- Bitcoin has fallen 22.5% from its peak, with current minor gains insufficient for recovery.

- Recent futures market data suggests a bearish sentiment, potentially setting the stage for future bullish trends.

As a seasoned analyst with over a decade of experience in the volatile world of cryptocurrencies, I find myself cautiously optimistic about Bitcoin’s current situation. The 22.5% plunge from its peak is certainly concerning, but it’s important to remember that such fluctuations are par for the course in this industry.

For the last few weeks, Bitcoin’s [BTC] value has experienced a substantial decrease, falling about 22.5% from its peak of over $73,000 reached in March.

Despite a modest increase of 0.6% over the last day for the asset, it hasn’t fully recovered from ‘Red Monday’. On a more positive note, Bitcoin has seen an uptick, but on a weekly scale, it is still experiencing a drop of 11%.

Futures market sentiment

According to ShayanBTC, a cryptocurrency expert at CryptoQuant, he recently discussed on Quicktake how the influence of perpetual markets and long-squeeze scenarios can shape the value of Bitcoin.

As an analyst, I’ve observed that Bitcoin’s recent price decline might primarily be due to heightened selling pressure within these markets. This notion is reinforced by the significant decrease in funding rates, a crucial marker reflecting market sentiment.

Lately, funding costs have become negative, indicating that pessimism, particularly among short sellers, is prevalent. This change hints that the futures market may be experiencing a cooling period, which could pave the way for a more balanced bullish phase in the days ahead.

Shayan particularly noted:

As a seasoned investor with years of experience under my belt, I have witnessed both bull and bear markets, and I must say that the current negative funding rates are not a cause for immediate alarm but rather an intriguing development worth paying attention to. The dominance of short sellers and overall bearish sentiment could be seen as a red flag in the heat of the moment, but upon closer inspection, it might indicate that the futures market is finally cooling down after being overheated for too long.

Bitcoin recovery on the horizon?

Although the immediate future may appear bleak, there are signs pointing towards a possible road to recuperation.

