As a researcher, I’m tracking a significant amount of contracts – around $8.27 billion worth – that are coming up for renewal. This large volume could lead to increased price swings in the short term and potentially affect how prices react around important benchmark numbers.

Key takeaways:

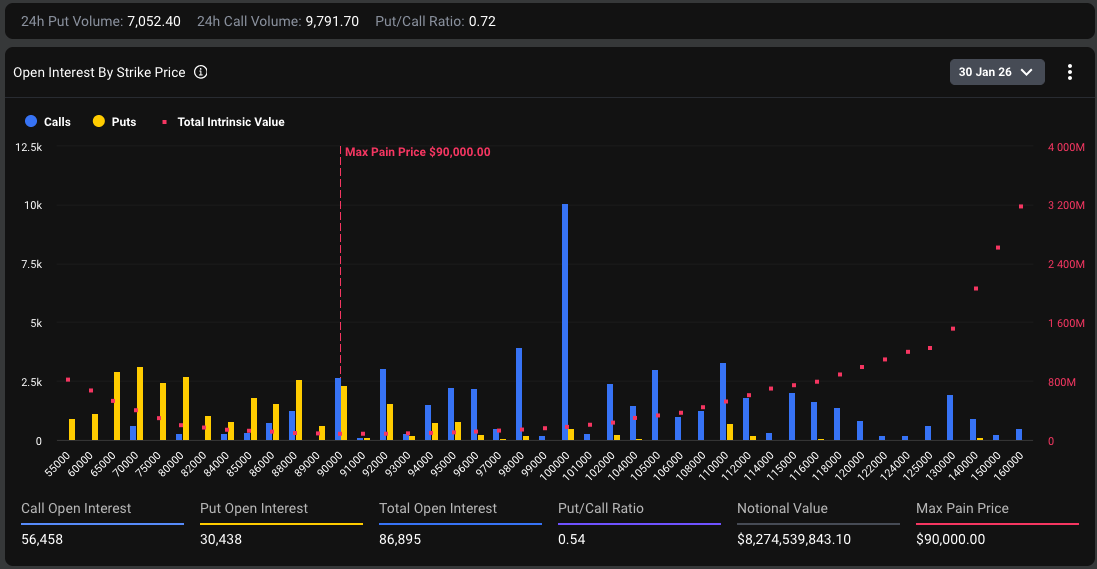

- Around $8.27 billion in Bitcoin options are set to expire on January 30.

- This is the largest options expiry Bitcoin has seen so far in 2026.

- The estimated “max pain” level sits near $90,000.

With a lot of open interest, this week’s options expiration is key for traders. How traders are positioned with call and put options will show where they anticipate the market will face buying or selling pressure.

Looking at options trading, there’s a lot of activity around call options with a strike price of $100,000, which indicates many traders believe Bitcoin could soon reach that level. On the other hand, put options are mostly clustered between $65,000 and $80,000, meaning traders are preparing for a potential price drop, but not necessarily a crash.

Bitcoin price consolidates near $95,500

I’m watching Bitcoin closely, and it’s been stuck trading between around $95,500 and $96,000 for a bit now. We tried to push higher earlier this week, aiming for around $97,000 to $98,000, but couldn’t quite hold those levels.

As a researcher, I’ve been observing the market, and it seems we’ve reached a temporary balance. Buyers are stepping in to support prices when they fall, but sellers are preventing significant gains. This sideways movement appears to be driven by traders preparing for the options expiry on January 30th, which is making people less confident about a clear upward or downward trend and keeping volatility under control for now.

Technical indicators signal neutral-to-slightly bullish bias

Market momentum suggests prices are settling down instead of moving strongly in one direction. The Relative Strength Index, currently around 55, shows a neutral market with a slight tendency to rise, but doesn’t indicate an unsustainable surge.

The Moving Average Convergence Divergence indicator is showing less downward momentum, as it’s leveling off around the zero line. This suggests the price might start to rise if trading volume increases. Generally, the technical indicators show Bitcoin is currently stabilizing, but leaning slightly towards a potential price increase. This means Bitcoin could experience significant price swings once a major event or piece of news appears.

This article is just for informational and educational purposes, not financial or investment advice. Coindoo.com doesn’t support or suggest any particular investment or cryptocurrency. Always do your own research and talk to a financial professional before investing.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- These Are the 10 Best Stephen King Movies of All Time

- Best Controller Settings for ARC Raiders

- Silent Hill 2 Leaks for Xbox Ahead of Official Reveal

- Meet the cast of Mighty Nein: Every Critical Role character explained

- USD JPY PREDICTION

2026-01-17 21:39