-

BTC’s futures open interest climbs to its highest level since January 2023.

The coin’s price is trending within a range.

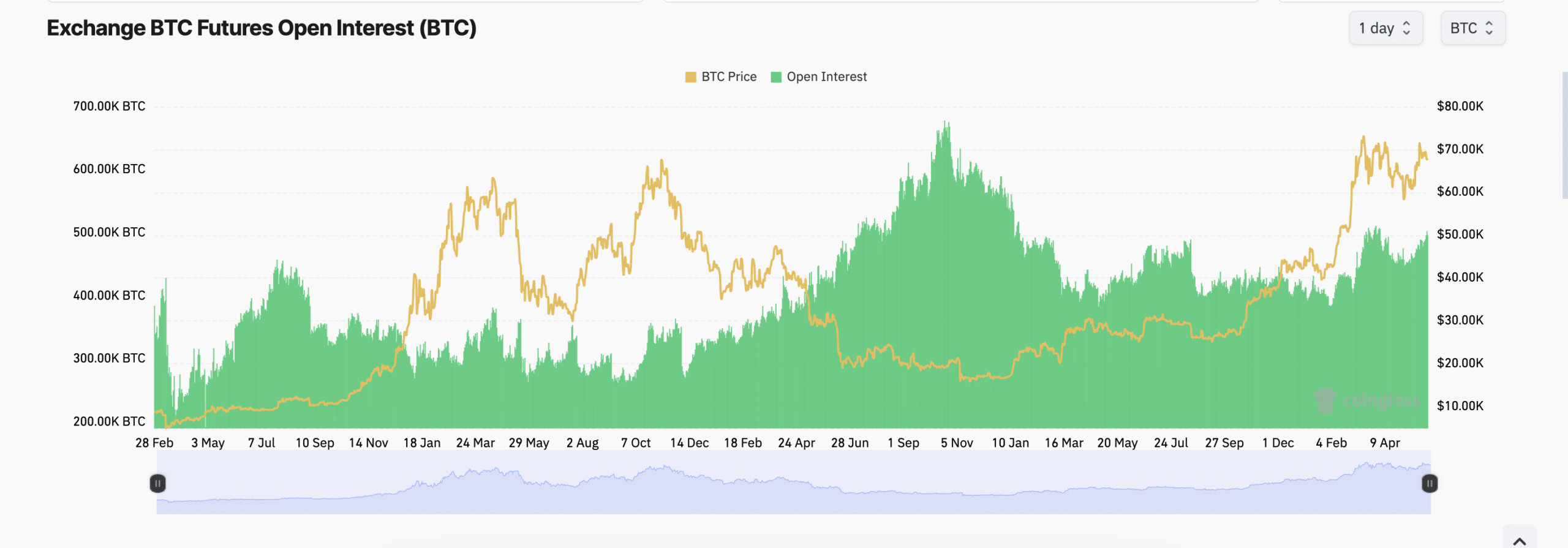

As an analyst with extensive experience in the cryptocurrency market, I find the recent surge in Bitcoin’s [BTC] futures open interest and positive funding rates intriguing. The data from Coinglass indicates that the aggregate futures open interest for BTC has climbed to its highest level since January 2023, reaching 516k BTC on May 29th. This is a clear sign of heightened market activity and increased trader sentiment.

The data from Coinglass shows that the open interest for Bitcoin futures contracts has reached its peak in the past 16 months.

As a researcher analyzing cryptocurrency market data, I’ve noticed an intriguing development. Based on the latest figures from the reputable on-chain data provider, the aggregate open interest for Bitcoin (BTC) futures contracts reached a staggering 516,000 BTC on the 29th of May. This figure is noteworthy since the last time we witnessed such high levels of open interest in BTC futures was back in January 2023.

As a researcher studying Bitcoin (BTC), I would explain that the “futures open interest” refers to the current number of active futures contracts in the market that have yet to be settled. An increase in this metric indicates heightened market activity or a shift in the attitudes of traders, suggesting a bullish outlook on the cryptocurrency’s future price movement.

It suggests that more market participants are opening new positions.

The open interest for Bitcoin (BTC) has been increasing, and notably, its funding rate stays positive across cryptocurrency platforms. Despite encountering substantial resistance near the $70,000 mark, BTC continues to exhibit this pattern.

As a financial analyst, I can explain that in perpetual futures contracts, funding rates play a crucial role in keeping the contract’s price aligned with the current spot price. These rates serve as a mechanism for transferring the difference between the contract price and the spot price on a regular basis. This way, market participants are incentivized to keep their positions in line with the underlying asset, ensuring price convergence.

When an asset’s future borrowing cost is more than zero, it reflects robust interest in holding long positions. This optimistic sign hints at a possible continuation of the asset’s price increase.

According to Coinglass data, BTC’s funding rate was 0.0106% a press time.

