Bitcoin, that most capricious of modern deities, now teeters on the precipice of $110,800-a price point less a number and more a moral test. Should it falter, the market’s collective gasp of despair will echo louder than a Cossack choir at a funeral.

Glassnode, that vigilant scribe of blockchain lore, has scribbled in its ledger: $110,800 is the sacred average cost of new investors, those brave souls who bought during May to July’s “I-just-have-to-know” frenzy. A time when Bitcoin’s price danced higher than a peasant’s heart at a village fair.

The Noble Defense of $110,800

Glassnode, ever the philosopher of on-chain data, insists that newer investors (those who’ve held their coins with the patience of a cat watching a mouse trap) reveal truths about the market’s soul. Their average cost? $110,800. A number so sacred it should be carved into the walls of a cathedral-or at least a crypto Twitter bio. 🕊️

History, that fickle old friend, whispers warnings: fall below this line, and the bear market shall descend like a blizzard on a poorly prepared investor. Corrections, it seems, are nature’s way of saying, “You’ve had too much cake.” 🧁

Behold the chart, a tale of two lines: orange (new investors’ cost) and black (Bitcoin’s price). When black crosses beneath orange, chaos follows. It’s the financial equivalent of a horse kicking over a chessboard-messy, dramatic, and deeply unprofitable. 🎭

Monday’s liquidation event? A bloodbath for longs, worthy of Tolstoy’s own war epics. Over $150 million vaporized, leaving behind a smoldering crater where hope once lived. Tuesday’s brief dip to $108,600 was but a prelude to the main act: the desperate scramble to reclaim $110,800 before the wolves of doubt arrive. 🐺

Ethereum’s Feverish Dance

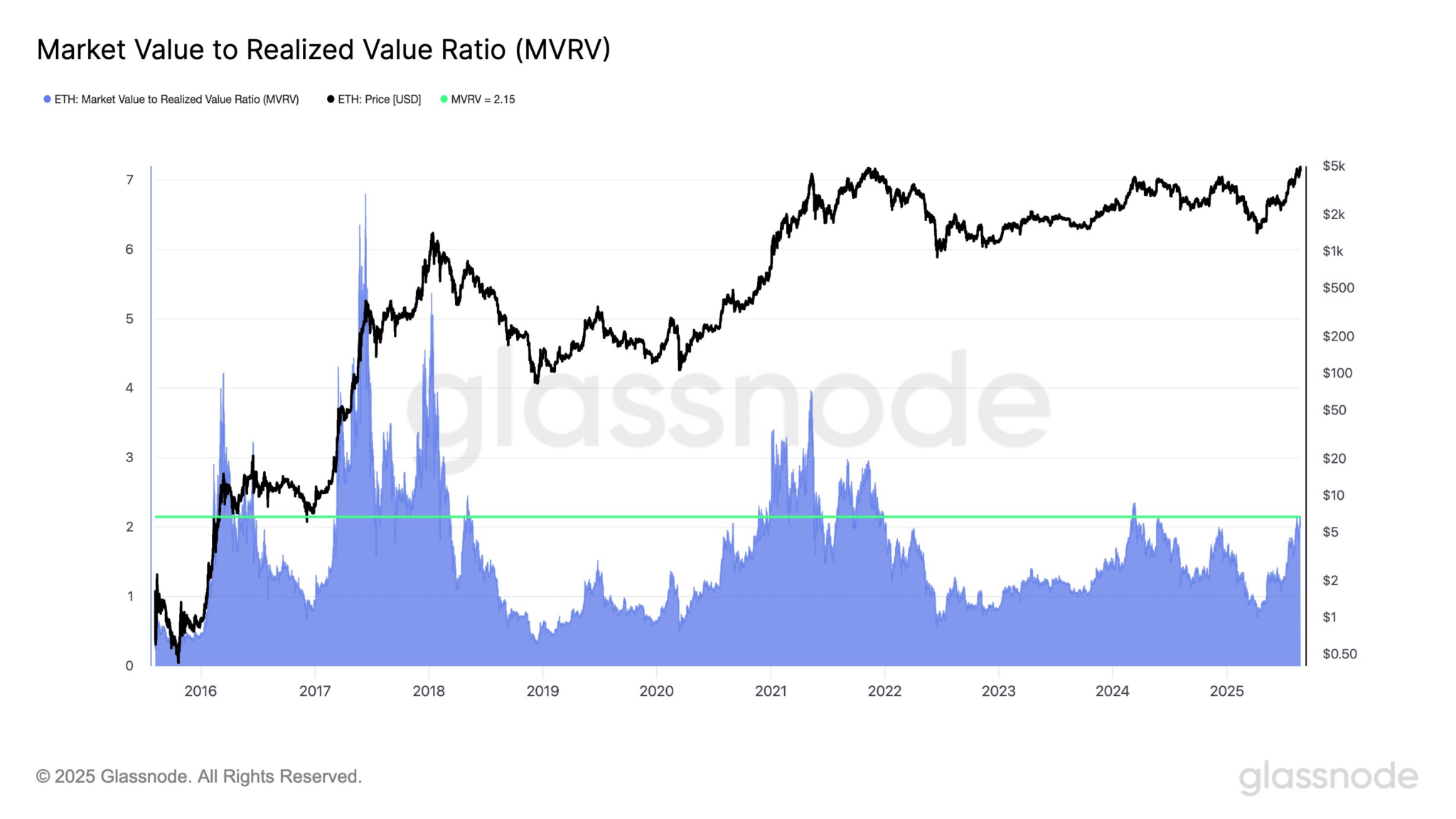

Ethereum, that overconfident cousin at the family reunion, now parades at record highs. Glassnode, ever the party pooper, notes its MVRV ratio has climbed to 2.15. A number so lofty it makes the Tsar’s hat look modest. 😂

This MVRV ratio-market value vs. realized value-is the financial world’s version of a lie detector. At 2.15, investors hold unrealized gains like a hot potato. One wrong move, and the whole thing could go *boom*. 💣

Glassnode’s verdict? “This level mirrors prior market structures.” Translation: we’ve been here before, and it ended with more tears than a soap opera finale. The echoes of March 2024 and December 2020 whisper, “Profit-taking is coming… and it brings a knife.” 🔪

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Werewolf Movies (October 2025)

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- USD JPY PREDICTION

- Meet the cast of Mighty Nein: Every Critical Role character explained

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- These Are the 10 Best Stephen King Movies of All Time

2025-08-26 13:31