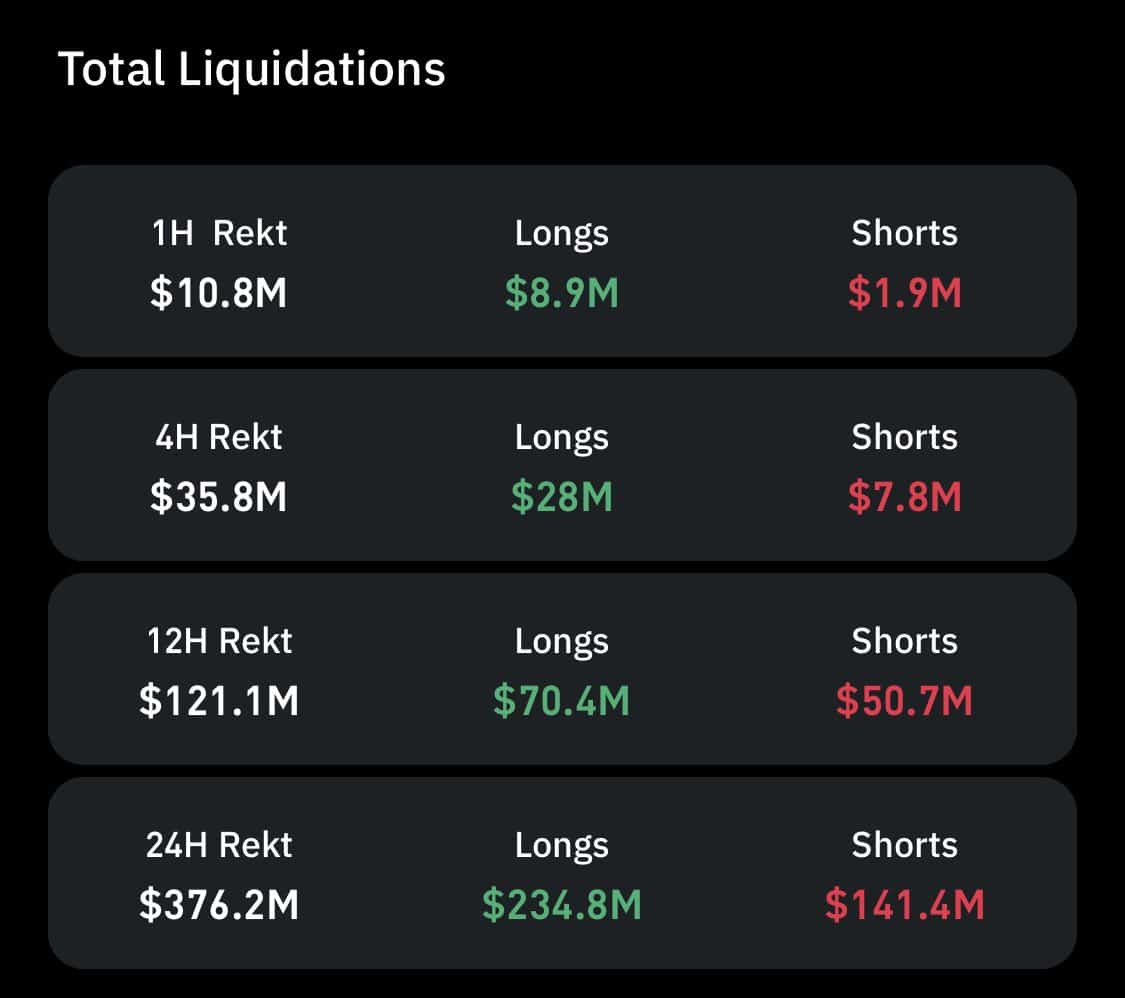

Over the past day, the story has become even more thrilling. An astounding number of 160,527 traders suffered losses totaling $376.22 million, due to the unpredictable swings in market prices that affected both long-term and short-term investments.

This significant increase in liquidations suggests extreme volatility within the derivatives market. Could it be an indication that a major change in the overall market is approaching?

Long-squeeze triggered as bears’ strategy plays out

Current long/short ratios reveal a bearish tilt, with traders heavily shorting Bitcoin.

