- Bitcoin Options expiry can be significant, as the expiration of large numbers of contracts can lead to sharp price movements

- Call options were dominant at press time, with $7.9 billion in Open Interest indicating a bullish sentiment.

As a seasoned crypto investor with a knack for deciphering market trends, I find myself on the precipice of anticipation as we approach the Bitcoin Options expiry on December 27th. The bullish sentiment is palpable, fueled by the promise of $100k and the record-breaking Open Interest that’s now touching $50 billion.

As the deadline for Bitcoin options on December 27th draws near, there’s a sense of anticipation building within the market due to the bullish sentiment surrounding the potential reach of $100k. This optimism follows a significant increase in capital influx post-election, causing the Open Interest to soar – Reaching an all-time high of $50 billion.

However, reaching $100k and maintaining it are two different challenges. While the current bullish sentiment, driven by a mix of micro and macroeconomic factors, suggests a potential new all-time high, the Options market must be closely watched.

As a crypto investor, I’m keeping a close eye on the impending expiration of the $11.8 billion worth of call and put orders for Bitcoin. These could potentially shape the price dynamics over the next few days, so it’s crucial to stay informed and adapt strategies accordingly.

Bitcoin Options show bias with call order dominance

Currently, Bitcoin is being traded below $90,000, and it holds a market dominance over 60%. In the past day, there appears to be a slight adjustment in its price trajectory as well.

