-

Bullish sentiment soars as halving event nears.

However, some indicators suggest the possibility of a further drop in BTC’s value.

According to an anonymous analysis by CryptoQuant’s Gaah in a recent report, the Bitcoin market may experience a price drop before any potential increase following the halving event.

On April 19th, the planned “halving” occasion will cut down the amount of circulating Bitcoin by decreasing the reward given to miners by half. Currently, miners earn 6.25 Bitcoins as a reward; however, following this event, they will only receive 3.125 Bitcoins instead.

History books tell us this about the coin’s next move

In the past, the value of a bitcoin (BTC) has significantly increased following each halving. As reported by Bloomberg, BTC’s price rose 8,691% one year post-halving in 2012, 295% after the 2016 occurrence, and an increase of 559% occurred shortly after the 2020 event.

In spite of current market instability causing concerns, these historical trends have fueled an increase in optimistic outlooks. Yet, as per Gaah’s analysis, certain signs suggest that Bitcoin’s price may still drop further.

Gaah assessed BTC’s Funding Rates on a 30-day moving average and noted that it has climbed,

“To the levels of the 2021 all-time high.”

When the Futures Funding Rate for an asset experiences a significant increase and remains positively high, it’s a sign that there is robust interest in taking on long positions.

It is considered a bullish signal and a precursor to an asset’s continued price growth.

An excessive Funding Rate can result in lengthy liquidations, which in turn can cause heightened market volatility and uncertain price fluctuations.

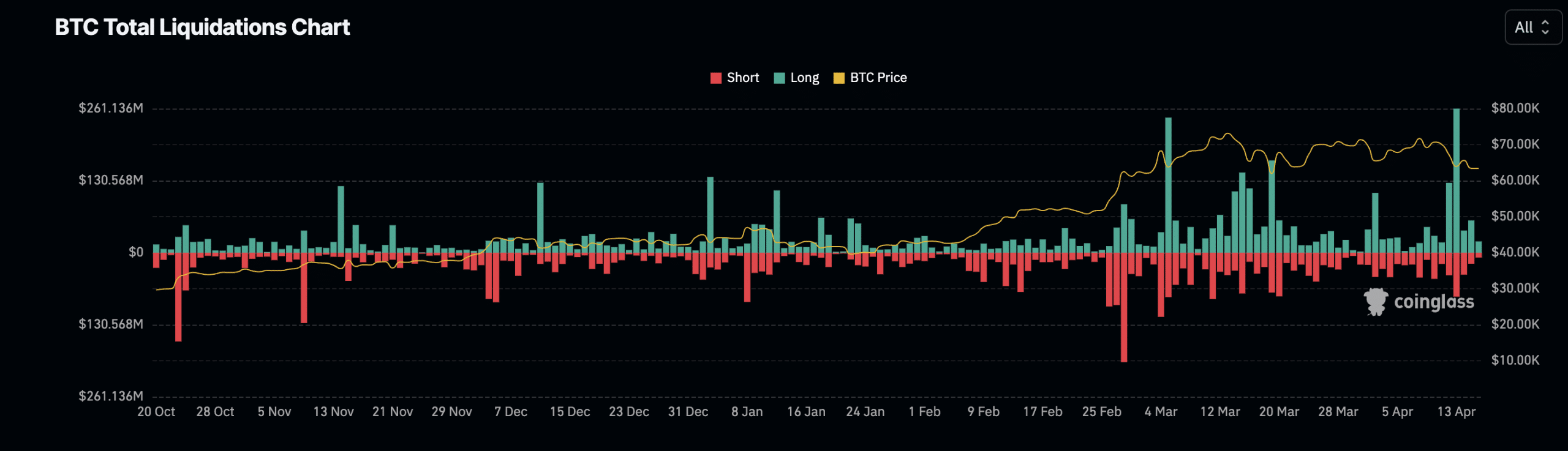

On the 13th of April, the coin experienced a sudden drop in price, going from around $67,000 down to $62,000 by the end of the day.

That day saw a significant increase in long liquidations, reaching a multi-month peak of $261 million, based on the information from AMBCrypto’s analysis of Coinglass’ data.

Gaah noted that BTC’s current all-time high, $73,750, represents,

“Its greatest resistance ever.”

At this price point, strong demand is putting significant pressure on the price to advance, making it challenging for the price to surpass and set new record highs.

Furthermore, Gaah discovered that the surge in Bitcoin’s price starting from October 2023 ignited greater interest among retail investors, according to his findings.

For the past three years, the Retail flow has failed to exceed the average value, suggesting a noticeable presence of these investor categorizations in the current market.

Based on Bitcoin’s past trends, the analyst observed an increase in the number of transactions or usage of Bitcoin.

“Means a potential top is in the making.”

Hence, a price drop may be on the horizon.

Read More

2024-04-16 15:03