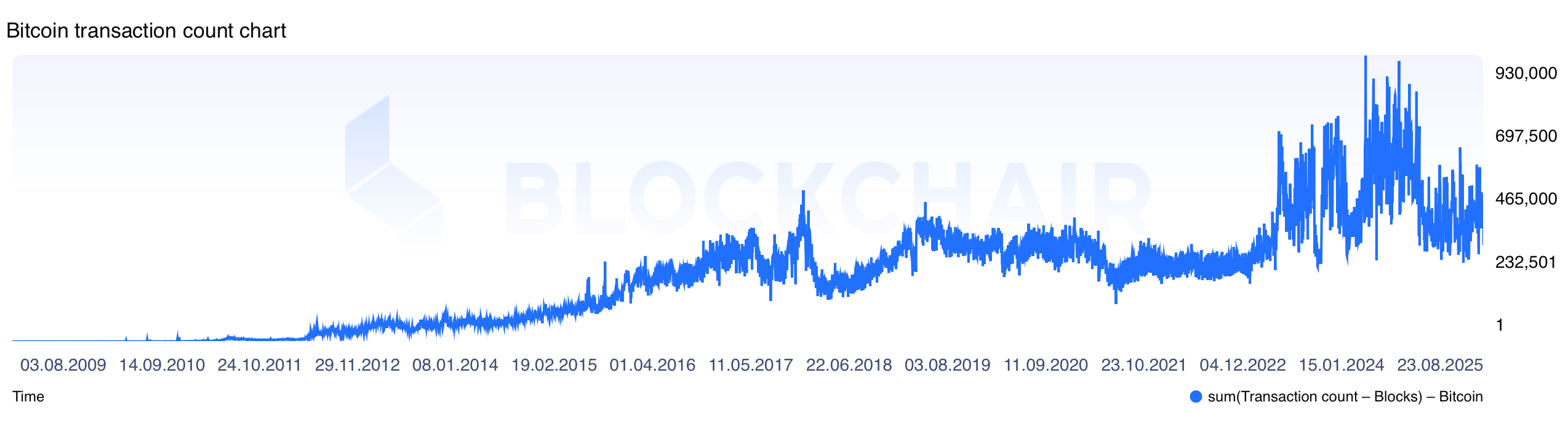

Ah, Bitcoin! Once the darling of the digital realm, now it seems to have taken a leisurely stroll in 2025 after last year’s exhilarating sprint. Data from the grand timeline of Jan. 1, 2017, to Aug. 23, 2025, reveals that our dear Bitcoin’s year-to-date throughput is trailing behind 2024’s full-year average by a rather dramatic one-quarter. And as for miners? Their fee share is flirting with the lower end of the nine-year spectrum-how positively quaint! 💸

