-

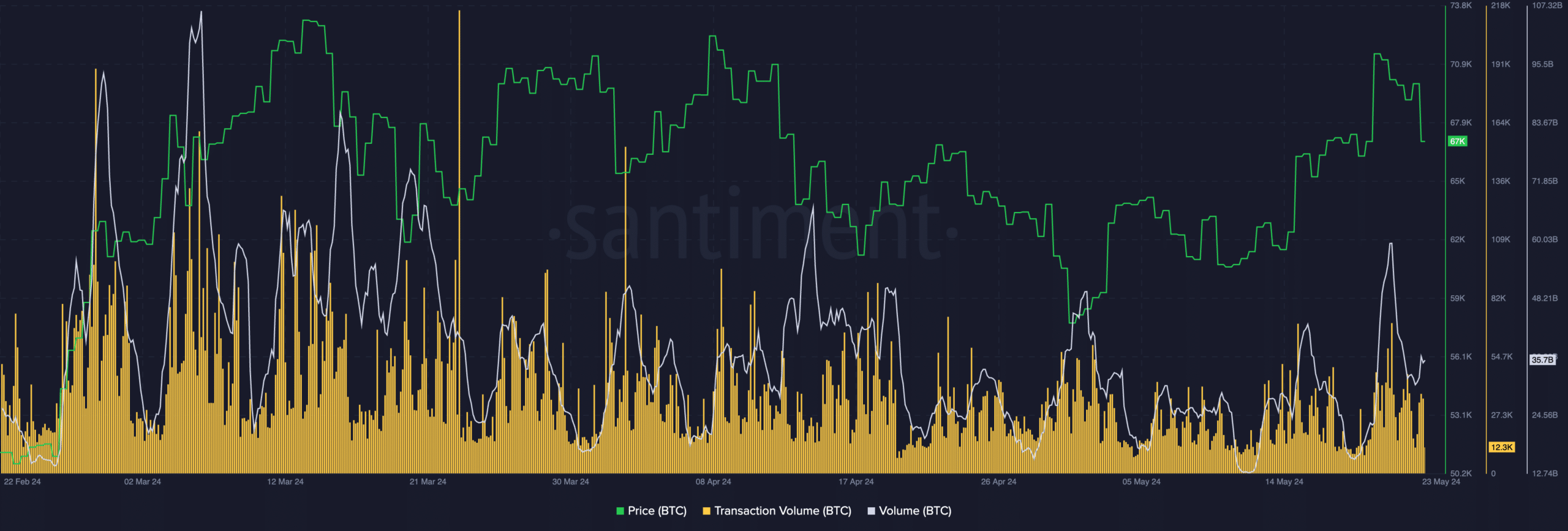

Data showed that the seven-day trading volume has fallen below $14 billion.

Price of BTC continued to soar while profitability grew.

As a researcher with a background in crypto markets and data analysis, I find the recent trends in Bitcoin’s trading volume and network activity quite intriguing. The data shows that the seven-day trading volume has dropped below $14 billion, which is concerning since it’s at the same level as when Bitcoin was trading below $30,000. However, this decline could also indicate that more addresses are holding their BTC rather than actively trading.

As Bitcoin (BTC) nears its record-breaking peak, there’s been an increase in excitement and fear among investors about the leading cryptocurrency. However, the trading activity surrounding Bitcoin has decreased, even though the hype and curiosity surrounding it have grown significantly.

Bitcoin volumes decline

Seven-day trading volumes dipped below the $14 billion mark, a figure last seen in 2023 when Bitcoin’s price hovered around $30,000.

As a researcher examining the data, I’ve noticed an intriguing trend: the number of Bitcoin (BTC) addresses with no transaction history for a certain period has increased significantly. While this could potentially be a concerning sign and indicate that the market may have lost some momentum, it could also be viewed positively as more investors are choosing to hold onto their BTC rather than sell it.