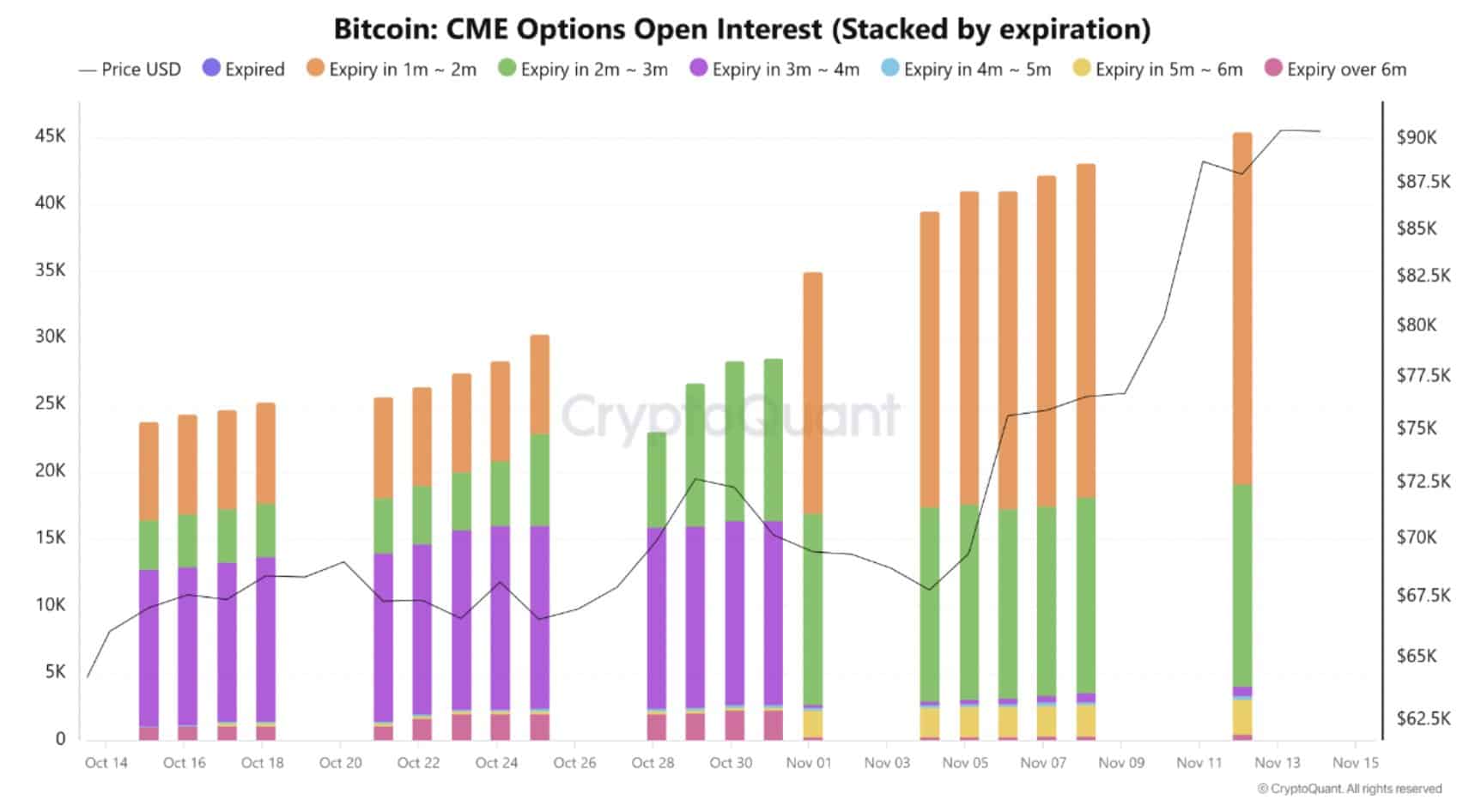

In the world of Bitcoin options trading, Deribit dominates with roughly three-quarters of the total market share. Meanwhile, CME and Binance each account for about 10.3%. This significant concentration of activity on Deribit suggests that most speculation regarding Bitcoin’s price fluctuations is taking place there.

Based on data from Coinglass, about 70% of the market’s orders are for calls (or bets that the price will rise), indicating a strong positive outlook among investors. In fact, numerous investors seem to believe that Bitcoin could hit $100k and continue climbing higher.

If Bitcoin reaches its projected $100k value, a substantial number of Options contracts worth approximately $11.8 billion will be due, with the large majority being Call Options – essentially bets that the price would increase.

As a result, traders with these Call Options might choose to exercise them to cash in their gains, or sell them off to secure their profits. This action could lead to increased selling, particularly if multiple traders decide to leave the market simultaneously, causing potential price drops.

Consequently, whether the $100k price point remains steady primarily hinges on the development of these contracts. A momentary drop might transpire under two possible situations: firstly, if Call Option holders decide to invoke their contracts, or secondly, when Put Options gain prominence over Call Options.

Can Bitcoin hit $100k amid growing volatility?

Despite a brief drop following five consecutive days of growth, primarily caused by miners offloading Bitcoin, long-term investors are holding steady in their investments. This persistence is notable, given the growing level of leverage in the market as a result of derivative trading.

With an increasing number of traders participating in the Bitcoin Options market, many positions are due to expire by the end of this quarter. This has led to a significant surge in market volatility, with daily highs becoming more common.

Source : CryptoQuant

Regardless of its fluctuations, Bitcoin has persisted in its rising trend, suggesting that long-term investments are still prevailing over short-term ones as evidenced by multiple market indicators.

In simpler terms, Bitcoin’s market doesn’t seem to have reached a point of excessive extension just yet. Even though the Relative Strength Index (RSI) indicates ‘overbought’ conditions, miners selling, and investors cashing out for immediate profits, these factors haven’t resulted in significant price drops – an occurrence that usually happens under such circumstances.

In simpler terms, the price of Bitcoin is showing strength and might soon reach $100,000. If it achieves this milestone before the end of the month, it won’t come as a shock.

Read Bitcoin (BTC) Price Prediction 2023-24

Nonetheless, there remains an air of doubt in the Bitcoin options market, as contracts valued at approximately $11.8 billion could determine whether Bitcoin begins the new year with optimistic or pessimistic trends.

Considering the significant implications tied to the $100k price target and the approaching expiration of call options as market volatility increases, the latter scenario appears to be more plausible.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-15 13:12