Bitcoin’s Most Frantic Days Were in 2024; 2025 is Just a Gentle Breeze

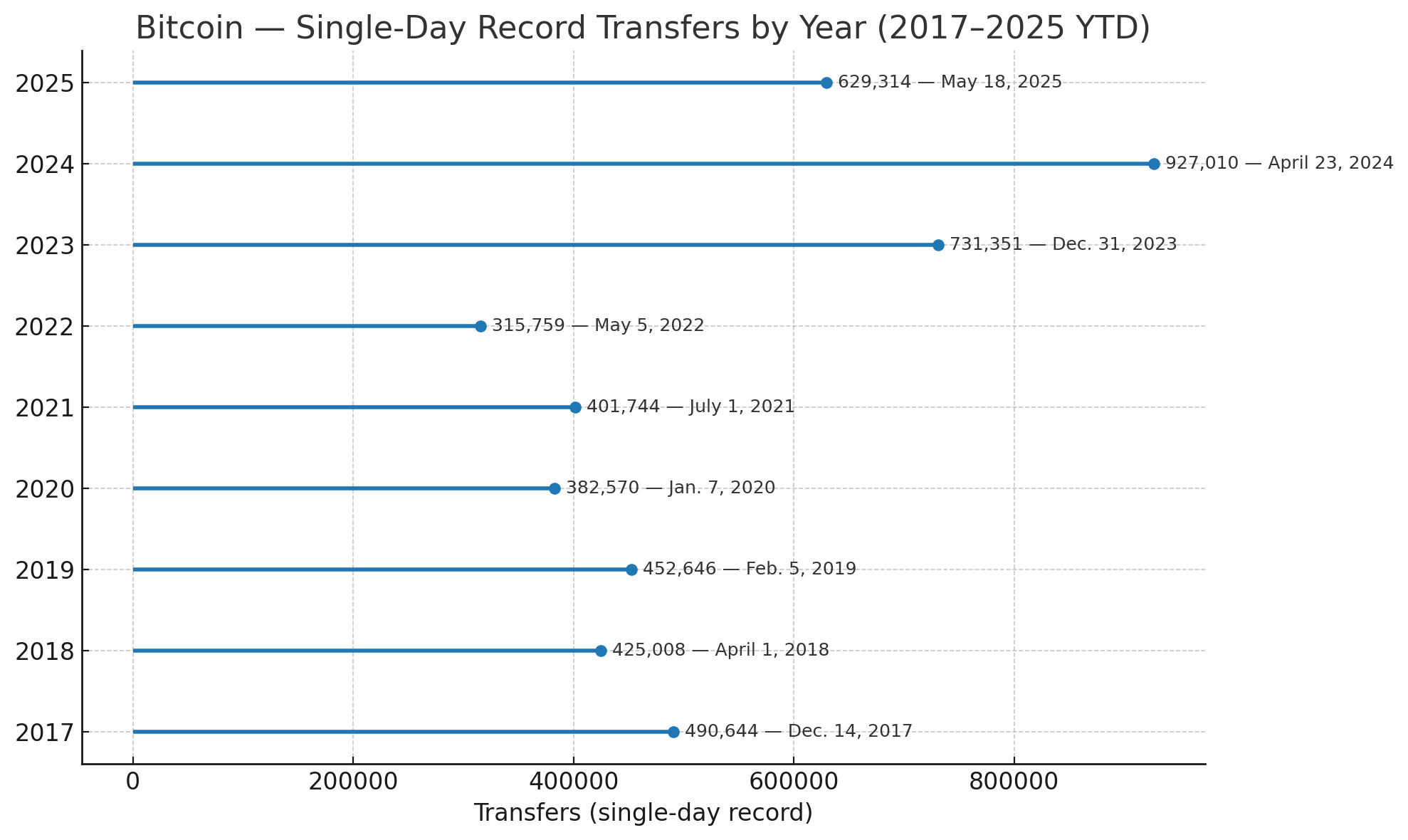

The pièce de résistance of Bitcoin’s bustling days was April 23, 2024, when the network processed a staggering 927,010 transfers. In contrast, 2025’s top performance, on May 18, saw a mere 629,314 transfers-still impressive, but hardly a record-breaker. The top five days of yore all belong to 2024, including the likes of Aug. 9 (910,083), July 21 (859,629), and so forth. One might say 2025 is merely a shadow of its former self! 🌥️

Now, let’s talk averages, shall we? The 2025 year-to-date mean sits at a rather modest 395,077 transfers per day, compared to 525,269 in 2024. That’s a decline of 24.8%-or about 130,000 fewer transfers a day. Oh, the humanity! Yet, fear not, for 2025 is still above the nine-year average of 331,060 transfers per day. It’s just that this year is a tad less frenetic than last year’s high-octane escapades. 🏎️💨

Yearly single-day highs tell a tale of growth punctuated by bursts of excitement: 490,644 (Dec. 14, 2017), 927,010 (April 23, 2024), and now, the humble 629,314 (May 18, 2025). That record from 2024 is a staggering 2.35 times the average for 2025. Talk about setting the bar high! 🎩

Annual Bitcoin transaction averages tell a similar story, with 2025’s 395,077 year-to-date average trailing behind 2024’s high watermark of 525,269. The weakest annual average? Why, that dubious honor belongs to 2018. How charming! 🥳

The distribution of quiet days reveals the delightful chaos of on-chain transfer activity. The five lowest days include June 27, 2021 (121,538) and Jan. 8, 2017 (131,875). The range of activity has expanded and contracted over the years, with 2025’s amplitude measuring a respectable 373,242. Not too shabby, if I do say so! 📉

Coverage from 2017 to 2025 is quite comprehensive, with 365 daily entries for most years and a mere 203 for 2025 through Aug. 23. This breadth makes comparisons across the nine-year window as easy as pie-if only pie were as delightful as Bitcoin! 🥧

If 2024 was the year of throughput records, 2025 is the year of delightful normalization in financial transfers. The Bitcoin network is still moving sizable volumes of transactions daily, albeit at a pace that’s more akin to a leisurely stroll than a mad dash. 🐢