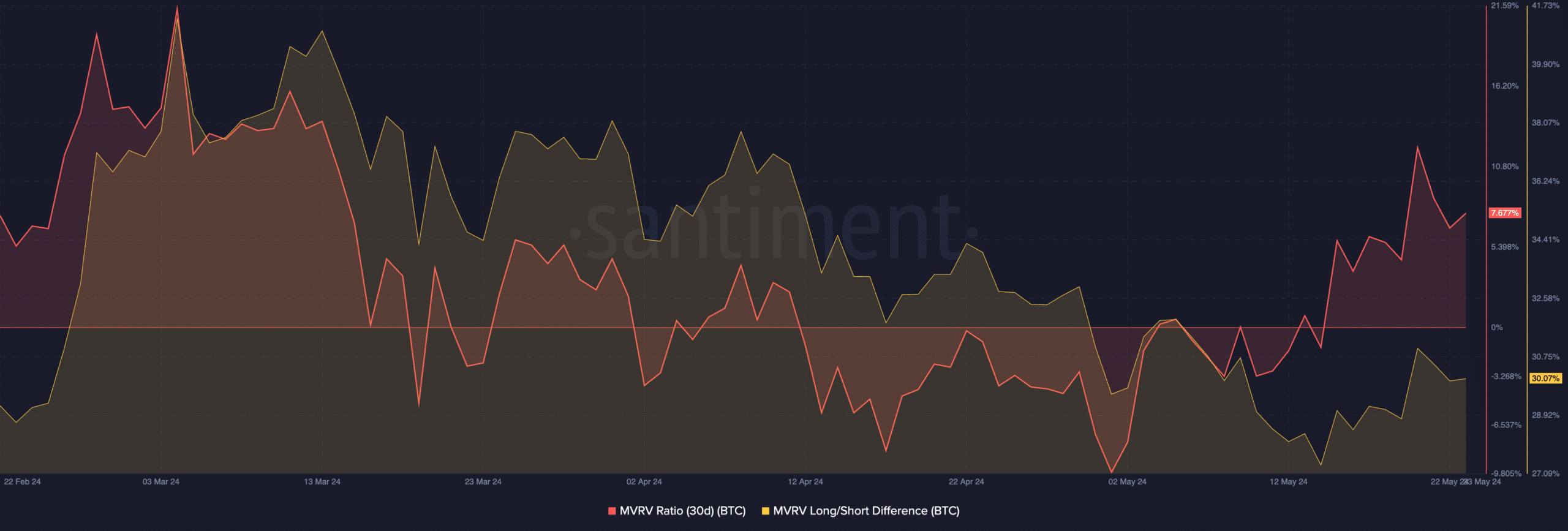

As of the moment this statement is being made, the price of Bitcoin was at $68,899.70 in exchange for a single unit. In the previous 24-hour period, its value increased by 2.14%. The MVRV (Moving Average Realized Value) ratio for Bitcoin has significantly gone up, signaling that the majority of its holders have recently experienced profits.

With increasing profits for Bitcoin holders, there may be an inclination for some to sell, potentially leading to a decrease in BTC‘s price.

During this timeframe, the gap between long and short positions for Bitcoin expanded. This signified a substantial increase in the number of long-term investors holding Bitcoin over the past few days.

People who have held onto their investments for an extended period tend to be more patient and less prone to selling during market volatility.

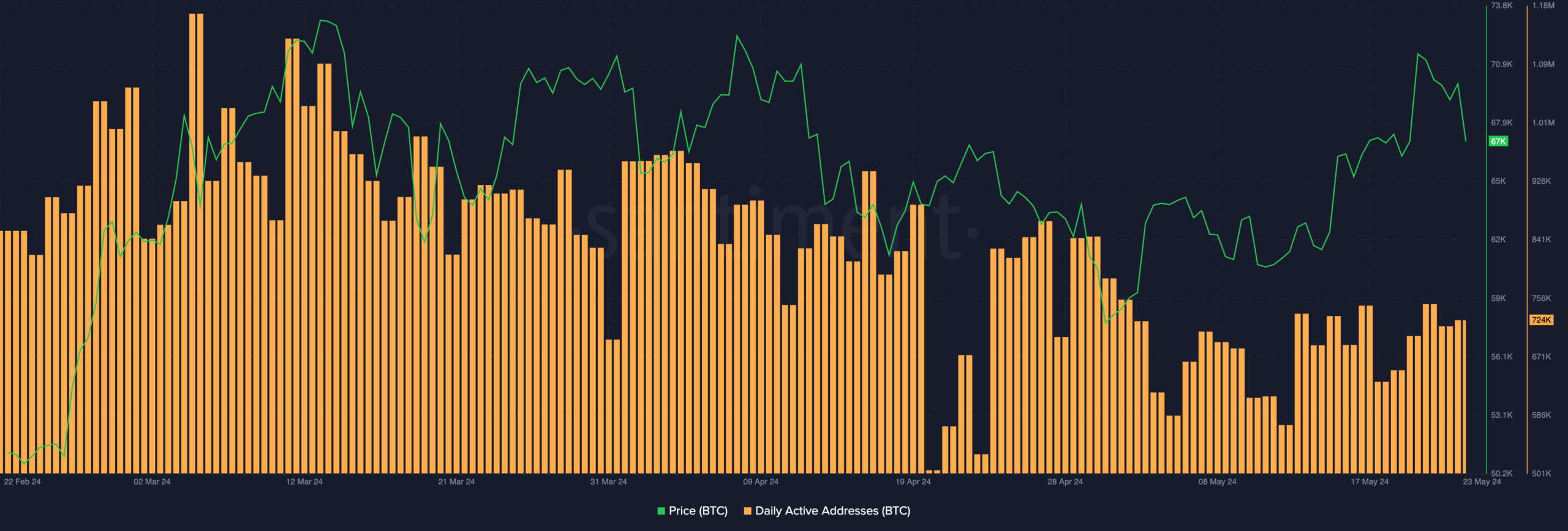

A notable sign of investor attention towards Bitcoin lies in the amount of active addresses on its network. According to AMBCrypto’s analysis of Santiment’s data, there has been a substantial decrease in the daily count of active Bitcoin addresses over the past several weeks.

