-

Over 28,000 BTC have been accumulated by whales and sharks in the last three months

Bitcoin, at press time, was trading above $60,000, despite recent declines

As a seasoned analyst with over two decades of market experience under my belt, I must admit that the recent price action in Bitcoin (BTC) has been nothing short of intriguing. The strategic accumulation by whales and sharks, coupled with the significant decrease in BTC supply on exchanges, is reminiscent of a game of chess between these key players and the market.

Bitcoin (BTC) surpassed the significant $60,000 barrier, leading to a high number of short positions being closed in the past day. As this price milestone was approached, notable Bitcoin accumulations from important wallets have increased substantially during the previous three months.

Additionally, BTC supply on exchanges steadily declined too, with more Bitcoin leaving exchanges.

BTC crosses the psychological barrier

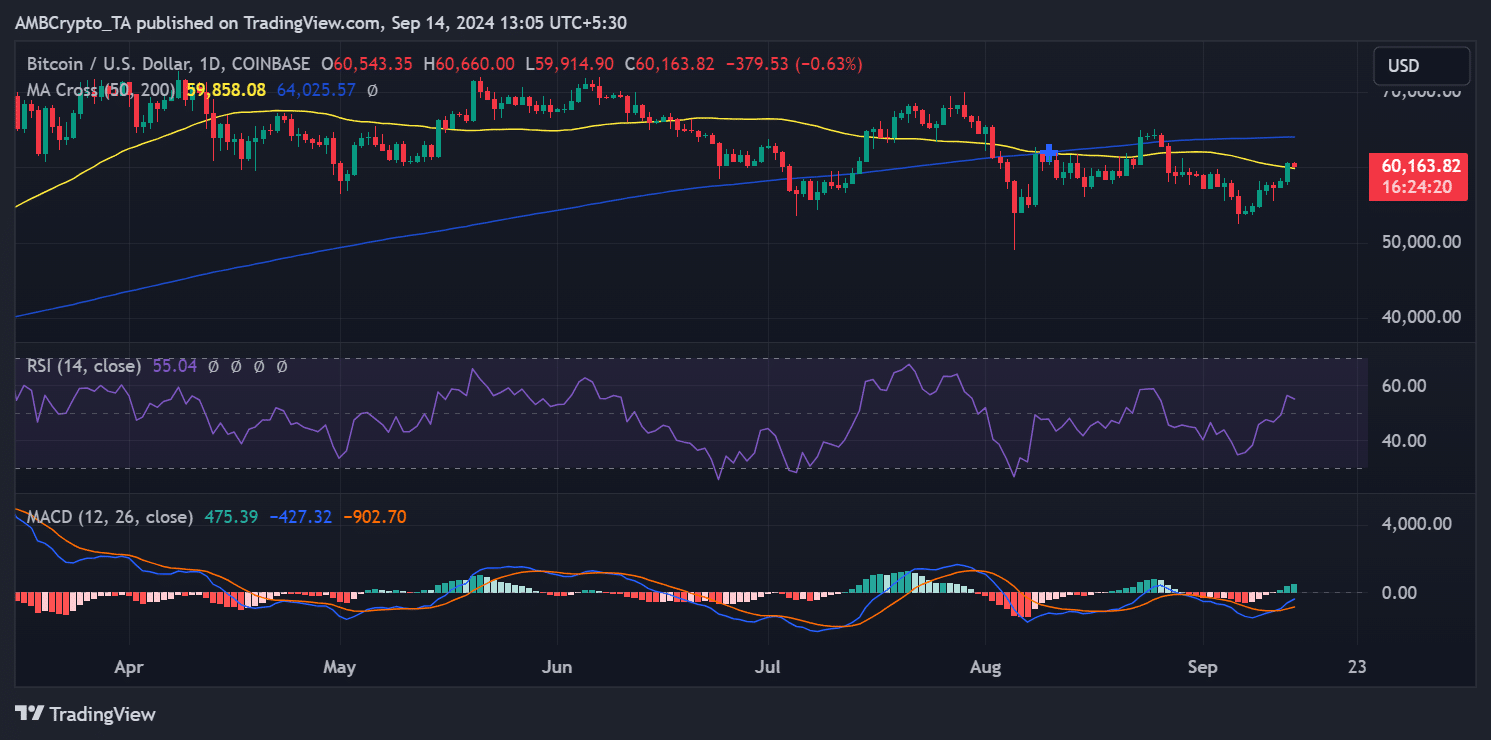

As a researcher, I observed an intriguing pattern in Bitcoin’s price movement on September 13th. A significant uptrend was noticed, propelling Bitcoin beyond the psychological barrier of $60,000. At its peak, it was trading at $60,543, marking a 4% increase within a single day. This upward push enabled Bitcoin to surpass its short-term moving average (represented by the yellow line), which had previously served as resistance.