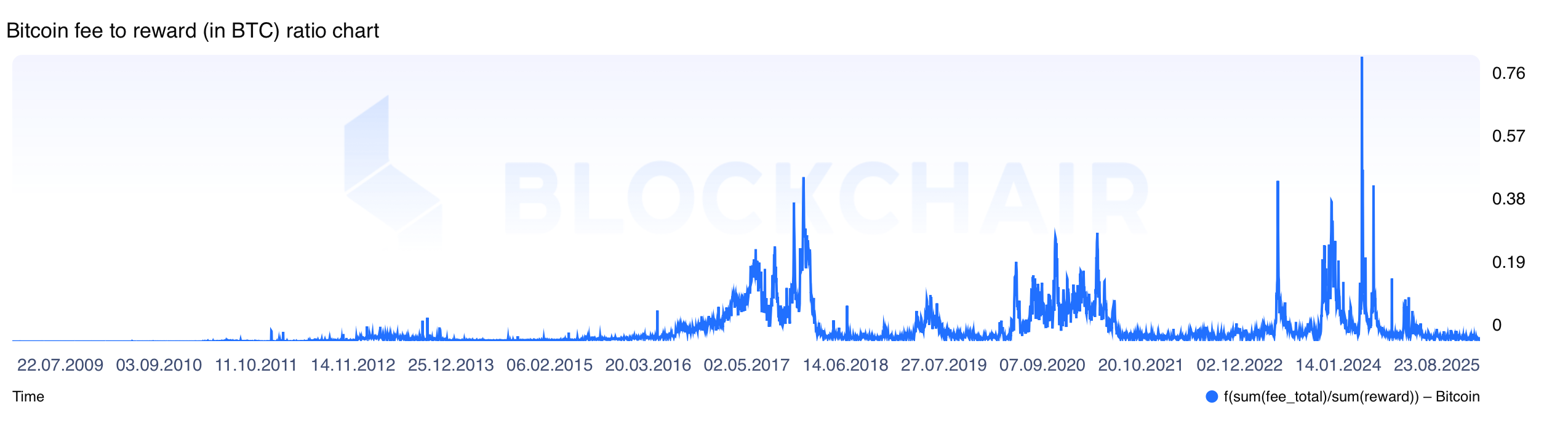

Halving Heat Faded Fast: 2025’s Fee-to-Reward Ratio Slides

Now, let’s address the fee-to-reward ratio, which adds a rather troublesome layer to our tale. This year, it averages a paltry 1.21%-the lowest in our nine-year saga. In contrast, 2024’s full-year average was a robust 5.60%. Oh, how the mighty have fallen! 📉

The extremes of the fee series cluster around the last halving period, with the all-period record arriving on April 20, 2024, at a staggering 75.44% of the block reward. This year, however, has logged some of the leanest fee days on record. Among the five lowest are Aug. 17, 2025 (0.53%) and June 29, 2025 (0.54%). How positively dreary! 😩

Year-over-year comparisons paint a stark picture. Against 2024’s full-year average of 5.60%, 2025’s 1.21% implies a drop of about 78%. Miners are earning a much smaller slice of their daily revenue from fees this year than they did last year. How tragic! 🎭

Two Metrics, One Message

When we join the two pictures-transactions and fees-a consistent pattern emerges. The Bitcoin network’s daily transfer counts have stepped down from a cluster of 2024 records, while the fee share has moved from extraordinary to subdued. It’s as if the party has ended, and everyone has gone home! 🏠

Context across the nine-year span helps frame expectations. After a low annual average in 2018, transfer activity rose into 2019, eased in 2020-2022, then accelerated in 2023 and peaked in 2024 before cooling this year. Fee share followed its own path, dipping and soaring like a dramatic play! 🎭

It’s also worth noting how wide the day-to-day bands can be, even within a single year. The annual low-to-high range stretched from 128,925 in 2022 to 663,028 in 2024, illustrating how bursts and quiet periods coexist. In 2025, the range is 373,242-wider than several prior years, but narrower than last year’s extravaganza. 🎉

For those tracking the network’s cadence, the data is simple: 2024 set the records; 2025 has eased from those heights. Yet, 2025 still exceeds the long-run daily average since 2017, meaning activity remains solid by historical standards, even as it cools from last year’s peak phase. 🥂

For miners, the fee picture is even clearer but decidedly gloomy. The fee-to-reward ratio in 2025 is low by any recent yardstick, with most days under 2% and only a single day topping 3%. The bottom line is unambiguous: 2025 looks like a year of normalization for both network throughput and fee share relative to 2024’s exceptional stretch. 🥳

Takeaway for readers: Last year’s records were real and dramatic, and this year’s cooling is equally plain in the numbers. Still, the Bitcoin network continues to move a large volume of transactions each day-above the nine-year average-while the fee-to-reward ratio has reset to low single digits. That combination defines 2025 so far: steady traffic by historical standards and a notably thin fee component for miners. Cheers! 🥂

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

2025-08-25 07:59