- Bitcoin’s 2019 behavior repeats itself, thanks to its investors.

- Analysts divided on a post-halving rally in 2024 and the likely price trigger.

As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I have learned to navigate the tumultuous waters of market predictions and analyst opinions with a grain of salt. The 2019 halving behavior repeating itself is an interesting observation, but history doesn’t always repeat itself in the world of Bitcoin.

Five months have passed since the halving event, but Bitcoin’s [BTC] anticipated parabolic surge based on past trends has yet to materialize

However, according to CryptoQuant, the halving rally might still be in play, especially as current short-term BTC investors mirrored 2019 behavior.

Based on the information available, Bitcoin experienced a surge approximately 490 days following the peak of new investors around the 2019 halving event, and it appears a comparable trend may be unfolding now

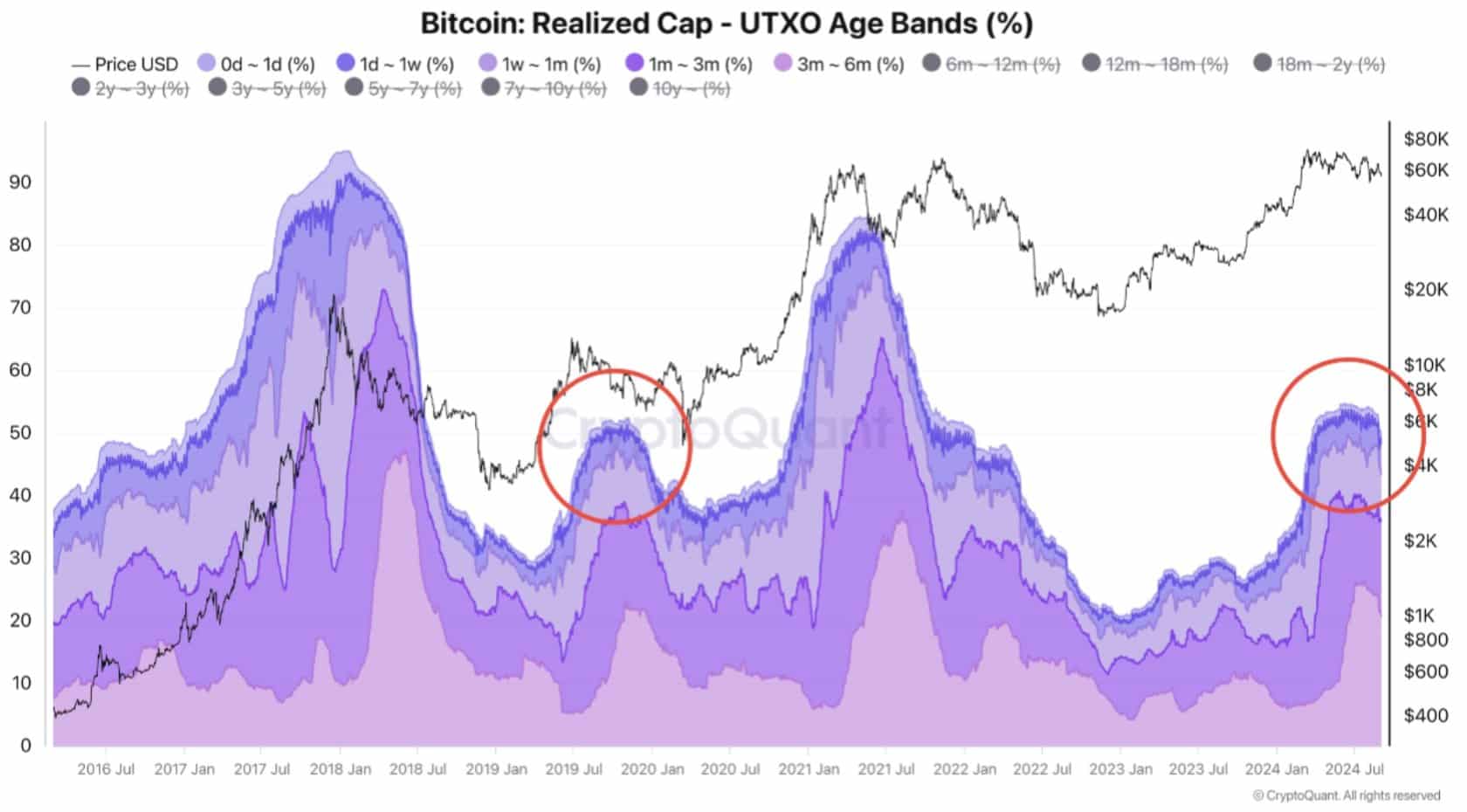

At the moment, there’s a slight spike in Unspent Transaction Outputs (UTXOs) that have been active for less than six months. This pattern is reminiscent of one we saw back in 2019, as indicated by the red circle

Mixed views on post-halving BTC rally

For context, UTXO (unspent transaction output) offers insights about BTC holders and, by extension, their behavior based on age bands. The above data tracked those who held BTC for less than six months (new users).