BTC lingers in a range

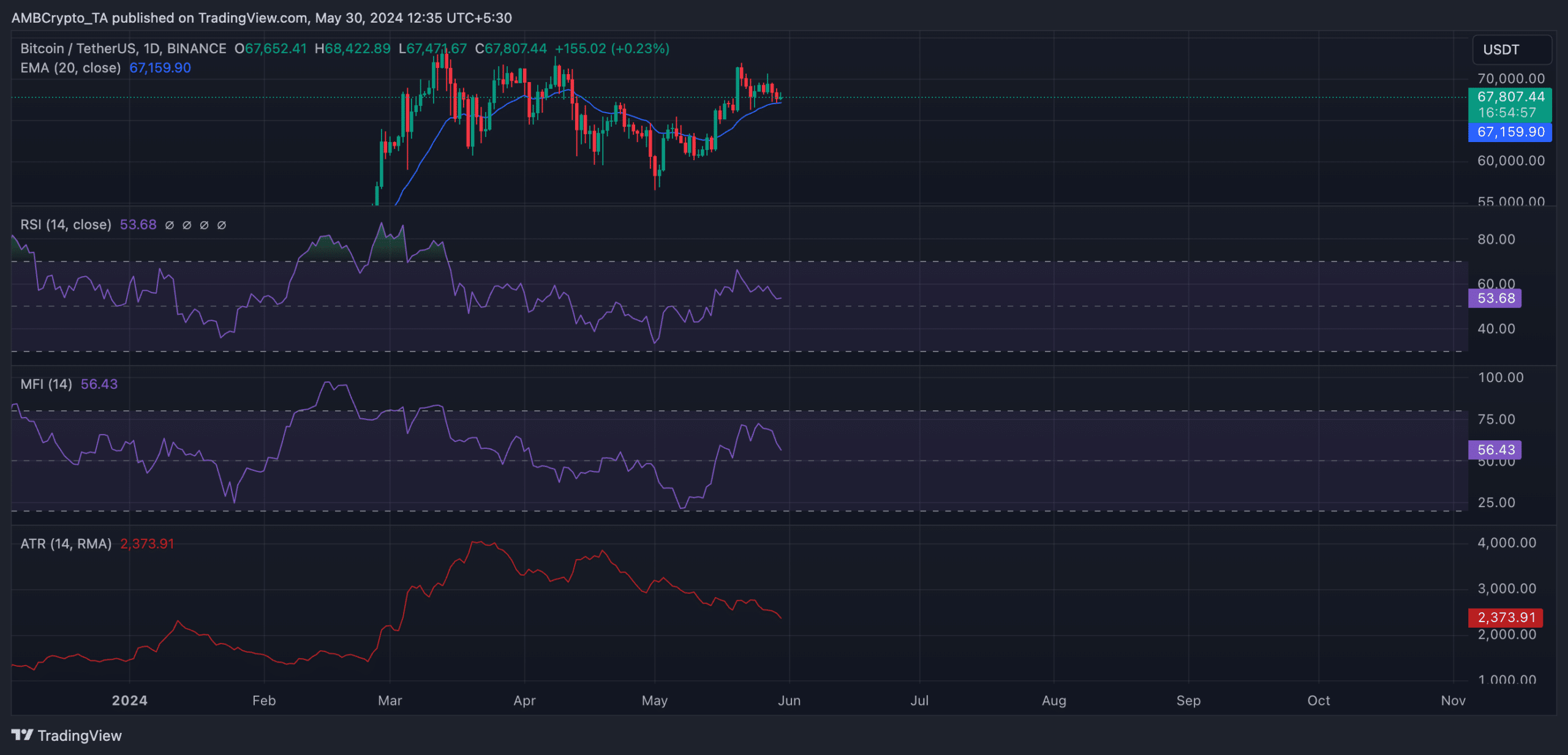

In the last week, according to AMBCrypto’s analysis, Bitcoin’s price movement has been relatively close to its 20-day Exponential Moving Average. This situation is referred to as a consolidation period in the cryptocurrency market.

As an analyst, I would interpret this situation as follows: The back-and-forth nature of these price movements indicates that neither buyers nor sellers currently hold significant dominance in the market.

In recent days, Bitcoin’s price action has shown limited fluctuation, which is reflected in its decreasing Average True Range (ATR) value. Currently priced at $2,373, Bitcoin’s ATR has dropped by nearly 10% over the past week.

As an analyst, I would interpret the Average True Range (ATR) of an asset as a measure of its price volatility during a specified timeframe. A descending trend in ATR could potentially signal a period of consolidation for the asset.

At the current moment, the RSI value for Bitcoin stood at 53.85, while its Money Flow Index came in at 57.94.

As an analyst, I would interpret those indicator readings to mean that neither the buyers nor the sellers held complete dominance over the coin’s price action at this stage. Instead, the price was consolidating or bouncing between certain limits, suggesting a balanced market dynamics.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-05-30 20:07