The unevenness you see carries this caveat: overuse of borrowed capital in derivative trading might lead to abrupt adjustments or prolonged squeezes – an unseen trigger potentially causing the recent flip for Bitcoin.

Over the last day, more than $234 million worth of long positions were closed out, representing a significant jump of about 65.96% over the previous day’s $141 million in short position closures.

Source : Coinglass

The significant difference between current and previous prices emphasizes the market’s instability, as those who had placed long bets (anticipating price rises) were compelled to liquidate their positions due to Bitcoin’s recent drop from its record high of $99,317, which occurred only two days ago.

When Bitcoin temporarily dipped, sensible traders decided to sell off their holdings to limit potential losses, considering the significant value attached currently. This action might have set off a chain reaction of long position closures, which bears probably initiated.

In this ongoing bull market, Bitcoin’s growth has been steady rather than excessive, largely because a majority of trades are long-term positions, thereby keeping speculative fervor in check.

Yet, slight departures from the optimistic trajectory gave room for bears to apply pressure. Consequently, this led to an extended period of squeezing where traders were forced to sell off, which ultimately caused a nearly 2% drop in Bitcoin’s value.

Although reaching $100K might still be possible, the market’s volatility is growing more and more noticeable.

With Bitcoin approaching a significant historical threshold, investors are making portfolio changes. Some are redirecting focus towards other high-value assets, while others are taking advantage of substantial returns by selling off their Bitcoin holdings.

As an analyst, I’m observing that whenever Bitcoin (BTC) hits a new All-Time High (ATH), it often triggers a surge in selling from bears capitalizing on the volatility. This repeated selling can squeeze out long-term investors, potentially leading BTC into a cycle unless an external factor intervenes to disrupt this pattern and propel a breakout.

The $100K dream could be on hold for now

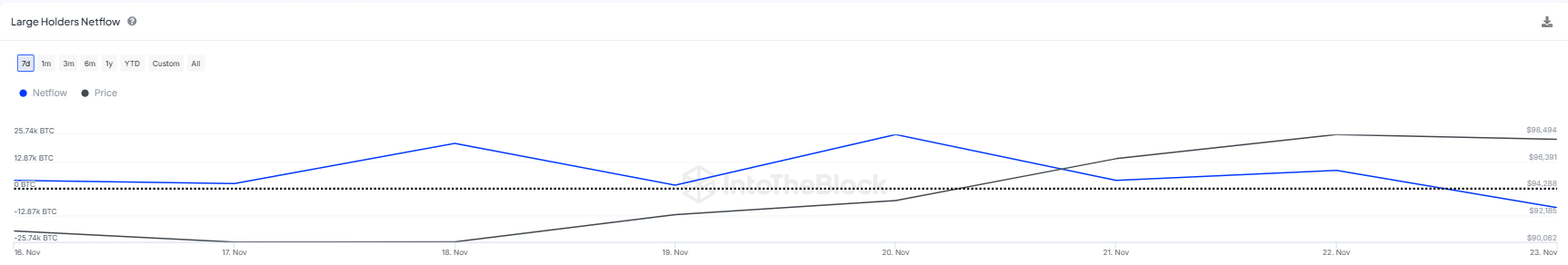

Over the last two days, it’s been quite intriguing that roughly 10,000 Bitcoins, each valued at about $98,121, have been ‘stored’ by whales. This has accumulated to a substantial sum of nearly $981 million.

Source : IntoTheBlock

Moreover, this underlines the consistency with AMBCrypto’s prior assessment, demonstrating that bears profited significantly from the major change in market dynamics as large investors unloaded their assets.

The action caused a drop in price, providing an opportunity for short-sellers to take charge. Consequently, those with long positions were compelled to sell off their holdings as a means of reducing potential losses.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As I embark on this exciting endeavor, I can’t help but feel the buzz surrounding the prospect of reaching the $100K mark. However, I am fully aware that the path to this milestone will not be a simple one. It promises challenges and obstacles, but the journey is what makes the destination all the more rewarding.

Every time Bitcoin approaches its predicted peak, there’s often a mass exodus of long-term investors, day traders, and miners, which provides an ideal setting for bearish market participants to seize control. This recurring pattern keeps Bitcoin locked in a persistent loop, hindering its smooth climb towards its historic landmark.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-25 09:12