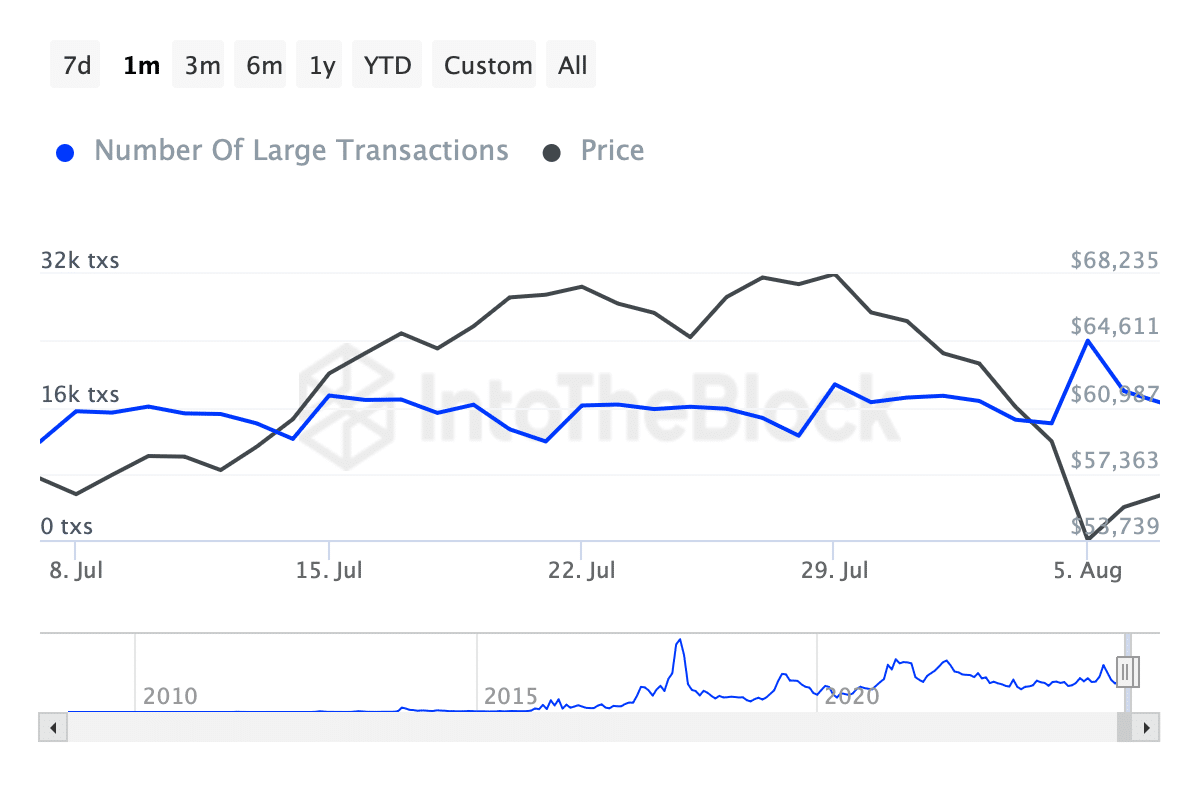

Large Bitcoin transactions, specifically those worth more than $100,000 according to IntoTheBlock data, experienced a significant surge on the 5th of August, jumping from approximately 16,000 to over 23,000. This spike was followed by a decrease, leaving us with around 16,560 large transactions today.

The change in whale activity might indicate increased attention from significant investors, potentially suggesting they are amassing assets at reduced costs as part of a strategic plan.

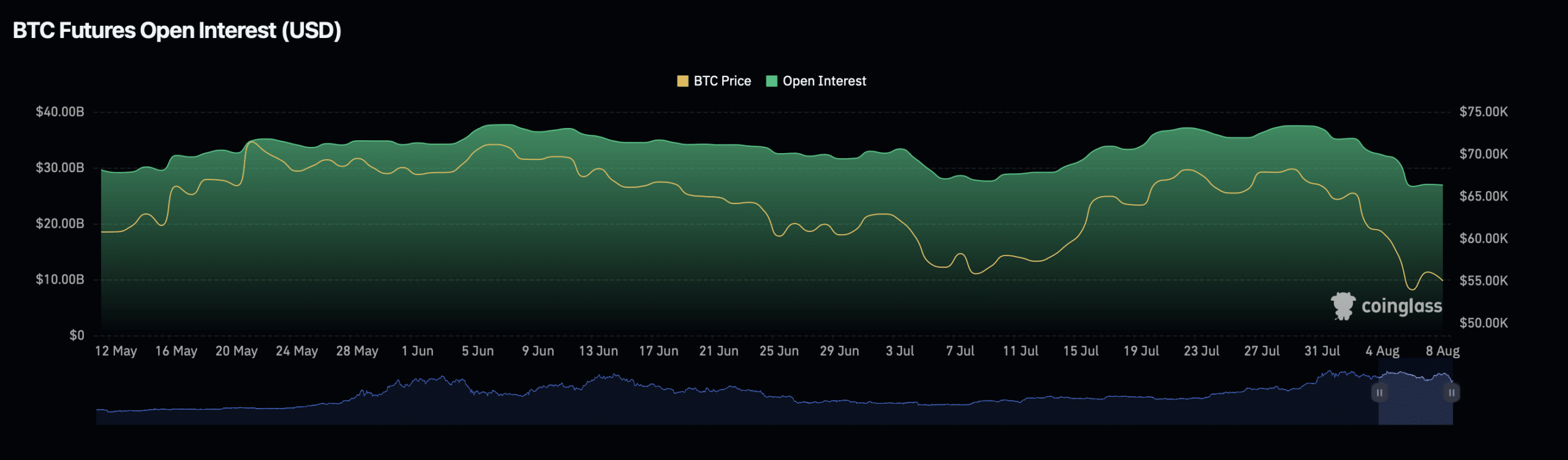

Moreover, there’s been a minor decrease of 0.2% in Bitcoin’s open interest over the past day, amounting to roughly $27.56 billion. This reduction mirrors a decline of 7% in open interest volume, currently at around $76.14 billion.

As a researcher, I’ve noticed some changes in open interest metrics. These shifts might be hinting at a lessening of leveraged positions, potentially mitigating the risk of prolonged short squeezes and aiding in market equilibrium.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-08-08 17:11