Currently, Bitcoin’s value dropped back down to roughly $60,177 shortly after, but its overall sentiment remains optimistic or bullish. This was further supported by its Relative Strength Index (RSI), which has been maintaining an average around 55 – a signal of strong market momentum.

Above the short-term moving average, a persistent uptrend in Relative Strength Index (RSI) indicates that Bitcoin might continue its upward trend. A brief dip could be imminent, but if purchasing activity remains strong, there’s a possibility of additional price increases.

Bitcoin’s sustained accumulation and withdrawal

Over the last several months, there’s been a substantial increase in Bitcoin being stored (accumulated) and taken out of exchanges – a sign often associated with a rising market trend.

As per information from Santiment, entities possessing at least 10 Bitcoins have amassed approximately 28,000 Bitcoins over the past three months. Now, these significant holders are in charge of over 16 million Bitcoins, indicating growing faith in the asset’s value.

Furthermore, Bitcoin fell under $60,000 on August 29th, indicating that these wallets have amassed Bitcoin at different price points. This tactical amassing during price fluctuations implies that these owners are positioning themselves for possible future profits.

Over the last three months, a substantial amount of Bitcoin (BTC) – about 75,000 units – has been withdrawn from exchanges, leaving roughly 1.8 million BTC currently on these platforms. This reduction in exchange-held Bitcoin is indicative of a bullish trend because it suggests that holders are choosing to store their coins long-term instead of selling them. As a result, the amount of Bitcoin available for trading has become more limited, which could potentially drive up its value.

Should Bitcoin’s existing price trend persist or continue to rise, a confluence of buying activity (accumulation) and reduced availability on trading platforms might fortify the positive price movement. This could potentially cause the graphical representation of its price to ascend further.

Short positions take a massive loss

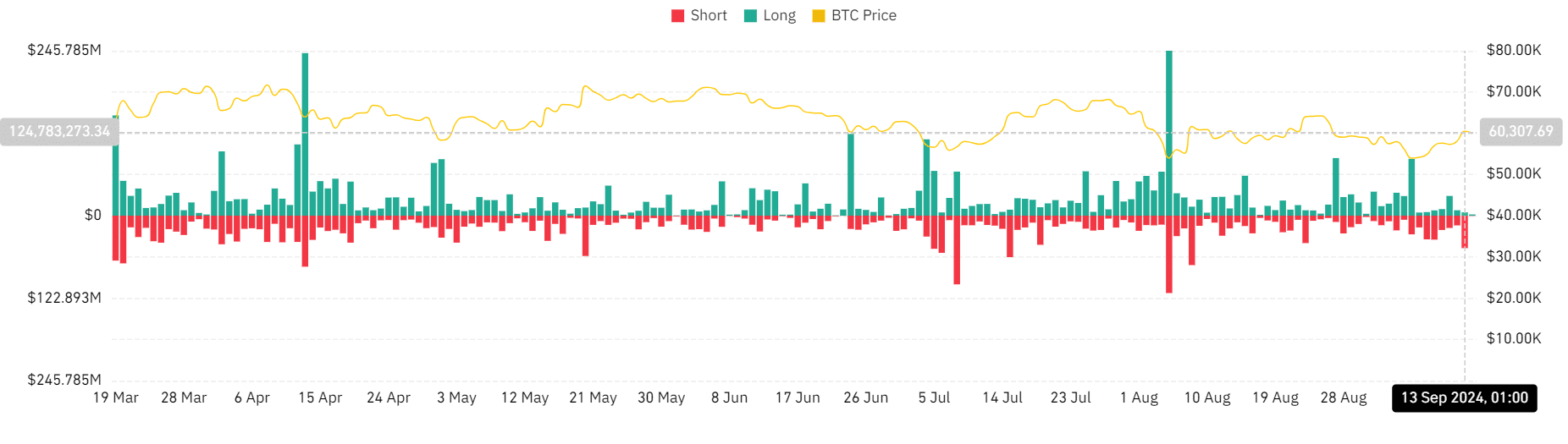

The 4% hike in Bitcoin’s price during the last trading session led to a major liquidation of short positions.

Based on an analysis of the Coinglass liquidation chart, it appears that short positions accrued over $48 million in liquidations at the close of trading on September 13. In contrast, long positions experienced just $5 million in liquidations during the same period.

– Read Bitcoin (BTC) Price Prediction 2024-25

On August 8th, an incident occurred that was reminiscent of a past event, where the value of Bitcoin suddenly surged from approximately $55,000 to more than $61,000. This sudden increase in price resulted in a similar surge in short liquidations.

This liquidation event, along with other positive indicators, might ignite additional growth in the near future.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-09-14 22:15