Bitcoin has been on a bit of a bender lately, flirting with the $105,000 mark like it’s the last drink at a party. Investors are watching, some with bated breath, others with a cocktail in hand. The leading cryptocurrency has gained some serious momentum, mainly thanks to institutional interest and a market mood that’s cautiously optimistic—like a cat near a bath tub.

But, of course, there’s always a catch. The market’s in such a state of flux that Bitcoin might just fall short of its new all-time high—kind of like a runner in the final stretch who trips on the last step. Who would’ve guessed?

Bitcoin Holders Hoarding Like It’s the End of the World

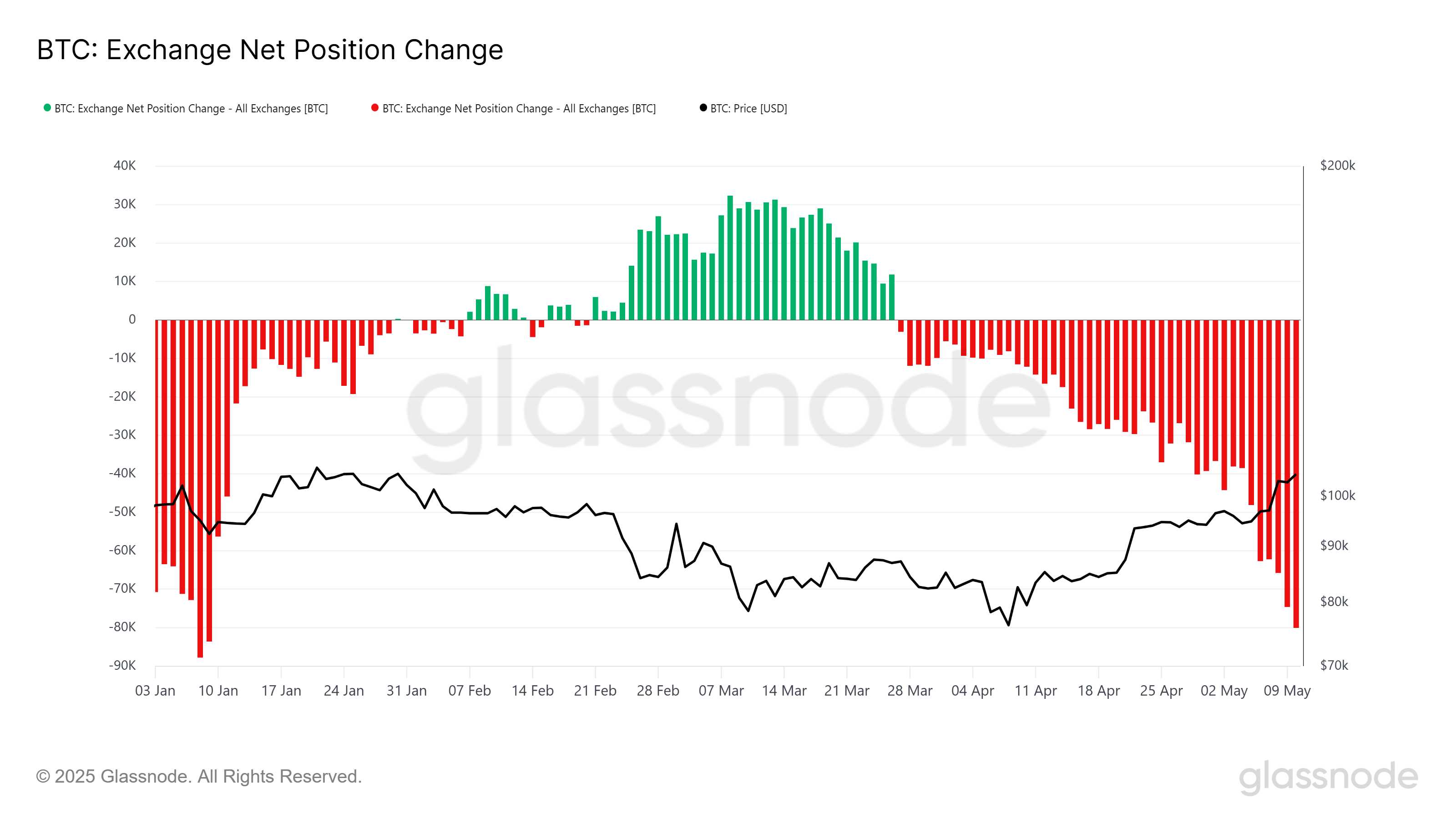

Let’s talk about the so-called “bullish” investor activity. Over the past week, more than 30,072 BTC were scooped up, with a total value of over $3.13 billion. That’s right, billion. The exchange net position has dropped to its lowest level in four months, which—spoiler alert—means that more coins are being whisked off exchanges than being deposited. Classic hoarding behavior, folks. Just like people buying toilet paper before a storm.

There’s a certain flavor of panic FOMO (Fear of Missing Out) in the air as Bitcoin hovers near its record highs. Long-term holders seem to be adding more to their bags, betting on a potential breakout. Because, who doesn’t love a good gamble?