After Bitcoin reached its peak in March, there was a decrease in the UTXO (Unspent Transaction Output), a trend that seems to be linked to the possibility of new investors selling off their holdings following losses

In other words, according to the findings from our study, a significant surge in Bitcoin’s value could occur if there is an influx of new Bitcoin investors

Historically, an increase in Bitcoin’s price is often linked to the arrival of fresh investments by new investors

In both 2019 and 2024, Bitcoin underwent halving events, but the significant price surge took place in 2020 following the halving. Could history repeat itself?

However, Outlier Ventures’ Jasper De Maere cautioned that BTC and digital assets have matured and that the halving event was inconsequential to price in 2024.

Instead of striving to align with market fluctuations based on a four-year cycle, it would be wiser for entrepreneurs and investors to pay closer attention to major economic trends that have longer-term impact

As a crypto investor, I personally view the latest 34% drop to $49k during this bull run as a normal fluctuation. I remain optimistic that the post-halving rally is yet to fully unfold

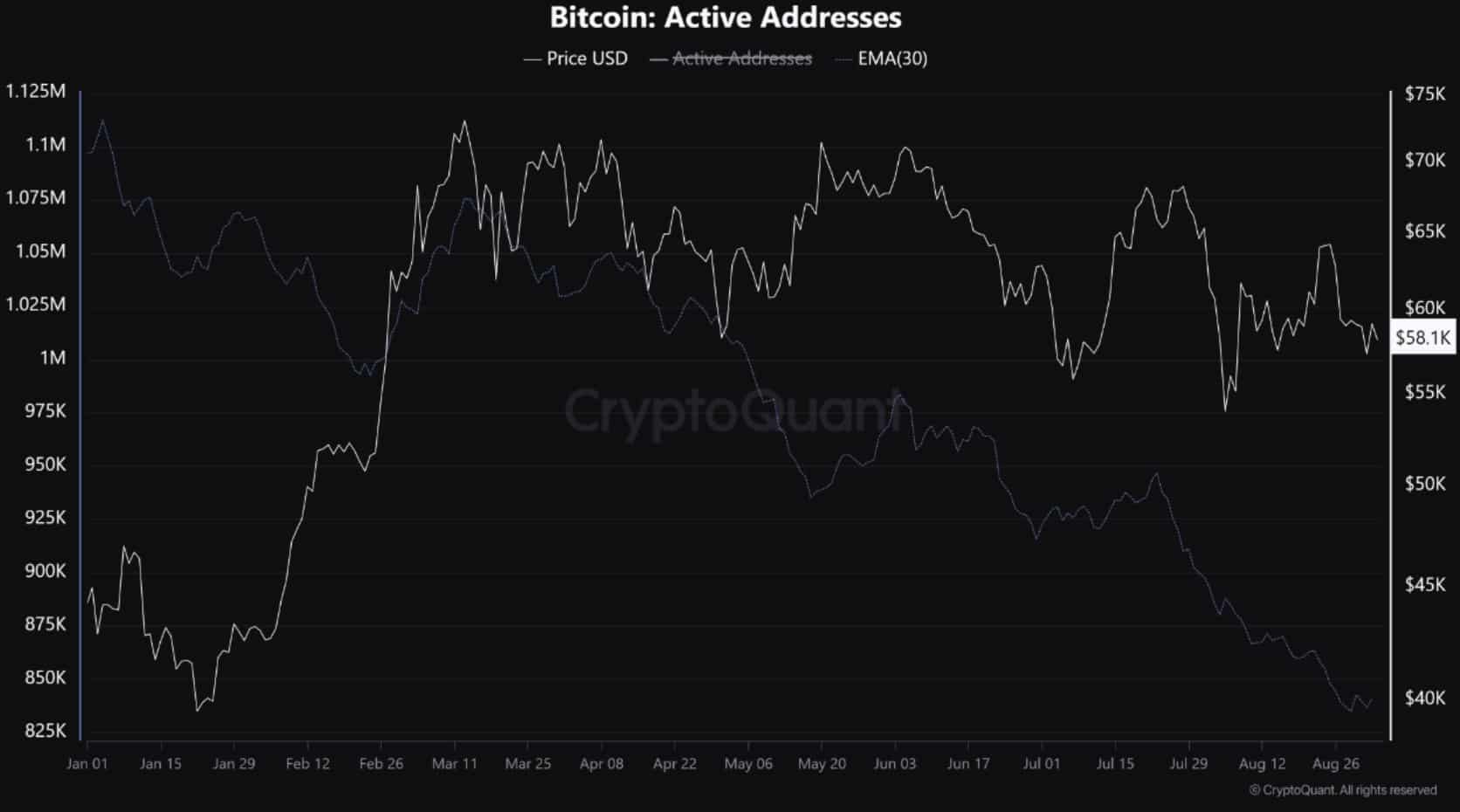

2024 saw a significant decline in Bitcoin network activity, with the number of active addresses reaching an all-time low. This trend might continue, potentially causing the price to drop even more, as there seems to be less enthusiasm for this digital currency among users

2024 saw record-low active Bitcoin network addresses, mirroring levels last seen about three years prior, a time when the value of one Bitcoin was approximately $45,000

It’s yet unclear if the predicted favorable economic conditions following a potential Fed interest rate reduction will lead to the anticipated cryptocurrency price surge after the halving event

Currently, Bitcoin’s value stood at approximately $56,700 at the moment of reporting, and it hasn’t surpassed the $60,000 mark since early September

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-05 20:35