As a crypto investor, I’ve noticed that one potential explanation for the current market situation could be the recent downturn in the Non-Fungible Token (NFT) sector. In the past few weeks, there’s been a decrease in NFT sales, as well as fewer buyers and sellers active in this space.

Over the past few days, the sales volume for Crypto Slam experienced a significant drop of 75.36%. Additionally, there was a substantial decrease of approximately 60% in the total number of NFT transactions taking place on the network.

Is your portfolio green? Check the Bitcoin Profit Calculator

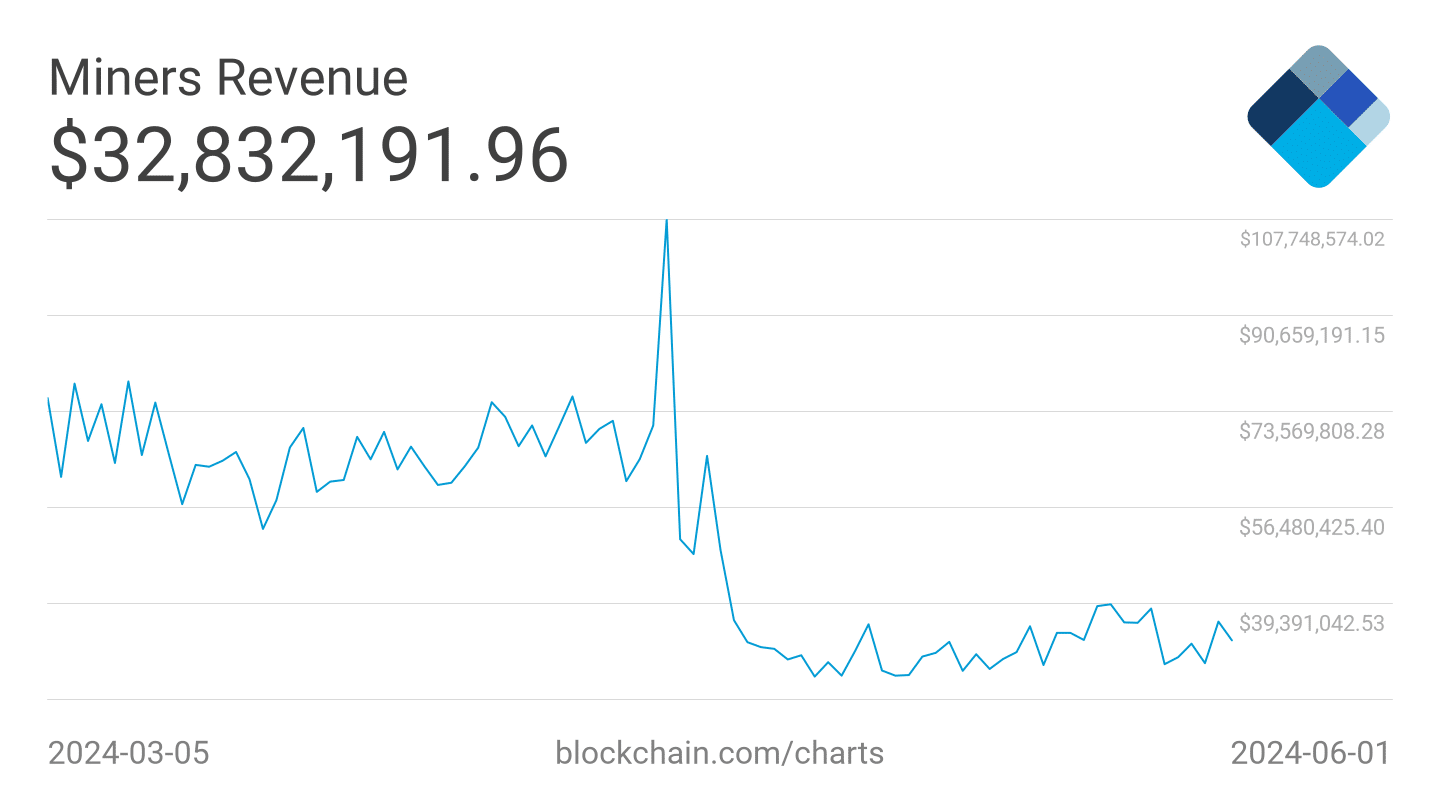

If activity on the network continues to decline, miner revenue can get impacted.

Lately, Bitcoin miners have experienced a substantial decrease in their daily earnings. Should this trend persist, these miners might be forced to offload their Bitcoins for profit, potentially contributing to further price drops.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-04 08:07