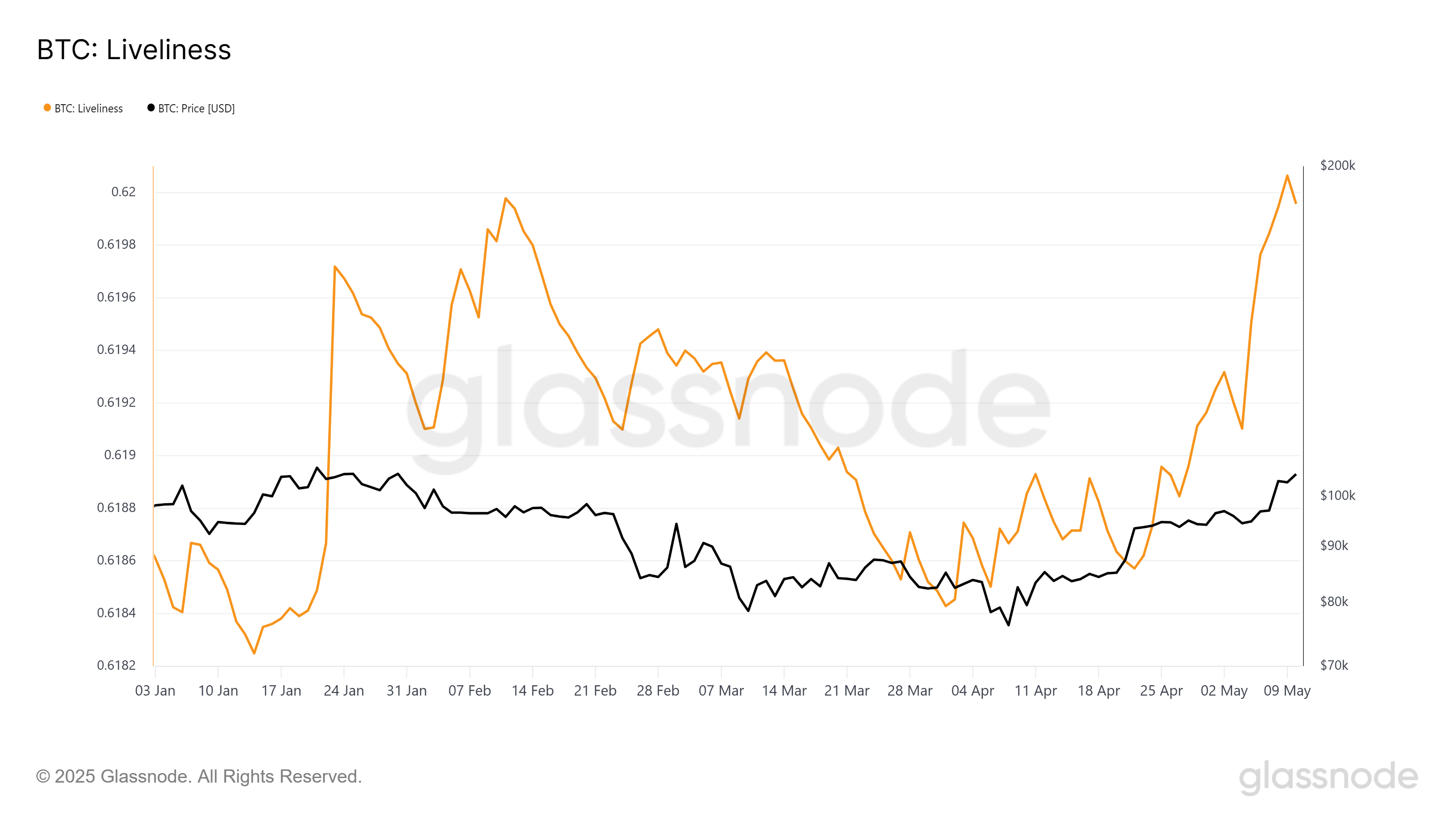

However, not everything’s as sunshine and rainbows as it seems. The Liveliness indicator—a super exciting name for a rather mundane metric—has spiked since May, signaling that long-term holders might be ready to cash out. Apparently, coins that were lying around, gathering dust, are waking up and being sold. Great, just what we need: more selling pressure.

If long-term holders (LTHs) decide to liquidate more of their Bitcoin stash, it could throw a wrench in the bullish momentum that’s been generated by all that fresh accumulation. Because who doesn’t love a little chaos, right?

BTC: Gunning for a New ATH or Just Dreaming?

Currently, Bitcoin is teasing the $104,231 mark, which is just shy of the magical $105,000 resistance. But hold your horses! The real barrier seems to be $106,265, which has been a tough nut to crack since December 2024. The chart looks a bit like a dog trying to catch its tail—Bitcoin can’t seem to get any further despite the best efforts of its price.

Now, let’s throw some numbers around. The all-time high is sitting pretty at $109,588, but Bitcoin has this little obstacle at $106,265 to deal with first. Selling pressure from the LTHs and conflicting investor sentiment are making this level harder to breach than a locked door with no key.

So, here’s the fun part. If Bitcoin can’t break through that $106,265 resistance, don’t be surprised if it takes a trip back to $100,000. Nothing like a nice little correction to keep things interesting.

But hey, if Bitcoin manages to break through and turn $106,265 into a comfy support level, we might just see the party continue. The next stop? Maybe $109,588—and who knows, a brand new all-time high. It could even hit $110,000. Stranger things have happened, and let’s be real, the world of crypto is anything but predictable.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-05-12 03:54